by Don Vialoux, EquityClock.com

Technical Notes for Tuesday January 5th

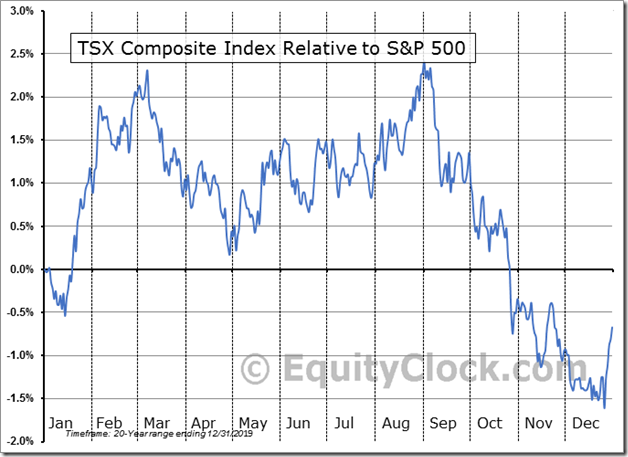

‘Tis the season for the TSX Composite to outperform the S&P 500 Index between now and early March!

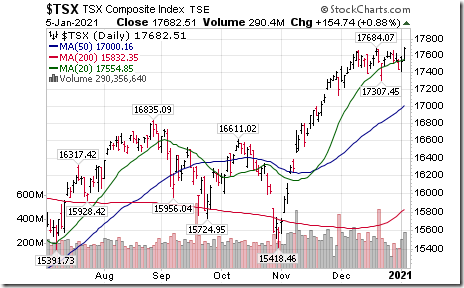

TSX Composite Index moved above an inter-day high at 17,684.07 and a closing high at 17.652.94 extending an intermediate uptrend

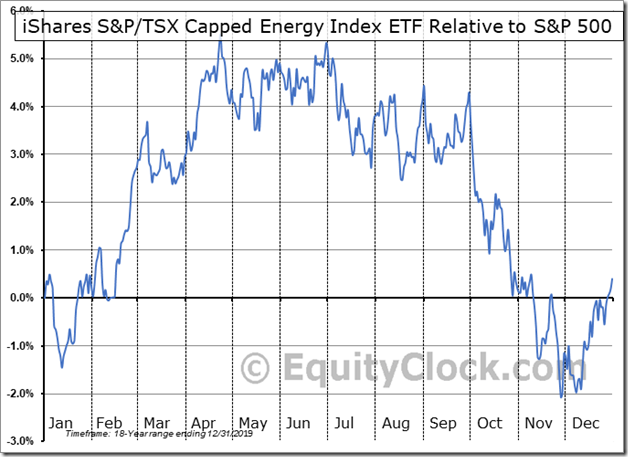

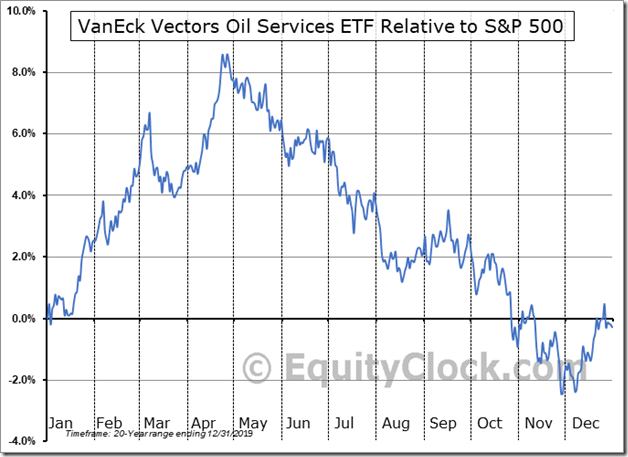

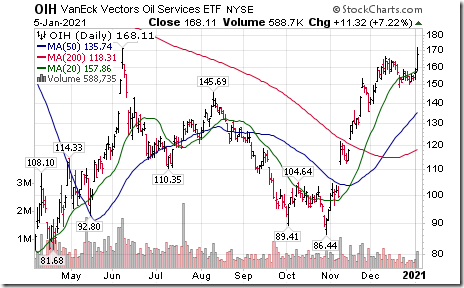

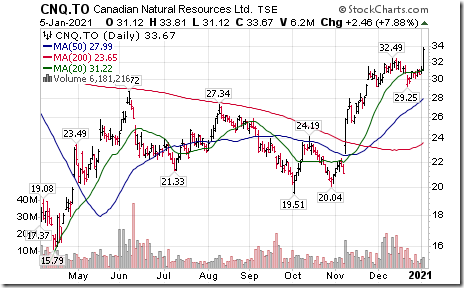

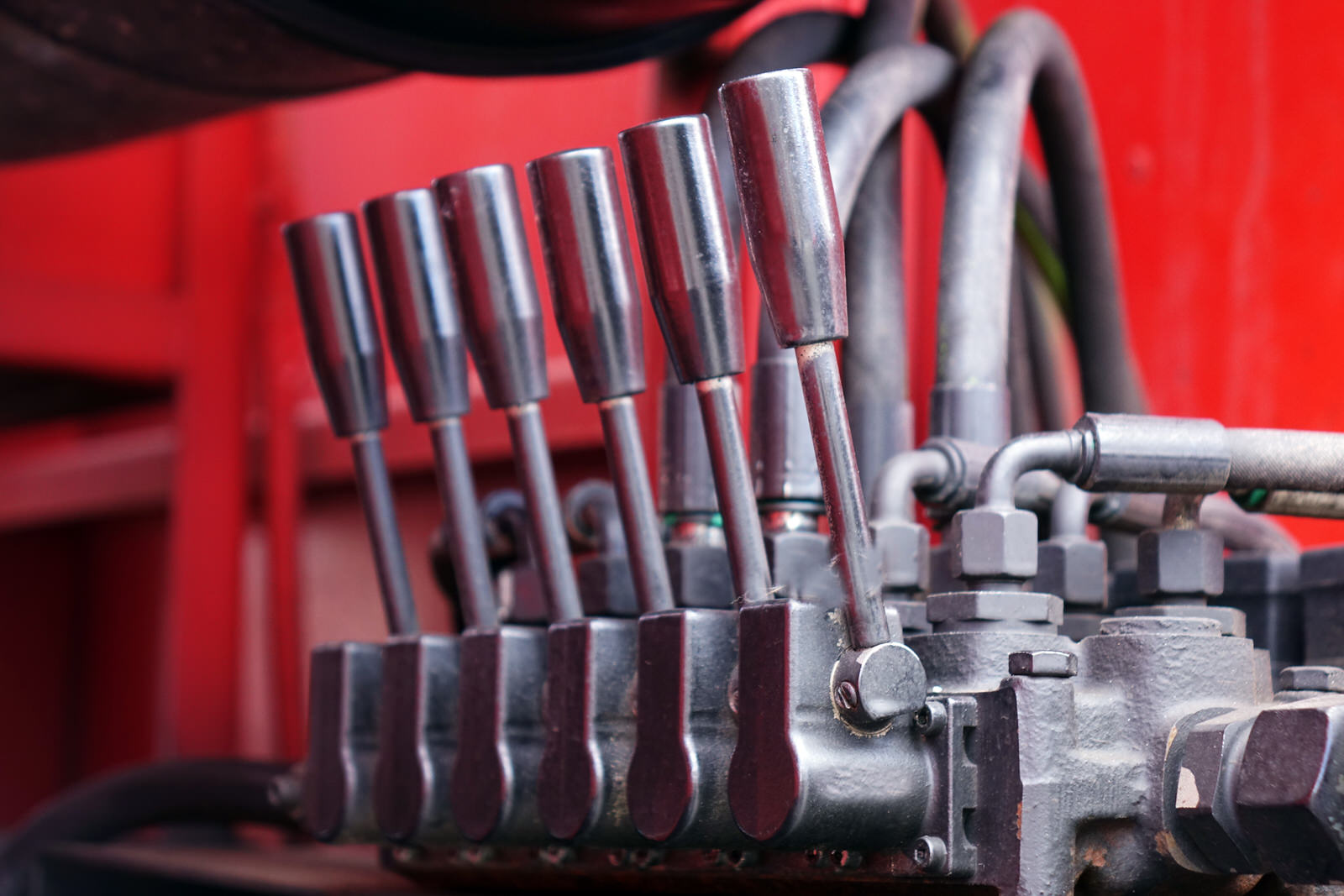

‘Tis the season for energy and energy service stocks on both sides of the border to move higher into late April!

North American energy and oil services stocks moved higher on news that Saudi Arabia decided to reduce production by 1 million barrels per day in February and March. Crude oil prices moved higher, testing the $50.00 per barrel level. Oil and Gas Exploration iShares (XOP) moved above $63.77 extending an intermediate uptrend.

Oil Services ETF (OIH) moved above $166.68 extending an intermediate uptrend.

TSX Energy iShares (XEG) moved above $6.35 extending an intermediate uptrend.

ExxonMobil (XOM), a Dow Jones Industrial Average stock moved above $44.47 extending an intermediate uptrend.

Cenovus (CVE), a TSX 60 stock moved above $8.21 extending an intermediate uptrend.

Imperial Oil (IMO), a TSX 60 stock moved above $25.88 extending an intermediate uptrend.

Canadian Natural Resources (CNQ), a TSX 60 stock moved above $32.49 extending an intermediate uptrend.

Cameco (CCO.TO CCJ), a TSX 60 stock moved above Cdn.$18.38 and US $14.41 respectively extending an intermediate uptrend.

Base Metal equities and related ETFs (e.g. ZMT.TO, XBM.TO) continue move higher. Hudbay Minerals (HBM.TO) moved above $9.54 extending an intermediate uptrend.

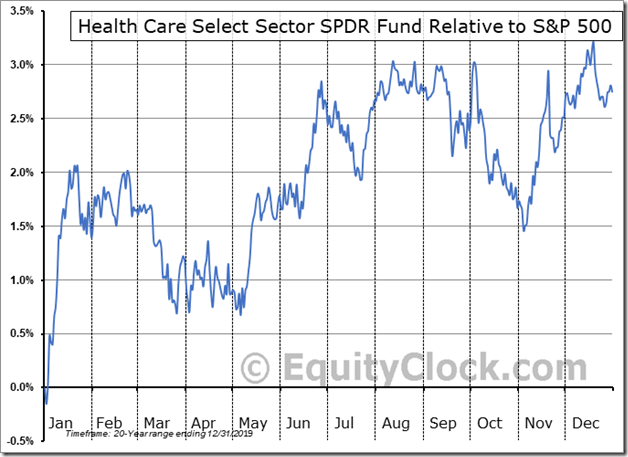

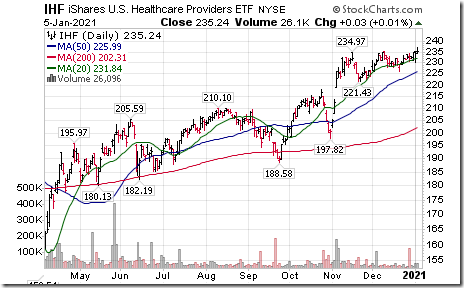

‘Tis the season for the Healthcare sector to move strongly higher in January on a real and relative basis!

Healthcare SPDRs (XLV) moved above $113.94 to an all-time high extending an intermediate uptrend. The sector is moving higher partially to anticipation of news next week about new healthcare products and services announced at JP Morgan’s annual healthcare conference in San Francisco. The conference is held this year from January 13th to January 16th.

U.S. Healthcare Providers iShares (IHF) moved above $235.31 to an all-time high extending an intermediate uptrend. Expected to benefit from a Biden presidency!

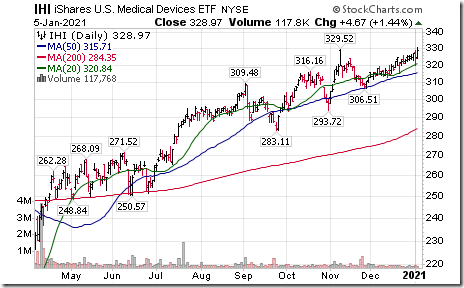

U.S. Medical Devices iShares (IHI) moved above $329.52 to an all-time high extending an intermediate uptrend. Expected to benefit from a Biden presidency!

Target (TGT), an S&P 100 stock moved above $181.17 to an all-time high extending an intermediate uptrend.

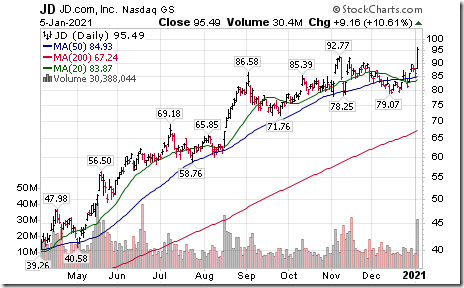

JD.com (JD), a NASDAQ 100 stock moved above $92.77 to an all-time high extending an intermediate uptrend.

NetEase (NTES), a NASDAQ 100 stock moved above $98.18 resuming an intermediate uptrend.

Rogers Communications (RCI), a TSX 60 stock moved above US $47.77 and Cdn$61.15 extending an intermediate uptrend.

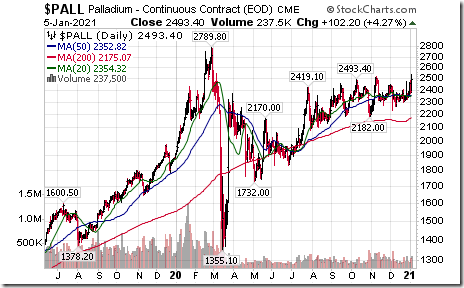

Palladium advanced above $2,523.50 per ounce extending an intermediate uptrend.

Trader’s Corner

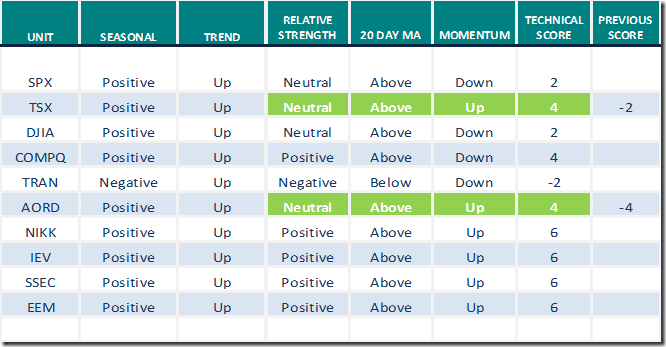

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for January 5th 2021

Green: Increase from previous day

Red: Decrease from previous day

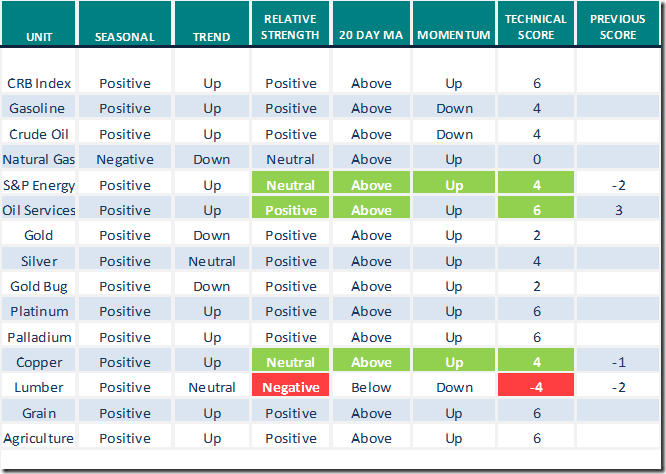

Commodities

Daily Seasonal/Technical Commodities Trends for January 5th 2021

Green: Increase from previous day

Red: Decrease from previous day

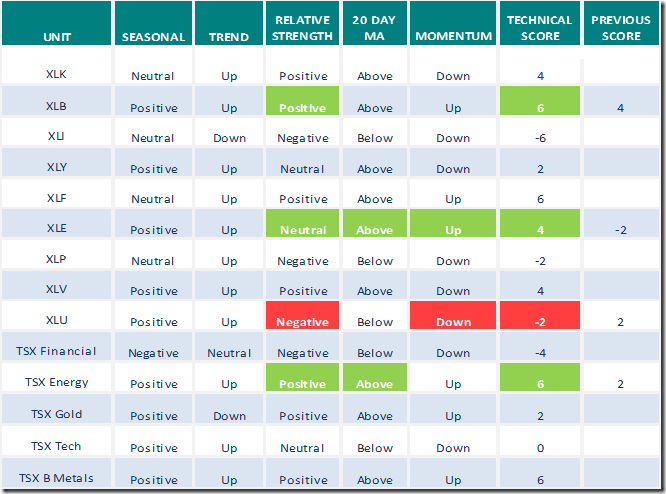

Sectors

Daily Seasonal/Technical Sector Trends for January 5th 2021

Green: Increase from previous day

Red: Decrease from previous day

Please note that seasonality ratings on several equity indices and several U.S. sectors are scheduled to change on January 7th. Most of the changes are downgrades from Positive to Neutral.

S&P 500 Momentum Barometer

The Barometer added 3.21 to 77.35 yesterday. It remains intermediate overbought.

TSX Momentum Barometer

The Barometer added 3.21 to 76.67 yesterday. It remains intermediate overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.