by Pramod Atluri, Mike Gitlin, and Karl Zeile, Capital International Asset Management

Bonds offer balance in times of economic uncertainty. Here are three ways fixed income allocations can help balance risk and provide yield in this environment.

Many people will be happy to forget 2020. In some ways, markets have already moved on, boosted by promising news on vaccines and improving economic data around the world. Investors have found their animal spirits, helping fuel rebounds in prices for equities and other risk assets.

Most fixed income sectors are on track to notch healthy gains for the year. But with low interest rates and relatively modest yields for credit, much of that optimism is already priced into markets. As a result, we expect more moderate returns as we look forward to 2021.

With the tailwind of ultra-low interest rates, accommodative monetary policy and the potential for additional fiscal stimulus, we believe the economy will continue to heal in 2021. And if vaccines and other medical advances prove effective, growth could continue to look better than expected.

However, COVID-19 has had a huge impact on virtually every part of the global economy. These effects will be felt for years to come.

Huge swaths of the small business and services sector have been wiped out and will have to be rebuilt. The future of commercial real estate has been fundamentally changed as businesses have adapted to work-from-home arrangements. Residential real estate is undergoing a massive boom as new home building trends, living preferences and Americans leaving cities have reshaped the industry. Travel, hospitality, energy and retail sectors have all been upended. While this has created opportunities for the strong, it has meant distress or bankruptcy for the weak.

Looking ahead to 2021, we see a vastly different economic and market backdrop compared to the pre-COVID world. Interest rates in many parts of the globe are negative and likely to remain that way for some time.

In the U.S., the Federal Reserve’s near-zero interest rate policy looks set to continue for years while unemployment remains elevated. Inflation had been low and stable for years, but it fell precipitously in 2020. It looks set to push higher going forward due to massive central bank stimulus, stronger economic growth and other factors. After a decade of dollar strength, surging budget deficits and reduced globalization could trigger a U.S. dollar bear market.

The new year is going to look very different. The shifting tides we see ahead create both risk and opportunity for investors. With valuations fully recovered in many parts of the market, active security selection will be critically important. Portfolio managers need to be poised to take advantage of opportunities and avoid investments that will not fully recover.

In this challenging environment, investors should consider these three actions:

1. Do more with cash

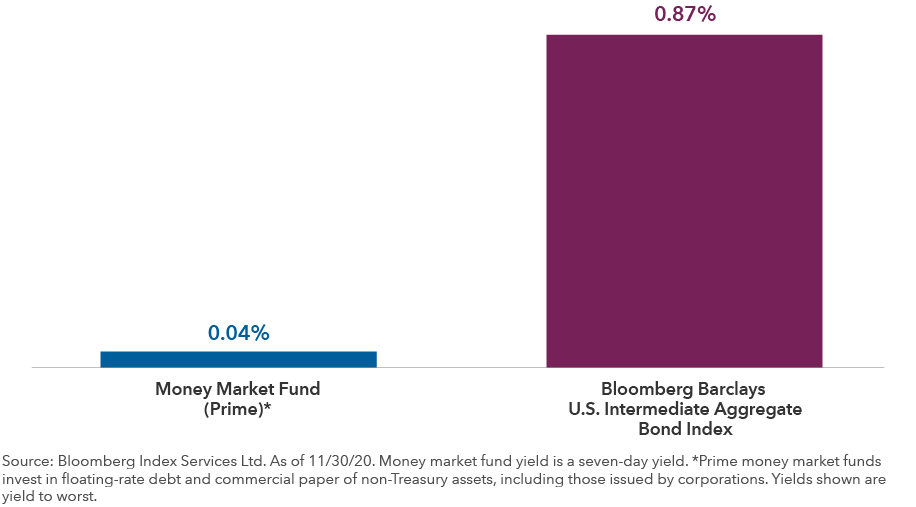

In the U.S. where money markets yield almost 0% and inflation is moving higher, holding excess cash is likely to destroy wealth and purchasing power. And with the Fed expected to hold rates down for two years or more, this wealth destruction will be compounded. With an accommodative Fed and an improving economic outlook, excess cash may be a significant drag on returns.

Fixed income securities offer alternatives that seek to provide relative safety and liquidity, as well as yields that should better keep pace with expected inflation. Short- and intermediate-term funds offer yields near 1%. And in an actively managed fund, investors may be able to generate even stronger total returns.

Holding cash can be costly

While the relative safety of a bond fund is not quite as strong as cash since a negative return is possible, some can get close. Consider a short-term fund consisting of 100% investment-grade bonds and a track record of capital preservation as an alternative to pursue some investment gain.

2. Stay strong at the core

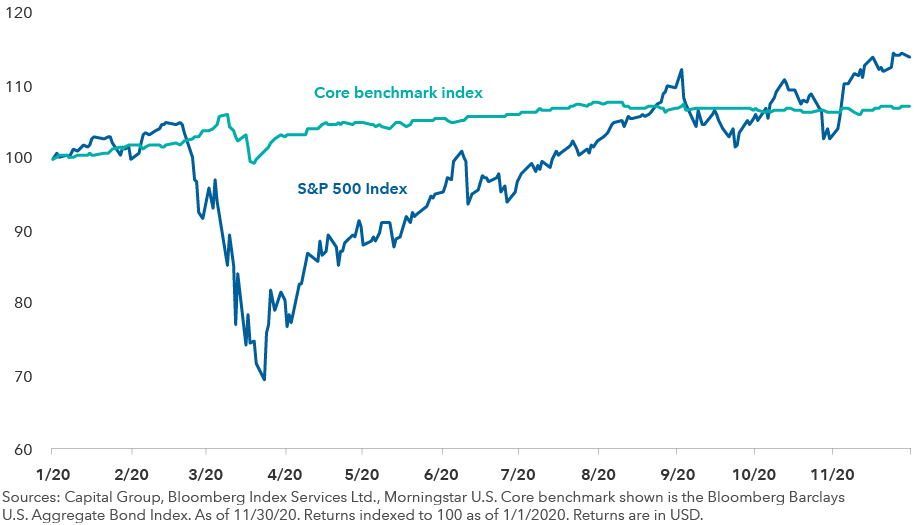

Coming into 2020, some bond bears argued that with most U.S. Treasury yields below 2%, fixed income offered little value and might no longer be an effective hedge for a portfolio’s equity investments. Once again, these predictions proved wrong. During the deep equity correction, the Bloomberg Barclays U.S. Aggregate Bond Index, a typical benchmark for U.S. core bond funds, did exactly what it was supposed to do. It zigged when stocks zagged, providing both diversification and capital preservation.

Even as equities have recovered, bonds have held up. The benchmark was up 7.4% in USD as of November 2020. In this challenging market environment, high-quality fixed income has shined. Anyone who held a strong core fixed income allocation should be more convinced than ever of its value and its role in a balanced portfolio.

The core bond benchmark held steady as stocks sank

Equity indices recently set new all-time highs in the face of a shifting and uncertain economic backdrop. The resulting equity appreciation creates an excellent opportunity for investors to consider rebalancing portfolios by adding fixed income to restore their desired allocation. This would seek to rebuild the diversification and capital preservation that proved so valuable in 2020.

Of course, not all core and core-plus bond funds are created equal. Some put too much emphasis on yield. Such funds take on the sort of credit risk that should be avoided when pursuing stability. A strong track record of diversification from equities matters.

3. Rethink income

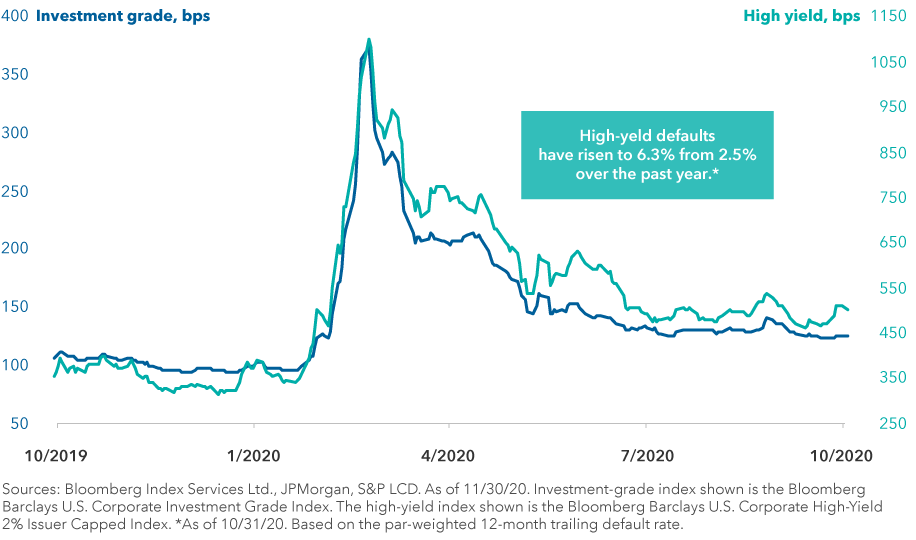

Credit is an area where careful security and industry selection should be front and centre in 2021. Finding good value in corporate bonds now requires a much more discerning eye. In the U.S. the yield gap between corporate bonds and U.S. Treasuries, known as the spread, has returned to near pre-COVID levels, despite deteriorating prospects and fundamentals.

In other words, corporates on the whole are not offering a tremendous amount of compensation for the additional risks entailed. High-yield default rates have risen and are still rising.

In this type of environment, owning the corporate index indiscriminately at a time when it includes nearly US$300 billion of BBB bonds (the lowest investment-grade rating) with a negative outlook does not seem prudent. Fundamental research is more important than ever to distinguish between companies with the strongest return potential and those with weakening prospects.

Corporate bond spreads have fallen to near pre-COVID levels

Plenty of opportunities can also provide attractive sources of income beyond investment-grade corporate credit. The coming year is likely to be one where we see significant shifts in sector leadership. A diversified multisector approach can offer particular value here by uncovering additional investment ideas and providing varied sources of potential return.

What to consider

Consider Capital Group World Bond FundTM (Canada), a portfolio that takes a prudent approach to global diversification by investing primarily in sovereign and corporate bonds in both developed and developing markets.

Looking ahead, it seems likely that the world will soon start to overcome this terrible pandemic. Even so, it seems prudent to prepare for bumps along the road to recovery. In our view, the three actions outlined can help smooth the ride for your portfolio, no matter what comes next.

About

Pramod Atluri Fixed income portfolio manager

Pramod Atluri Fixed income portfolio manager

Pramod Atluri is a fixed income portfolio manager at Capital Group. He holds an MBA from Harvard and a bachelor's in biological chemistry from the University of Chicago. Pramod is also a CFA charterholder.

Mike Gitlin Head of fixed income

Mike Gitlin Head of fixed income

Mike Gitlin is head of fixed income at Capital Group. He has 26 years of investment industry experience. Before joining Capital in 2015, Mike was head of fixed income and global head of trading for T. Rowe Price. He holds a bachelor's from Colgate University.

Karl Zeile Fixed income portfolio manager

Karl Zeile Fixed income portfolio manager

Karl Zeile is a fixed income portfolio manager with 28 years of investment experience. He also serves on the fixed income management committee. He holds a master's in public policy from Harvard. He is also a CFA charterholder.

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness.

Bloomberg Barclays U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. Bloomberg Barclays U.S. Intermediate Aggregate Bond Index is a market index of high-quality, domestic fixed income securities with maturities of less than 10 years. Bloomberg Barclays U.S. Corporate Investment Grade Index represents the universe of investment grade, publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index covers the universe of fixed-rate, non-investment grade debt. The index limits the maximum exposure of any one issuer to 2%. Bloomberg Barclays Municipal Short-Intermediate 1–10 Years Index is a market value-weighted index that includes investment-grade tax-exempt bonds with maturities of one to 10 years. Bloomberg Barclays Municipal Bond Index is a market value-weighted index designed to represent the long-term investment-grade tax-exempt bond market. Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

©2020 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2020. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, "Bloomberg"). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, "Barclays"), used under licence. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds and Capital International Asset Management (Canada), Inc. are part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. The Capital Group companies manage equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Copyright © Capital International Asset Management