by Don Vialoux, EquityClock.com

Morning Technical Notes for Thursday December 17th

Silver ETN (SLV) moved above $23.96 resuming an intermediate uptrend.

Silver stocks are responding to higher silver prices. First Majestic Silver moved above US$12.21 and Cdn$15.90 resuming an intermediate uptrend.

Travelers (TRV), a Dow Jones Industrial Average stock moved above $138.11 extending an intermediate uptrend.

Accenture (ACN), an S&P 100 stock moved above $253.93 to an all-time high extending an intermediate uptrend. The company reported higher than consensus quarterly results this morning.

Illumina (ILMN), a NASDAQ 100 stock moved above $356.00 extending an intermediate uptrend.

ADP (ADP), a NASDAQ 100 stock moved above $176.24 and $177.99 to an all-time high extending an intermediate uptrend.

Activision (ATVI), a NASDAQ 100 stock moved above $87.73 to an all-time high extending an intermediate uptrend.

Paychex (PAYX), a NASDAQ 100 stock moved above $94.95 to an all-time high extending an intermediate uptrend.

BMO Emerging Markets ETF (ZEM) moved above $23.61 to an all-time high extending an intermediate uptrend.

Pre-opening Comments for Thursday December 17th

U.S. equity index futures were higher this morning. S&P 500 futures were up 18 points in pre-opening trade.

Index futures were virtually unchanged following release of economic news at 8:30 AM EST. Consensus for November Housing Starts was unchanged at.1.530 million units in October. Actual was 1.547 million units. Consensus for the December Philly Fed Index was a slip to 20.0 from 26.3 in November. Actual was a drop to 11.1. Consensus for Weekly Jobless Claims was 800,000 versus revised 862,000 last week. Actual was 885,000.

Lennar added $1.94 to $76.23 after reporting higher than consensus fiscal fourth quarter sales and earnings.

General Mills gained $0.41 to $59.33 after reporting higher than consensus fiscal second quarter sales and earnings.

Advanced Micro Devices advanced $0.44 to $97.29 after Deutsche Bank raised its target price from $75 to $90.

Nvidia added $2.81 to $532.51 after Deutsche Bank raised its target price from $500 to $515.

EquityClock’s Daily Comment

Following is a link:

http://www.equityclock.com/2020/12/16/stock-market-outlook-for-december-17-2020/

Note seasonality chart on U.S. Retail Trade

Responses to the FOMC Meeting Announcement at 2:00 PM

The Federal Reserve chose to maintain the overnight lending rate at 0%-0.25%. Responses to the news after 2:00 PM EST yesterday were as follows:

S&P 500 Index initially moved lower, but closed virtually unchanged from 2:00 PM

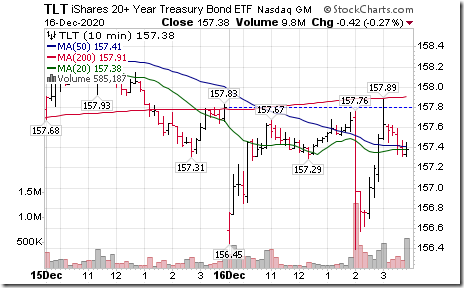

Long term bond prices moved lower, but closed virtually unchanged

The U.S. Dollar Index ETN initially moved higher, but closed slightly lower

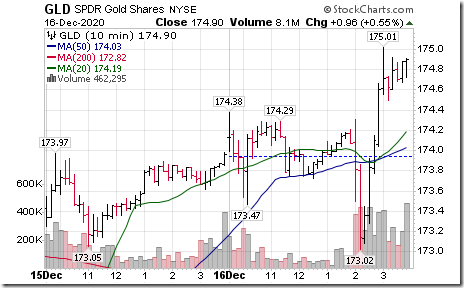

Gold and silver initially moved lower, but closed higher.

Technical Notes for December 16th

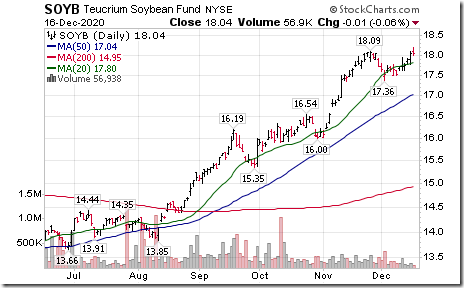

Soybean ETN (SOYB) moved above $18.09 extending an intermediate uptrend.

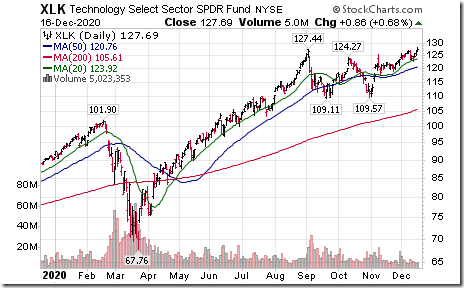

Technology SPDRs (XLK) moved above $127.44 to an all-time high extending an intermediate uptrend.

NetApp (NTAP), a NASDAQ 100 stock moved above $63.20 extending an intermediate uptrend.

Oracle (ORCL), an S&P 100 stock moved above $62.35 to an all-time high extending an intermediate uptrend.

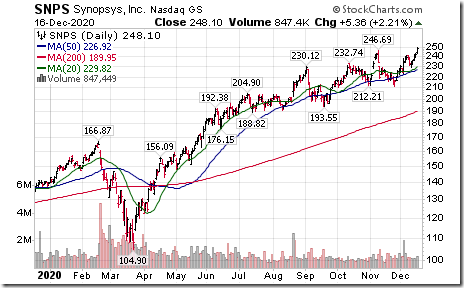

Synopsys (SNPS), a NASDAQ 100 stock moved above $246.69 to an all-time high extending an intermediate uptrend.

TSX REIT ETF (XRE) moved above $16.80 extending an intermediate uptrend.

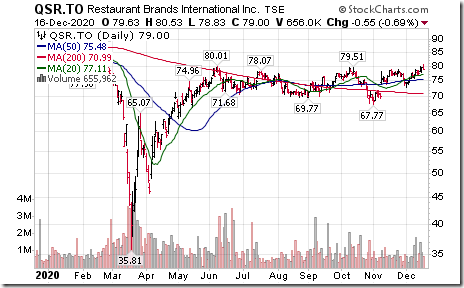

Restaurants International (QSR), a TSX 60 stock moved above $80.01 resuming an intermediate uptrend.

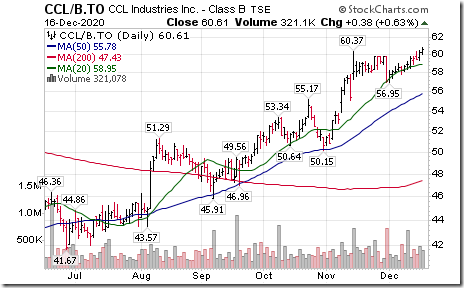

CCL Industries (CCL.B), a TSX 60 stock moved above $16.80 extending an intermediate uptrend.

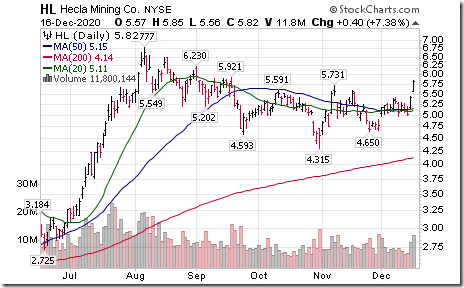

Silver stocks responded to higher silver prices. Hecla Mining (HL) moved above $5.73 setting a new intermediate uptrend.

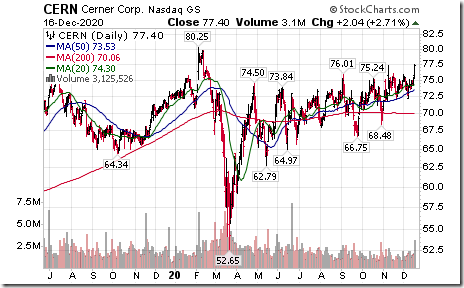

Cern (CERN), an S&P 100 stock moved above $77.33 extending an intermediate uptrend.

Trader’s Corner

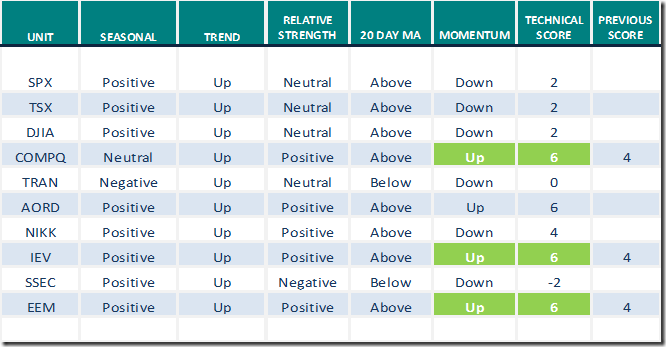

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for December 16th 2020

Green: Increase from previous day

Red: Decrease from previous day

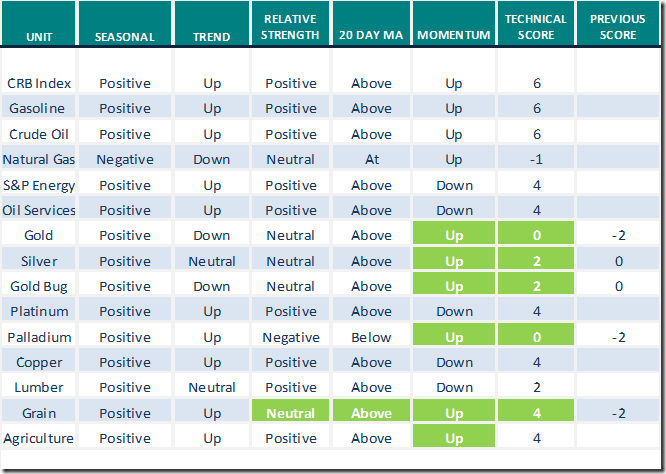

Commodities

Daily Seasonal/Technical Commodities Trends for December 16th 2020

Green: Increase from previous day

Red: Decrease from previous day

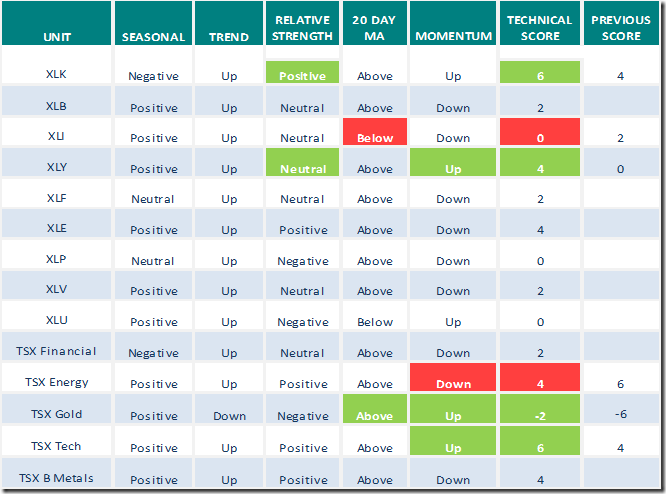

Sectors

Daily Seasonal/Technical Sector Trends for December 16th 2020

Green: Increase from previous day

Red: Decrease from previous day

Market Buzz

Greg Schnell focuses on “Sorting Software Names”. Following is a link:

https://www.youtube.com/watch?v=mM0Xb97w1Rc&feature=youtu.be&ab_channel=StockCharts

S&P 500 Momentum Barometer

The Barometer was unchanged at 81.56 yesterday. It remains extremely intermediate overbought.

TSX Momentum Barometer

The Barometer slipped 0.93 to 72.90 yesterday. It remains intermediate overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image001[7] clip_image001[7]](https://advisoranalyst.com/wp-content/uploads/2020/12/clip_image0017_thumb-5.png)

![clip_image002[7] clip_image002[7]](https://advisoranalyst.com/wp-content/uploads/2020/12/clip_image0027_thumb-4.png)

![clip_image003[7] clip_image003[7]](https://advisoranalyst.com/wp-content/uploads/2020/12/clip_image0037_thumb-2.png)

![clip_image004[7] clip_image004[7]](https://advisoranalyst.com/wp-content/uploads/2020/12/clip_image0047_thumb-2.png)

![clip_image005[5] clip_image005[5]](https://advisoranalyst.com/wp-content/uploads/2020/12/clip_image0055_thumb-1.png)

![clip_image006[5] clip_image006[5]](https://advisoranalyst.com/wp-content/uploads/2020/12/clip_image0065_thumb-2.png)

![clip_image007[5] clip_image007[5]](https://advisoranalyst.com/wp-content/uploads/2020/12/clip_image0075_thumb.png)

![clip_image008[5] clip_image008[5]](https://advisoranalyst.com/wp-content/uploads/2020/12/clip_image0085_thumb.png)

![clip_image009[5] clip_image009[5]](https://advisoranalyst.com/wp-content/uploads/2020/12/clip_image0095_thumb.png)

![clip_image001[5] clip_image001[5]](https://advisoranalyst.com/wp-content/uploads/2020/12/clip_image0015_thumb-9.png)

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2020/12/clip_image0025_thumb-8.png)

![clip_image003[5] clip_image003[5]](https://advisoranalyst.com/wp-content/uploads/2020/12/clip_image0035_thumb-8.png)

![clip_image004[5] clip_image004[5]](https://advisoranalyst.com/wp-content/uploads/2020/12/clip_image0045_thumb-5.png)