by Berlinda Liu, Director, Global Research & Design, S&P Dow Jones Indices

In response to the economic ravages of COVID-19, central banks and investors around the world went on a bond buying spree, pushing fixed income yields down and complicating the search for portfolio-generated income. While yields are generally off their March 2020 extremes, by historical standards they remain quite diminished.

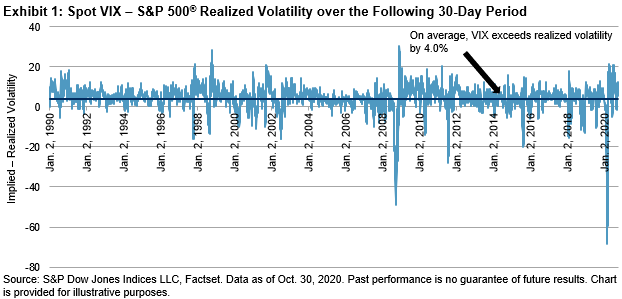

One alternative strategy to generate supplemental income from long-horizon portfolios is to sell covered calls on the holdings of structurally long exposures. This takes advantage of implied volatility in option prices exceeding that of subsequently realized volatility on average.

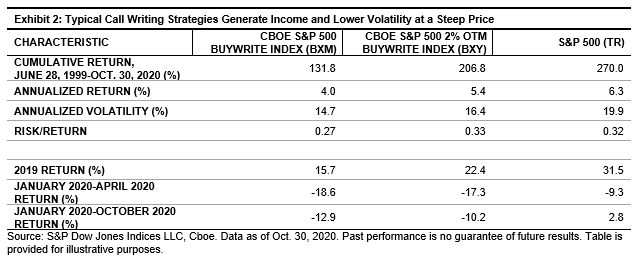

Alas, typical covered call strategies tend to underperform significantly in strongly upward-trending markets (such as in 2019) or when a sharp downturn is immediately followed by a quick rebound (March-April 2020). In both cases, the options written would be exercised and the holdings called away, costing an investor dearly by not participating in the market’s upside.

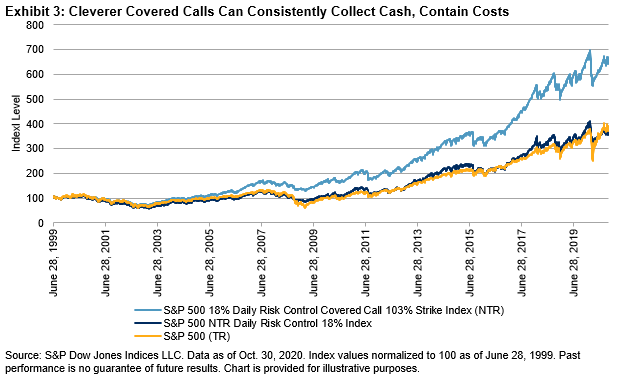

The trick, then, is to find a way to generate sufficient income in calm markets to offset any gains given up, and to limit the upside surrendered during rebounds. The S&P 500 18% Daily Risk Control Covered Call 103% Strike Index illustrates one way to accomplish that. While the name is rather unwieldy, let’s look at each of the ingredients it comprises and how they come together:

- First, start with the S&P 500.

- Next, add 18% daily risk control. Risk control increases leverage when volatility is low, and decreases leverage when volatility is high, in order to match a given volatility target (variants exist from 5% up to 18%; 18% was chosen here to generally match the historical volatility of the S&P 500).

- Finally, sell monthly covered calls struck at 103% of the risk controlled index’s level.

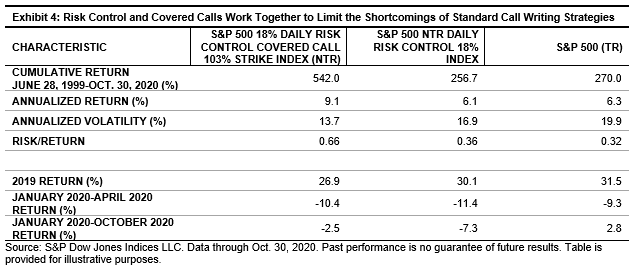

So why go through the trouble of adding risk control if only to target the usual volatility of the S&P 500? Because now the covered calls are based on the exposure of the risk-controlled index: exposure that dynamically increases in calm markets and automatically reduces when markets turn volatile.1

When markets begin selling off and increase in volatility, the calls currently being held would have been sold with a strike above the highs, the same as with a normal call writing program. But rather than continuing to sell calls on the full portfolio through the (eventual) nadir, the risk control overlay typically reduces exposure, and thus fewer calls are sold, which means less of the eventual upside is called away. As markets rebound, volatility tends to recede, allowing the risk control index to add exposure—and new calls, at higher strikes, to be written.

This doesn’t completely offset the consequences of selling calls in an upward market, but it does narrow the spread significantly when compared to standard call writing strategies. However, combined with the added exposure of the risk control index in calm periods, it historically not only has generated more premium income than standard call writing strategies, but outperformed the base indices. While bulls and bears endlessly debate market direction and political winds, theta gang can quietly take advantage of higher implied volatility, generating supplemental income and added value over time.

1 The construction of the covered call index uses synthetic call options (priced with a transaction volatility cost of 150 bps) written on the risk control index. In practice, it’s far more likely, and more practical, to dynamically trade options on the S&P 500 itself to match the exposure of the risk control index.

The posts on this blog are opinions, not advice. Please read our Disclaimers.