by Avi Lavi, CIO, Global and International Value Equities, Portfolio Manager – Global Research Insights, AllianceBernstein

Growing challenges to bank returns during the pandemic have weighed on recovery hopes for value stocks. But our research of Japan’s experience and global value trends suggests value stocks don’t necessarily need financials to turn the corner.

Value stocks continue to struggle through the coronavirus crisis. The MSCI World Value Index fell 15.7%, in US dollar terms in the year through July 31, underperforming the MSCI World, which was down 1.3% over the same period. Financials, which comprise about one-fifth of the global value benchmark, were down 21.9%.

Banks face a long list of challenges. Perpetually low interest rates are compressing net interest margins. Loan volumes are falling, and bad debts are rising. In this environment, it will be tough for banks to outperform. And if banks are stuck in the mud, the outlook for value stocks looks questionable.

But is that assumption true? Not necessarily. While many investors associate banks with value stocks, our research suggests that value stocks can do well without relying on banks as the engine for recovery.

Japan’s No-Bank Value Market

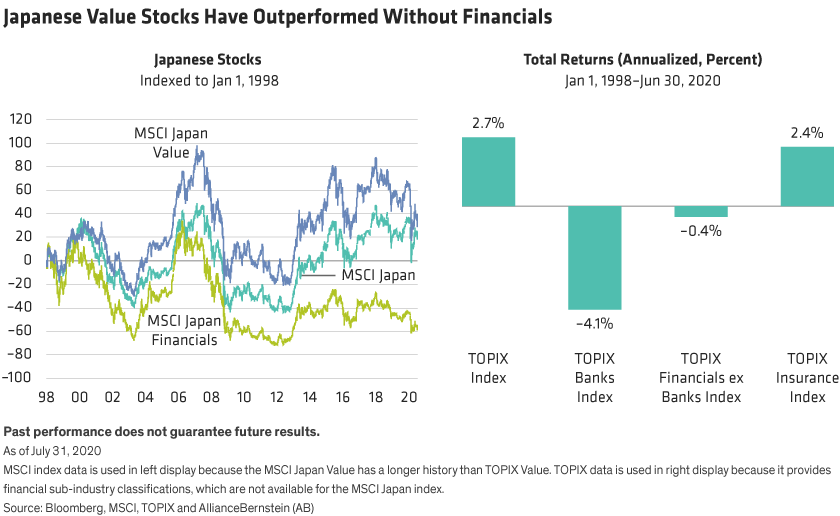

Japan provides a good case study for a different kind of value market. In the Japanese market, financials have underperformed the broader stock market since 1998 (Display, left). Yet over the same period, value stocks have outperformed the market. That’s counterintuitive to many value investors.

At the time, Japanese bond yields had fallen to historic lows. In 1998, the 10-year Japanese government bond yield slipped below 2%, where it stayed for most of the next two decades. Similarly, in 2019, the US 10-year Treasury fell below the 2% threshold and is now widely expected to remain very low for a prolonged period as the Fed battles the macroeconomic effects of the pandemic with loose monetary policy.

In Japan’s ultralow rate environment, banks were indeed handicapped. Since 1998, Japanese banks underperformed sharply, while Japanese insurance companies did well and performed in line with the broader market (Display above, right). With banks around the world likely to face similar challenges today, we think the Japanese experience could be more relevant for global value investors than in the past when the country was widely seen as a macroeconomic outlier.

Maybe Japan is different? It’s well known that Japan’s demographics are shaped by an aging population, while its economy and labor market are less flexible than developed peers. And Japan’s banks—which account for about 16% of the country’s value index—historically haven’t written down bad debts as much as US and Western European lenders have. So while the Japanese case is instructive, we also took a closer look at the role of financials in global value performance over the years.

Global Value: More than Just Financials

For investors in global equities, the association between value stocks and financials is hard to break. Yet the weight of financials in the MSCI World Value Index has been falling, from 34% in September 2009 to about 22% in July 2020.

It’s true that financial stocks have been standout performers when value has done well. Our research shows that the financial sector has outperformed the broader market in nine out of 11 years of global value outperformance since 2004 (Display, left). Yet during those periods, the excess returns of global financials was relatively modest at 2.6% on average. Other sectors such as energy, materials, utilities and real estate generated stronger returns on average. The same pattern holds true when excluding the US, as in the MSCI EAFE benchmark, where value outperformed in 13 years (Display, right). In our view, these past trends show that strong performance in nonfinancial sectors has been an engine for value outperformance.

Value stocks across sectors still face plenty of challenges. However, value stocks also trade at an extraordinary discount to growth stocks. By the end of July, the MSCI World Value was 63% cheaper than the MSCI World Growth based on a combination of three value metrics: price/sales, price/cash flow and price/forward earnings. Past experience suggests that at this deeply discounted level there may be plenty of pent-up recovery potential.

To capture the potential, we believe investors should target higher-quality value stocks with more resilient businesses, strong balance sheets and better profitability to support solid free cash flows.

Companies with attractively valued cash flows and resilient businesses can be found today across many industries, sectors and countries. This provides value investors with a wide opportunity set to search for companies with unrecognized recovery potential. By finding these companies today and building a diversified portfolio of higher-quality value stocks, we think investors can position for a potential long-term value recovery without taking riskier positions in the banking sector.

Avi Lavi is Chief Investment Officer—Global and International Value Equities; Portfolio Manager—Global Research Insights

Past performance and current forecasts do not guarantee future results.

Source: Bloomberg, FactSet, MSCI, TOPIX and AllianceBernstein (AB)

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

This post was first published at the official blog of AllianceBernstein..