by Don Vialoux, EquityClock.com

Technical Notes for Monday January 18th

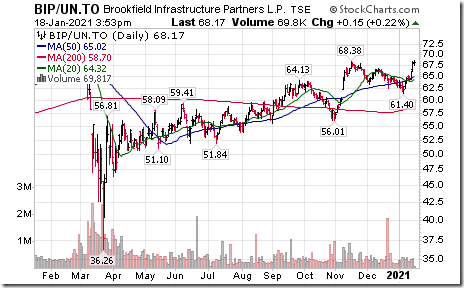

Brookfield Infrastructure (BIP/UN), a TSX 60 stock moved above $68.38 extending an intermediate uptrend.

Chinese based ETFs listed on the TSX responded to the better than expected 6.5% annualized GDP gain by China in the fourth quarter. XCH moved above Cdn$30.21 to an all-time high extending an intermediate uptrend.

Trader’s Corner

Editor’s Note: No change in ratings for the TSX and TSX sectors yesterday

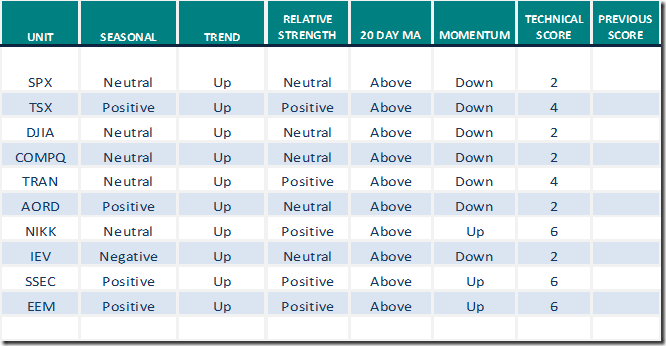

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for January 18th 2021

Green: Increase from previous day

Red: Decrease from previous day

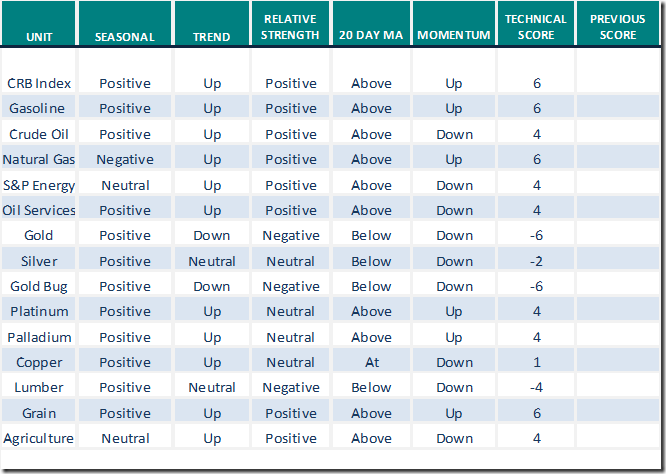

Commodities

Daily Seasonal/Technical Commodities Trends for January 18th 2021

Green: Increase from previous day

Red: Decrease from previous day

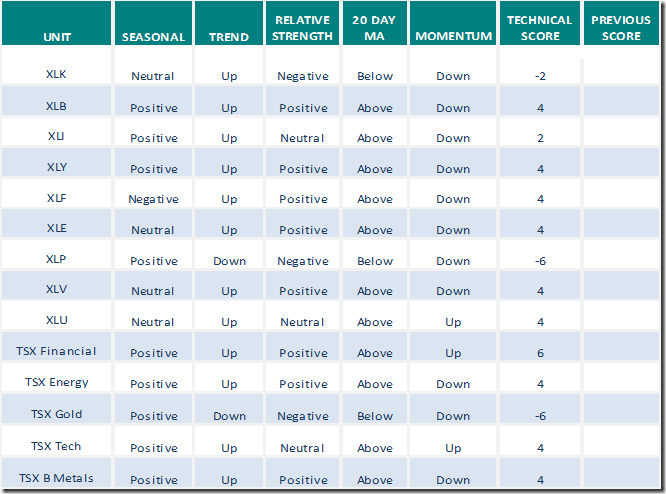

Sectors

Daily Seasonal/Technical Sector Trends for January 18th 2021

Green: Increase from previous day

Red: Decrease from previous day

Berman’s Call Yesterday

During his education segment, Larry offered interesting observations on central bank liquidity and likely action by the Federal Reserve to curtail liquidity at its next meeting on January 26th and 27th. Signs of a reduction in liquidity could have a short term negative impact on U.S. equity markets. Following is a link:

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.