by Don Vialoux, EquityClock.com

Pre-opening Comments for Thursday August 13th

U.S. equity index futures were mixed this morning. S&P 500 futures were unchanged in pre-opening trade.

Index futures moved slightly higher following release of the Weekly Jobless Claims report at 8:30 AM EDT. Consensus was 1.120 million versus 1.186 million last week. Actual was 963,000.

Cisco dropped $3.10 to $45.00 after lowering its first quarter guidance.

Tapestry added $0.73 to $16.33 after reporting higher than consensus fiscal fourth quarter revenues and earnings.

NVIDIA advanced $0.60 to $458.21 after Deutsche Bank raised its target price from $315 to $405.

Micron slipped $0.88 after Deutsche Bank downgraded the stock from Buy to Hold. Target price was dropped to $48 from $60.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2020/08/12/stock-market-outlook-for-august-13-2020/

Note seasonality chart on Crude Oil Days of Supply.

Technical Notes for August 12th

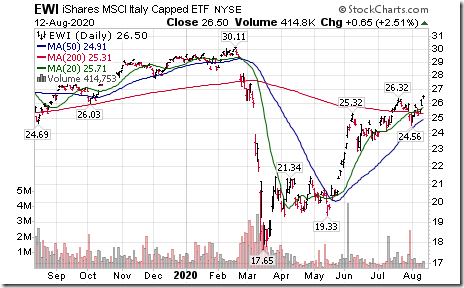

Italy iShares (EWI) moved above $26.32 extending an intermediate uptrend.

Morgan Stanley (MS), an S&P 100 stock moved above $53.14 extending an intermediate uptrend.

Royal Bank (RY), a TSX 60 stock moved above $98.27 extending an intermediate uptrend.

Nutrien (NTR), a TSX 60 stock moved above $51.76 extending an intermediate uptrend.

Inter Pipeline (IPL), a TSX 60 stock moved above $14.58 extending an intermediate uptrend.

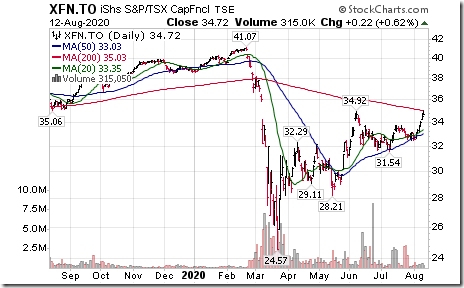

TSX Financials iShares (XFN.TO) moved above $34.92 extending an intermediate uptrend.

Base metals stocks continue to move higher. Hudbay Minerals moved above $4.97 extending an intermediate uptrend.

Lithium ETN (LIT) moved above $38.71 extending an intermediate uptrend.

Splunk (SPLK), a NASDAQ 100 stock moved below 190.48 completing a double top pattern.

Trader’s Corner

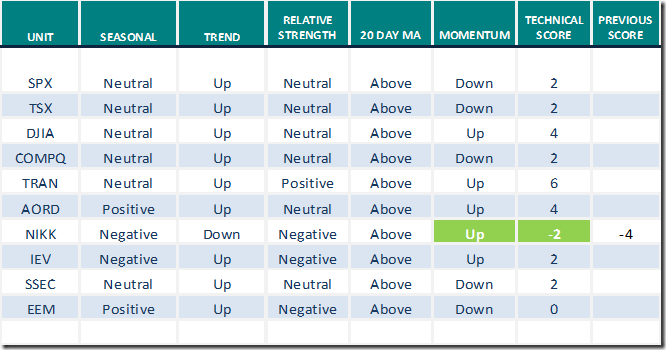

Equity Indices and related ETFs

Daily Seasonal/Technical Equity Trends for August 12th 2020

Green: Increase from previous day

Red: Decrease from previous day

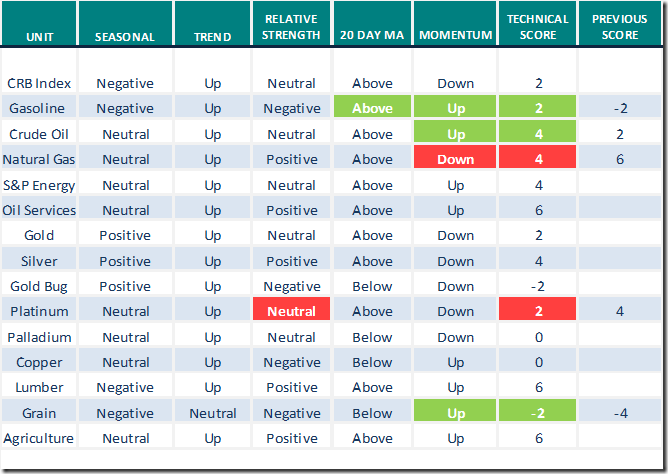

Commodities

Seasonal/Technical Commodities Trends for August 12th 2020

Green: Increase from previous day

Red: Decrease from previous day

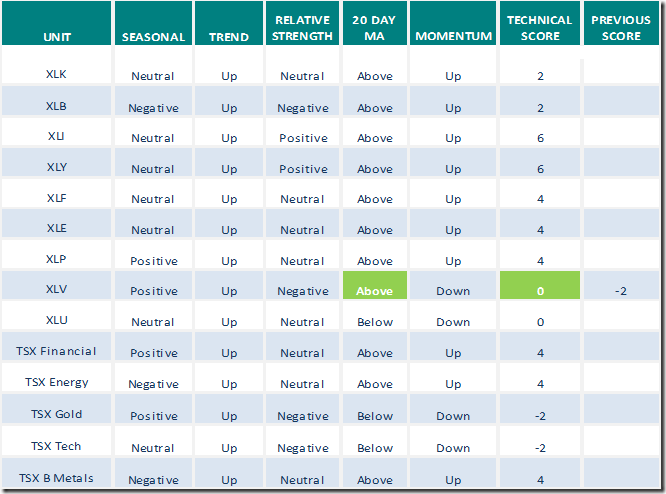

Sectors

Daily Seasonal/Technical Sector Trends for August 12th 2020

Green: Increase from previous day

Red: Decrease from previous day

Greg Schnell’s “Market Buzz”

Greg says, “Roll, baby, roll”. A focus on the transportation sector1 Following is a link:

https://www.youtube.com/watch?v=kj6ahK5r0KY&feature=youtu.be

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image001[5] clip_image001[5]](https://advisoranalyst.com/wp-content/uploads/2020/08/clip_image0015_thumb-4.png)

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2020/08/clip_image0025_thumb-3.png)

![clip_image003[5] clip_image003[5]](https://advisoranalyst.com/wp-content/uploads/2020/08/clip_image0035_thumb-3.png)

![clip_image004[5] clip_image004[5]](https://advisoranalyst.com/wp-content/uploads/2020/08/clip_image0045_thumb-3.png)