by Scott Brown, Ph.D., Chief Economist, Raymond James

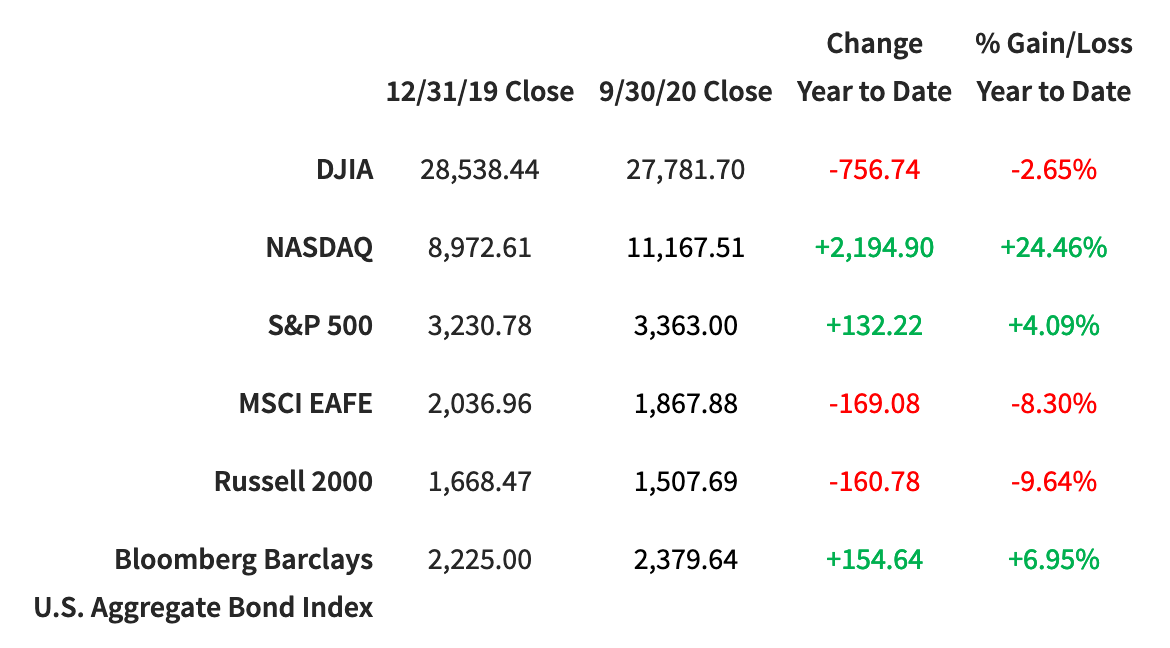

Despite a September slump, the S&P 500 and NASDAQ wrapped up the third quarter with gains of 8.47% and 11%, respectively.

September headwinds are common enough that the S&P 500’s descent from its September 2 all-time peak feels familiar amid an otherwise historic year. Despite this “September effect,” many economic indicators are brightening, suggesting a recovery that has slowed, not turned.

As the S&P 500 had advanced 50% in a 125-day period, a loss of upward momentum didn’t surprise Chief Investment Officer Larry Adam. “Valuations rose to the highest level since 2001,” he explained, “and technical indicators suggested that the market had reached stretched levels.”

Technology, the highest-flying sector of the COVID-19 era, took one of the largest hits during September. But burdened by the resurgence of COVID-19 in Europe and the lack of another U.S. stimulus package, the downward movement spread across the market.

Unquestionably, the tale of two markets and the “K-shaped recovery” continues. As Adam mentioned previously, some parts of the economy will flourish while others struggle.

Housing has been a bright spot during the pandemic. Federal Reserve leaders have indicated that near-zero interest rates may persist through 2023, and perhaps longer, boosting home sales to levels last seen around 2006. This homebuying surge may also be impacted by Americans looking to better align their home workspaces with their companies’ more flexible views on telecommuting.

Meanwhile, political pressures – and the urging of Federal Reserve Chairman Jerome Powell – continue to push for Congress and the White House to find a deal on fiscal stimulus.

Volatile conditions aren’t likely to change very soon. However, there will be opportunities for market improvement this month and in the months to come. Earnings season starts in October, which should give the technology sector a chance to express its foundational strength. And though it is not uncommon to see volatility leading up to the election, once the issue is settled, investors usually make a quick return to form.

Here at the end of the quarter, we can clearly see the gains made by the mainstream indices. The S&P 500 gained 8.47% of value and the NASDAQ saw an 11% rise since the June 30 closing bell, despite the September slump.

Performance reflects price returns as of market close on Sept. 31, 2020, except for the

MSCI EAFE and Bloomberg Barclays Aggregate Bond, which reflect the Sept. 29 closing values.

Analysts are looking at these key factors, both here and abroad.

Economy

- Real gross domestic product is expected to have risen sharply in the third quarter, following a steep drop in the previous quarter. However, the overall level of activity remains below where we were at the end of last year.

- The broad range of economic data have continued to suggest improvement, but the pace of the recovery has moderated. A few sectors, such as housing, are doing better than before the pandemic. Others won’t fully recover until the pandemic is well behind us.

- Further fiscal policy support will be important in securing the economic recovery. An elevated level of layoffs appears as a significant risk into 2021.

Equities

- The winners through the COVID-19 era are likely to continue to be the market leaders, said Joey Madere, senior portfolio strategist, Equity Portfolio & Technical Strategy, but there are reasons to reach into “recovery” sectors – industrials, materials and select consumer discretionary stocks.

- Some sectors, such as housing, internet retail and grocery stores are doing better than they were in February. Others such as travel and tourism, spectator events and business apparel won’t fully recover until the pandemic is well behind us.

- Oil may continue to struggle, especially as lockdown headlines in Europe escalate. Longer term, California’s recent executive order mandating new passenger vehicles be zero-emission by 2035 represents a demand headwind. “The oil industry needs to adapt to this electrification trend, including by participating in the building of electric vehicle charging infrastructure,” said Energy Analyst Pavel Molchanov.

International

- Markets outside the U.S. experienced fluctuations through September for many reasons: a second wave of COVID-19 eroding confidence in Europe; trade and diplomatic tensions hampering major Chinese markets; and Japanese investors seeing hope in the new prime minister’s economic reform initiatives, though broad skepticism about the ability to carry out the changes may have rounded those expectations.

- Neither the European Central Bank nor the Bank of England loosened monetary policy during the month, but they indicated they may take action by the end of the year, probably by expanded qualitative easing measures, European Strategist Chris Bailey says.

- Chinese economic data continues to show signs of progress, and the government has shown more confidence about producing a positive rate of economic growth through 2020.

Fixed income

- “Corporate bond issuance in September almost reached record heights as issuers are taking advantage of not only low rates, but the Federal Reserve messaging about maintaining low rates for an extended period of time,” said Chief Fixed Income Strategist Kevin Giddis.

- The fixed-income market displayed very little volatility in September. Treasury yields remain in a very tight trading range, with yields virtually flat inside seven years, and marginally lower outside seven years.

- Municipal bonds were also relatively flat through September, with no more than a 2-basis-point move on any point on the curve.

Bottom line

- September took the top off what had been a hot market leading up to the month. The dent in the armor for technology and other pandemic-era champions should be seen in this context.

- Economic indicators suggest continued, if tempered, economic improvement.

- Although uncertainty remains certain, we continue to view the pullback as a normal correction as opposed to a shift to a bear market, says Madere.

Your advisor will continue to share any new developments that affect your financial plan. In the meantime, please reach out to him or her if you have any questions.

Investing involves risk, and investors may incur a profit or a loss. All expressions of opinion reflect the judgment of Raymond James and are subject to change. There is no assurance the trends mentioned will continue or that the forecasts discussed will be realized. Past performance may not be indicative of future results. Economic and market conditions are subject to change. The Dow Jones Industrial Average is an unmanaged index of 30 widely held stocks. The NASDAQ Composite Index is an unmanaged index of all common stocks listed on the NASDAQ National Stock Market. The S&P 500 is an unmanaged index of 500 widely held stocks. The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. The Russell 2000 is an unmanaged index of small cap securities. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. An investment cannot be made in these indexes. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise. Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors. Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Copyright © Raymond James