by Kent Chan, Victor Kohn, F. Chapman Taylor, Capital Group

Has the tide finally turned for emerging markets (EM) equities after a decade of trailing U.S. markets? Here are some potential catalysts that could bolster sentiment.

Key takeaways

- A broader rebound beyond tech-related companies is likely to accelerate.

- Structural reforms may regain momentum after the COVID-19 pandemic begins to ease.

- A lower risk premium is more warranted for emerging markets equities compared with prior crises.

Has the tide finally turned for emerging markets equities after a decade of trailing U.S. markets? It’s a question we often hear. After two consecutive years of solid gains for the benchmark MSCI Emerging Markets Index, emerging markets appear well positioned for further growth. The U.S. dollar has weakened, commodity prices have firmed, U.S.-China trade tensions may simmer down and there are a number of investible opportunities that could allow investors to take advantage of a potential cyclical recovery in global markets.

Here are five reasons why emerging markets could power ahead in 2021.

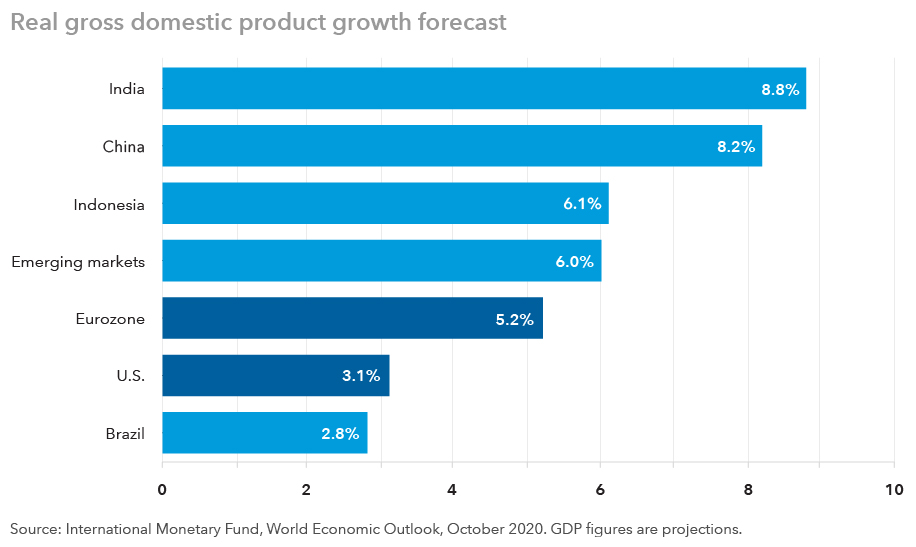

1. A swifter economic recovery

Emerging economies are coming out of their pandemic-induced slowdowns faster than many developed economies. We anticipate an accelerated recovery in emerging markets that spreads beyond China, Taiwan and South Korea to countries like India, Indonesia and Vietnam.

As of mid-January, many developing countries were showing signs of containing COVID-19 and avoiding the resurgent outbreaks seen in the U.S. and Europe. With vaccines beginning to be approved, large-scale immunization programs could be a catalyst for positive momentum. In our view, the market may be underestimating the speed at which vaccines are being rolled out in emerging markets. Indonesia, for example, has already secured vaccine supplies and as a first step plans to inoculate its working-age population (ages 18 to 59) — an approach that contrasts with some developed countries.

Faster recoveries should limit the need for much larger fiscal stimulus, which can strain the budgets of many of these countries.

Growth is projected to snap back in emerging markets in 2021

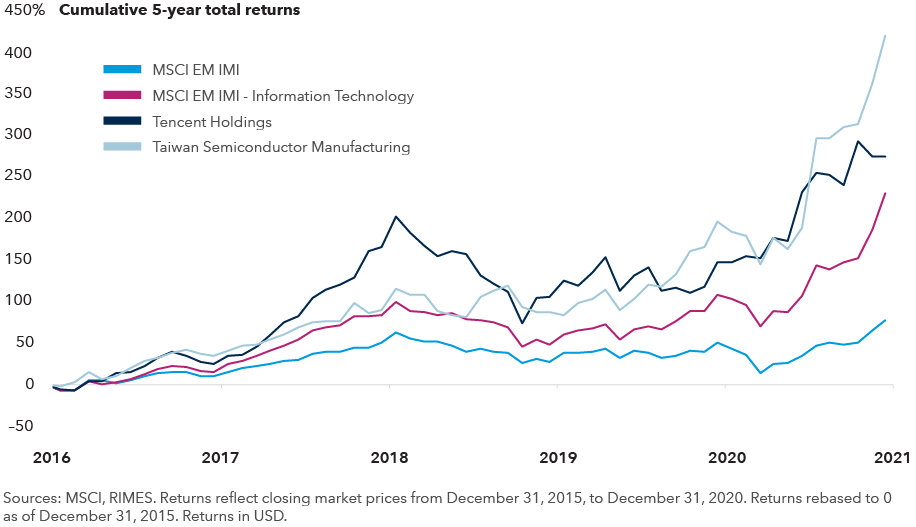

2. Rally likely to broaden beyond a couple of sectors

As in the U.S., the rally in emerging markets has been supercharged and narrowly focused, benefiting companies in certain areas of technology and internet services, largely those in Greater China.

Because of COVID-19, differences among sectors and regions were exacerbated. Internet-related platforms saw their multiples expand considerably, while financial companies in most countries were depressed further and consumer companies landed in between.

As economies recover, we believe the market rally could broaden to other areas:

Financials: Plans for vaccine rollouts and anticipation of a strong economic recovery have lifted sentiment for financial companies across Asia. There are some banks that we think can benefit from a broader recovery in Indonesia and any asset quality improvements in the country’s banking system. India is likely past the worst in terms of stress on its economic and financial systems. Private sector banks have already begun to report loan and profit growth. Asian-based insurers selling financial products in China could get a boost from being able to conduct in-person meetings.

Travel: We continue to be hopeful for an eventual recovery in the travel and entertainment industries, where we think there is a lot of pent-up demand. Casino operators in Macau could be among the first beneficiaries. Macau and China have controlled the virus successfully. With many Chinese reluctant to travel overseas, the recovery of Macau’s gaming industry depends largely on the return of bilateral travel between the mainland and the autonomous region. In October and November, Macau’s casinos were operating at around 30% of capacity, which is about breakeven in terms of cash flow.

Property: Housing demand remains vibrant in China, especially from first-time homebuyers and those seeking to upgrade to nicer homes with their own bathroom or kitchen. While China’s government has issued new guidelines aimed at preventing a housing bubble, we think industry concentration is going to be accelerated among the largest players with stronger balance sheets that mostly trade at very reasonable valuations.

Commodities: Rather than investing directly in materials or energy companies, there are ways to gain indirect exposure to the rebound in commodities demand. Our conviction has grown in certain Russian and Brazilian companies that may benefit from an economic rebound in their countries and higher consumer spending. These include companies operating in the financial, consumer and real estate industries.

A rally in a few areas of EM equities could broaden to other sectors

3. Stimulus, commodities demand and reform momentum

In our view, governments and central banks will likely err on the side of doing more, rather than less. It will be a political imperative for policymakers around the world to ensure there is a resumption of growth without major damage to their economies.

As global growth rebounds in 2021 and developed countries look to restock their supply chains, this should help support commodity-rich countries that supply industrial metals and other raw materials used in basic infrastructure, as well as technological components and consumer goods.

Further, if emerging economies do indeed recover relatively quickly, it could be an impetus for political leaders to resume their reform agendas.

China: Reform efforts are already resuming in China. The government’s focus is back on curbing debt excesses in the financial system and setting new industry guidelines, such as in real estate and technology, where regulators have targeted the country’s largest internet-related companies for anticompetitive behaviour. Given U.S. sanctions on semiconductor and technological equipment manufacturers and supply chain concerns, there is renewed emphasis on the Made in China 2025 program; this is creating some intriguing investment opportunities among China’s domestic companies that might benefit from the government’s plan.

India: Before COVID, several sweeping reforms to modernize the country had begun to gain traction within India’s economy, including a bankruptcy law and a national sales tax. Recently, India has taken steps to attract investments in manufacturing as multinationals reassess their global supply chains and consider moving some production out of China. Mobile phone assembly has been one of the first areas targeted.

Indonesia: In October 2020, President Joko Widodo passed an omnibus law with a number of measures to improve the business climate in the country. These include cutting the corporate tax rate, reducing red tape for businesses, attracting foreign investment and creating more free trade zones. Primary markets are also showing signs of life. Popular e-commerce platform Tokopedia is reportedly accelerating its plan to go public this year.

4. More effective virus containment and favourable geopolitics

We also see other factors at work that could support a rebound in emerging markets.

Virus containment: Some developing countries have been more effective than developed countries at implementing strict measures to mitigate the spread of the virus. So far, China, Taiwan, Thailand and Vietnam fit in this category. These countries have reported among the lowest number of COVID-19 cases and deaths per 100,000 according to Johns Hopkins data.

Other countries, including Indonesia, Brazil and India, have been less restrictive, seeming to accept a higher level of infections and deaths as the price of avoiding draconian lockdowns. But in India, for instance, infections and mortality are relatively low on a per capita basis owing to a large, young population.

More favourable geopolitics: While trade tensions and geopolitical conflicts between China and the U.S. are likely to continue to generate headline risk for China-related investments, we expect a more predictable evolution of policies under the Biden administration compared with the volatile relationship of the past four years. This is more conducive to long-term planning and market stability.

We do think it’s likely that the Biden administration will maintain previous trade tariffs and recent bars on certain Chinese companies from being listed on U.S. stock exchanges. In regard to our investments in Chinese stocks, we continue to calibrate ongoing risks and potential actions that may be taken by government authorities in the U.S. and China.

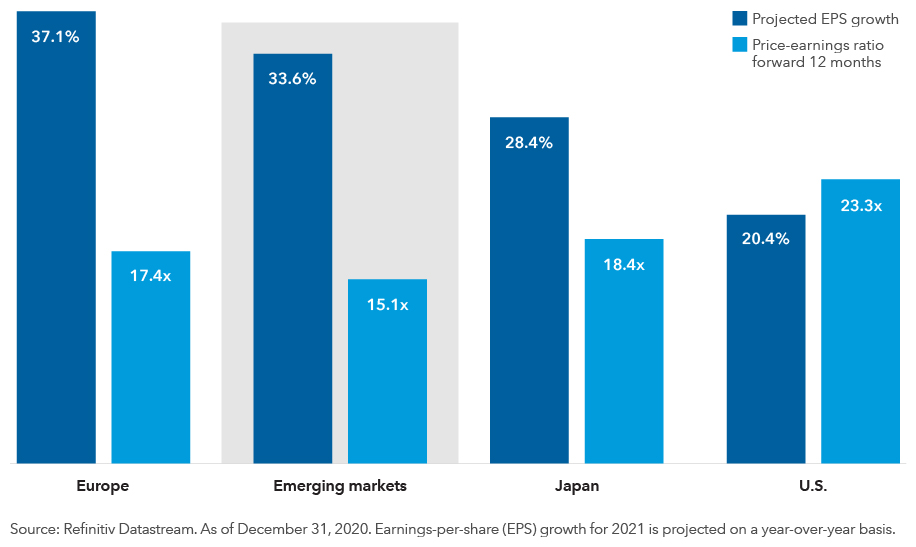

Attractive valuations: This could help support emerging markets in 2021. On a forward-looking basis, emerging markets equities trade at a significant discount compared with other parts of the world, based on recent price-to-earnings data.

EM valuations look attractive given growth projections

5. Potential compression in risk premia

As an emerging market and the world’s second-largest economy, China has its own dynamic. But even excluding China, in our view emerging markets are no longer a high-beta asset class.

While there are huge divergences from country to country, economic policies in many countries are quite orthodox, embracing independent central banks, moderate fiscal stimulus, floating exchange rates and business-friendly rules for corporate governance. Managements of many companies are on par with their developed-market counterparts and have experience in running companies through economic cycles.

Yet EM stock valuations reflect a much higher risk premium than developed markets. In our view, stock price-earnings multiples in many industries could rise as the investor base for emerging markets expands.

In a world of low growth in developed markets outside the U.S., we believe investor interest in the fast-growing emerging markets economies is likely to increase. We have already seen this in emerging Asian technology stocks. We believe this can extend to other areas, including select private sector financials, fintech, health care and housing. Commodities are also experiencing a rebound, as mentioned earlier: management of commodities-related companies has improved over the past decade, and balance sheets have been restructured.

Finally, while it is impossible to time a currency cycle, emerging markets currencies are broadly viewed by our currency analysts as undervalued on a medium- to long-term basis. This should provide another tailwind for emerging markets equities. Overall, we believe it is a good time for investors to take a fresh look at the asset class.

About

Kent Chan, Equity investment director

Kent Chan, Equity investment director

Kent Chan is an equity investment director with 29 years of industry experience (as of 12/31/20). He holds a bachelor’s degree in political economics from the University of California, Berkeley.

Victor Kohn, Portfolio manager

Victor Kohn, Portfolio manager

Victor D. Kohn is an equity portfolio manager with 35 years of industry experience (as of 12/31/2020). He holds an MBA from Stanford Graduate School of Business and both master’s and bachelor’s equivalent degrees summa cum laude in industrial engineering from the Universidad de Chile.

F. Chapman Taylor, Portfolio manager

F. Chapman Taylor, Portfolio manager

F. Chapman Taylor is an equity portfolio manager with 30 years of industry experience (as of 12/31/20. He holds an MBA in finance and strategic planning from the Wharton School of the University of Pennsylvania, and a bachelor’s degree in physics and theology from Tulane University.

The MSCI Emerging Markets Investable Market Index (IMI) captures large, mid- and small-cap representation across 27 emerging markets (EM) countries.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2020. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, "Bloomberg"). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, "Barclays"), used under licence. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds and Capital International Asset Management (Canada), Inc. are part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. The Capital Group companies manage equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Copyright © Capital Group