by Don Vialoux, EquityClock.com

Technical Notes for Wednesday January 13th

Bausch Health (BHC), a TSX 60 stock moved above Cdn$30.52 extending an intermediate uptrend. Quarterly results beat consensus.

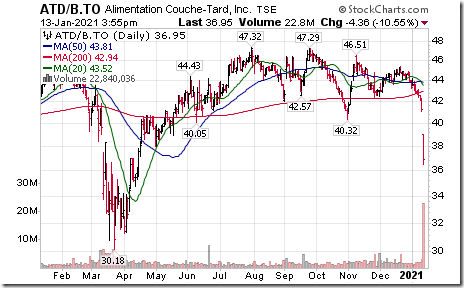

Couche Tard (ATD.B), a TSX 60 stock moved below Cdn$40.32 on rumors that it has offered to purchase a French based convenient store company, Carrefour for $15 billion. Note the volume.

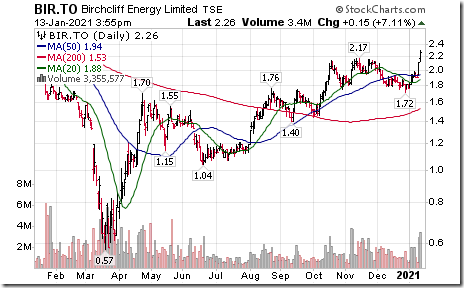

Canadian “gassy” stocks continue moving higher. Birchcliffe Energy moved above $2.17 extending an intermediate uptrend. ARC Resources moved above $7.13 extending an intermediate uptrend.

Enbridge (ENB), a TSX 60 stock moved above $43.63 and $43.65 resuming an intermediate uptrend.

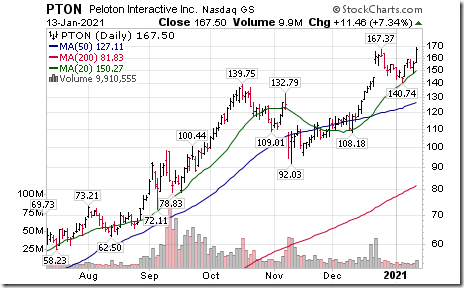

Peleton (PTON), a NASDAQ 100 stock moved above $167.37 to an all-time high extending an intermediate uptrend.

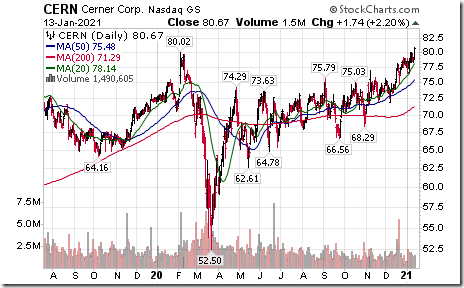

Cerner (CERN), a NASDAQ 100 stock moved above $80.02 to an all-time high extending an intermediate uptrend.

PayPal (PYPL), a NASDAQ 100 stock moved above $244.25 to an all-time high extending an intermediate uptrend.

Trader’s Corner

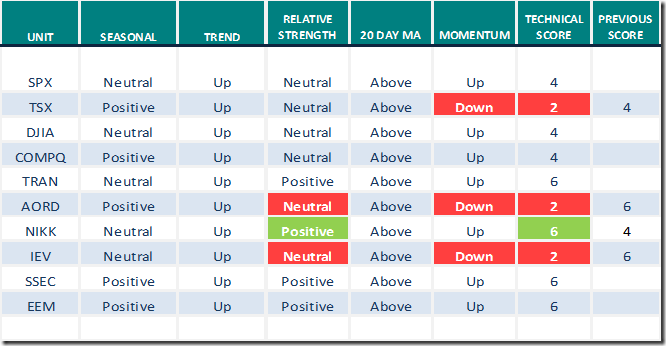

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for January 13th 2021

Green: Increase from previous day

Red: Decrease from previous day

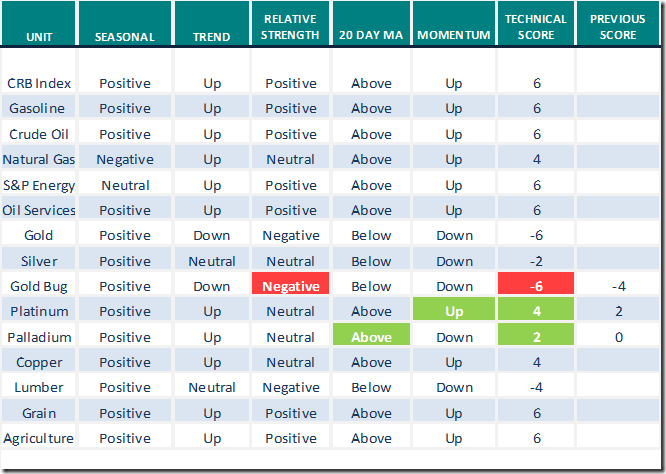

Commodities

Daily Seasonal/Technical Commodities Trends for January 13th 2021

Green: Increase from previous day

Red: Decrease from previous day

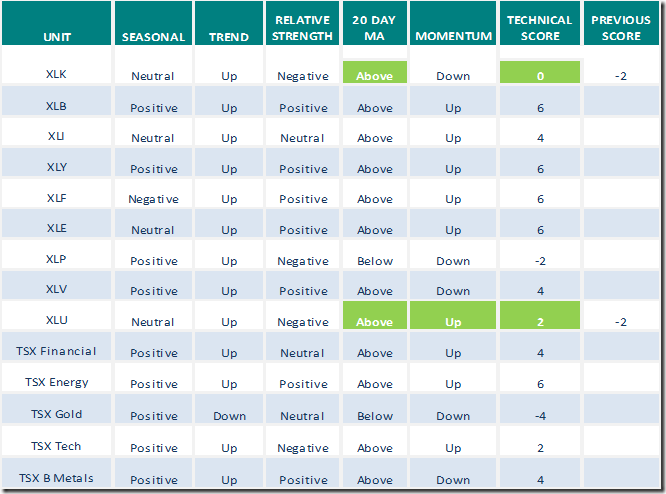

Sectors

Daily Seasonal/Technical Sector Trends for January 13th 2021

Green: Increase from previous day

Red: Decrease from previous day

The Canadian Technician

Greg Schnell notes, “Another continent soars”! Following is a link:

Another Continent Soars | The Canadian Technician | StockCharts.com

S&P 500 Momentum Barometers

The 50 day Barometer added 1.40 to 79.36 yesterday. It remains intermediate overbought, but has yet to show significant signs of a short term downturn.

The 200 day Barometer was unchanged at 90.18 yesterday. It remains extremely intermediate overbought above 80.00, but has yet to show significant signs of a short term downturn.

TSX Momentum Barometers

The 50 day Barometer dropped 3.81 to 65.71 yesterday. It remains intermediate overbought and has started a short term downtrend.

The 200 day Barometer dropped 0.95 to 79.05 yesterday. It changed from extremely intermediate overbought to intermediate overbought on a move below 80.00 and has started a short term downtrend.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.