by Richard Brink, AllianceBernstein

Hey everybody, I hope this video finds you well. You know, recently someone said to me, there’s a lot of noise around the election, but Rick, if you just had a few minutes, what would you say are the most important things that I should be aware of?

OK, well, here’s two for you. Number one, historically elections have not mattered to markets or to the economy, not on average over a very long period of time, but we believe they matter a great deal today. Now, the reason for that is probably beyond the scope of this video, but it leads me to number two. Then, what should I be focused on immediately that will be influenced by election outcomes?

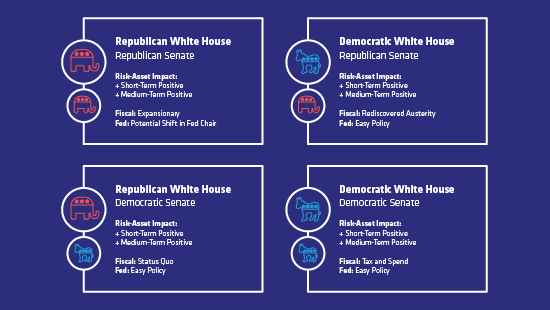

And the first thing is going to be fiscal stimulus. Now, my colleague Eric Winograd has already written on this topic and provided a wonderful graphic, so I’m just going to steal that and share it with you. What you’re looking at is the potential outcomes of the presidential election by party and leadership of the Senate and the possible combinations of those outcomes, both in terms of a Republican sweep, a Democratic sweep and divided leadership. So what should you focus on? First things first, take a look at fiscal, because as we all know, the combination of monetary and fiscal policy was critically important in stabilizing the economy and leading to all the market strength that we’ve seen, and we believe we need significantly more, but there’s been a lot of challenge getting another round of fiscal stimulus passed through.

So what’s the clearest path to additional fiscal stimulus after the election? We think it’s a clean sweep either way. On the Democratic side, that’s the easiest. They already passed a big package in the House that would just come to fruition under a clean sweep. Even Republicans, where there’s been some objection by some of the Senate rank and file, if President Trump wins a second term, we think everybody gets right into line and more fiscal stimulus comes.

The challenge happens with divided leadership, where we believe roadblocks would show up on either side. As a result of that, even if fiscal stimulus is eventually passed, time causes damage to the economy under that scenario, and ultimately, that flows through to weakness in markets. And, so critically, the first thing we want to watch before policy is ever talked about is what happens with fiscal stimulus after the election.

And the second is going to be expectations for short- and medium-term performance, because I’m asked that all the time. So, look, let’s take a crack at it. In the short term, we believe that Republicans, a Republican sweep, would be met favorably, an expectation that policies would continue. And in the medium term, we think they’re right, and so medium-term performance would be strong. That’s probably the most straightforward, I think, to get to. More challenging is what would happen under the case, in the case of a Democratic sweep. In the near term, we believe markets would react negatively on the expectation that increased corporate tax rates, if they were to take place, would unwind some of the gains that we saw when corporate tax rates were cut. And that may be true. However, there’s a countervailing force that we should probably be aware of, which is significantly expansionary fiscal policy, both in terms of general spending, think infrastructure, and also potentially in the form of tax cuts or an increase in the minimum wage. Remember, GDP in this country is largely driven by consumption and an expansionary fiscal policy would allow for that. And, so while we would have increased corporate tax rates, we believe there’ll be higher consumption and higher top line. And so net net, medium term, we’d expect market performance to be strong or solid.

Now, meanwhile, back at the ranch, divided leadership again for us is problematic, because both of those approaches, those two roads diverged in the woods, politically speaking, both, in our estimation, lead to medium-term positive market performance, but blocking either, we think is problematic. So not just the fiscal stimulus we need now, but policies one way or the other that get enacted as we go forward are going to be really important to where the market ultimately ends up.

Now, look, this was a very high-level treatment, and there’s a lot of devils in the details, and so if you’d like more, we have a lot more to share. So reach out to your AllianceBernstein representative, and we’ll be happy to get you as much as you can handle as we make our way through the election season. Once again, I hope you’re all well, and we’ll see you next time.

Rick Brink is a Market Strategist in the Client Group at AB.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

This post was first published at the official blog of AllianceBernstein..