by Don Vialoux, EquityClock.com

Technical Notes for August 25th

Honeywell (HON) moved above $164.79 extending an intermediate uptrend. The stock was added to the Dow Jones Industrial Average.

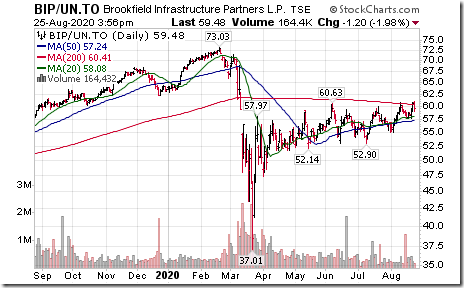

Brookfield Infrastructure Properties (BIP/UN), a TSX 60 stock moved above $60.63 extending an intermediate uptrend.

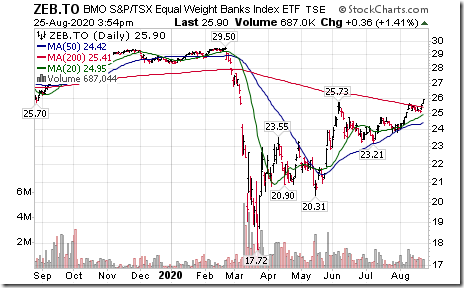

BMO Equal Weight Canadian Banks ETF (ZEB) moved above $25.73extending an intermediate uptrend. The sector is a focus this week with most of Canada’s major banks reporting fiscal third quarter results.

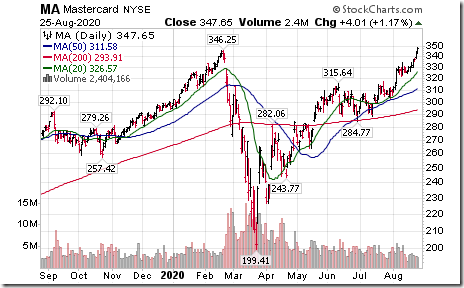

MasterCard (MA), an S&P 100 stock moved above $346.25 to an all-time high extending an intermediate uptrend.

NetEase.com (NTES), a NASDAQ 100 stock moved above $503.27 to an all-time high extending an intermediate uptrend.

BMO Emerging Markets ETF (ZEM) moved above $21.33 and $21.34 to a 28 month high extending an intermediate uptrend.

Grain ETN (1/3 each in Corn, Wheat and Soybean futures) moved above $19.13 completing a base building pattern. Look for news about additional grain sales to China.

Trader’s Corner

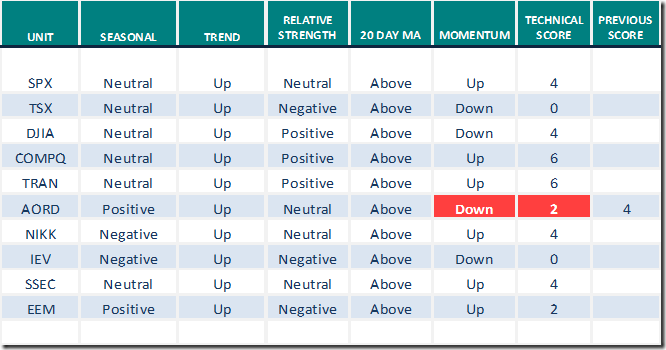

Equity Indices and related ETFs

Daily Seasonal/Technical Equity Trends for August 25th 2020

Green: Increase from previous day

Red: Decrease from previous day

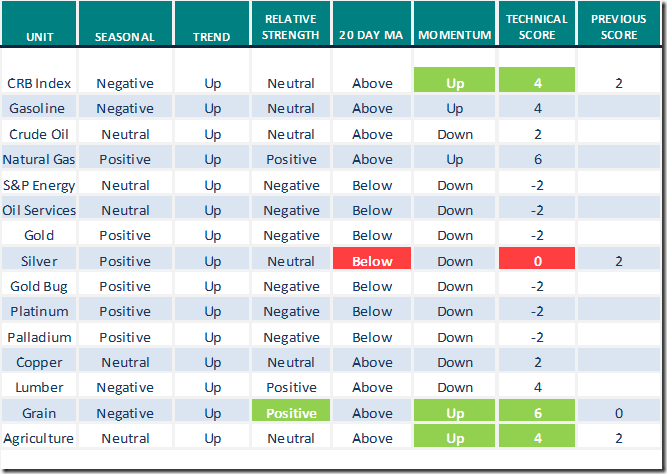

Commodities

Seasonal/Technical Commodities Trends for August 25th 2020

Green: Increase from previous day

Red: Decrease from previous day

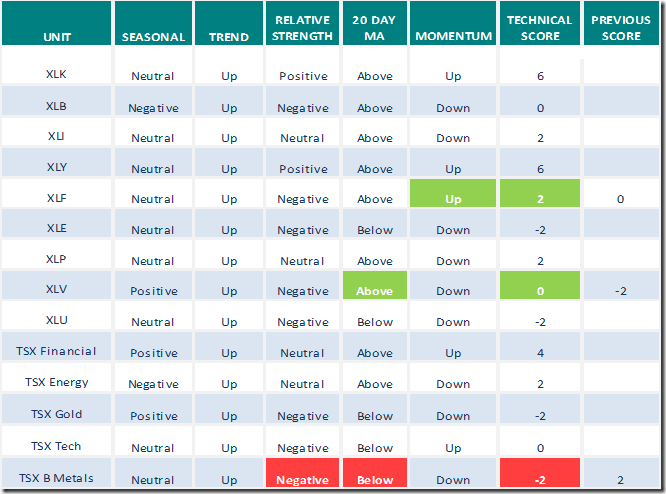

Sectors

Daily Seasonal/Technical Sector Trends for August 25th 2020

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometer

The Barometer eased 2.20 to 75.95 yesterday. It remains intermediate overbought.

TSX Momentum Barometer

The Barometer dropped 4.27 to 73.48 yesterday. It remains intermediate overbought and showing signs of rolling over.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image001[5] clip_image001[5]](https://advisoranalyst.com/wp-content/uploads/2020/08/clip_image0015_thumb-13.png)

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2020/08/clip_image0025_thumb-10.png)