by Don Vialoux, EquityClock.com

Technical Notes for September 2nd

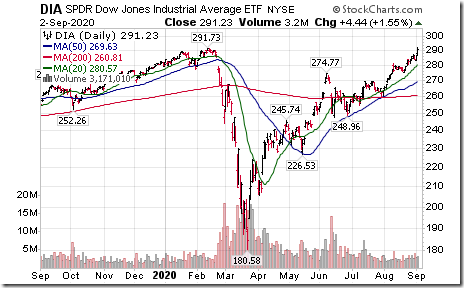

Dow Jones Industrial Average SPDRs (DIA) moved above $291.73 to an all-time high extending an intermediate uptrend.

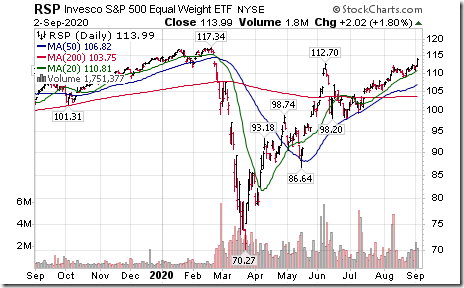

S&P 500 Equal Weight ETF (RSP) moved above $112.70 extending an intermediate uptrend.

Comcast (CMCSA), an S&P 100 stock moved above $45.20 extending an intermediate uptrend.

Caterpillar (CAT), a Dow Jones Industrial Average stock moved above $146.20 extending an intermediate uptrend.

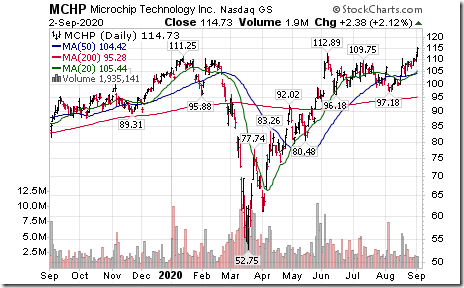

Microchip Technologies (MCHP), a NASDAQ 100 stock moved above $112.89 to an all-time high extending an intermediate uptrend.

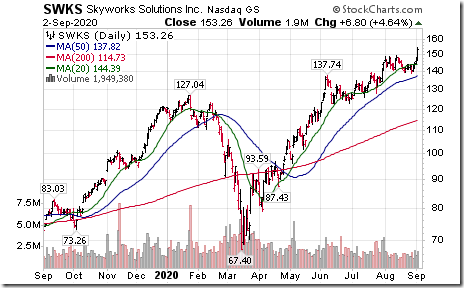

Skyworks Solutions (SWKS), a NASDAQ 100 stock moved above $149.32 to an all-time high extending an intermediate uptrend.

Cerner (CERN), a NASDAQ 100 stock moved above $74.70 extending an intermediate uptrend.

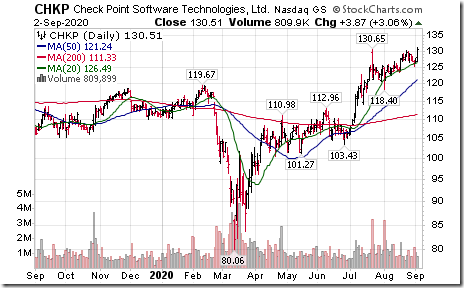

Check Point Software Technologies (CHKP), a NASDAQ 100 stock moved above $130.65 to an all-time high

Cogeco (CGO.TO) moved above $90.80 extending an intermediate uptrend after Rogers Communications made an offer net valued at $4.9 billion to acquire the company’s Canadian assets.

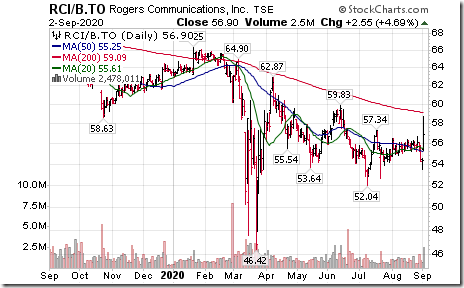

Rogers Communications (RCI.B), a TSX 60 stock moved above $57.34 setting an intermediate uptrend.

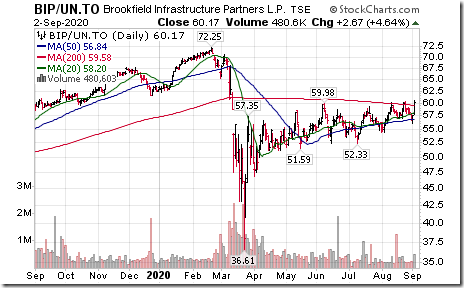

Brookfield Infrastructure Partners (BIP/UN), a TSX 60 stock moved above $59.98 extending an intermediate uptrend.

CGI Group (GIB), a TSX 60 stock moved above US$71.91 extending an intermediate uptrend.

Steel ETF (SLX) moved above $31.59 extending an intermediate uptrend.

T-Mobile (TMUS), a NASDAQ 100 stock moved above $118.00 to an all-time high extending an intermediate uptrend.

Verizon (VZ), a Dow Jones Industrial Average stock moved above $60.25 to an all-time high extending an intermediate uptrend.

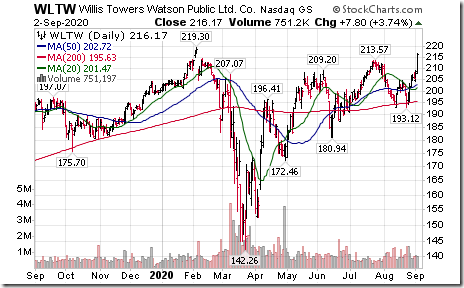

Willis Towers Watson (WLTW), a NASDAQ 100 stock moved above $213.57 extending an intermediate uptrend.

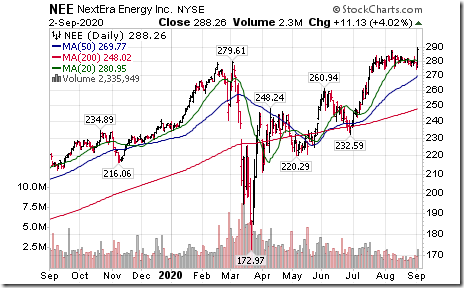

NextEra Energy (NEE), an S&P 100 stock moved above $287.96 to an all-time high extending an intermediate uptrend.

Trader’s Corner

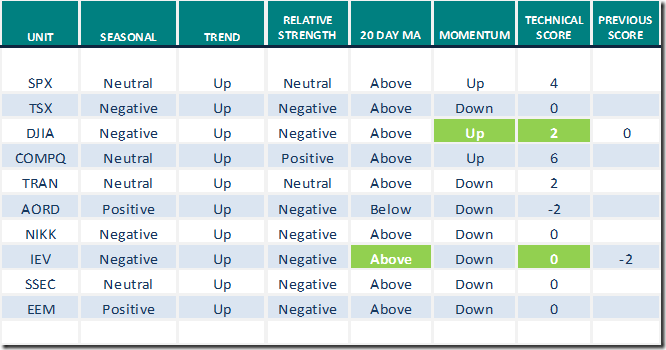

Equity Indices and related ETFs

Daily Seasonal/Technical Equity Trends for September 2nd 2020

Green: Increase from previous day

Red: Decrease from previous day

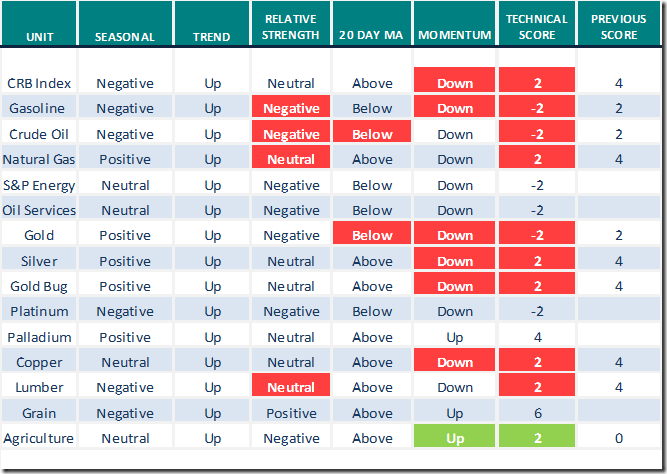

Commodities

Editor’s Note: Commodity prices and their technical ratings drop significantly yesterday with strength in the U.S. Dollar Index and its related ETN:UUP.

Seasonal/Technical Commodities Trends for September 2nd 2020

Green: Increase from previous day

Red: Decrease from previous day

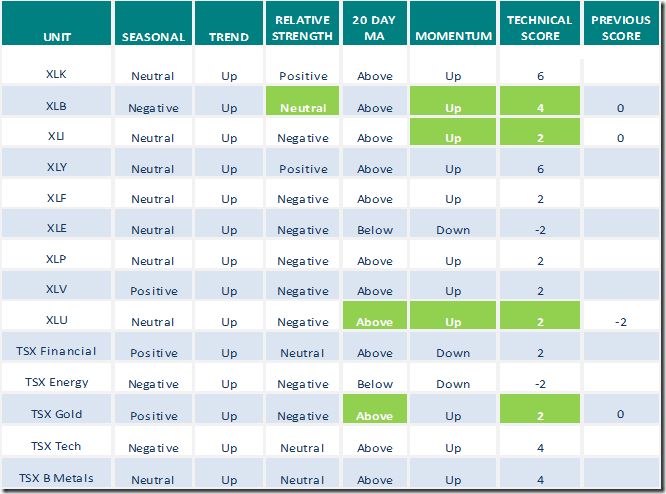

Sectors

Daily Seasonal/Technical Sector Trends for September 2nd 2020

Green: Increase from previous day

Red: Decrease from previous day

Greg Schnell’s “Market Buzz”

Headline reads, “NASDAQ Momentum: Effortless”? Following is a link:

https://www.youtube.com/watch?v=n01HDk45GD8&feature=youtu.be

S&P 500 Momentum Barometer

The Barometer added 7.82 to 83.37 yesterday. It returned from intermediate overbought to extremely intermediate overbought on a move above 80.00.

TSX Momentum Barometer

The Barometer added 4.92 to 71.90 yesterday. It remains intermediate overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.