Policymakers around the world share the challenges of containing the renewed outbreak and supporting those affected by it.

by Carl R. Tannenbaum, Ryan James Boyle and Vaibhav Tandon, Northern Trust

Summary

- Dark Before The Dawn

Few will look back wistfully on 2020. COVD-19 did tremendous damage to public and economic health around the world. Unprecedented medical and fiscal responses established a recovery, but progress has been uneven within and across populations.

The conventional wisdom is that the new year can’t help but be better. Vaccination is now underway in many countries, and asset prices are certainly reflecting optimism about the post-pandemic future. But new lockdowns will constrain commerce during the initial months of 2021, and logistical challenges will limit the progress of inoculation programs.

The performance of the world economy in the months ahead will hinge on several factors:

- The course of COVID-19. Infections are still at high levels in many parts of the world, and a new variant of the virus is spreading more rapidly. Formal and informal restrictions on movement will remain a primary containment strategy until a high fraction of the population has been immunized. Public health measures will continue to limit economic activity for months to come.Our central assumption is that vaccination will be effective and will allow for accelerated growth during the middle of the year. The worst-case scenario would be a viral mutation that is more pervasive and pernicious. The best-case scenario would be more rapid vaccination that allows economies to reopen more completely and durably.

- The limits of economic stimulus. Central banks are at the edge of their effectiveness, and governments are experiencing bailout fatigue. Europe and the United States approved supplemental budget measures at the end of last year to assist businesses and workers. But with debt rising and an end to the pandemic on the horizon, policy makers are becoming more inclined to let economies operate on their own.Policy risks are two-sided. If fiscal support proves insufficient, broad economic “scarring” could be harmful to labor markets and key industries. If policy proves to be excessive, inflation and interest rates could come under pressure. We think both of these extremes can be avoided.

- Paradigm shifts. The new American government, a last-minute Brexit agreement, and lasting impacts of COVID-19 are among the environmental elements that will bear importantly on economic performance this year. Tensions between China and the West, along with the difficult circumstances faced by some emerging markets, will also merit close watching.

Our expectation is that the global recovery will gain strength as this year progresses, and become more widespread. The long-term economic consequences of what we have been through are still not fully apparent, but not all of them will be unpleasant.

Following are our views on how these circumstances will affect major world markets.

United States

- We are cautiously optimistic that the year ahead bodes well for those whose work, business or leisure prospects were curtailed by COVID-19. The accelerating vaccine rollout should end unpopular lockdowns and allow pent-up demand to boost economic momentum. We expect activity to grow at its strongest rate in the middle two quarters of 2021.

- The last action of the outgoing Congress was to pass over $900 billion in stimulus and support. These funds will prevent 14 million people from losing unemployment benefits and spare (at least temporarily) millions of households from facing eviction. Consumers largely saved or paid down debt with the prior round of economic incentive payments, so we do not expect the $600 supplement to cause a sudden breakout in spending or inflation. However, the bill mitigates near-term downside risks.

- The incoming Biden administration will inherit an economy in recovery but still severely impaired, with nearly ten million fewer people employed than there were pre-crisis. Further legislative support may be necessary for the specific sectors that will be last to recover. The Senate’s apparent 50-50 split, with legislative ties breaking in Democrats’ favor, raises the prospects for more rapid fiscal support if needed in the near term, and a wider scope for legislation thereafter. We will update our U.S. forecasts as legislative priorities take shape.

Eurozone

- After a tumultuous year, the health and economic outlook in Europe is looking brighter on the back of positive vaccine developments. Vaccine distribution is off to a slow start in key member states, forcing policymakers to implement renewed restrictions. However, the pace of immunization is expected to improve in the coming months, allowing for a stronger economic rebound. Recovery in tourism and the disbursement of European recovery funds will be key growth drivers. Unemployment rates will remain elevated as countries begin reviewing their support programs.

- Eurozone inflation has been hovering in negative territory recently, thanks to the significant demand shock caused by the pandemic and low energy prices. As economic recovery takes hold and negative base effects from energy prices start to fade, headline inflation will bounce back to positive territory. However, it will continue to hover well below the 2% target, prompting the European Central Bank to maintain its highly accommodative policy stance this year.

- The European Union (EU) recovery fund, along with the temporary suspension of the EU Growth and Stability Pact’s fiscal rules, are important steps forward for the unity and recovery of the region. Nonetheless, concerns over soaring public deficits and debt in countries like Italy will re-emerge in the post-COVID era. With Brexit agreements nearly complete, EU-U.K. trade in goods will continue without tariffs or quotas, but notable non-tariff barriers will be problematic.

United Kingdom

- More than four years after the U.K. voted to leave, Britain has finally begun a new economic relationship with the EU. Both sides agreed to a thin free trade agreement less than a week ahead of the December 31 deadline. The accord averted the worst potential economic outcomes like widespread tariffs and quotas, but trade is likely to remain disrupted in the short term as new rules are put into place.

- The U.K. economy will continue to suffer in the first quarter owing to a renewed nationwide lockdown. But as the immunization campaign gathers more stream, we expect activity to rebound sharply thereafter. Consumers and dependent sectors, which suffered the most during the lockdowns, will likely be the main engine of growth amid easing mobility and social restrictions. High take-up of the U.K.’s furlough scheme will continue to limit the rise in unemployment.

- The Bank of England will maintain its accommodative monetary policy stance, owing to remaining slack in the labor markets and a below-target inflation rate. As the worst impacts of the pandemic fade and a no-deal Brexit moves out of the equation, talks of negative interest rates will likely be a thing of the past.

Japan

- Japan has managed better health outcomes than most advanced economies, but policymakers couldn’t replicate that success on the economic front. The Japanese economy entered last year on a weak footing after the late 2019 consumption tax hike, and the pandemic caused a major setback. As conditions begin to normalize domestically and globally, the Japanese economy will build on the momentum gained in the second half of 2020. Japan is expected to host the postponed Tokyo Olympics this summer; but with health restrictions and fewer spectators, the Olympics are likely to deliver only a modest boost to GDP.

- With inflation likely to remain well below 2%, the Bank of Japan is expected to remain on hold throughout 2021. Fiscal policy will likely remain supportive as Prime Minister Suga Yoshihide has pledged to continue with “Abenomics.”

- Japan’s foreign policy will be in focus in this year as the country risks getting caught in the middle of the rivalry between the U.S. and China, its two most vital trading partners. Japan’s relations with the U.S. go far beyond economics, but its economic links to China run deep.

China

- The Chinese economy, the first to emerge from virus-induced shock, will continue to bounce back in 2021. Global recovery, along with the recently signed Regional Comprehensive Economic Partnership trade agreement, will support strong export growth in 2021. Those gains will be partly offset by a notable drop in COVID-related purchases and the strength of China’s currency. Though China will continue to rely on state-led corporations to support growth, its macro policy stance is likely to shift from expansionary to contractionary to contain leverage and financial risks.

- S.-China decoupling will likely continue under the new U.S. administration. Though President-elect Biden could adopt a more pragmatic approach towards China, current tariffs, technology and export control measures are here to stay. If anything, the Biden administration’s coalition-building approach with allies will likely exert additional pressure on China to reform its current trade and investment practices.

- While foreign investors are warming up to Chinese fixed income markets, high corporate debt and surging defaults in domestic bond markets have the potential to dent market confidence.

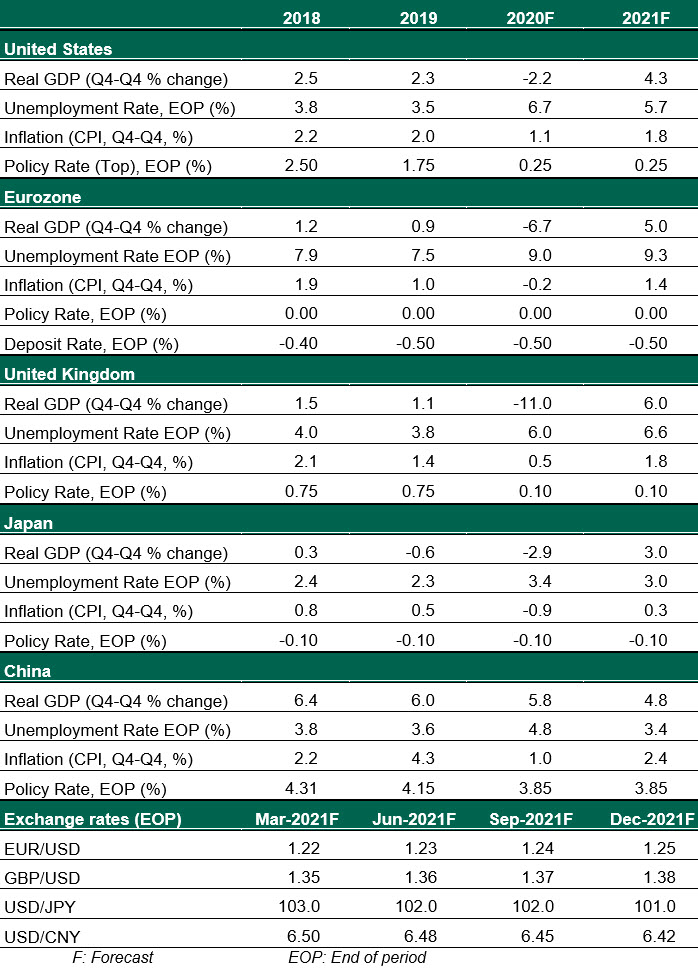

Global Economic Forecast – January 2021

Copyright © Northern Trust