by Don Vialoux, EquityClock.com

Technical Notes for Monday November 16th

TSX Composite Index moved above 16,835.09 resuming an intermediate uptrend.

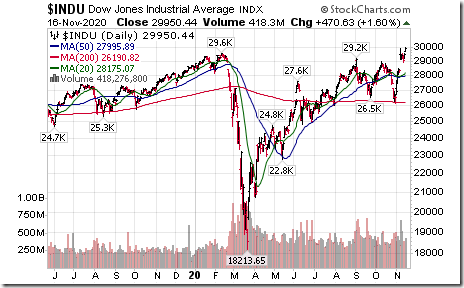

Dow Jones Industrial Average moved above its previous all-time closing high at 29,551.42 extending an intermediate uptrend.

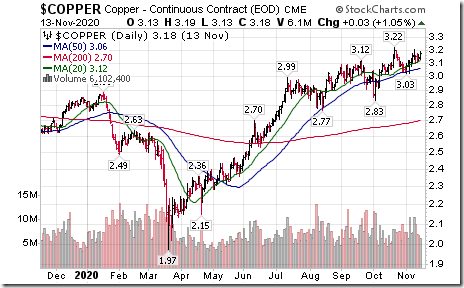

Copper moved above $3.218 per lb. to a 29 month high of $3.24 extending an intermediate uptrend. Copper stocks and copper equity ETFs (e.g. PICK in the U.S. and XBM.TO on the TSX) responded accordingly.

Walmart (WMT), a Dow Jones Industrial Average stock moved above $151.33 to an all-time high extending an intermediate uptrend.

Aerospace & Defense ETF (PPA) moved above $64.03 resuming an intermediate uptrend.

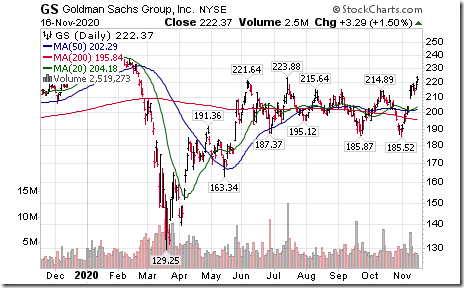

Goldman Sachs (GS), a Dow Jones Industrial Average stock moved above $223.86 resuming an intermediate uptrend.

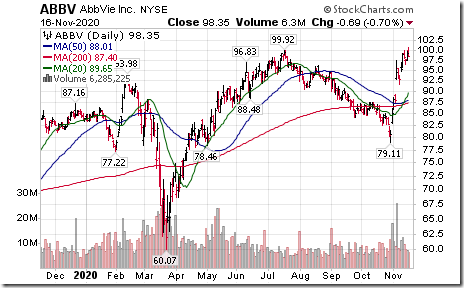

AbbVie (ABBV), an S&P 100 stock moved above $99.92 extending an intermediate uptrend. After the close, Berkshire Hathaway revealed that it has acquired a position in the stock.

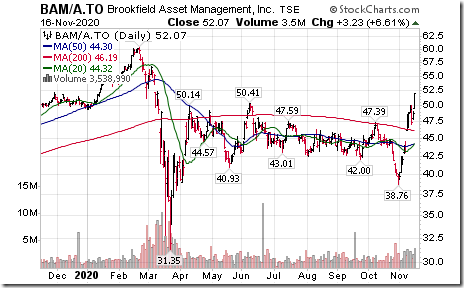

Brookfield Asset Management (BAM.A), a TSX 60 stock moved above $50.41 resuming an intermediate uptrend.

Trader’s Corner

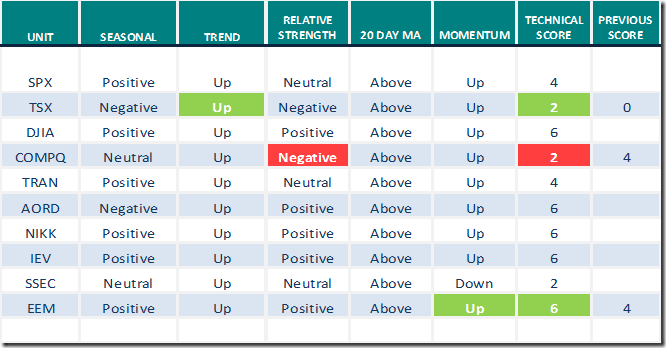

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for November 16th 2020

Green: Increase from previous day

Red: Decrease from previous day

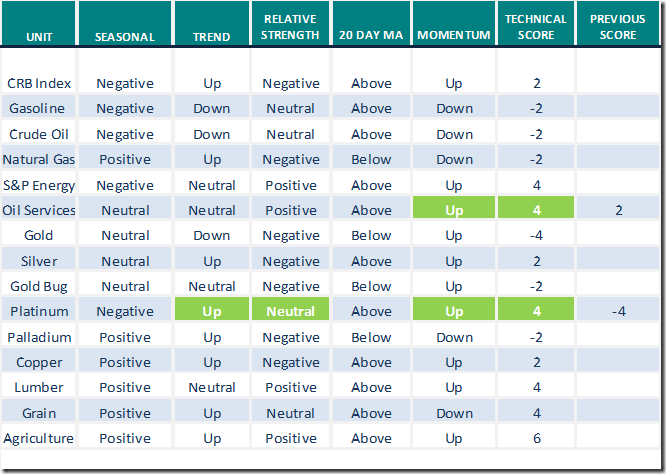

Commodities

Daily Seasonal/Technical Commodities Trends for November 16th 2020

Green: Increase from previous day

Red: Decrease from previous day

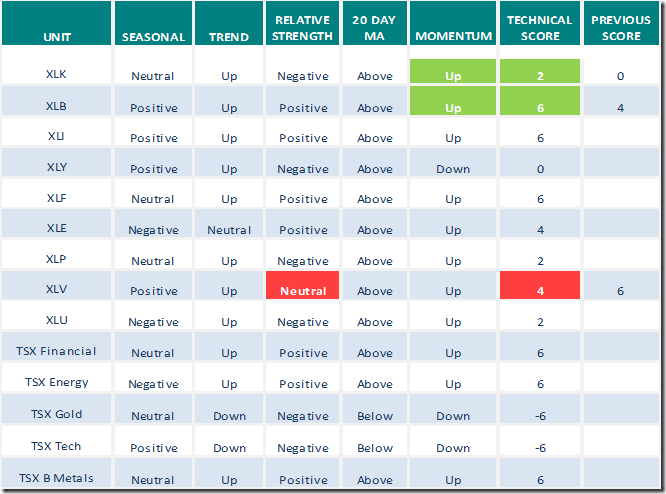

Sectors

Daily Seasonal/Technical Sector Trends for November 16th 2020

Green: Increase from previous day

Red: Decrease from previous day

Technical Scoop

Thank you to David Chapman and www.EnrichedInvesting.com for a link to their weekly comment. Headline reads, “Maybe vaccine, tossed lawsuits, highs reversed, constitutional grip, precious effects, boom possible”. Following is the link:

Tech Talk notes used for the interview on Michael Campbell’s Money Show last Saturday

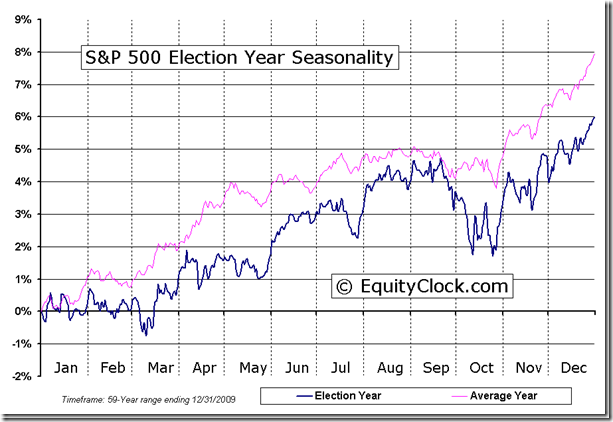

North American equity markets are following their traditional seasonal pattern after release of U.S. Presidential election results.

History shows that the strongest 12 week period for U.S. equity market indices in the four year U.S. Presidential cycle has been from Presidential Election Day to Inauguration Day on January 20th. Since 1952, the S&P 500 Index advanced in 11 of 17 periods. Average gain per period was 2.6% excluding one important event in 2008.

The one exception was the year Obama was first elected President in 2008. During that period, the S&P 500 Index plunged 17.4%.after Obama and the Democrats won a “super majority” including control of the Senate and House of Representative. Obama proposed a higher tax on companies and individuals when he entered the White House. Equity markets responded accordingly.

What about this time? After the election, the U.S. government remained in gridlock: Biden won the Presidency, Republican maintained control of the Senate with a smaller majority and Democrats maintained control of the House of Representatives with a smaller majority. Based on continuation of this scenario, Goldman Sachs announced on Wednesday that its target price for the S&P 500 by the end of 2021 is 4,300.

But… Republicans effectively have 50 seats and the Democrats have 48 seats in the Senate after the recent election. The remaining two seats are located in Georgia and will be determined on January 5th following runoff elections that requires the winner to obtain more than 50% of the vote. On November 3rd nobody gained more than 50% of the vote when third party participants were included. However, Republican candidates had the lead in both seats and are expected to win both seats on January 5th. However, if the Democrats win both seats on January 5th, votes in the Senate will tie at 50 seats Republican and 50 seats Democrats. Ties are broken in the Senate by the Vice President who will be Vice President elect Kamala Harris. Democrats effectively will control Congress and will be able to pursue a more “progressive” agenda including higher government spending, higher corporate and personal taxes and higher regulation. Under this scenario, North American equity markets will respond strongly on the downside. Watch for a substantial increase in political advertising in Georgia prior to January 5th

What to do as a Canadian equity investor.

Thankfully, the world heard last week that a vaccine for COVID 19 is approaching approval. Front line workers probably will have access to the vaccine on a limited basis by the first quarter next year. General access to the vaccine probably will become available before the end of next year. Meanwhile, the virus has been spreading exponentially particularly in Europe and North America. More shutdowns of economic activity between now and mid 2021 are likely in both areas. In contrast, Far East countries took strong government action to lock down their economies when the virus first appeared last spring. They have maintained control of the virus with low infection rates. Far East economies including China, Japan, South Korea, Vietnam, Taiwan and Singapore have started to grow again without further lockdowns.

Look for investment opportunities outside of North America. Far East economies and equity markets already have started to recover following their COVID 19 shutdowns. Investments in Far East equity markets already are outperforming European and North American equity markets Their outperformance is expected to continue until at least next spring when a COVID vaccine potentially could become available to the world on a limited basis. The easiest way to invest in the recovery of Far East economies is through ETFs that track equity markets for China, South Korea, Taiwan, Vietnam and Hong Kong. ETFs ticker symbols include XCH, ZCH and ZEM on the Toronto Exchange and EEM, EWY, EWT, EWH and VNM on U.S. exchanges).

Accumulate North American equities that will benefit from a recovery in Far East economies. Their recovery is expected to boost demand for North American commodities including base metals, lumber, grains and fertilizer. Recently, these stocks have started to outperform the TSX and S&P 500. Also, equities and ETFs of Canadian companies producing these commodities are entering a period of seasonal strength in mid-November.

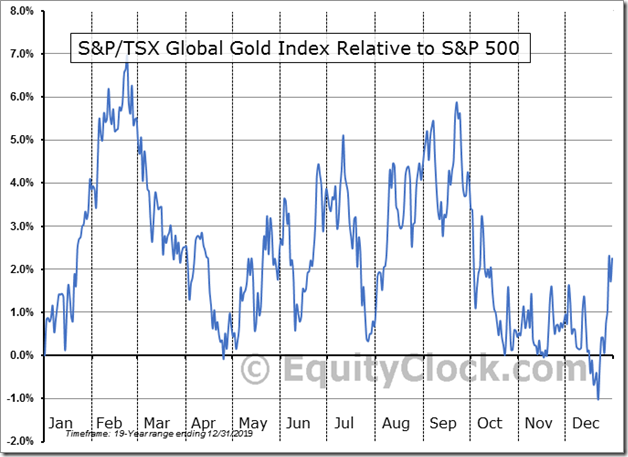

Consider an investment in gold and gold equities near the end of the year. Martin Murenbeeld released a favourable report on gold last week. Noteworthy in the report was that Chinese demand for gold is picking up and inferred demand by China was unusually high in the third quarter. Seasonal influences for gold turn positive on a real and relative basis in mid –December for a seasonal trade to the end of February. An extension of COVID infections into the middle of next year will place strains on the stability of world currencies, notably the U.S. Dollar. Precious metal prices normally move higher when the U.S. Dollar moves lower.

S&P 500 Momentum Barometer

The Barometer added 1.80 to 86.57 yesterday. It remains extremely intermediate overbought, but has yet to show signs of reaching a short term peak.

TSX Momentum Barometer

The Barometer added 1.08 to 70.42 yesterday. It remains intermediate overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.