by Julie Moret, Head of ESG, Franklin Templeton Investments

The following is an excerpt. Want to learn more? Read the full paper here.

Before the Well Runs Dry: The Time for Investors to Understand Water Risk Is Now

There is a lot of talk about how regulatory reforms connected to climate change will impact financial markets. However, we firmly believe the leading issue, at the end of the day, is that we have been entrusted to look after our clients’ assets and are responsible for returning those assets in better condition than when we received them. Therefore, we have a duty to understand the full spectrum of business relevant risks that can reshape a company’s or sector’s competitive positioning in the marketplace and impact its operational resiliency.

When the well is dry, we know the worth of water”.

Benjamin Franklin, 1746

Riffing on Benjamin Franklin’s observation in the context of the current landscape of understanding the importance of water to financial markets: if we don’t know how much water there is in the well, we won’t know until the well goes dry. Meaning: unknown and undisclosed risks are likely to be mispriced and put assets at risk. Therefore, companies and sectors lacking understanding of their water sources and footprints, lagging in disclosure of water risk, and/or postponing adjustments to the regulatory reforms touched upon later in this piece all present long-term risks to investors.

Ultimately, we are trying to help end investors understand that water itself isn’t just an economic policy issue and risk arising from population growth and climate change. Water is impacting the day-to-day operations of investee companies and how they are thinking through their own business models and business risk.

The Macro View: Our Water Future

By 2030, the global population will reach nine billion and the world will require 40% more water than it does today.1 However, the global supply of accessible fresh water accounts for less than 1% of water supplies and will not grow with population. This limited supply is threatened by overuse, contamination, and over-demand. The World Economic Forum (WEF) has identified “Water Crisis” as one of the top five global risks in terms of impact in nine out of its last 10 Global Risks Reports, including 2020.2 The WEF classifies water crisis as a “Societal” risk; it’s easily argued that a water crisis would envelop the totality of the WEF’s risk categories: economic, environmental, geopolitical and technological.

Critical investments in purification, reuse, efficiency and delivery infrastructure are required on a global scale—including in first world countries such as the United States.

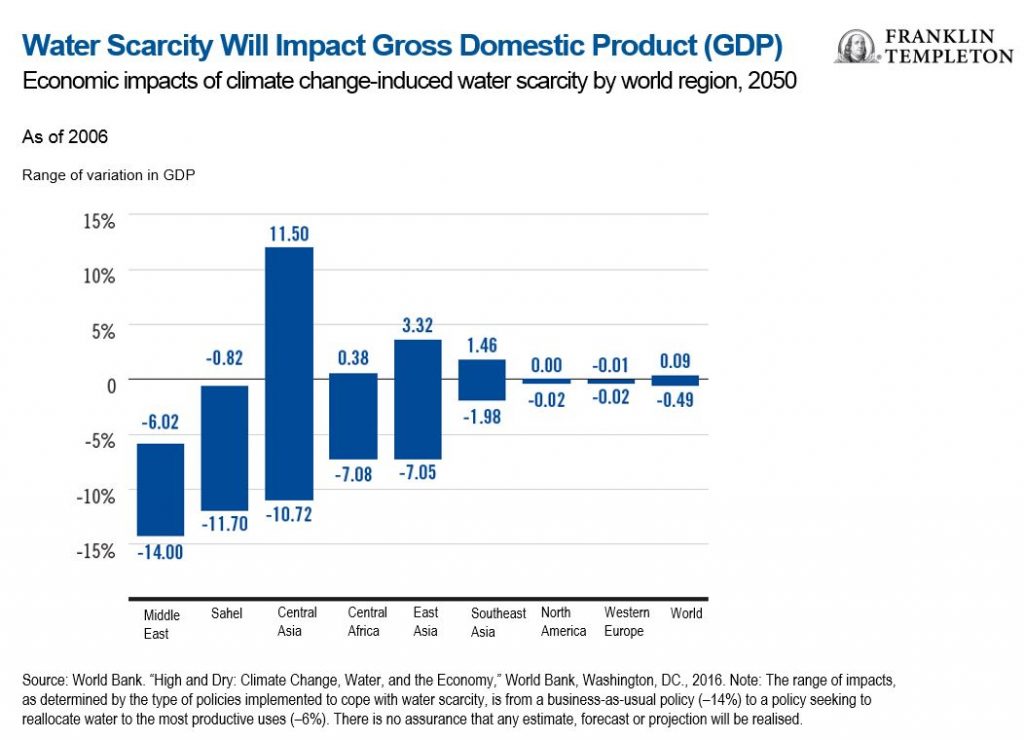

Then, there’s climate change. Projections of 2°C increases in global temperature from climate change, expected by 2050, will accelerate water scarcity in many regions of the world. As seen in the chart below, the World Bank estimated that water scarcity exacerbated by climate change will cost some regions 6% in gross domestic product (GDP)—without policy change, declines may reach 14%.3 These declines are not limited to frontier and emerging markets; they impact every continent and economy.

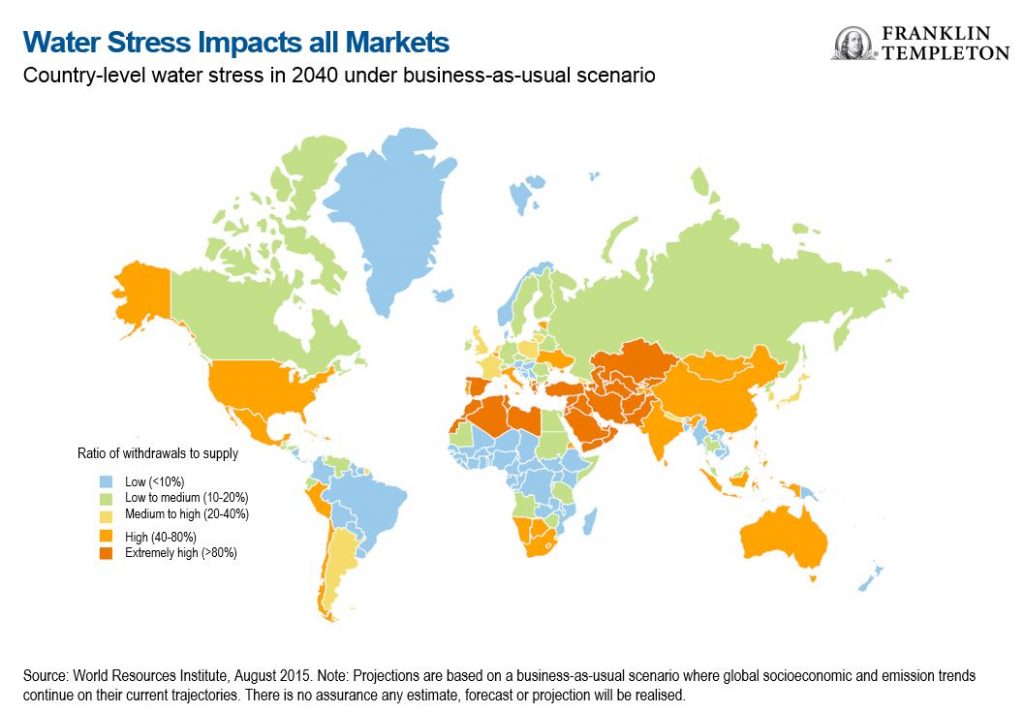

The San Francisco Bay Area—home of Franklin Templeton’s headquarters—is in one of these water stressed regions. This may seem counterintuitive to some. California is perceived to be a land of abundance; home to two of the world’s most fertile and water intensive valleys—the “Central” and “Silicon”—one growing almonds and the other cooling data servers. In reality, it’s in one of the most drought prone and high water risk regions in the world. And, without early 20th century water wars (have you seen the movie Chinatown?), multi-billion-dollar infrastructure investments, and a system of the most complex and litigated intrastate and binational water agreements on the planet, the world’s fifth-largest economy would have run out of water decades ago. Think about that in the context of risk to an investor.

Finally, California is often cited as a microcosm for an impending global water crisis driven by population growth and climate change.4 Referring to the highly complex nature of water in California combined with climate change, Dr. Peter Gleick—a MacArthur Genius Fellow who many refer to as the foremost expert on world water—points to California as a “laboratory for all of peak water’s concerns”.5

Peak water is an idea he coined akin to peak oil. Meaning, all the water (or oil) on the planet is already here. As we use it, and pollute it in the case of water, it will never be replaced. Again, take a minute to think about that in the context of risk to an investor. Yet very few asset managers are talking about water risk as an investment concern. Why is that?

Why We’re Thinking about Water…

The projected declines in water availability, and corresponding dips in GDP, present across-the-board risk for investors. And these risks extend to all asset classes and encompass a

broad range of sectors—from those with logical connections, like agriculture and utilities, to those that may not be so apparent, like packaging and semiconductors. In already water-stressed emerging and growth markets, like China and India, climate change models project that stress to grow.

This significantly impacts sectors where many investors are now seeing growth opportunities, such as: apparel, textiles, metals, mining and materials. These sectors are essentially “building blocks” for other sectors. Therefore, the water risk in these sectors does not stop once they are grown or extracted; they carry forward to the complex web of sectors that transform the building blocks into products—think of everything from lithium-ion batteries in your smartphone, to the shirt you’re wearing.

As stewards of our clients’ assets, we believe water risk must be accounted for in portfolios today, not in 2030 or 2050. But how can this be done? Water is not only a misunderstood commodity but also a basic human right recognised by the United Nations (UN) in 2010. As sustainability-informed investors using environmental, social and governance (ESG) metrics as key performance indicators (KPIs), how do we address the dual-bottom line of adding value to clients’ portfolios while also contributing to positive outcomes? How do we translate macro-scale risks into a focused investment lens? And, finally, what is our role as investors and what more can we do to move the dial?

These are all important questions. And we admit we don’t have all the answers. But we are thinking about these questions on a daily basis and aspire to grow our knowledge base and capabilities. It is our duty as active managers and stewards of our clients’ assets to find solutions that address information gaps and benefit clients’ portfolios. It is within these information gaps that mispricing happens. Where mispricing happens, an active manager can find opportunity.

In the case of water, we see three main areas contributing to information gaps: pricing, risk and markets. The subsequent chapters of this piece explore each of these ideas through the lens of equity, fixed income and alternative investments.

The Signals

It is important to quickly discuss the underpinnings of our strategy related to water. First, we believe ESG factors can have a material impact on the long-term performance of the investments we make. And, as ESG-informed investors, we analyse ESG factors alongside traditional financial and economic measures, to promote a more comprehensive view of the value, risk and return potential of an investment. The analysis includes looking at current and upcoming “signals” that are going to shift the landscape for all investors. We don’t want to go into great detail about these regulatory issues but feel it is important to touch on them briefly.

Current signals include the UN Sustainable Development Goals (SDGs) and the corresponding targets set for 2030. These will drive companies’ bottom lines, consumer and investor behaviour, and the long-term viability of some industries. Looking forward, we are confident major regulatory reforms focused on directing investor capital toward carbon neutrality, such as the implementation of the 2019 Sustainable Finance Disclosure Regulation (SFDR) and the 2021 European Union (EU) framework for a common classification for sustainable activities (aka, the “Taxonomy Regulation”), are going to drive assets toward companies implementing best practices for sustainability and disclosure.

Disclosure is key to understanding risk and is lacking in many industries. In our view, companies and sectors currently leading on disclosure of water risk and its impacts on operating costs will have a leg up on competitors who are trailing or resistant.

Bottom Line: Water Risk Imperils Clients’ Assets

Our fundamental position is guided by three main principles. First and foremost, our stewardship and fiduciary responsibility to our clients. We must make better-informed decisions because we have a duty to our clients. Second, the time to identify water risk is now, not the future. Water risk is a material risk. We must recognise that broader environmental risks are beginning to pose business-relevant vulnerabilities today. These vulnerabilities translate into asset value destruction through asset impairment via valuation.

We are always trying to connect the dots on how these broad issues translate into asset impairment by identifying the channels of financial impact that macro-factors could have on a company and how our analysts price in this impact—whether pricing through a readjustment to a financial model or through an adjustment to a company’s financial forecast. For example, if a company operating in a water-stressed region does not have good governance and/or broad oversight of its water supply, these problems will trickle down to the bottom line through higher operating costs or a lack of supply chain optimisation.

Third, as active managers, ultimately, our goals are to be better informed managers generating sustainable risk-adjusted returns for our clients. We must be able to identify companies and sectors, through their management of these issues, that differentiate themselves as better run businesses. We must identify companies where latent risks become much more business relevant, and in quicker time frames than anticipated. We are also seeking to identify companies providing solutions to deal with water scarcity, water sanitation and water efficiency.

We anticipate these issues are going to take on much more prominence in the asset management industry and the client landscape. Issues related to climate change—water scarcity, sea level rise, more severe storms and wildfires—can no longer be ignored or be considered latent risks just because many believe they are priced too far out or they will not impact portfolios until a point in the distant future. As a fiduciary for our clients’ assets, we must be positioning our portfolios for climate change today, not in 2030 or 2050.

*****

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in developing markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with developing markets are magnified in frontier markets.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com—Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

______

1. Source: The 2030 Water Resources Group, Annual Report: Building Trust, Growing Resilience, 2019.

2. Source: World Economic Forum, The Global Risks Report 2020, January 2020.

3. Sources: Food and Agriculture Organization of the United Nations; World Bank Group, Water Management in Fragile Systems: Building Resilience to Shocks and Protracted Crises in the Middle East and North Africa, Cairo: August 2018.

4. Source: E. Hamin Infield, E. Yaser Abunnasr, R. Ryan, eds. 2019. Planning for Climate Change: A Reader in Green Infrastructure and Sustainable Design for Resilient Cities. New York, NY: Routledge.

5. Source: Wilkinson, A. “The Water Crises Aren’t Coming—They’re Here”, Esquire Magazine, 23 August 2018.

The post Water Disruption: Investment Risk from Multiple Angles appeared first on Beyond Bulls & Bears.

This post was first published at the official blog of Franklin Templeton Investments.