by Karen Watkin, AllianceBernstein

Having strongly underperformed the wider stock market in 2020, high-dividend stocks have shown early signs of a rebound in recent weeks. There is a good chance for this dynamic to continue. Dividend cuts and suspensions have started to normalize, and the ongoing low-interest-rate environment and the recent tightening in credit spreads should tempt investors back towards dividend payers.

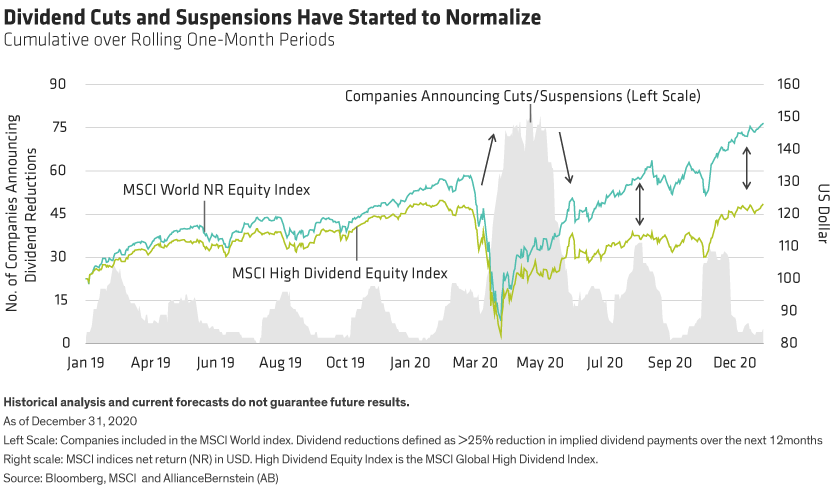

It’s normal to see a trickle of companies cutting or suspending their dividends. But from March through April last year, that trickle turned into a tsunami, as COVID-19 hammered businesses forcing many to cut and suspend capital distributions in order to protect their balance sheets. In the second half of 2020, the pace of dividend cuts and suspensions eased, and more typical dividend patterns have started to return (Display, left scale). The improved global economic outlook for 2021 and strong corporate earnings growth forecasts should support this development. Yet, the dispersion of returns in 2020—or “performance gap” between high-dividend stocks and the broad equity market—was the widest it has been in 20 years (Display, right scale).

High-Dividend Payers Substantially Underperformed in 2020

High-dividend equities lagged the wider stock market by 16% in 2020 and fell behind growth stocks by more than 30%. In previous years, the magnitude of the dispersion of returns between global equities and high-dividend equities was far less pronounced. While the MSCI World Index surged to new highs in 2020, the MSCI High Dividend Equity Index has only recently recovered its March 2020 drawdown.

Interestingly, this underperformance of high-dividend payers occurred in an environment of falling bond yields. It is unusual for dividend stocks to underperform this much in an environment where investors would typically seek out attractive sources of income.

Current High-Dividend Yields at Similar Levels to High-Yield Credit

High-dividend payers look attractive relative to high-yield credit (HY) too. Over the last 10 years, HY bond yields exceeded high-dividend equity yields by around 240 basis points (b.p.) on average (as measured by the Bloomberg Barclays Global High Yield Index and MSCI Global High Dividend Index). At the onset of the COVID crisis, this yield differential spiked to 570 b.p.

But credit has rebounded strongly since. With HY credit spreads having narrowed, high-dividend payers now offer a similar distribution to high-yield bonds. In fact, the current yield differential between high-dividend stocks and high-yield credit is the lowest it has been in a decade.

With high-dividend payers offering a yield of 3.7% and HY bonds yielding 4.2% (index yields of the MSCI Global High Dividend Index and Bloomberg Barclays Global High Yield Index), the yield difference has dropped to around 50 b.p. as of end of January 2021. This is very unusual, given that high-dividend payers are often high quality companies with substantially stronger fundamentals than high-yield issuers.

Extraordinary Conditions Favor a Multi-Asset Approach

The abnormal performance of high-dividend payers represents part of a wider picture. The dispersion of returns triggered by the COVID-19 crisis has been among the most extreme in decades. Across business sectors, global economies and asset classes, the pace of recovery has varied considerably, creating opportunities in asset classes and segments which have so far lagged the wider market. In this environment, we believe an unconstrained multi-asset approach can help investors capture valuation anomalies and take advantage of the progressive normalization of the world economy. High-dividend equity could be one of the beneficiaries.

Source: Bloomberg, Bloomberg Barclays, MSCI and AllianceBernstein (AB)

Karen Watkin is Portfolio Manager, Multi-Asset Solutions at AllianceBernstein (AB)

The value of an investment can go down as well as up and investors may not get back the full amount they invested.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorized and regulated by the Financial Conduct Authority in the United Kingdom.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein.

This post was first published at the official blog of AllianceBernstein..