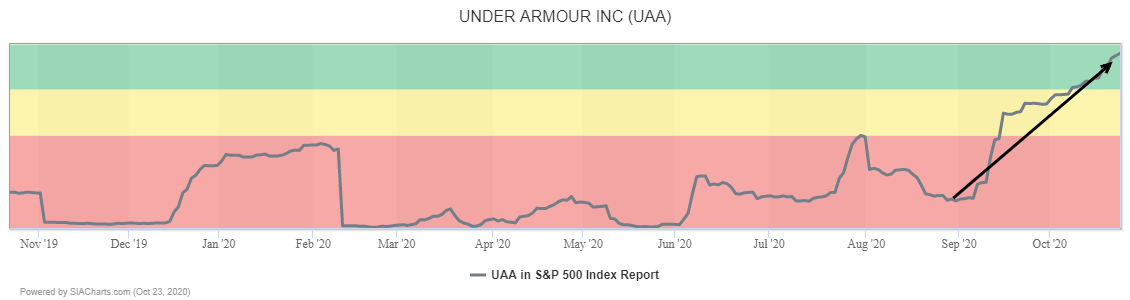

Athletic clothing producer Under Armour (UAA) continues to steadily climb within the Green Favored Zone of the SIA S&P 500 Index Report. UAA has moved up into 31st place after climbing 6 spots on Friday and 136 places in the last month.

Earlier this month, Under Armour (UAA) shares completed a bullish Ascending Triangle base with a breakout over $12.00. Since then, the shares have remained under accumulation, steadily climbing toward initial potential resistance in the $15.00 to $15.50 range where a round number, measured move and previous support converge. Next potential upside tests after that on trend appear near $18.00, based on previous support/resistance and a measured move, then the $20.00 round number. Initial support has moved up toward $13.50 from the $12.00 breakout point.

Since bottoming out back in May, Under Armour (UAA) shares have been steadily recovering. After spending the spring and summer base building, accumulation has accelerated in recent weeks, with the shares have decisively breaking out to the upside with the completion of a bullish Spread Triple Top pattern confirmed by a higher bullish Double Top breakout.

Initial upside resistance for the shares appears near $15.65 where a test of a downtrend line converges with a horizontal count. Next resistance after that appears in the $18.35 to $19.10 zone based on vertical and horizontal counts. Initial support appears near $13.35 based on a 3-box reversal.

With a perfect SMAX score of 10, UAA is exhibiting near-term strength across the asset classes.

Disclaimer: SIACharts Inc. specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment whatsoever. This information has been prepared without regard to any particular investors investment objectives, financial situation, and needs. None of the information contained in this document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. As such, advisors and their clients should not act on any recommendation (express or implied) or information in this report without obtaining specific advice in relation to their accounts and should not rely on information herein as the primary basis for their investment decisions. Information contained herein is based on data obtained from recognized statistical services, issuer reports or communications, or other sources, believed to be reliable. SIACharts Inc. nor its third party content providers make any representations or warranties or take any responsibility as to the accuracy or completeness of any recommendation or information contained herein and shall not be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon. Any statements nonfactual in nature constitute only current opinions, which are subject to change without notice.