by Matthew J. Moberg, Franklin Templeton Investments

Listen to our latest podcast below.

View the full paper “Investing in Innovation.” An excerpt follows.

Innovation has persisted throughout the course of history, but it has not always progressed in a predictable or linear fashion. Innovation is episodic. Periods when we have seen increases in new ideas and technologies typically coincide with sustained and accelerating economic growth.

Consider: Growth in the Western world from AD 1 to AD 1820 was approximately 6% per century.1 By comparison, Americans enjoyed a doubling of real output every 32 years throughout the 20th century.2 Before then, real output required 12 centuries to double.

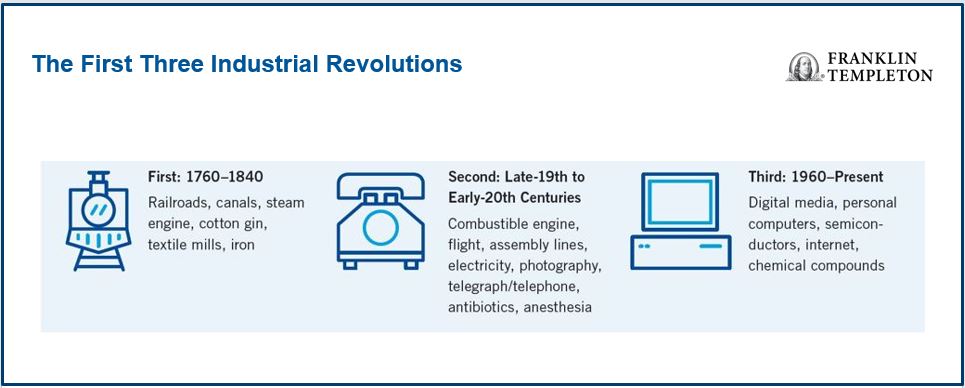

Economists define these periods as industrial revolutions. Typical of their creativity, they refer to them as the First, Second, Third and Fourth, the First beginning in 1760.

We believe we are living through the Fourth Industrial Revolution today, and that it is driving the current pace of innovation in the marketplace. Building on the Third, a digital revolution occurring since the mid-20th century, the Fourth reflects many technologies—blurring the lines between physical, digital and biological spheres.

Increased Productivity Increases Wealth Creation

As investors in innovation, the transformational impact of the Fourth Industrial Revolution supports the five platforms of growth we have previously discussed. Technological and industrial advancements increase economic productivity, which is foundational to wealth creation. Paul Krugman, Nobel Prize winner in economics, noted: “Productivity isn’t everything, but in the long run it is almost everything, as a country’s ability to improve its standard of living over time depends almost entirely on its ability to raise its output per worker.”3 Today, the average American only needs to work 11 hours per week to match the productivity of a 40-hour work week in the 1950s.4

Real-World Examples of Increased Productivity

- When I started my career, I was a bank auditor. In a bank, only the most senior members approved loans. It was typically done in group settings, with highly paid individuals sitting in conference rooms, reviewing files, crunching numbers and deliberating for hours. Today, with FICO (individual credit) scores, virtually no human being looks at any credit request below US$50,000. A computer does it all.5

- In the days depicted in the popular TV show Mad Men, which took place in the 1960s and 1970s, advertising was sold based on the number of pages in a magazine or sold as a 30-second television slot. Sales were high touch and it was understood that much of advertising spending was “wasted.” In the current US$600 billion annual advertising market, Google, Facebook and others use algorithms to not only maximise revenue, but to also maximise return on investment (ROI) for their customers. Today, internet ad buying is not only the most automated advertising medium, it’s also the most effective. It can be effective as a branding or a direct-response event.

- One of the most important aspects of any business is the pricing of products. Pricing is usually done with sales, finance and senior management working together to maximise profit. Historically, it was a very labor-intensive research exercise. Today, the pricing of enormous markets is entirely automated. Airlines, e-commerce companies and hotels, just to name a few, allow machines to price their offerings. These are some of the biggest revenue pools in our economy, all completely automated. Pricing can change based on real-time inventory availability, minute-to-minute demand, and even the weather. Algorithms attempt to maximise elasticity of demand across hundreds of thousands of products in real time.

This trend towards increasing productivity, a result of the Fourth Industrial Revolution, is only beginning, in our view. Over the next decade, we believe we will see major technology-driven efficiencies or product improvements in many areas. These will include insurance, medical diagnosis, automotive distribution, industrial design, the pricing and exchange of capital, and the analysis of data.

To get insights from Franklin Templeton delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

For timely investment updates, follow us on Twitter @FTI_Global and on LinkedIn.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com—Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton Investments’ U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. The technology industry can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants as well as general economic conditions. Investments in fast-growing industries, including the technology and health care sectors (which have historically been volatile) could result in increased price fluctuation, especially over the short term, due to the rapid pace of product change and development and changes in government regulation of companies emphasising scientific or technological advancement or regulatory approval for new drugs and medical instruments. Actively managed strategies could experience losses if the investment manager’s judgement about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results.

The companies and case studies shown herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The opinions are intended solely to provide insight into how securities are analysed. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio. This is not a complete analysis of every material fact regarding any industry, security or investment and should not be viewed as an investment recommendation. This is intended to provide insight into the portfolio selection and research process. Factual statements are taken from sources considered reliable but have not been independently verified for completeness or accuracy. These opinions may not be relied upon as investment advice or as an offer for any particular security. Past performance is not an indicator or a guarantee of future results.

______________________________________

1. Source: Maddison, A. “Poor until 1820,” The Wall Street Journal, 11 January 1999.

2. Source: Gordon, R., 2016, “The rise and fall of American growth: The U.S. standard of living since the Civil War,” Princeton: Princeton University Press.

3. Source: Krugman, P., 1990, “The Age of Diminished Expectations: U.S. Economic Policy in the 1990s,” Cambridge: MIT Press.

4. Source: Brynjolfsson, E. and A. McAfee, 2014, “The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies,” New York: W. W. Norton & Company.

5. Source: Bayston, et al., “Digital innovations—pinpointing fixed income credit risks,” Franklin Templeton Thinks: Fixed Income Markets, 6 September 2019.

This post was first published at the official blog of Franklin Templeton Investments.