by Don Vialoux, EquityClock.com

Technical Notes for Monday October 26th

The VIX Index spiked above 31.18 on news of a growing pandemic in the U.S.

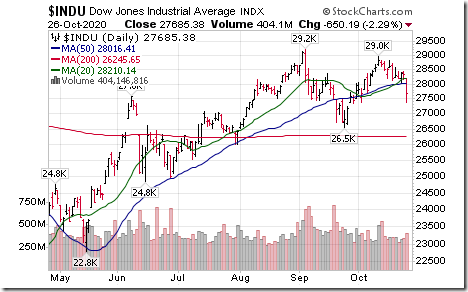

Dow Jones Industrial Average moved below its 20 day moving average at28221.63 and its 50 day moving average at 28021.11.

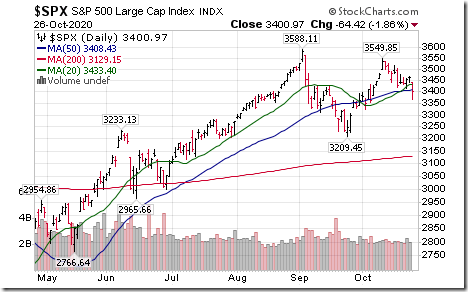

S&P 500 Index moved below its 20 day moving average at 3,433.10 and 50 day moving average at 3.408.30

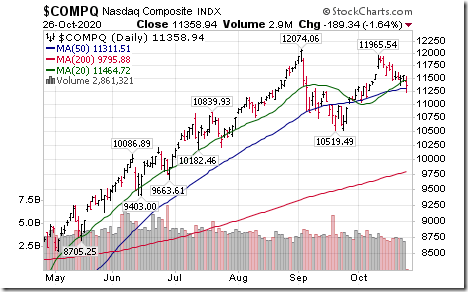

The NASDAQ Composite Index moved below its 20 day moving average at 11,461.80 and briefly moved below its50 day moving average at 11,310.34.

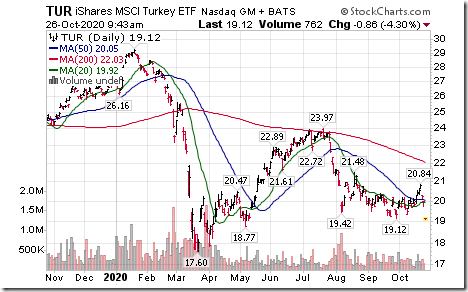

Turkey iShares (TUR) moved below $19.12 extending an intermediate uptrend.

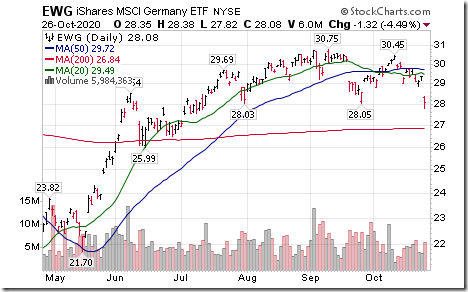

Germany iShares (EWG) moved below $28.05 completing a Head & Shoulders pattern.

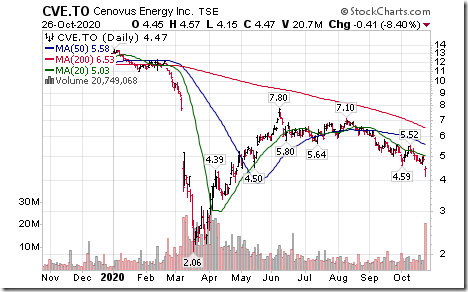

Cenovus (CVE), a TSX 60 stock moved below Cdn$4.59 extending an intermediate downtrend. Cenovus offered to acquire Husky Energy in a share exchange deal last night.

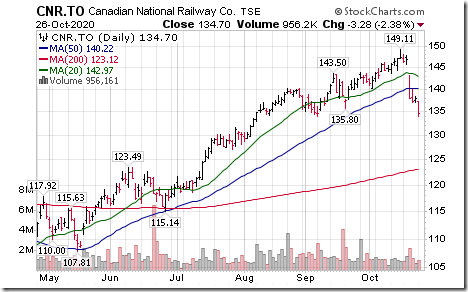

Canadian National Railway (CNR), a TSX 60 stock moved below $135.80 and $135.16 setting an intermediate downtrend.

Oracle (ORCL), an S&P 100 stock moved below $58.05 completing a double top pattern.

Johnson & Johnson (JNJ), a Dow Jones Industrial stock moved below $142.96 completing a double top pattern.

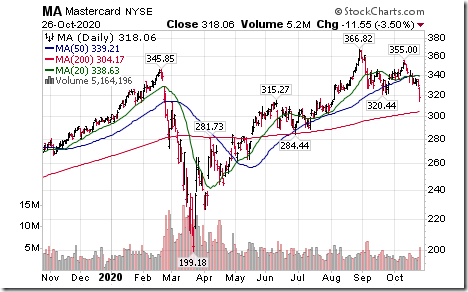

MasterCard (MA), an S&P 100 stock moved below $320.44 completing a double top pattern.

Visa (V), a Dow Jones Industrial stock moved below $193.13 completing a double top pattern.

Cisco (CSCO), an S&P 100 stock moved below $37.26 extending an intermediate downtrend.

Intel (INTC), a Dow Jones Industrial Average stock moved below $48.42 and $46.63 extending an intermediate downtrend.

BHP Inc. (BHP), one of the world’s largest base metal miners, moved below $50.34 extending an intermediate downtrend.

Trader’s Corner

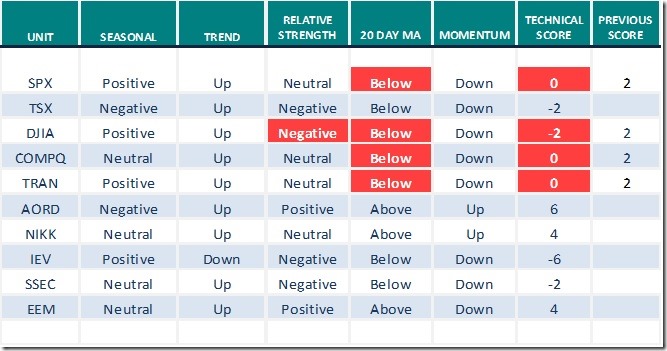

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for October 26th 2020

Green: Increase from previous day

Red: Decrease from previous day

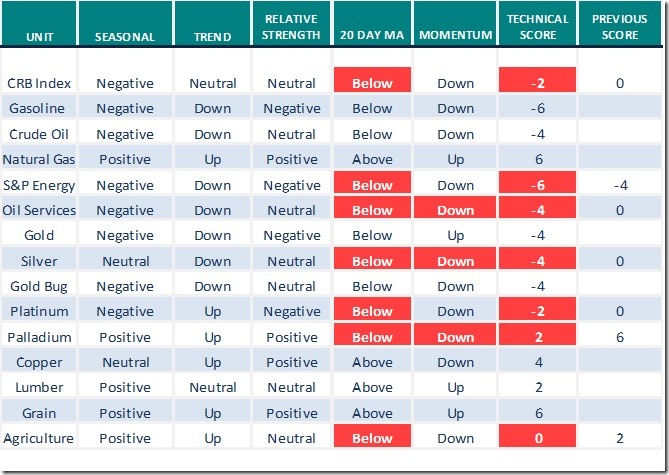

Commodities

Daily Seasonal/Technical Commodities Trends for October 26th 2020

Green: Increase from previous day

Red: Decrease from previous day

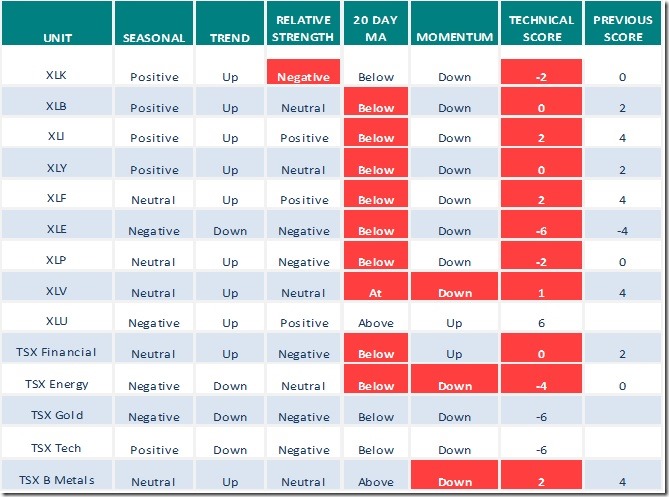

Sectors

Daily Seasonal/Technical Sector Trends for October 26th 2020

Green: Increase from previous day

Red: Decrease from previous day

Technical Scoop

Thank you to David Chapman and www.EnrichedInvesting.com for a link to their weekly comment. Headline reads, “Contentious election aftermath, chaos toppy divergence, rising rates, ravaged revival, small cap challenge”. Following is the link:

S&P 500 Momentum Barometer

The Barometer plunged 13.63 to 54.51 yesterday. It changed from intermediate overbought to intermediate neutral on a move below 60.00 and continues to trend lower.

TSX Momentum Barometer

The Barometer plunged 13.74 to 43.13 yesterday. It remains intermediate neutral and is trending lower.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.