by Kathy Jones, Senior Vice President, Head of Fixed Income Strategies, Schwab Center for FInancial Research

The bond market has been quiet for the past six months, with Treasury yields holding in narrow ranges near historic lows. Given these low yields, there is a lively debate going on about whether bonds can continue to provide diversification in a portfolio. Many fear that if markets become volatile and stocks decline again, bond yields don’t have much room to fall—and therefore, won’t provide the balance to a portfolio that they have in the past. This view is often wrapped up with the idea that the traditional balanced portfolio of 60% stocks and 40% bonds is “dead.” These fears were stoked by the turmoil in the markets in March, when bonds and stocks sold off at the same time for a few days, before the Federal Reserve stepped in to calm the markets.

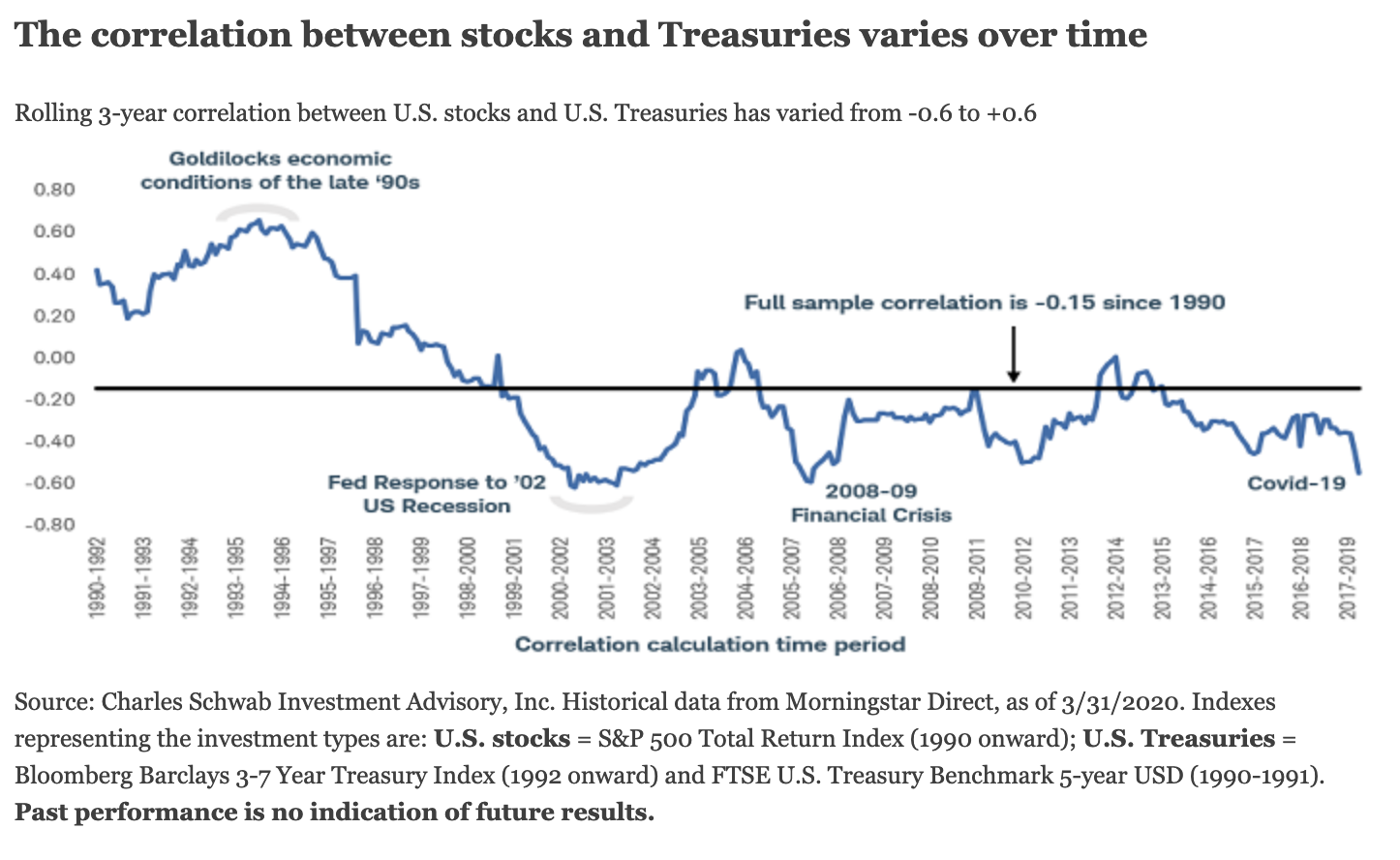

In our view, those fears appear overblown. The 60/40 portfolio was never right for everyone. The right mix of assets depends on an individual’s capacity and tolerance for risk and specific goals. The 60/40 portfolio was more of a starting point. Moreover, correlations between asset classes diverge from time to time, so it’s a myth that they are stable in the first place. Investors should expect some variations in the short run. More importantly, we still expect low-risk or risk-free bonds, like Treasuries, to provide diversification from stocks during times of market downturns, even though a 60/40 portfolio may not be the best choice for most investors.

Separating diversification from expected returns

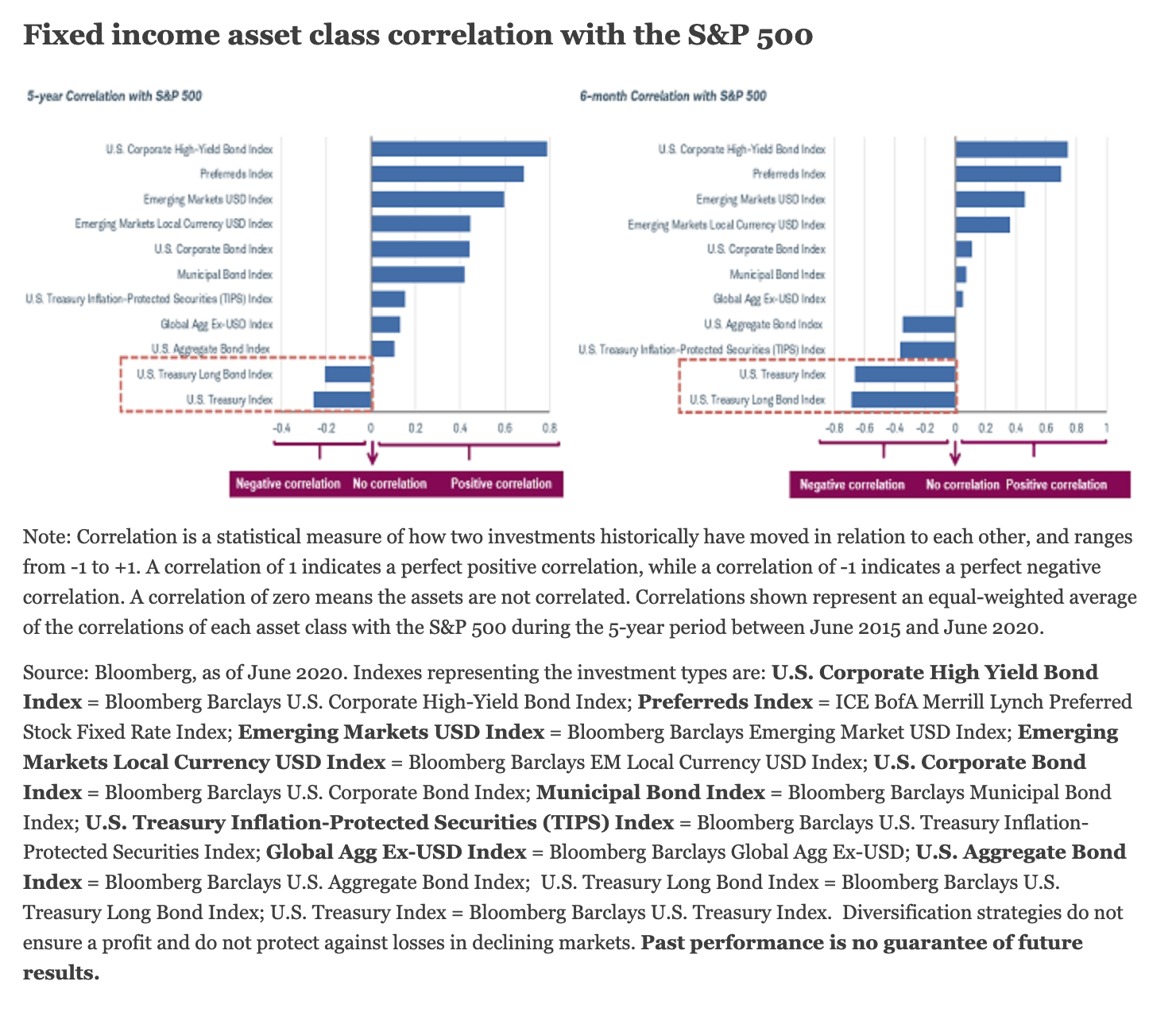

Despite concerns, Treasuries have demonstrated an even higher level of inverse correlation with stocks over the past six months compared with the past five years. There was a brief period of about a week in March when Treasuries and stocks were positively correlated, but that ended quickly. If your investing time horizon extends beyond a few days or weeks, we would not consider short-term dislocations to be significant. As the chart below illustrates, the correlation between Treasuries and the S&P 500® index over the past six months was similar to the correlation over the past five years. Treasuries—especially long-term Treasuries—have moved in the opposite direction of stocks.

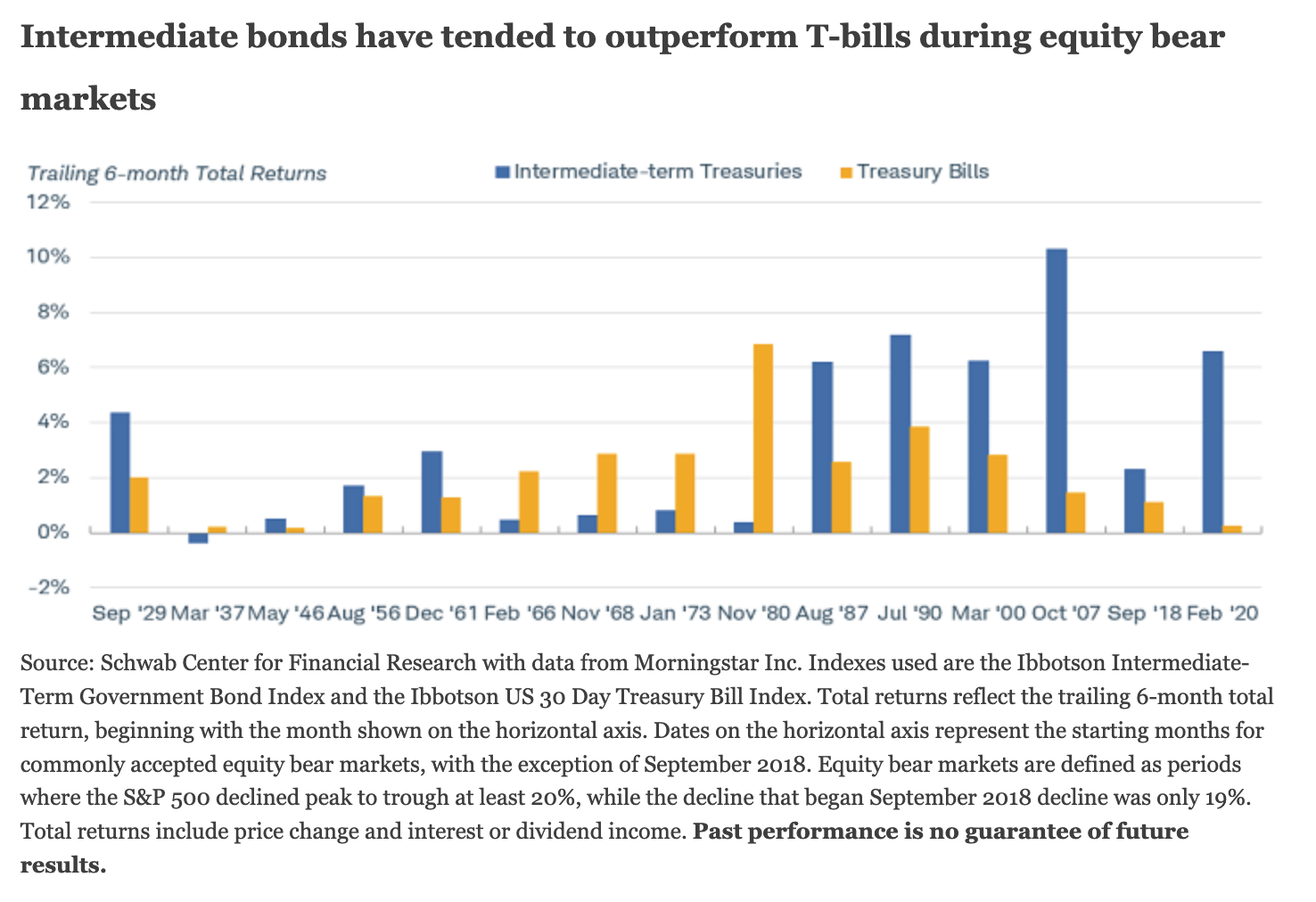

Moreover, we are hard pressed to find an example in history when the stock market has had a significant drop and returns for bonds over the subsequent six months were not positive. Even at very low yields, bonds generally have held their value or appreciated during significant stock market declines.

Finally, since the U.S. Treasury market is still considered a safe haven during times of market stress, there is no clear alternative to fill that role. No other government bond market has the depth or liquidity of the U.S. Treasury market. Nor is it necessarily true that bond yields can’t continue to fall. Even with the Fed trying to hold short-term yields above zero, bond yields could fall into negative territory, as Europe and Japan have demonstrated. We don’t expect that to happen, but it’s theoretically possible under adverse economic conditions.

Expected returns are low

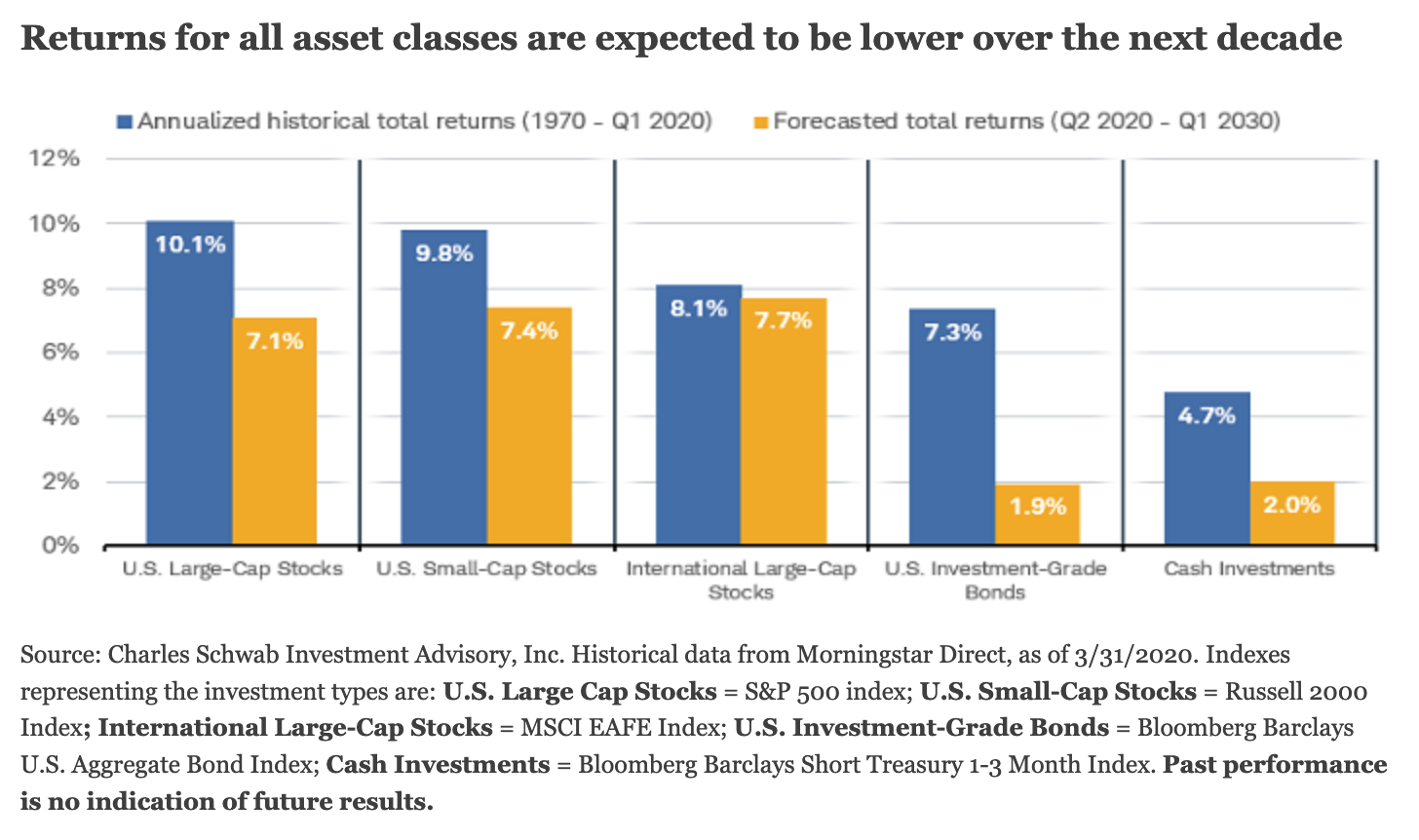

Looking beyond the diversification issue, however, we have to acknowledge that with yields so low, the high returns seen year to date in the bond market aren’t likely to be repeated over the next few years, especially if the economy continues to recover. In fixed income investments, the starting yield is a reliable indicator of future returns over the long run.

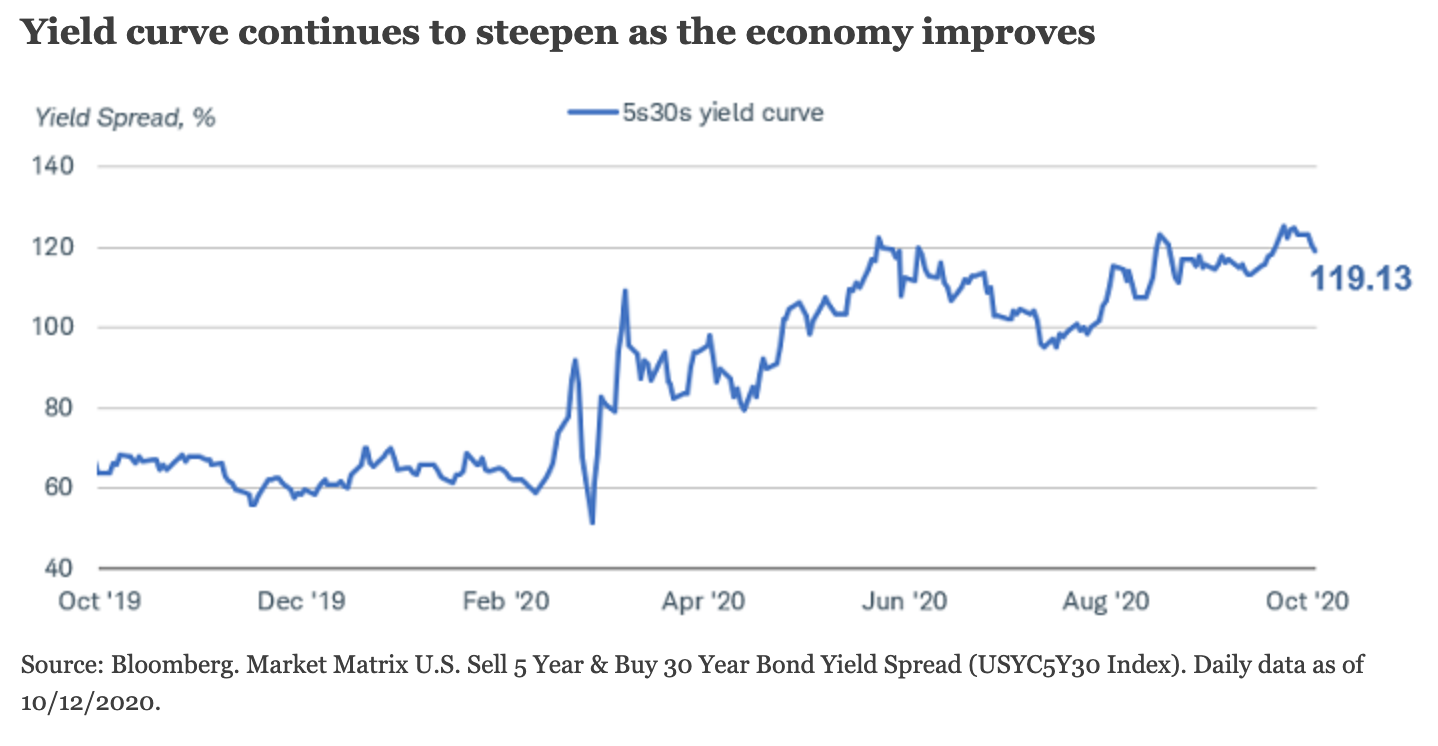

Over the next year, our expectation is that the economy will continue to improve, albeit at a somewhat slower pace than over the past few months, and that inflation will gradually move higher. Another round of fiscal stimulus would provide an extra boost to growth in the short run and likely push inflation expectations higher. In that scenario, bond prices would fall as intermediate to long-term yields would move higher, and the yield curve would continue to steepen.

We see the potential for 10-year Treasury yields to rise to the 1% level over the next six months, even as the Fed keeps short-term interest rates near zero. Consequently, we continue to suggest reducing the overall duration in a portfolio to mitigate the risk of rising long-term bond yields, but maintaining an allocation to intermediate-term bonds for diversification benefits. (Duration is a measure of the sensitivity of bond prices to changes in interest rates.) Investors could consider using a barbell approach, with some short and long-term bonds. The short-term bonds provide stability and the flexibility to reinvest if rates rise, while the long-term bonds provide a way to offset the risk of another round of market turmoil. Alternatively, investors could use a bond ladder, which allows for reinvesting in longer-term bonds when interest rates move up.

Going beyond 60/40

If the traditional 60/40 stocks-to-bonds allocation isn’t optimal, what’s an investor to do? We suggest broader diversification across asset classes. Our expected returns for both stocks and bonds are lower for the next 10 years than over the past 50 years, due to high starting valuations. We suggest exposure to a wide array of global asset classes to help manage risk and provide a broader set of investment opportunities.

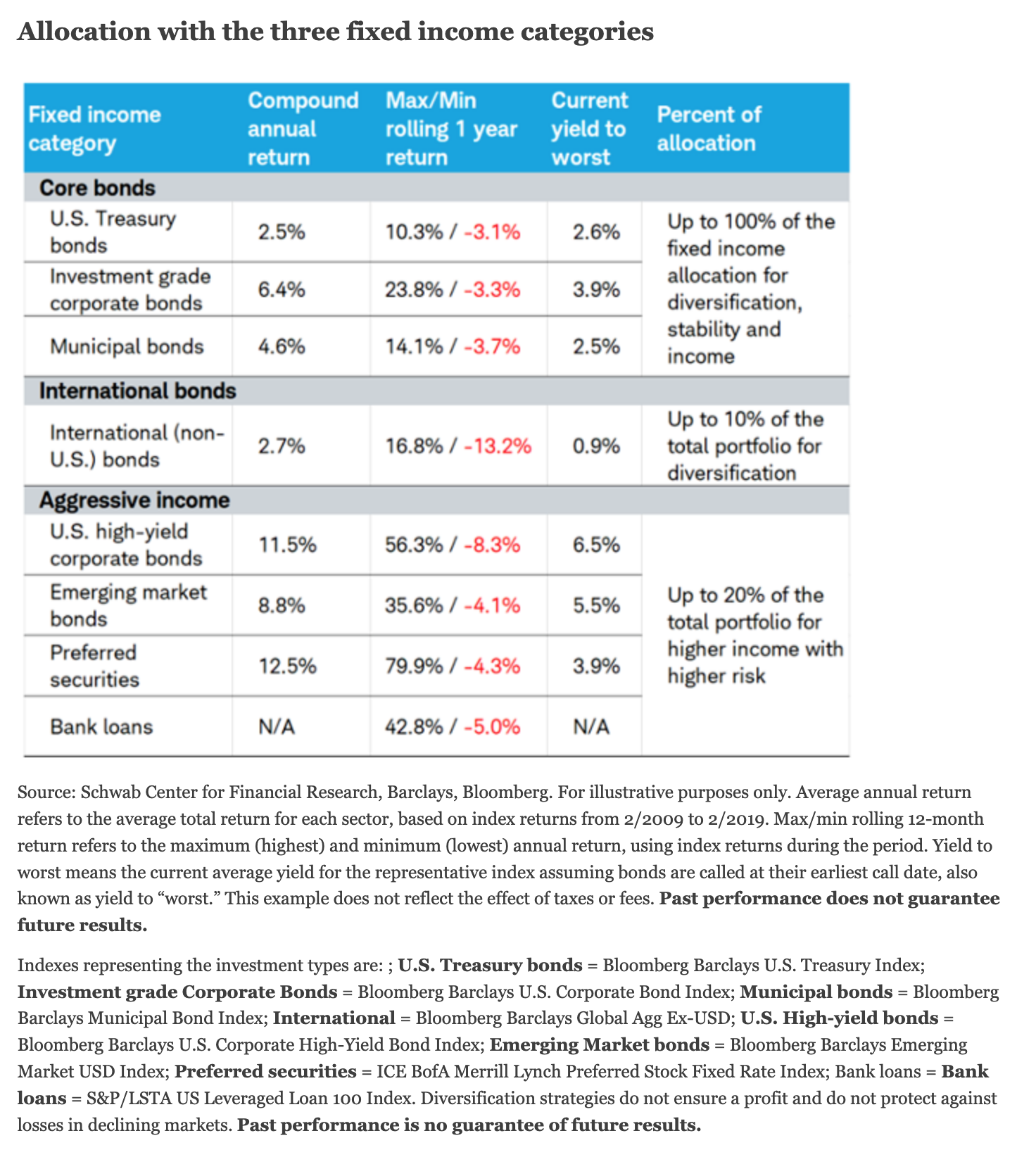

Within the fixed income market, we still favor allocating the bulk of the portfolio to “core bonds,” such as Treasuries and highly rated corporate and municipal bonds, for stability and capital preservation—but also including exposure to riskier asset investments like high-yield corporates, preferred securities, or emerging market bonds, if you have the capacity and tolerance for higher volatility. And while we don’t expect inflation to be a significant problem over the next few years, we believe holding some inflation-linked bonds, such as Treasury Inflation-Protected Securities (TIPS), makes sense, to mitigate the risk of a surprising increase in inflation.

The death of diversification with bonds has been greatly exaggerated

We don’t believe the diversification benefits of holding bonds has changed significantly. In fact, we believe bonds still play an important role as a diversifier from stocks.

However, with bond yields so low, finding the right balance between risk and reward is more challenging. We suggest fixed income investors consider reducing their exposure to long-term bonds to mitigate the risk of rising rates, and focusing on a broader array of bonds for diversification. A mix of domestic and international bonds, inflation-linked bonds like TIPS, along with limited exposure to higher-risk investments—like high-yield and emerging-market bonds, and preferred securities—can be balanced to provide more current income and diversification.

Copyright © Schwab Center for FInancial Research