by Don Vialoux, EquityClock.com

Responses to the Federal Reserve’s comments and actions

News from the FOMC meeting was that the Federal Reserve will maintain its easy money policy during the Pandemic. Responses by markets after the 2:00 PM release mainly were muted.

U.S. equity indices were virtually unchanged

Long term U.S. Treasury Bond prices were virtually unchanged

The U. S. Dollar and its related ETN was virtually unchanged

Gold and silver prices rose slightly with silver prices notably stronger.

Precious metals equities on both sides of the border moved slightly higher.

Technical Notes for Thursday November 5th

NASDAQ 100 and S&P 100 Breakouts Yesterday

Selected ETF Breakouts Yesterday

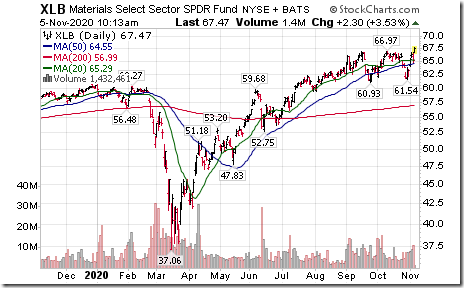

Materials SPDRs moved above $66.97 to an all-time high extending an intermediate uptrend.

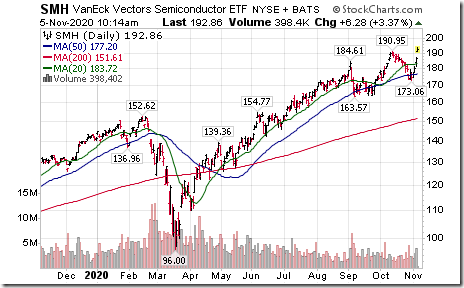

Semiconductor ETFs SMH and SOXX broke to all-time highs

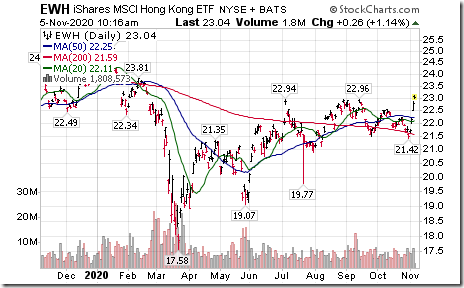

Hong Kong iShares moved above $22.96 extending an intermediate uptrend.

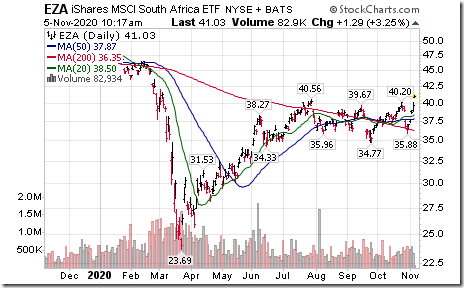

South Africa iShares moved above $40.56 extending an intermediate uptrend.

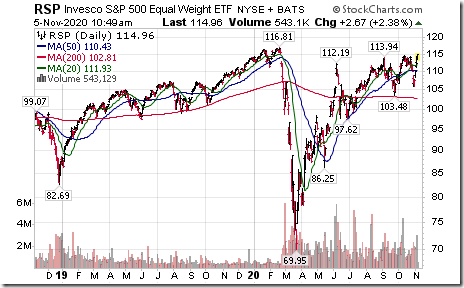

S&P 500 Equal Weight ETF moved above 114.68 extending an intermediate uptrend. Units are testing their all-time high at $116.81

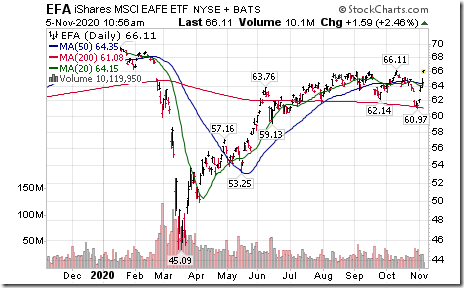

EAFE iShares (EFA) moved above $66.11 extending an intermediate uptrend.

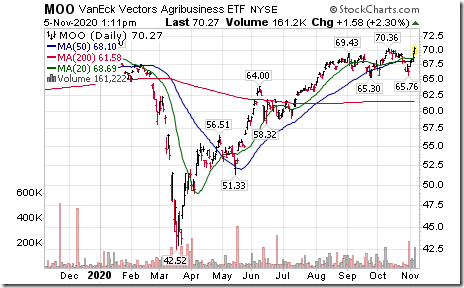

Agricultural ETF (MOO) moved above $70.36 to an all-time high extending an intermediate uptrend.

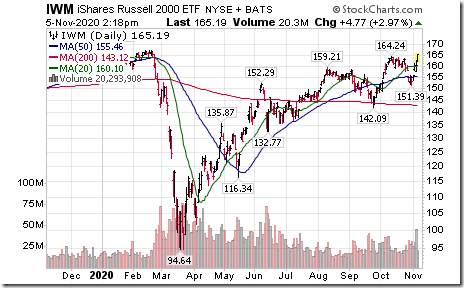

Russell 2000 iShares moved above $164.24 extending an intermediate uptrend.

Australia iShares moved above $21.16 extending an intermediate uptrend.

Technical Notes on Canadian Equities

Metro (MRU), a TSX 60 stock moved above $64.38 to an all-time high extending an intermediate uptrend.

SunLife Financial (SLF), a TSX 60 stock moved above $57.30 extending an intermediate uptrend.

Base Metals equities and ETFs are moving higher. HudBay Minerals moved to a 22 month high.

Trader’s Corner

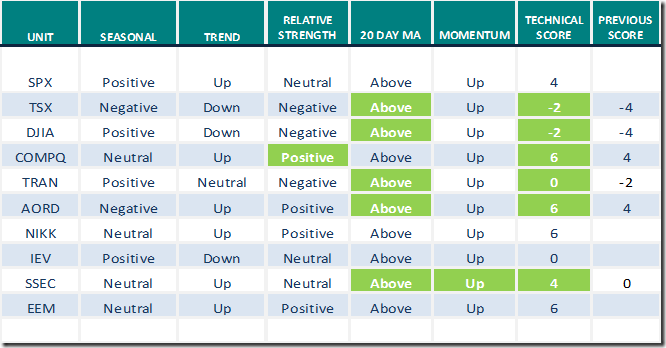

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for November 5th 2020

Green: Increase from previous day

Red: Decrease from previous day

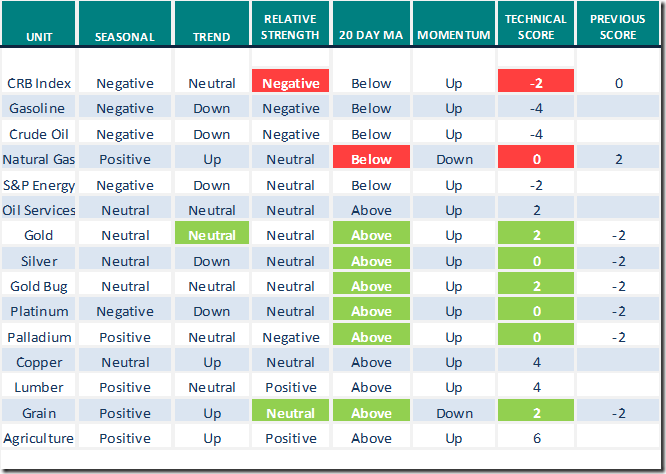

Commodities

Daily Seasonal/Technical Commodities Trends for November 5th 2020

Green: Increase from previous day

Red: Decrease from previous day

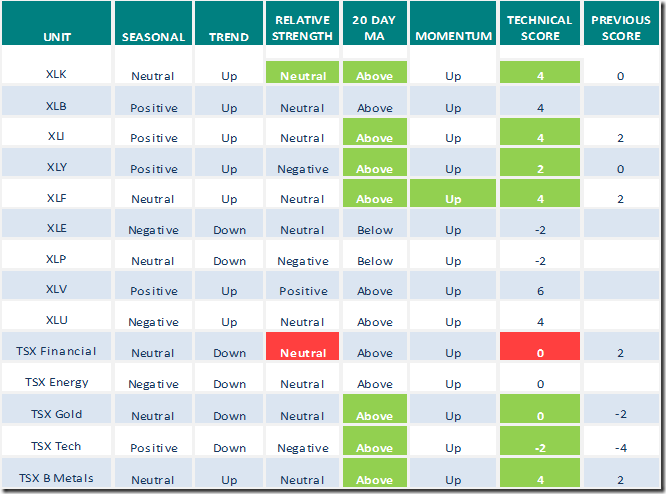

Sectors

Daily Seasonal/Technical Sector Trends for November 5th 2020

Green: Increase from previous day

Red: Decrease from previous day

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

|

|

|

|

This post was originally publised at Vialoux's Tech Talk.

![clip_image004[1] clip_image004[1]](https://advisoranalyst.com/wp-content/uploads/2020/11/clip_image0041_thumb-2.png)