by Scott Brown, Ph.D., Chief Economist, Raymond James

There are a number of uncertainties heading into the November 4 election and many more as we look ahead into 2021. There’s a long held belief that the stock market abhors uncertainty. There’s also an old adage that says the market often climbs a wall of worry. We can lay out a number of scenarios for the election results, the pandemic, and so on, but it’s typically what you don’t see coming that matters most.

“Reports that say that something hasn't happened are always interesting to me, because as we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns—the ones we don't know we don't know. And if one looks throughout the history of our country and other free countries, it is the latter category that tend to be the difficult ones.”

– Defense Secretary Donald Rumsfeld, DoD news briefing, February 12, 2002

Rumsfeld said many controversial things during his second stint as U.S. Secretary of Defense, but the above quote seemed to be the most ridiculed, even though it makes perfect sense to anyone who has studied logic.

We don’t know who will win the White House. We don’t know which party will control the Senate. The results of some of these races may be contested and it may take some time before we know who won. We don’t know if a vaccine will be available for COVID-19, how effective it will be, if people will take it, or whether people will resume their pre-pandemic spending habits if an effective and widely distributed vaccine is available.

We can run scenarios, of course. If Biden wins the White House and the Democrats gain control of the Senate and keep the House, we can expect more fiscal stimulus, including a major infrastructure package. An increased likelihood of a Democratic sweep appears to be the main reason behind the recent uptick in bond yields. In the past, when in control, Democrats have instituted pay-go rules, which say that additional spending should be deficit neutral. That is, if you want to spend more on something, you have to raise taxes or find some other spending to cut. Republicans let these rules expire once they are in charge. Pay-go rules don’t apply during periods of economic weakness, but we would likely see some internal debate within the Democratic Party, and (at this point) these rules appear unlikely to be re-adopted. There would be some infighting between the moderate and progressive wings on a number of issues in the Democratic sweep scenario, but tax increases would be on the table. Republicans would fall back to being deficit hawks, but draw the line on tax hikes.

In Econ 101, one learns that there are three main roles for the government in an economy: public goods; dealing with externalities; and monopoly/ antitrust regulation. Public goods are things that anyone can benefit from but can’t be funded privately (national defense, police, fire departments, public health, etc.). Externalities are by-products of consumption or production. You want to encourage positive externalities and discourage negative ones (like traffic or pollution). The third role is the toughest. While monopoly regulation (of utilities, for example) is familiar, antitrust has been especially problematic. Major cases (Alcoa, IBM, AT&T, and Microsoft) are few and far between. The current admiration has recently launched a case against Google and Democrats could expand that to other tech giants. Department of Justice antitrust actions are expensive, lengthy, and difficult. Still, while this would be one more uncertainty in the outlook, any possible breakups would be years away.

Divided control in Washington would lead to fewer legislative options in 2021. The president would be constrained by the opposing party (whether in the House, Senate, or both). Regardless of the election outcome, fighting COVID-19 will be remain the key issue.

While the arrival of COVID-19 was a surprise, pandemics have long been anticipated (we just can’t say when and how severe they will be). The recent news hasn’t been good, with a record number of new cases in many states in recent weeks. Europe, which had some success in containing the virus, has also hit a record number of new cases. New cases in China remain low. Testing and tracing is an effective tool in preventing the spread of the virus, and the U.S. is still way behind. We can’t even get people to properly wear masks, which is by far the most effective means of containing the virus. As a consequence, the pandemic is expected to last a lot longer. Many furloughed workers have been re-employed, some new jobs have been created (grocery stores, deliveries), but many temporary layoffs are becoming permanent, and some firms are trimming workforces in response to reduced earnings.

Recent Economic Data

The Fed’s Beige Book reported that overall growth was characterized as “slight to modest” in most areas of the country, although “changes in activity varied greatly by sector.” Job growth “remained slow,” as “firms continued to report new furloughs and layoffs,” with firms adjusting to their employees’ health and childcare concerns. Overall, inflation was modest, although input costs were generally rising faster than consumer prices. There were widespread reports of continued additional costs for firms due to COVID-19, including personal protective equipment, sanitation equipment, testing equipment, and technology needed for remote work.

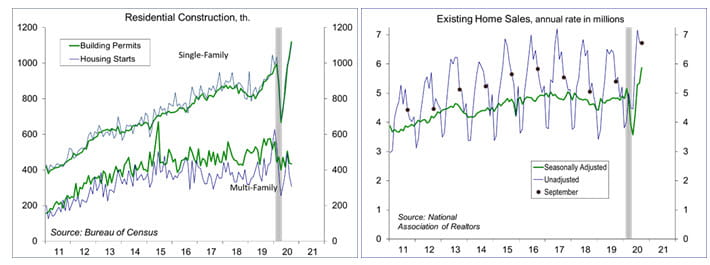

Building permits rose 5.2%, to a 1.553 million seasonally adjusted annual rate in September (+8.1% y/y), with single-family permits (the key figure in the report) up 7.8% (24.3% higher than a year earlier). Housing starts rose 1.9%, to a 1.415 million pace, with single-family starts up 8.5% (22.3% higher than a year ago).

Existing home sales jumped to a 6.54 million seasonally adjusted annual rate in September (+20.9% y/y), with the headline figure amplified by the seasonal adjustment (sales were unchanged before seasonal adjustment). The National Association of Realtors noted that housing strength has been fueled by low mortgage rates and the expectation of a longer-term shift to working from home.

Homebuilder sentiment (the National Association of Home Builders’ Housing Market Index) rose to another record high, coming in at 85 in October, vs. 83 in September and 78 in August. “Historic traffic numbers have builders seeing positive market conditions,” according to the NAHB, but “many in the industry are worried about rising costs and delays for building materials, especially lumber.”

The Index of Conference Board’s index of Leading Economic Indicators rose 0.7% in September, led by a drop in jobless claims, a gain in building permits, and strength in ISM New Orders. Together with the index of Coincident Economic Indicators, which rose 0.2%, the LEI “suggests that the post-pandemic recovery in economic activity may be slowing.” The report noted that “rising COVID-19 cases could pose additional risks in the near- term.”

Gauging the Recovery

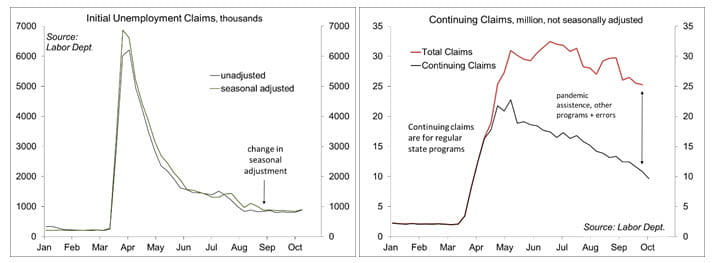

Jobless claims, a leading economic indicator, fell to 787,000 in the week ending October 17, with a downward revision (-56,000) to the previous week, as California ended its pause in processing claims. The four-week average was 811,250 – still an extremely high trend (although less horrific than in March and April). Continuing claims (for regular state unemployment insurance programs), a coincident economic indicator, fell by 1,024,000 (week ending October 10) to 8,730,000.

The New York Fed’s Weekly Economic Index rose to -3.80% for the week of October 17, up from -4.03% a week earlier (revised from -3.91%) and a low of -11.45% at the end of April, consistent with a moderation in the pace of the recovery. The WEI is scaled to four-quarter GDP growth (for example, if the WEI reads -2% and the current level of the WEI persists for an entire quarter, we would expect, on average, GDP that quarter to be 2% lower than a year previously). Note that the weekly figures are subject to revision

The University of Michigan’s Consumer Sentiment Index rose to 81.2 in the mid-month assessment for October (the survey covered September 30 to September 28), vs. 80.4 in September and 74.1 in August. Mid- October ratings remained sharply split by political affiliation (Republican: 100.6, vs. 98.9 in September, Democrat: 69.5, vs. 67.7, Independent: 75.7, vs. 76.6).

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report's conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Copyright © Raymond James