by Don Vialoux, EquityClock.com

Technical Comments for Tuesday December 1st

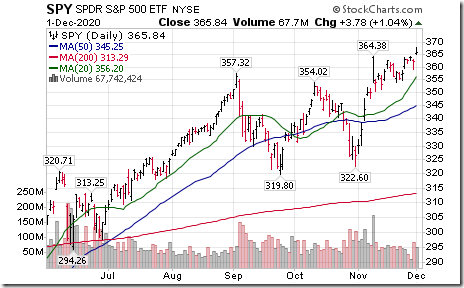

ETF tracking the S&P 500 Index (SPY) moved above $364.38 to an all-time high extending an intermediate uptrend.

NASDAQ 100 Index and its related ETF: QQQ moved above 12,439.48 to all-time highs extending an intermediate uptrend.

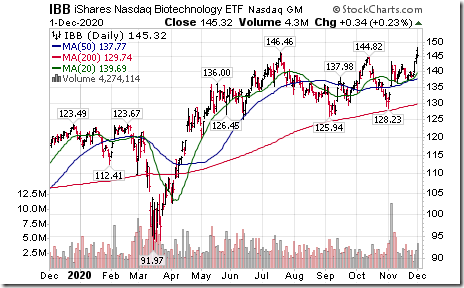

NASDAQ Biotech ETF (IBB) moved above $146.46 to an all-time high extending an intermediate uptrend.

TSX Technologies iShares (XIT.TO) moved above $43.34 to an all-time high extending an intermediate uptrend.

BlackBerry (BB.TO), a former TSX 60 stock and part of the TSX Technology Index moved above several previous resistance levels. BlackBerry Ltd. surged the most ever after the wireless company signed a multiyear agreement with Amazon Web Services to develop and market its “Intelligent Vehicle Data Platform,” called IVY.

Pfizer (PFE), a Dow Jones Industrial stock moved above $40.40 extending an intermediate uptrend.

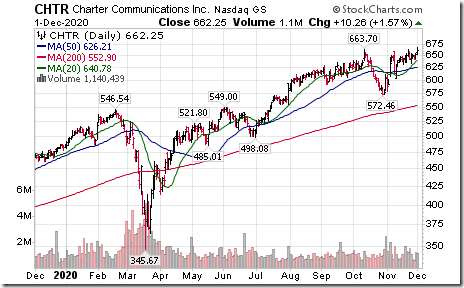

Charter Communications (CHTR), a NASDAQ 100 stock moved above $663.70 to an all-time high extending an intermediate uptrend.

A break below intermediate support by the U.S. Dollar Index prompted strength in the Euro above 120.11

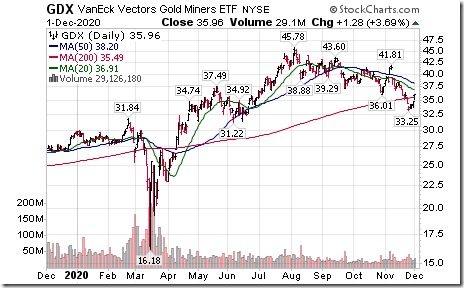

The break in the U.S. Dollar Index also prompted a bump in gold prices, gold stock prices and related ETFs. Mark Leibovit offered a short term favourable outlook for the sector. He noted,” ADDING TO POSITIONS IN AG, GOLD, DRD, BTG, GDX, GDXJ AND CEF AS IT APPEARS WE’VE SEEN A LOW (MAYBE THE BIG LOW) IN GOLD”.

Trader’s Corner

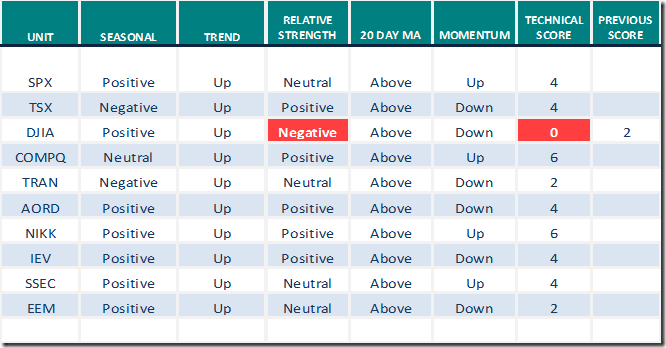

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for December 1st 2020

Green: Increase from previous day

Red: Decrease from previous day

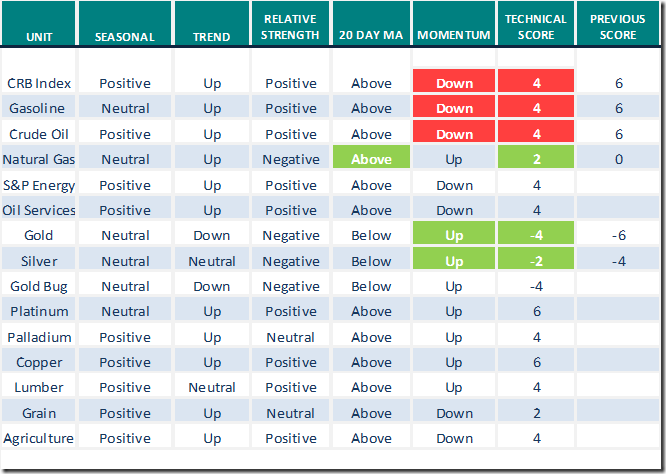

Commodities

Daily Seasonal/Technical Commodities Trends for December 1st 2020

Green: Increase from previous day

Red: Decrease from previous day

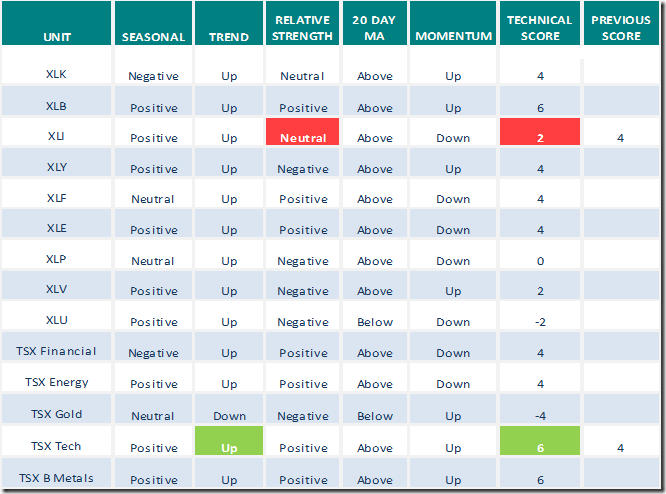

Sectors

Daily Seasonal/Technical Sector Trends for December 1st 2020

Green: Increase from previous day

Red: Decrease from previous day

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.