by Don Vialoux, EquityClock.com

The Bottom Line

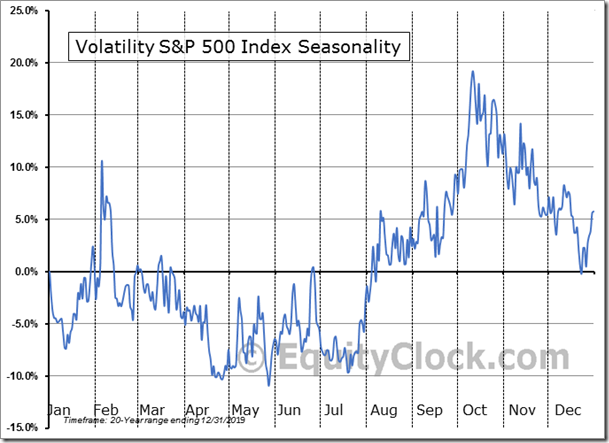

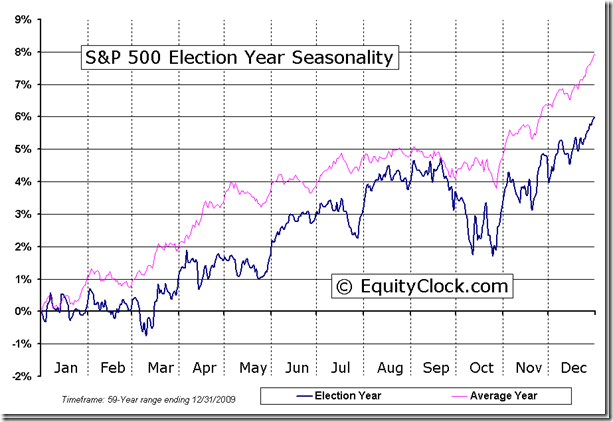

Most equity indices around the world moved slightly higher again last week. Major influences remain concern about a second wave of the coronavirus (negative) and possibility of approval of a vaccine (positive). Momentum indicators for North American equity markets remained intermediate overbought and past their peak. The VIX Index remained elevated: It typically moves higher between now and early October. Seasonal influences for most equity markets around the world tend to be slightly negative between now and early October (particularly during U.S. Presidential election years). Look for volatile, choppy equity markets between now and at least mid-October.

Observations

The VIX Index (better known as the Fear Index) remained elevated last week. Intermediate trend is flat/down. Watch for moves above 20, 50 and 200 day moving averages to signal a change in intermediate trend.

U.S. equity indices during U.S. Presidential Election years have a history of moving flat/lower from mid/late August to mid/late October.

Medium term technical indicators for U.S. equity markets (e.g. Percent of S&P 500 stocks trading above their 50 day moving average) moved slightly higher last week and became extremely intermediate overbought. See Barometer chart at the end of this report.

Medium term technical indicators for Canadian equity markets slightly moved lower last week. It remains overbought and shows early signs of rolling over. See Barometer chart at the end of this report.

Many short term short term momentum indicators for U.S. markets and sectors (20 day moving averages, short term momentum indicators) turned lower last week.

Many short term momentum indicators for Canadian markets/sectors also turned lower last week.

Updated consensus for S&P 500 company revenues and earnings from www.FactSet.com are unavailable this week and next week.

Economic News This Week

July Housing Starts to be released at 8:30 AM EDT on Tuesday are expected to increase to 1.237 million from 1.186 million in June.

July Canadian Consumer Price Index to be released at 8:30 AM EDT on Wednesday is expected to increase 0.5% versus a gain of 0.8% in June. Excluding food and energy, July Canadian Consumer Price Index is expected to versus a gain of 0.4% in June.

FOMC Meeting Minutes are released at 2:00 PM EDT on Wednesday.

August Philly Fed Index to be released at 8:30 AM EDT on Thursday is expected to slip to 20.5 from 24.1 in July.

July U.S. Leading Economic Indicators to be released at 10:00 AM EDT on Thursday are expected to increase 1.1% versus a gain of 2.0 in June.

June Canadian Retail Sales to be released at 8:30 AM EDT on Friday is expected to increase 24.5% versus a gain of 18.7% in May. Excluding auto sales, June Canadian Retail Sales are expected to increase 15.0% versus a gain of 10.6% in May.

July U.S. Existing Home Sales to be released at 10:00 AM EDT on Friday is expected to increase to 5.39 million units from 4.72 million units in June.

Selected Earnings News This Week

Trader’s Corner

Equity Indices and related ETFs

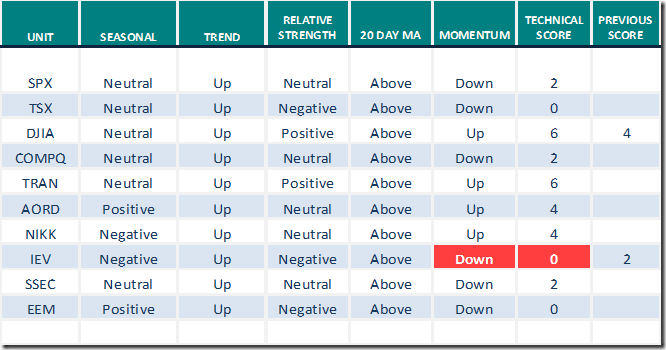

Daily Seasonal/Technical Equity Trends for August 14th 2020

Green: Increase from previous day

Red: Decrease from previous day

Commodities

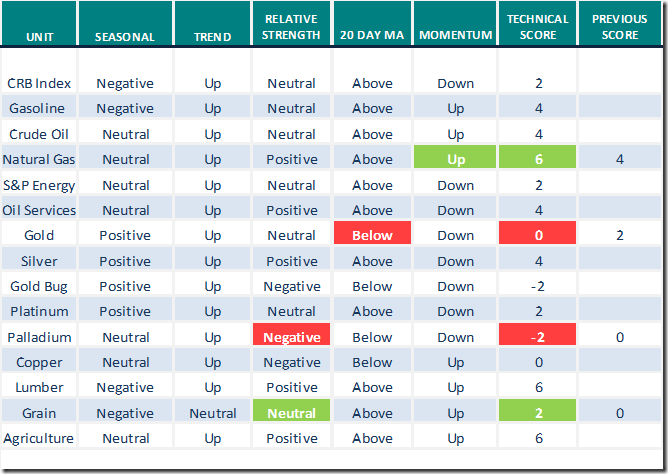

Seasonal/Technical Commodities Trends for August 14th 2020

Green: Increase from previous day

Red: Decrease from previous day

Sectors

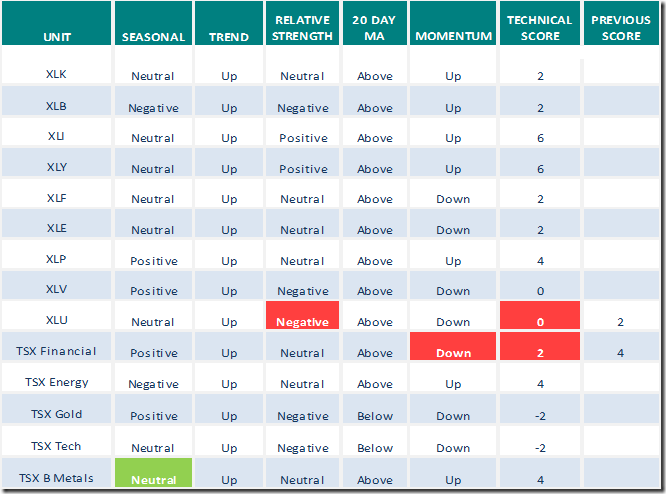

Daily Seasonal/Technical Sector Trends for August 14th 2020

Green: Increase from previous day

Red: Decrease from previous day

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes for August 14th

Applied Materials (AMAT), a NASDAQ 100 stock moved above $66.95 to an all-time high extending an intermediate uptrend. Target price was raised by Mizuho and Stifel Nicolaus this morning.

Merck (MRK), a Dow Jones Industrial Average stock moved above $84.00 extending an intermediate uptrend.

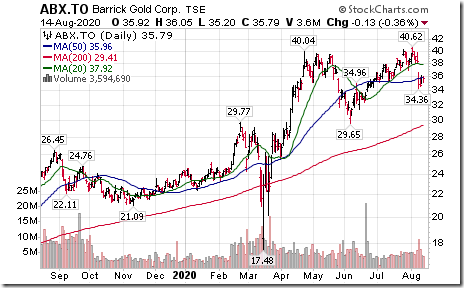

After the close on Friday, Berkshire Hathaway revealed that the company has taken an equity interest in Barrick Gold. The stock advanced 3% on the news.

S&P 500 Momentum Barometer

The Barometer increased last week from 74.35 to 80.16 last week. It changed from intermediate overbought to extremely intermediate overbought on a move above 80.00.

TSX Momentum Barometer

The Barometer slipped last week from 79.05 to 76.19 last week. It remains intermediate overbought and shows early signs of rolling over.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.