by Don Vialoux, EquityClock.com

The Bottom Line

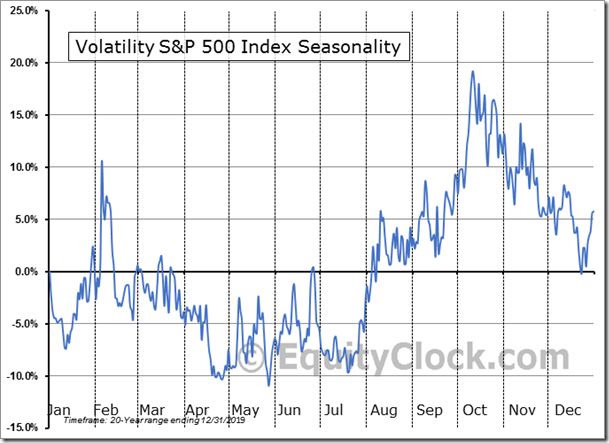

Most major equity indices around the world were mixed last week. Greatest influences remain growing evidence of a second wave of the coronavirus (negative) and possible approval of a vaccine (positive). Momentum indicators for North American equity markets moved lower last week from intermediate overbought levels. The VIX Index remained elevated, but moved past its seasonal peak. Look for continuation of volatile, choppy North American equity markets until at least U.S. Presidential Election Day on November 3rd.

Observations

The VIX Index (better known as the Fear Index) showing volatility by the S&P 500 Index remained elevated last week.

Ditto for VXN showing volatility by the NASDAQ 100 Index

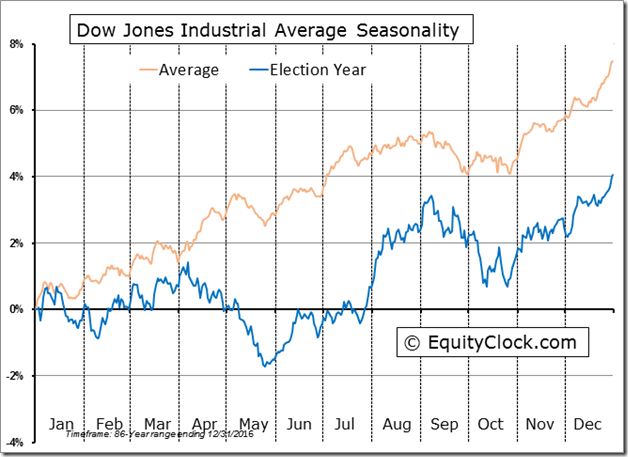

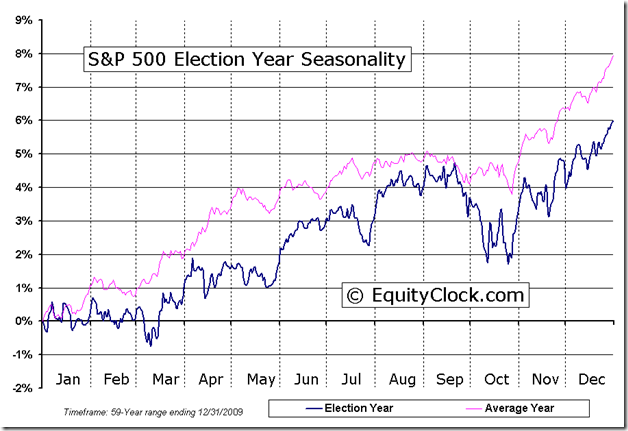

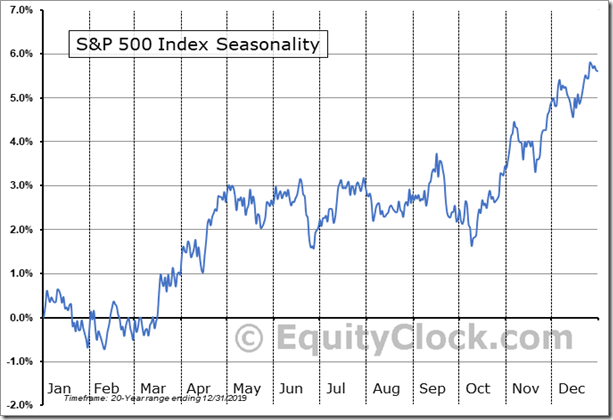

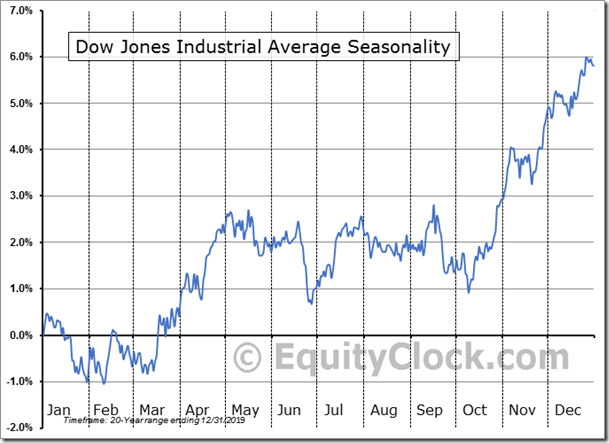

The Dow Jones Industrial Average and S&P 500 Index during U.S. Presidential Election years are following their historic trend. They moved lower from early September to the third week of October followed by a move higher after the election.

David Chapman’s recent Technical Scoop report offers a valuable study on performance of the Dow Jones Industrial Average showing the “New President Effect”. (i.e. Performance of the Average since 1952 from Presidential Election day on the first Tuesday in November to Inauguration Day in the third week in January). The study shows that the Average rose in 11 of the past 17 periods. Note that the Average dropped substantially (i.e. 17.4%) on only one occasion, the period that Obama first became President in November 2008 just after the U.S. monetary crisis. Obama’s election promises to raise corporate and personal tax rates further aggravated U.S. stock market sentiment between November 4th 2008 and January 20th 2009 and U.S. equity markets responded accordingly. Now, Biden is promising higher corporate and personal tax rates (including an increase in the tax rate on capital gains) if elected. Caveat Emptor! Following is a link to David’s study:

Jim Cramer of Mad Money fame commented on well-known technical analyst, Tom Demark’s recent forecast predicting a short term top by the Dow Jones Industrial Average today followed by weakness to just before U.S. Election Day on November 3rd

Medium term technical indicator for U.S. equity markets (e.g. Percent of S&P 500 stocks trading above their 50 day moving average) moved lower last week. It remained intermediate overbought. See Barometer chart at the end of this report.

Medium term technical indicator for Canadian equity markets also moved lower last week It changed from intermediate overbought to intermediate neutral. See Barometer chart at the end of this report.

Short term short term momentum indicators for U.S. markets/commodities/sectors (20 day moving averages, short term momentum indicators) moved lower last week from overbought levels.

Short term momentum indicators for Canadian markets/sectors mainly remained high last week.

Year-over-year 2020 consensus earnings and revenue declines by S&P 500 companies ebbed slightly again last west. According to www.FactSet.com, third quarter earnings are expected to fall 18.4% (versus a decline of 20.5% last week) and revenues are expected to slip 3.3% (versus previous decline of 3.6%). Fourth quarter earnings are expected to drop 11.8% (versus previous decline of 12.4%) and revenues are expected to decline 1.1%. Earnings for all of 2020 are expected to fall 17.1% (versus previous decline of 17.7%) and revenues are expected to decline 2.7%.(versus previous decline of 2.6%).

Consensus estimates for earnings and revenues by S&P 500 companies turn positive on a year-over-year basis in the first quarter of 2021. According to www.FactSet.com earnings in the first quarter of 2021 are expected to increase 14.1% (versus previous 12.8% increase) and revenues are expected to increase 3.1%. Earnings in the second quarter are expected to increase 44.6% (versus previous increase of 44.0%) and revenues are expected to increase 13.3% (versus previous increase of 13.7%. Earnings for all of 2021 are expected to increase 24.6% (versus previous increase of 25.5%) and revenues are expected to increase 8.0%.

Economic News This Week

September U.S. Housing Starts to be released at 8:30 AM EDT on Tuesday are expected to increase to 1.450 million units from 1.416 million units in August

September Canadian Consumer Price Index to be released at 8:30 AM EDT on Wednesday is expected to decrease 0.1% versus a decline of 0.1% in August.

August Canadian Retail Sales to be released at 8:30 AM EDT on Wednesday are expected to increase 1.0% versus a gain of 0.6% in July.

Beige Book is released at 2:00 AM EDT on Wednesday.

Weekly Initial Jobless Claims to be released at 8:30 AM EDT on Thursday are expected to drop to 860,000 from 898,000 last week.

September U.S. Existing Home Sales to be released at 10:00 AM EDT on Thursday are expected to increase to 6.25 million units from 6.00 million units in August.

September U.S. Leading Economic Indicators to be released at 10:00 AM EDT on Thursday are expected to increase 0.6% versus a gain of 1.2% in August.

Selected Earnings Report News This Week

Frequency of quarterly reports ramps up this week: 10% of S&P 500 companies have reported to date: 86% beat consensus earnings estimates and 82% beat consensus revenue estimates. However, share prices for about 2/3 of reporting companies moved lower on the news when traders took profits. Another 96 S&P 500 companies (including eight Dow Jones Industrial Average companies) are scheduled to report this week.

Trader’s Corner

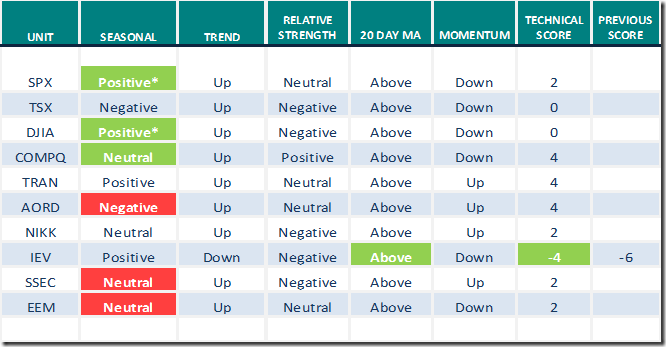

Changes in seasonality ratings are significant in this report. Method of setting the ratings was change this week from real performance to performance relative to the S&P 500 Index. In most cases, ratings for both measures are the same. Entities that recorded a change in rating this week and have the same rating are indicated with *.

Seasonality charts indicating a change in rating based on both real and relative return are offered below.

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for October 16th 2020

Green: Increase from previous day

Red: Decrease from previous day

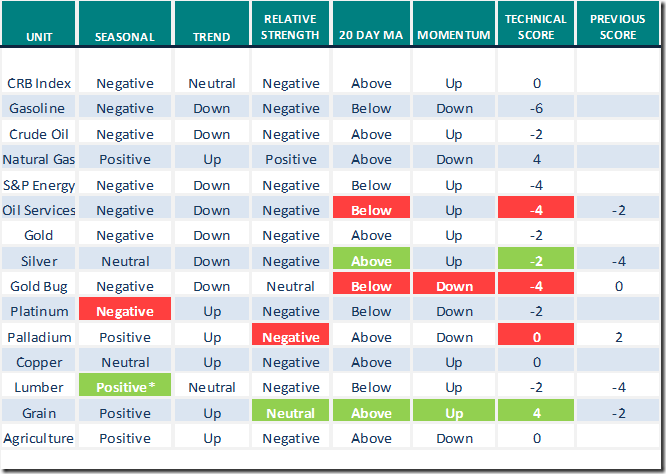

Commodities

Daily Seasonal/Technical Commodities Trends for October 16th 2020

Green: Increase from previous day

Red: Decrease from previous day

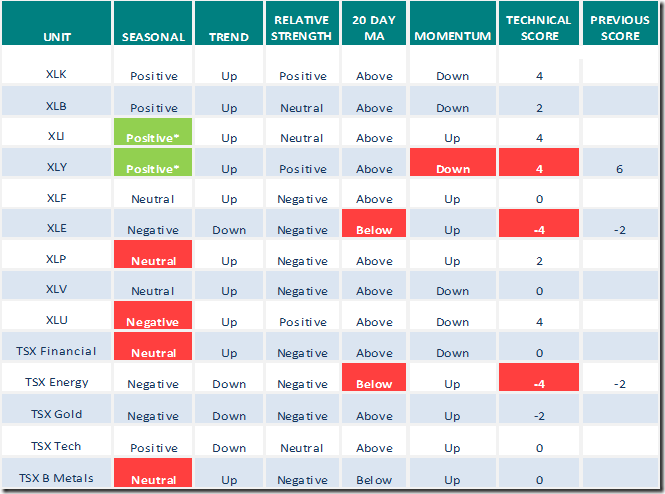

Sectors

Daily Seasonal/Technical Sector Trends for October 16th 2020

Green: Increase from previous day

Red: Decrease from previous day

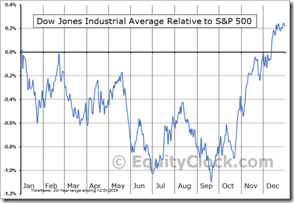

Dow Jones Industrial Average Seasonal Chart

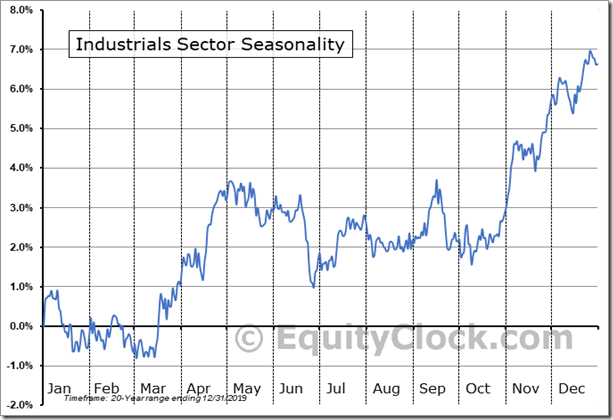

Industrials Sector Seasonal Chart

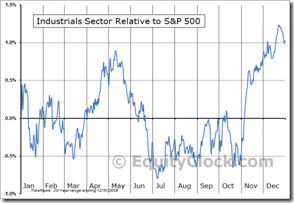

INDUSTRIAL Relative to the S&P 500

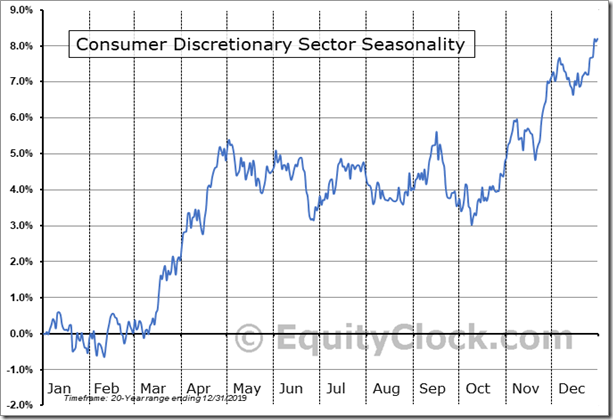

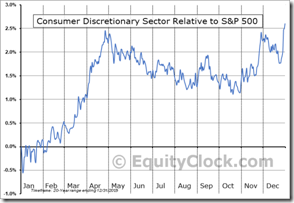

Consumer Discretionary Sector Seasonal Chart

DISCRETIONARY Relative to the S&P 500

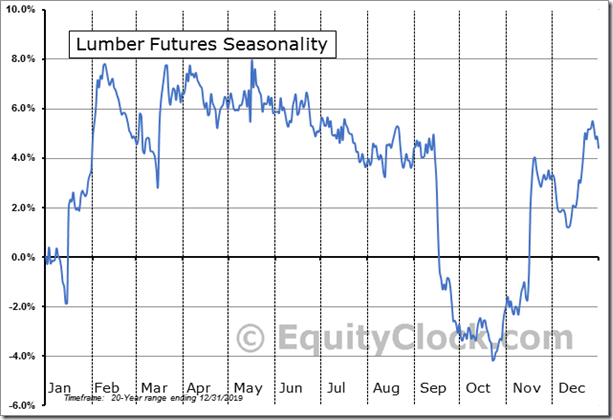

Lumber Futures (LB) Seasonal Chart

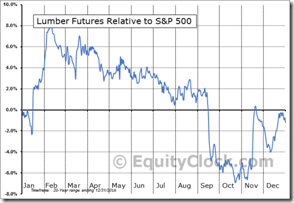

FUTURE_LB1 Relative to the S&P 500

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes for Friday October 16th

Home Depot (HD), a Dow Jones Industrial stock moved above $291.41 to an all-time high extending an intermediate uptrend.

General Electric (GE), an S&P 100 stock moved above $7.17 setting an intermediate uptrend.

General Motors (GM), an S&P 100 stock moved above $33.33 extending an intermediate uptrend.

ANYSS (ANSS), a NASDAQ 100 stock moved above $354.87 to an all-time high extending an intermediate uptrend.

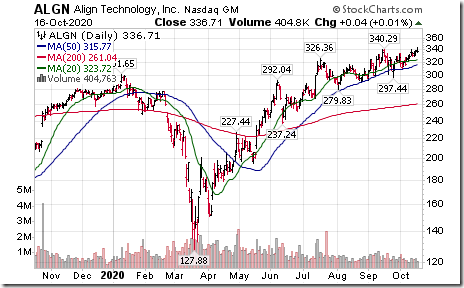

Align Technologies (ALGN), a NASDAQ 100 stock moved above $348.29 extending an intermediate uptrend.

Canadian “gassy” stocks are responding to higher North American natural gas prices. ARC Resources (ARX.TO) moved above Cdn$6.87 extending an intermediate uptrend.

S&P 500 Momentum Barometer

The Barometer slipped 0.20 on Friday and 4.82 last week. It remains intermediate overbought and showed early signs of rolling over.

TSX Momentum Barometer

The Barometer was unchanged on Friday and slipped 3.28 last week. It changed from intermediate overbought to intermediate neutral on a drop below 60.00 and showed early signs of rolling over.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.