by Don Vialoux, EquityClock.com

Technical Notes for Monday January 11th

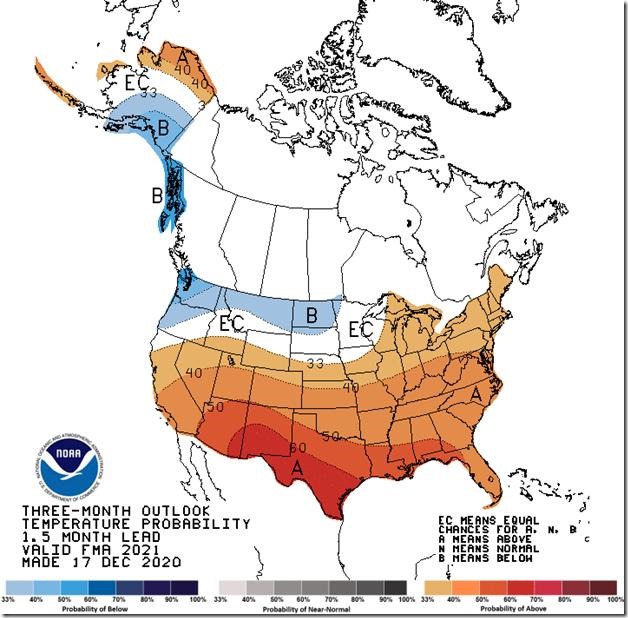

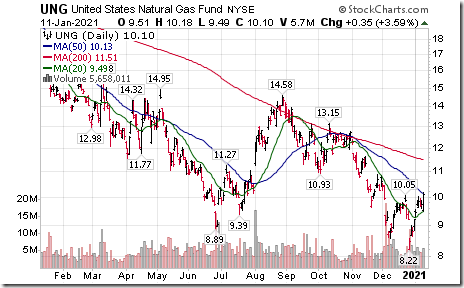

Natural Gas ETN (UNG) moved above $10.05 completing a double bottom pattern. Weather forecasters are warning about a “Polar Vortex” heading to western Canada and the northwestern U.S. states with colder than average temperatures and higher than average precipitation (i.e. snow) between now and March.

Biotech ETF (BBH) moved above $176.88 and $177.49 to an all-time high extending an intermediate uptrend. Responding to news from the Morgan Stanley’s Healthcare conference this week!

Biogen (BIIB), a NASDAQ 100 stock moved above $254.00 and $254.41 completing a base building pattern.

Lockheed Martin (LMT), an S&P 100 stock moved below $334.78 setting an intermediate downtrend.

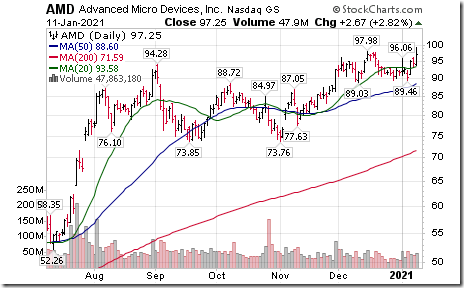

Advanced Micro Devices (AMD), a NASDAQ 100 stock moved above $97.98 to an all-time high extending an intermediate uptrend.

Xilinx (XLNX), a NASDAQ 100 stock moved above $154.12 to an all-time high extending an intermediate uptrend.

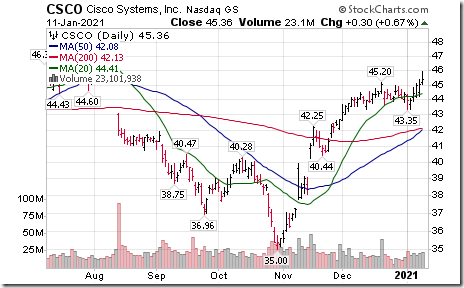

Cisco (CSCO), a NASDAQ 100 stock moved above $45.20 extending an intermediate uptrend.

AbbVie (ABBV), an S&P 100 stock moved above $109.15 extending an intermediate uptrend.

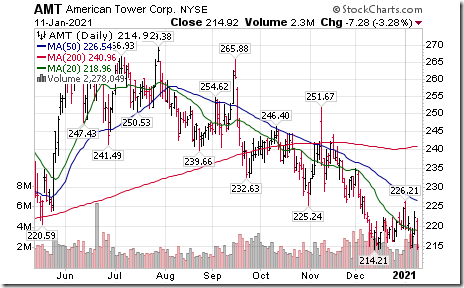

American Tower (AMT), a NASDAQ 100 stock moved below $214.21 extending an intermediate downtrend.

Fortis (FTS), a TSX 60 stock moved below $51.10, $50.90 and $50.82 extending an intermediate downtrend.

Trader’s Corner

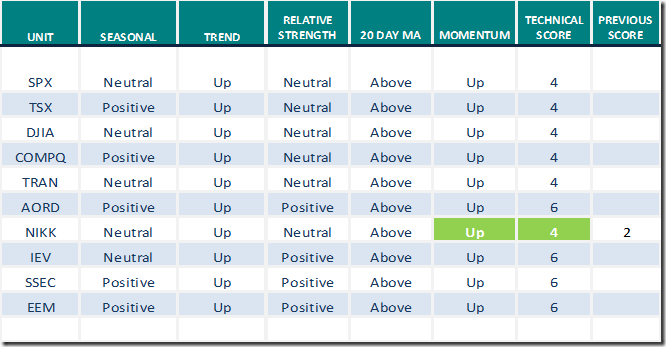

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for January 11th 2021

Green: Increase from previous day

Red: Decrease from previous day

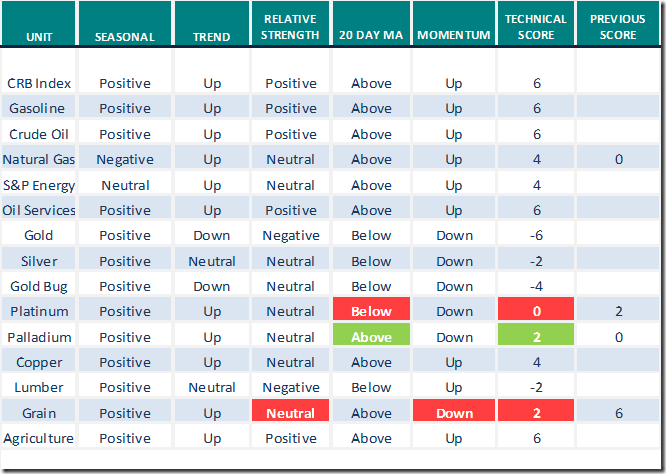

Commodities

Daily Seasonal/Technical Commodities Trends for January 11th 2021

Green: Increase from previous day

Red: Decrease from previous day

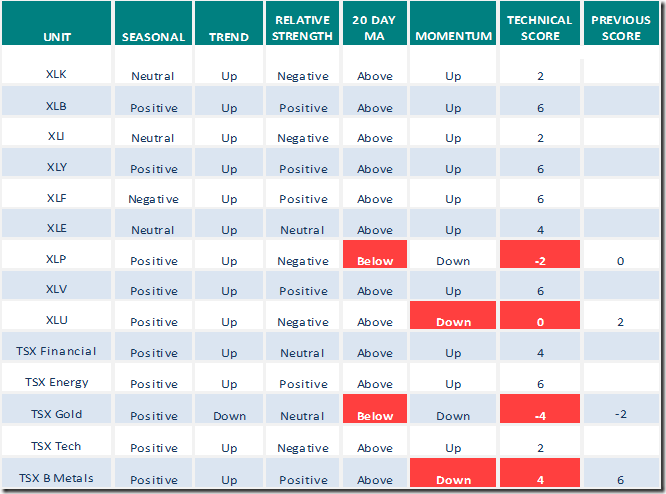

Sectors

Daily Seasonal/Technical Sector Trends for January 11th 2021

Green: Increase from previous day

Red: Decrease from previous day

Technical Scoop

Thank you to David Chapman and www.enrichedinvesting.com for a link to their weekly comment. Headline for the January 11th comment reads, “Democracy assault, higher markets, bitcoin mania, rates soar, gold down, oil rises, worse possible”. Following is the link:

Library | Enriched Investing Incorporated (frontlinesafeguard.com)

P.S. Also includes a link to previous weekly reports

S&P 500 Momentum Barometer

The Barometer dropped 4.21 to 79.76 yesterday. It changed from extremely intermediate overbought to intermediate overbought on a drop below 80.00.

TSX Momentum Barometer

The Barometer dropped 4.90 to 71.29 yesterday. It remains intermediate overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.