by Don Vialoux, EquityClock.com

Technical Notes for August 24th

Amazon (AMZN), a NASDAQ 100 stock moved above $3,344.29 to an all-time high extending an intermediate uptrend.

Autodesk (ADSK), a NASDAQ 100 stock moved above $251.39 to an all-time high extending an intermediate uptrend.

Twitter (TWTR), a NASDAQ 100 stock moved above $40.26 extending an intermediate uptrend.

Abbott Labs (ABT), an S&P 100 stock moved above $102.89 to an all-time high extending an intermediate uptrend.

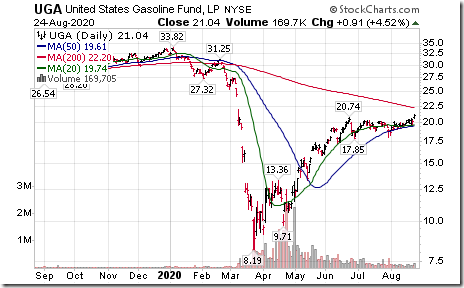

Gasoline ETN (UGA) moved above $20.74 extending an intermediate uptrend.

Mondelez (MDLZ), an S&P 100 stock moved above $57.70 extending an intermediate uptrend.

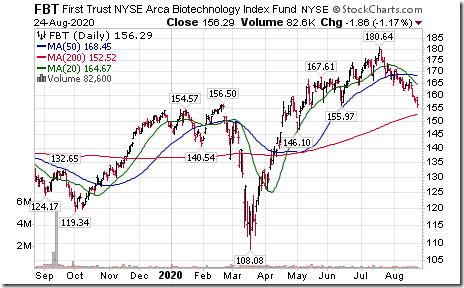

FT Biotech ETF (FBT) moved below $155.97 extending an intermediate downtrend.

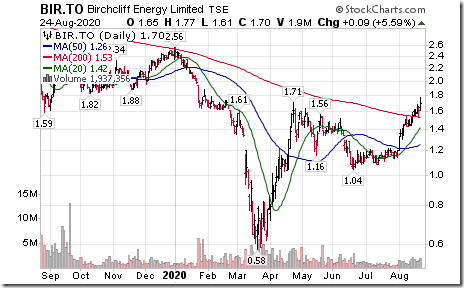

Canadian “gassy” stocks continue to move higher in response to higher natural gas prices and production cutbacks from the Gulf. Birchcliff Energy moved above $1.71 extending an intermediate uptrend.

Trader’s Corner

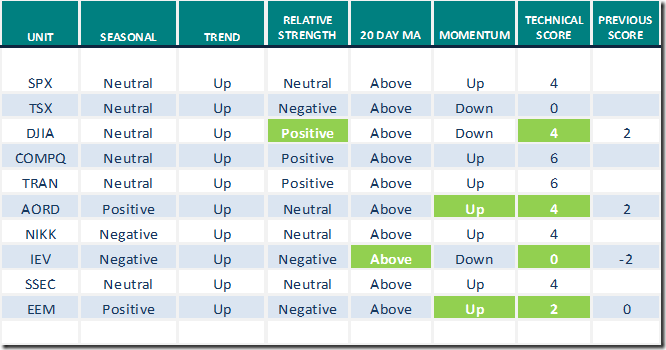

Equity Indices and related ETFs

Daily Seasonal/Technical Equity Trends for August 24th 2020

Green: Increase from previous day

Red: Decrease from previous day

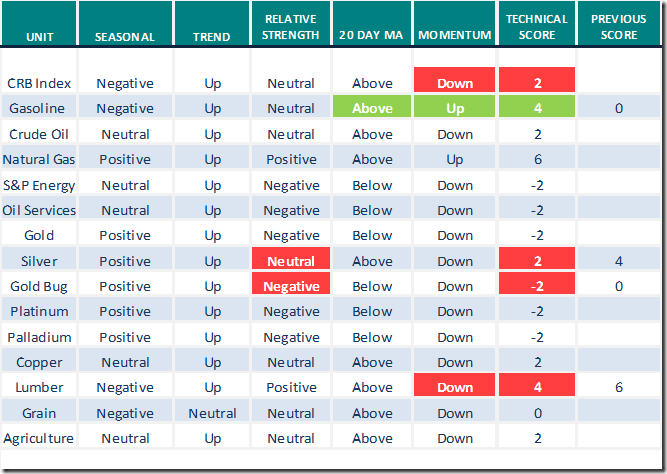

Commodities

Seasonal/Technical Commodities Trends for August 24th 2020

Green: Increase from previous day

Red: Decrease from previous day

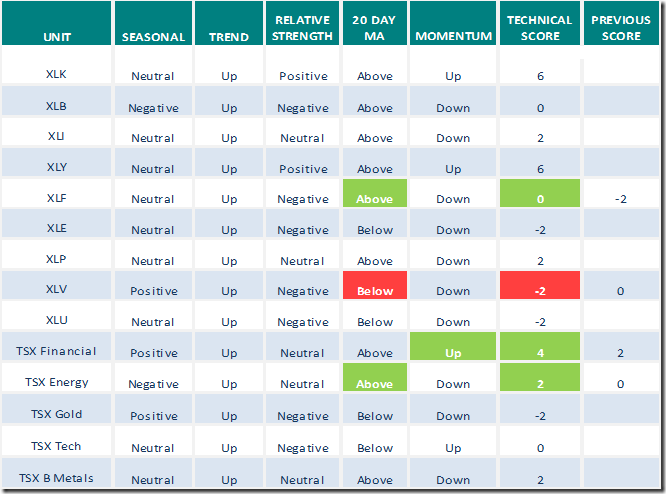

Sectors

Daily Seasonal/Technical Sector Trends for August 24th 2020

Green: Increase from previous day

Red: Decrease from previous day

Technical Scoop

Thank you to David Chapman and www.enrichedinvesting.com for the enclosed comment. Headline reads, “Another record, richer rich, narrow lead, mounting divergences, precious correction, presidential plans”. Following is the link:

Interesting observation about the S&P 500 Index is included. The capitalization weighted Index and its related ETF reached another all-time high yesterday. In contrast, the equally weighted S&P 500 Index and its related ETF reached an all-time peak at $117.34 in mid-February and an intermediate peak in mid-June at $112.70.

S&P 500 Momentum Barometer

The Barometer advanced 12.02 to 78.16 yesterday. It remains intermediate overbought.

TSX Momentum Barometer

The Barometer added 2.01 to 77.73 yesterday. It remains intermediate overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image001[5] clip_image001[5]](https://advisoranalyst.com/wp-content/uploads/2020/08/clip_image0015_thumb-12.png)

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2020/08/clip_image0025_thumb-9.png)