by Don Vialoux, EquityClock.com

Responses to FOMC Meeting Minutes released at 2:00 PM EDT

The U.S. Dollar and its related ETN moved higher.

Long term government bond prices moved lower.

Gold prices and their related ETN moved lower.

Equity indices responded to U.S. Dollar strength by moving lower.

Technical Notes for August 19th

Copper moved above $3.00 per lb to a 26 month high extending an intermediate uptrend.

Base metal stock prices and related ETFs responded accordingly.

Teck Resources (TECK), a TSX 60 stock and a major copper producer moved above US$12.23 extending an intermediate uptrend.

U.S. Medical Devices iShares (IHI) moved above $296.71 to an all-time high extending an intermediate uptrend.

Trader’s Corner

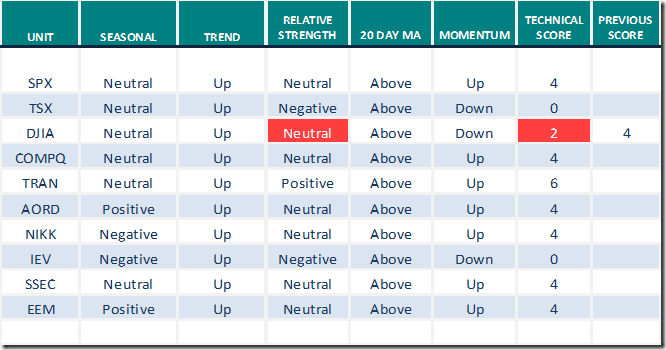

Equity Indices and related ETFs

Daily Seasonal/Technical Equity Trends for August 19th 2020

Green: Increase from previous day

Red: Decrease from previous day

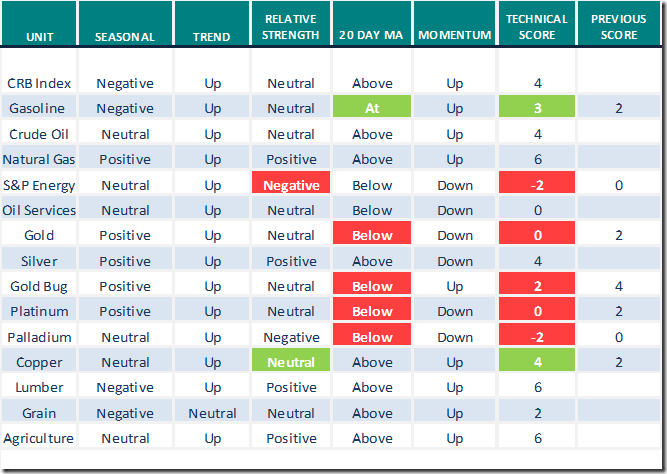

Commodities

Seasonal/Technical Commodities Trends for August 19th 2020

Green: Increase from previous day

Red: Decrease from previous day

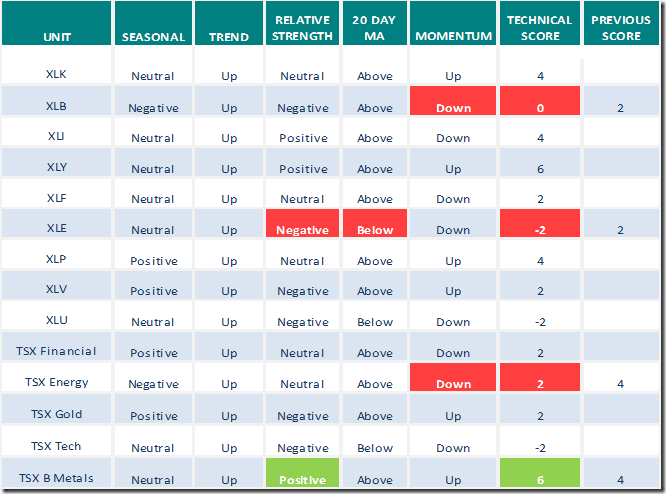

Sectors

Daily Seasonal/Technical Sector Trends for August 19th 2020

Green: Increase from previous day

Red: Decrease from previous day

Greg Schnell’s “Market Buzz”

Greg says, “S&P 500: New highs. Now what?” Greg reviews the Retail sector for a seasonal trade to late this year.

Following is a link:

https://www.youtube.com/watch?v=r__3OQKn7wg&feature=youtu.be

TSX Momentum Barometer

The Barometer slipped 2.20 to 73.95 yesterday. It remains intermediate overbought and showing signs of rolling over.

S&P Momentum Barometer

The Barometer dropped 3.13 to 78.30 yesterday. It changed from extremely intermediate overbought to intermediate overbought on a move below 80.00.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image001[5] clip_image001[5]](https://advisoranalyst.com/wp-content/uploads/2020/08/clip_image0015_thumb-9.png)

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2020/08/clip_image0025_thumb-7.png)