by Carl R. Tannenbaum, Ryan James Boyle and Vaibhav Tandon, Northern Trust

Summary

- Big Data for a Big Year

Editor’s Note: In our last issue for the year, Ryan reviews the new methods we’ve used to track the course of the COVID-19 crisis and the recovery that followed. We wish all our readers a healthy and restful holiday.

The pandemic has been top of mind for everyone throughout the year, especially during its most uncertain initial stages in the spring. For me, the sad situation was illustrated by one unforgettable sight.

I have the fortune of living near a small playground. In addition to years of fun for my kids, the playground has offered an easy place for local parents to meet, even sharing an occasional Friday afternoon pizza delivery. When public health guidance mandated social distancing, our local park district closed the playground, harshly. Swings were unbolted, and climbing structures were wrapped in yellow caution tape as if they were part of a crime scene. Each day, the quiet playground reminded us all that we were living in abnormal times.

The year has led us all to seek new ways to assess the damage done by COVID-19 and to gauge how much we have recovered. Fortunately, the presence of “big data” has provided a great assist.

As we’ve said, the course of the economy depends on the course of the virus. To keep track of outbreaks, dashboards from Johns Hopkins, IMHE, Financial Times and Our World In Data have proven indispensable. The trends they show are widely repeated in news coverage: An initial breakout in the spring, a healthier summer, and then renewed outbreaks that became more serious as fall progressed. Though every region had its own experience, much of the world followed these contours.

As the virus spread, we stayed home, as demonstrated by our smartphones. Apple and Google posted anonymized mobility data showing where people were going—and not going. Data for nearly every country is available, and the stories are consistent across all borders. After March, we spent more time at home and less at our workplaces. Grocery stores and pharmacies saw an initial bounce of traffic when we stocked up on essentials, and have remained popular destinations ever since. As summer weather and the viral trajectory allowed, mobility data shows that we enjoyed our time outdoors, with visits to parks holding high.

Once the economy reopened, more people returned to work, but not uniformly. Many part-time and temporary workers faced reduced hours or worked for businesses that stayed closed. Homebase, a platform that manages the workforces of small businesses, created datasets to show the decline in hours worked, numbers of staff reporting to work, and locations open. Across all types of businesses, we observe a summer labor recovery that has since tailed off, particularly for leisure and beauty businesses.

As the reality of the pandemic set in, many of us were forced to cancel travel plans, for business and pleasure alike. Air travel has yet to recover. Daily passenger counts posted by the U.S. Transportation Security Administration (TSA) show continually lower counts of airport visitors this year than last. We will welcome a return to travel by businesspeople and tourists in the year ahead, but for now, air travel is no longer routine.

“Restaurants and airlines tell a clear story of the response to COVID-19.”

As we stayed closer to home, we did not return to our usual habits. Operational metrics from restaurant reservation platform OpenTable showed we certainly weren’t dining out. By including major cities in its dataset, OpenTable tells stories of both local lockdowns and general skepticism of dining out. Most cities saw a 100% decline in reservations as restaurant dining rooms were ordered shut; though many pivoted to take-out service, those customers were not using OpenTable to make reservations. But even restaurants in cities with lighter restrictions show much lower levels of activity. Consumers will only return to economic activity when they feel safe and comfortable doing so, and that feeling has not recovered from the pandemic.

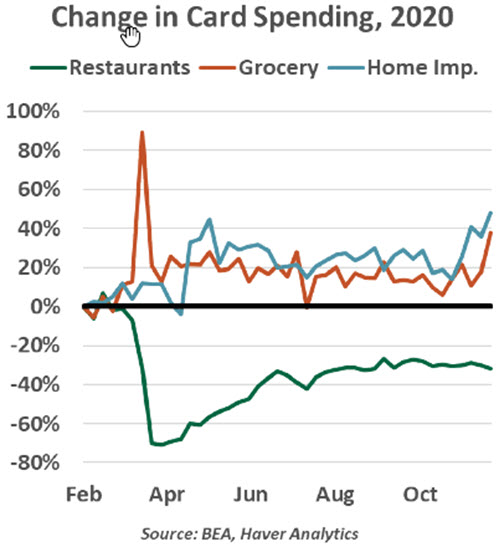

What replaced the outflows we were not spending on travel and entertainment? New payment card transaction data from the U.S. Bureau of Economic Analysis shows consumer spending was down across most categories. We spent more at grocery stores as we dined more at home, and we shopped at home improvement stores as we found time and motivation to improve our spaces. Aside from those categories, spending fell; some of that decline was reflected in the elevated U.S. savings rate. With a lack of anywhere to spend it, consumers kept more of their disposable incomes; some are saving up for opportunities to travel and dine out in 2021.

Uncertainty was evident everywhere we turned, not least in the media coverage of the year’s various crises. The World Uncertainty Index, which bases its level of uncertainty on the frequency with which the word “uncertainty” and its synonyms appear in mainstream news articles, reached new highs in 2020. Though it has fallen from the heights seen earlier in the year, it remains elevated.

“Online job sites allow tracking of the labor markets in real time.”

The year ahead offers hope of improved economic prospects, evident in more than just our eager speculation about the success of the COVID-19 vaccines. Recruiting site Indeed has published weekly aggregates of job openings. In total, the volume of job postings is trending below its 2019 levels, but above its troughs in spring. The degree of malaise varies: The U.S. is 11% below its 2019 level, while Australia has fully recovered, and the U.K. is languishing at more than 40% below its 2019 rate of job postings.

Indeed’s recent insights show local divergence in hiring trends. Job posting activity has recovered more strongly in cities whose residents are less likely to have jobs that can be done from home. Cities with more people working outside the home are benefitting from ripple effects that have maintained demand in the service sector. Hearteningly, these numbers bode well for employment prospects for workers across the skill and wage spectra. A lingering worry in the recovery from the global financial crisis of 2008-2009 was that only the highest earners benefited from the early stage of the recovery; we will welcome any evidence that the current growth cycle has potential for lower earners.

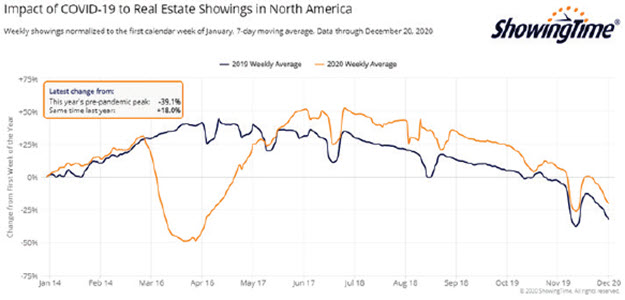

Prospects are also strong throughout the housing sector. As we spend more time at home for work, school and entertainment, more people have been motivated to buy homes. This has kept U.S. house prices appreciating despite a recession. Viewings of residential real estate properties for sale, as published by vendor ShowingTime, demonstrate that buyers stayed home in the initial quarantine (usually the peak home shopping season), but have been active ever since.

“Every metric shows recovery, but not normalcy.”

And lastly, whether renters or homeowners, this has been a year for us all to make the most of our time at home. That became clear most recently in an Evercore survey of Christmas tree lots. Sales volumes grew at a record pace this year, with 68% of tree lot operators selling their entire inventories after just three weeks of sales, when they usually stay open for a full month.

What is it all worth? Thus far, every one of these data sources tells a story. They are interesting, but not completely conclusive. Many of them share a blind spot, as their histories only begin as the pandemic struck. Analysts seeking to build a predictive model would need a longer history, ideally spanning multiple economic cycles, to use these indices in forecasting. Nonetheless, we welcome this bevy of novel data sources that give us new insights in nearly real time.

A theme through all of these measures is that we have returned to a level of activity that feels closer to normal, but we have not entirely recovered. So it is at our neighborhood playground: when the caution tape was removed, children (including my own) were back and playing within minutes. It was a palpable step toward recovery. But parents continue to wear masks and keep their distance; social gatherings were brief and infrequent this year. Aside from monitoring the story the data tells, I will know we have turned a corner when I see a pizza delivery made to the playground.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2020 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit our terms and conditions page.