by Don Vialoux, EquityClock.com

Technical Notes for October 12th

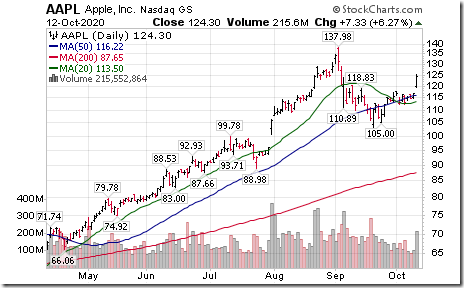

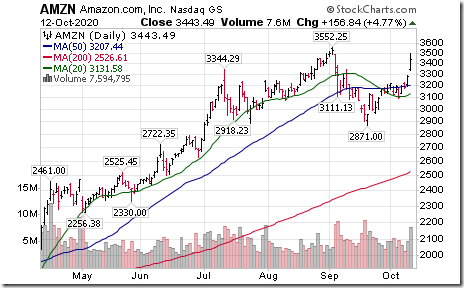

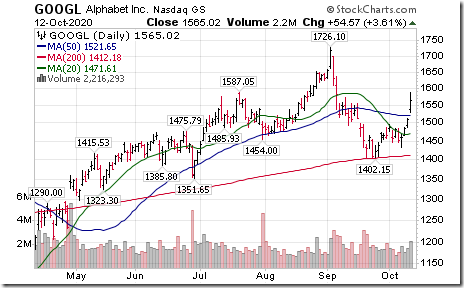

FAANG stocks + Microsoft led the advance by broadly based U.S. equity indices yesterday. Apple was a prominent leader in anticipation of news today about its new 5G iPhone.

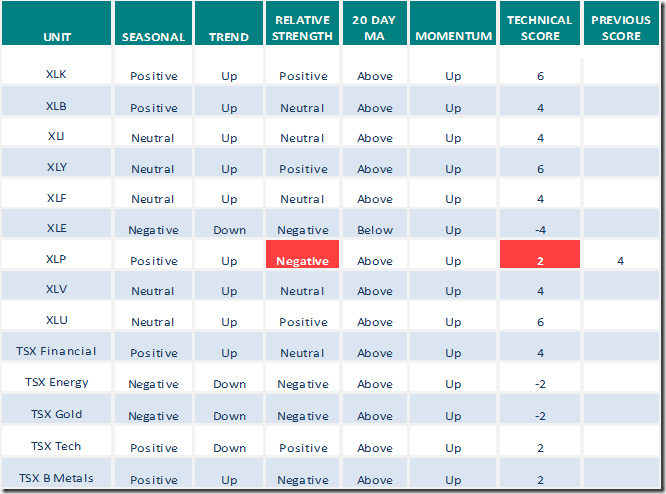

Consumer Discretionary SPDRs (XLY) moved above $153.81 to an all-time high extending an intermediate uptrend.

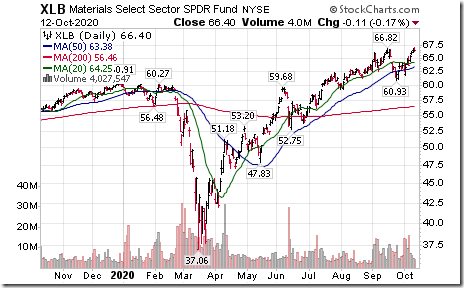

Materials SPDRs (XLB) moved briefly above $66.82 to an all-time high extending an intermediate uptrend, but retreated in late trading.

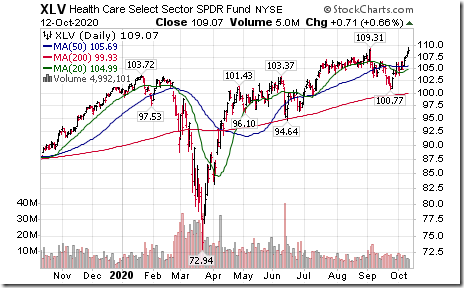

Healthcare SPDRs (XLV) moved above $109.31 to an all-time high extending an intermediate uptrend.

Global Timber iShares (WOOD) moved above $68.05 extending an intermediate uptrend.

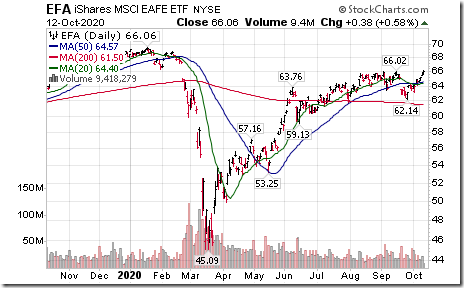

EAFE iShares (EFA) moved above $66.02 extending an intermediate uptrend.

Ford (F), an S&P 100 stock moved above $7.74 extending an intermediate uptrend.

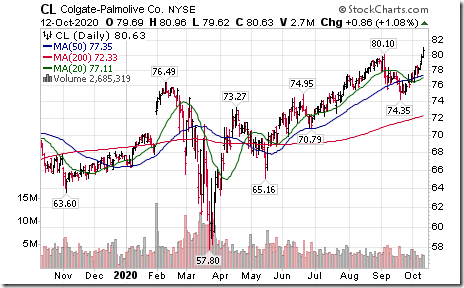

Colgate Palmolive (CL), an S&P 100 stock moved above $80.10 to an all-time high extending an intermediate uptrend.

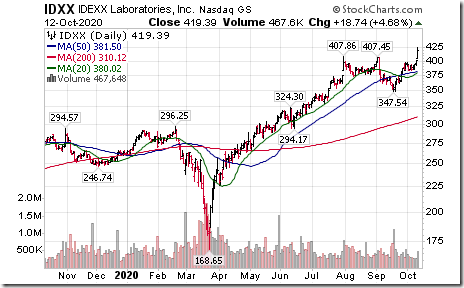

IDEXX Laboratories (IDXX), a NASDAQ 100 stock moved above $407.86 to an all-time high extending an intermediate uptrend.

Cintas (CTAS), a NASDAQ 100 stock moved above $307.65 to an all-time high extending an intermediate uptrend.

CDW Corp (CDW), a NASDAQ 100 stock moved above $128.79 extending an intermediate uptrend.

Verisk Analytics (VRSK), a NASDAQ 100 stock moved above $193.32 to an all-time high extending an intermediate uptrend.

Synopsys (SNPS), a NASDAQ 100 stock moved above $230.12 to an all-time high extending an intermediate uptrend.

T Mobile (TMUS), a NASDAQ 100 stock moved above $119.20 to an all-time high extending an intermediate uptrend.

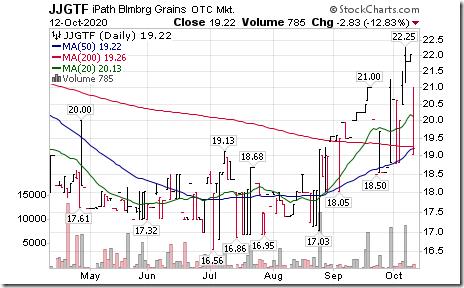

Surprising weakness in the grain ETN yesterday!!

Trader’s Corner

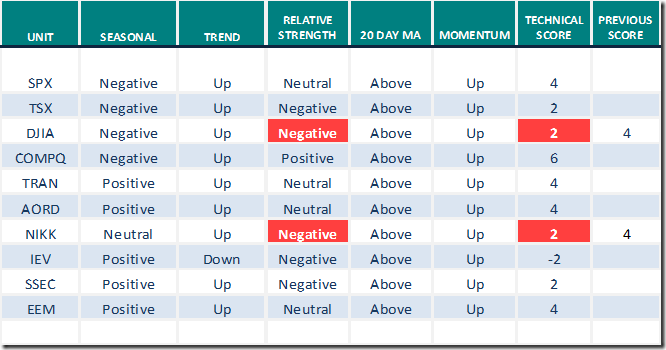

Daily Seasonal/Technical Equity Trends for October 12th 2020

Green: Increase from previous day

Red: Decrease from previous day

Commodities

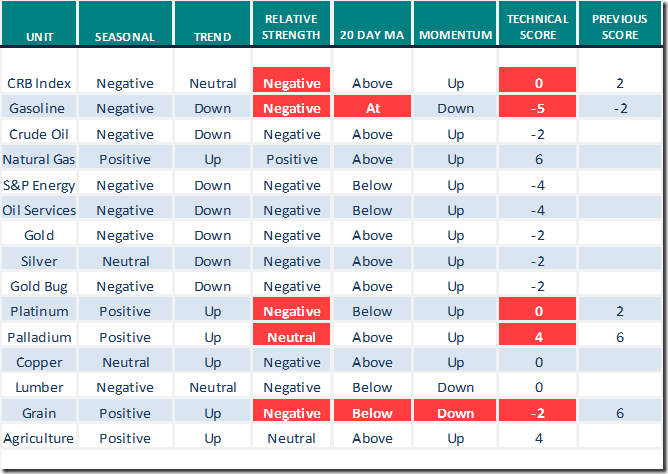

Daily Seasonal/Technical Commodities Trends for October 12th 2020

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for October 12th 2020

Green: Increase from previous day

Red: Decrease from previous day

Technical Scoop

Thank you to David Chapman and www.EnrichedInveting.com for a link to the weekly Technical Scoop . Headline reads, “Destabilizing swan, eery comparison, golden best, supply predictor, miraculous recovery, stimulus whipsaw” Following is the link:

S&P 500 Momentum Barometer

TSX Momentum Barometer

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.