A strong economic rebound is expected towards the middle of the year, followed by a return to more normal growth in 2022.

By Carl R. Tannenbaum, Ryan James Boyle. Vaibhav Tandon and Brian Liebovich, Northern Trust

Summary

- Emerging From The Shadows

The start of vaccination programs in several parts of the world raised hopes of economic turnaround this year. However, enthusiasm was curbed somewhat amid renewed virus waves, emerging variants of the virus and slow inoculation progress. With tight restrictions still in place in key jurisdictions, 2021 economic activity is off to a slow start.

That said, with inoculation programs gathering more steam and policy likely to remain supportive, a strong economic rebound is expected towards the middle of the year, followed by a return to more normal growth in 2022.

We expect that the vaccine rollout will allow durable economic reopening by the middle of the year, but the appearance of a more pernicious variant of COVID-19 (one against which current vaccines are not effective) is the most major risk to the outlook.

Following are our views on how these circumstances will affect major world markets.

United States

- Stimulus and vaccinations have set the stage for a strong year of growth. Aggressive campaigns to inoculate the public will help rebuild confidence and reopen commerce, leading to rapid growth in the middle of the year. Meanwhile, the Biden administration looks likely to pass most of the president’s $1.9 trillion proposal to support the economy, giving consumers more cash to weather the virus and spend when it is safe to do so.

- Despite optimism for a good year ahead, the first quarter of 2021 will be the slowest. Payroll growth of only 49,000 jobs in January, following a loss of 227,000 in December, shows the recovery has broadly stalled. The January reading of the consumer price index was flat month-over-month, and consumer spending in the fourth quarter reading of gross domestic product (GDP) was below expectations. The demand-driven downturn will require a demand-driven recovery that has not yet materialized.

Eurozone

- The fourth quarter GDP reading showed the eurozone economy suffered a modest decline as COVID-19 restrictions slowed economic activity. However, amid the still-worrying health situation and a faltering vaccination rollout, restrictions are being extended further in many member states, which will dent activity in the first quarter. A double-dip recession is looming over the common currency region.

- Beyond the first quarter, the improved rate of immunization programs will contribute to a broad-based reopening of sectors and economies, triggering a strong rebound into the middle of the year. Tourism and the disbursement of European recovery funds will be key growth drivers in the second half. Inflation will also recover as demand returns and negative energy base effects fade, but it will remain well below the 2% target. Unemployment rates will remain elevated as policymakers begin tapering some support programs. Countries like Italy warrant close monitoring.

United Kingdom

- The third national lockdown, in place since January, will leave a mark on the U.K. economy this quarter. However, after a record year of contraction, the worst in over three centuries, the U.K. looks set for a stronger year on the back of speedier rollout of vaccines (Britain is the best performer among the G20 nations). Growing consumer demand and sustained monetary and fiscal support will boost economic growth.

- Brexit has ensured tariff- and quota-free trade between the U.K. and the European Union (EU), but the new setup is causing notable disruptions at the borders in the form of bureaucratic and regulatory barriers. As a result, EU-U.K. trade flow has slowed, reflected in the significant drop in cargo shipments from the bloc to the U.K. The future of the economically vital services sector, particularly financial services, remains uncertain as the agreement did not address this sector and talks continue between the two sides.

Japan

- The Japanese economy continues to recover from the pandemic-induced weakness of early 2020, with GDP growing 3.0% quarter-over-quarter in the fourth quarter. Looking ahead, the economy will likely suffer a temporary setback early this year due to the state of emergency now in place, before building on the momentum it carried last year. Stronger external and domestic demand along with continued policy support will underpin the economy. Inflation will remain elusive, prompting the Bank of Japan to maintain a highly accommodative stance through 2022.

- Japan looks set to host the postponed Tokyo Olympics this summer, but with several health restrictions and fewer spectators. As a result, the Olympics will likely deliver only a modest boost to GDP in the third quarter, after which growth will gradually return to normal levels.

China

- China closed 2020 on a stronger than expected note, with real GDP growing 6.5% year-over-year. Investment, exports and consumption all improved. However, renewed outbreaks and reduced travel during the Chinese New Year holidays will weigh on first-quarter growth. Assuming the virus remains contained in China and abroad, strong external and domestic demand will drive growth this year and next.

- Despite heightened tensions with the U.S. and other major economies of the world, China’s role in global supply chains hasn’t diminished. In fact, China’s global export market share increased notably last year. That said, sustained frictions with an increasing number of trade partners will hinder China, as countries seek to reduce dependence on Chinese trade.

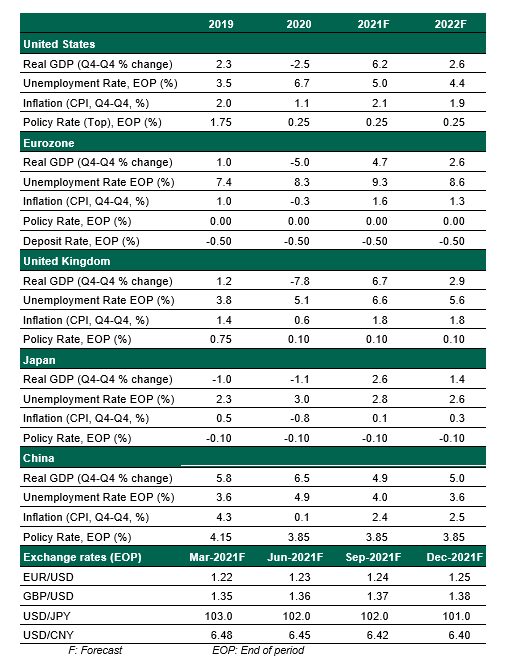

Global Economic Forecast – February 2021

Copyright © Northern Trust