by Erika Toth, Director, Institutional & Advisory, Eastern Canada, BMO Asset Management, via Indexology

Most investors are familiar with the S&P 500 index. Its mid and small cap counterparts, the S&P 400 and S&P 600 don’t get quite the same coverage in the financial press. Yet these are powerful tools that must not be overlooked.

1. Diversification of the Indices

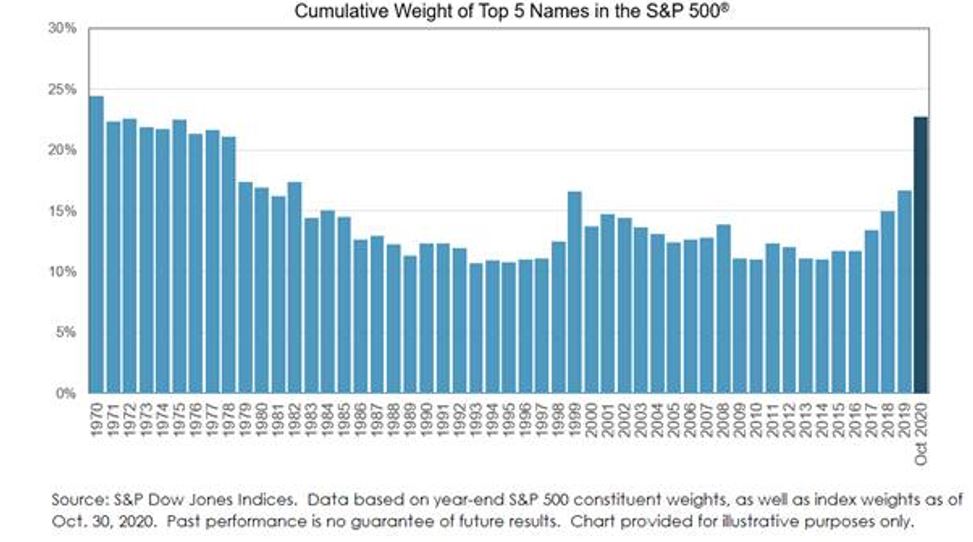

2020 was indeed a peculiar year for US equities. As the virus brought on volatility, the recovery in equity market indexes was uneven – and largely driven by a handful of mega-cap companies. If we look at the S&P 500 in particular, the level of concentration in the top 5 names is now the highest it has been in 40 years (20.19% as of December 31, 2020). It is interesting to note that between the 1970’s and today, the highest level of concentration reached was in December 1999, prior to the tech bubble burst.

An important implication is that the S&P 400 and 600 index returns are less reliant on a handful of names, and may therefore be an effective tool for diversifying US equity exposure.

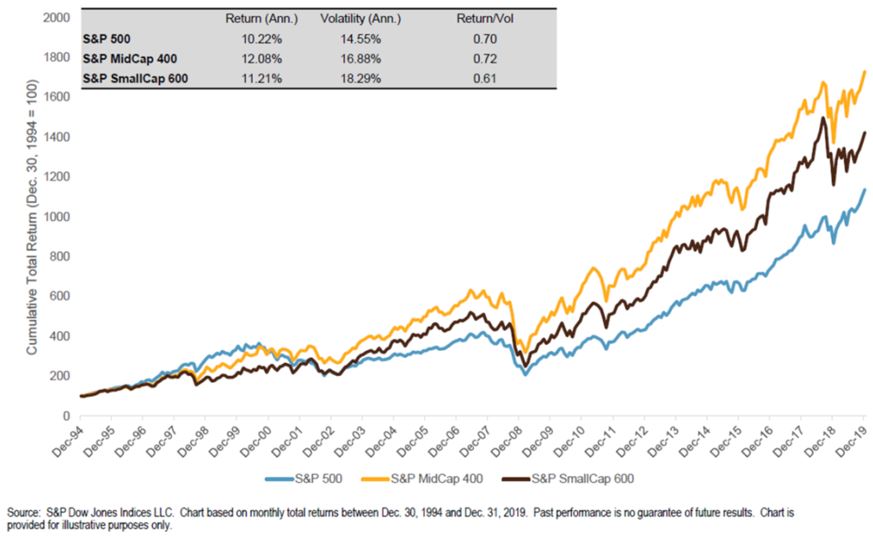

2. Historical Performance

Looking at very long term time periods, small and mid-size indexes have demonstrated superior performance when compared to large-cap only. 25 years of data show an outperformance of 186 basis points per year (S&P 400) and 99 basis points per year (S&P 600) compared to the S&P 500.

3. Why Consider These Indexes Now?

Small and medium sized businesses have been disproportionately impacted by the pandemic, and have lagged in recent years, but may present greater growth opportunities for long term investors moving forward. These mid and small cap indexes may be posed to benefit from “re-opening” and possible M&A activity ahead of us.

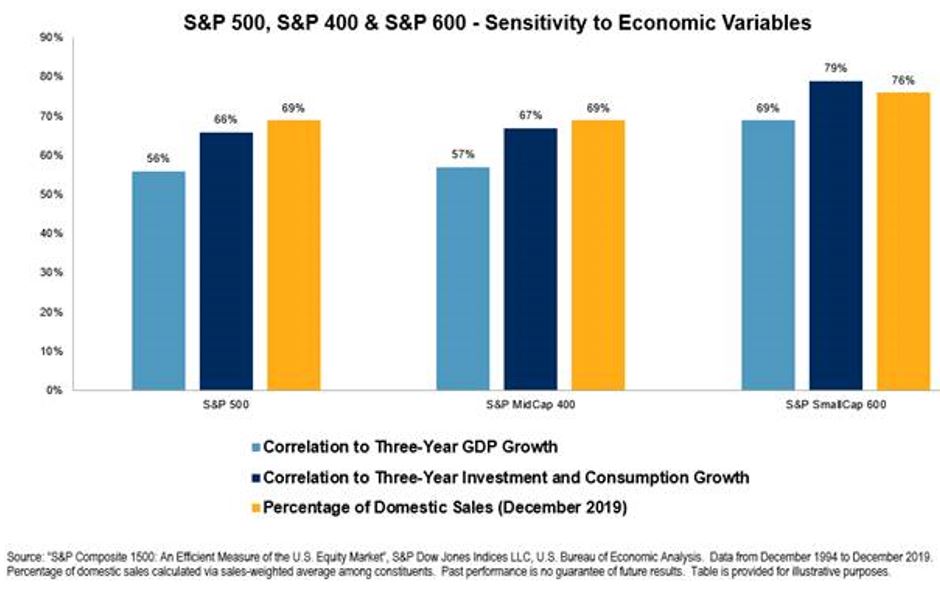

The S&P 400 and 600 have historically had a higher correlation to a number of economic indicators (GDP growth, investment and consumption growth). As the re-opening becomes more broad-based, if consistent with such higher correlations, these indexes may provide a higher beta, leading to outperformance versus the S&P 500.

These indexes can also serve as a complement to the S&P 500. While the 500 provides good exposure to big tech and healthcare, the 400 and the 600 provide a heavier weighting towards industrials, real estate, financials and consumer discretionary sectors – pro cyclical sectors that possibly stand to do well as the economy as a whole recovers.

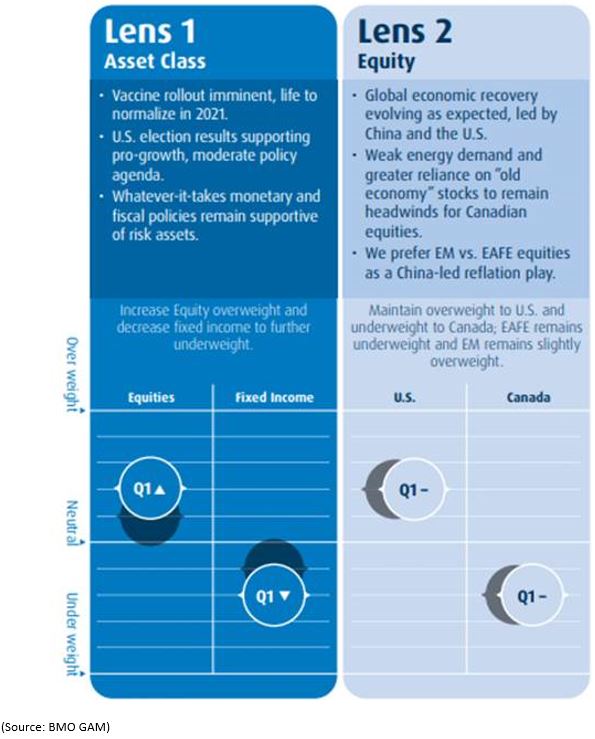

In the final quarter of 2020, BMO GAM’s Multi Asset Strategy Team (MAST) increased their overweight to equities versus fixed income based on the imminent rollout of vaccines and “Whatever-it-takes” monetary and fiscal policies supportive of risk assets. We maintained an overweight to US equities, and increased our portfolio beta by overweighting small cap equities on vaccine optimism. We expect these themes to continue into 2021.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Copyright © Indexology