Investors have been jumping into gold. While gold can help during big down markets, it isn’t the best inflation hedge.

by Jim McDonald, Chief Investment Strategist, Northern Trust

Gold has been on a tear over the last year, rising 32% while global equities have languished. Investors buy gold for many reasons, but a common objective is a hedge against some type of risk. In this report, we show how gold can reduce downside risk during big down markets, but that it isn’t the most effective inflation hedge.

Gold’s strong performance over the last year has some investors wondering if it is time to add gold to their portfolios. We aren’t recommending gold, as we find the current outlook for gold prices too uncertain.

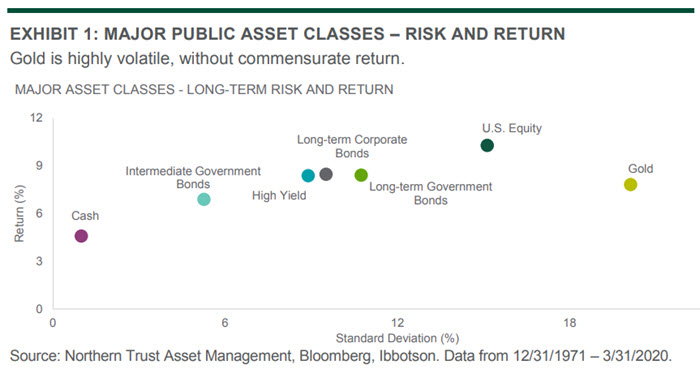

We believe that investors should be compensated for the risks they take in individual investments, and that every asset should have a purpose. We do not have a strategic allocation to gold as, over the long term, gold doesn’t generate returns sufficient enough to justify its risk levels. This can be seen in Exhibit 1, where gold is by far the riskiest asset, yet has generated returns lower than the other long-term assets. Gold can, however, be more useful on a shorter term basis and potentially as a hedge against risk. While many investors believe gold is a good inflation hedge, we show that both TIPS (Treasury Inflation-Protected Securities) and natural resource equities are superior hedges. We also show that gold can reduce portfolio downside risk during market downturns — as we have recently encountered. Because we are not overly bearish on the present risk taking environment, we are not currently recommending a tactical position in gold in our global policy model.

Drivers of Gold Prices

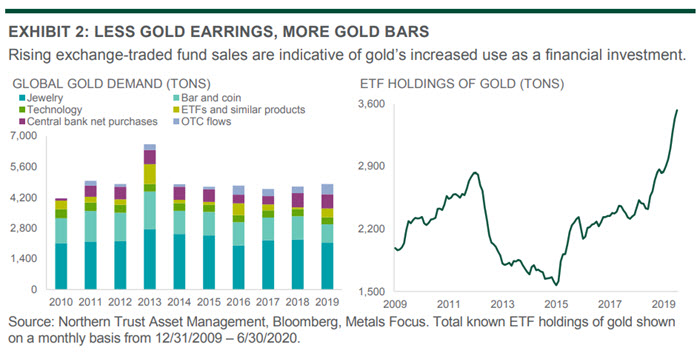

One of the key challenges in investing in gold is determining its true value. With no income stream to value, gold prices fluctuate widely based on short-term supply and demand. As shown in Exhibit 2, the traditional driver of gold demand (jewelry) has fallen as a percentage of total demand, while financial demand has increased. Because of this changing dynamic, we do not feel much insight will be gained by digging into non-financial supply and demand for gold as a clue to future prices.

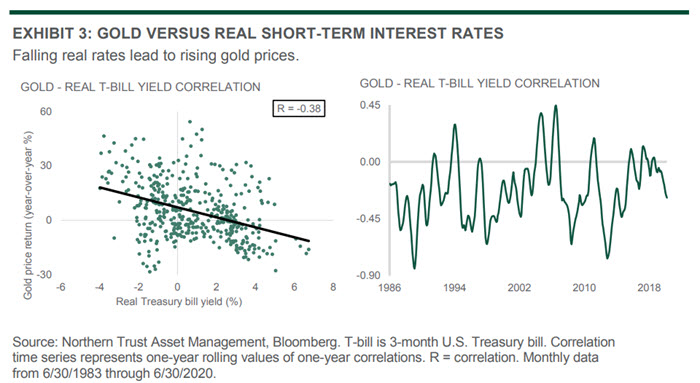

As shown in Exhibit 3, the best evidence we have found historically to explain gold price moves is what is happening with short-term real (after inflation) interest rates. Why should gold prices rise when real short-term rates are falling, and vice versa? If you decompose interest rates into two components — the real rate of interest and the inflation premium — you can better understand the drivers. Falling real rates of interest occur when economies are slowing and gold is attractive to some investors in that environment as a portfolio hedge. It is also less expensive to own gold in that environment, as both the carrying cost of the investment and the opportunity cost of foregone investment have fallen. If the inflation premium is rising (which lowers the real rate of interest), this will entice some investors to buy gold as an inflation hedge.

GOLD AS AN INFLATION HEDGE

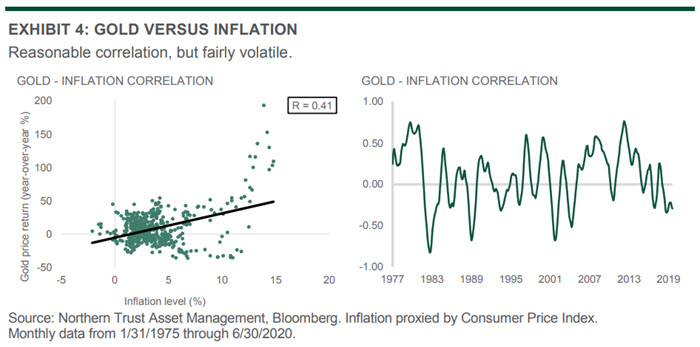

Investors have many options to hedge against inflation risk in their portfolios, from the simple (gold) to the more esoteric (inflation swaps). Three of the most common vehicles (and which we have utilized in the past) are gold, inflation-protected securities and natural resources (the equities of commodity-producing companies). Exhibit 4 shows that gold prices have historically had a reasonably positive correlation to rising inflation, but this correlation is not as strong as the alternatives. Additionally, the correlation has been more volatile over time as shown on the right side of the chart.

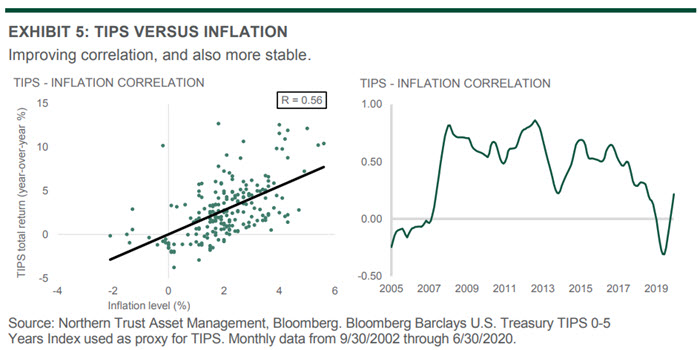

A higher correlation with inflation comes from TIPS (in this instance TIPS with a 5-year and shorter maturity). TIPS have the benefit of an income stream that is directly tied to the rate of inflation, but longer-maturity TIPS do carry greater interest rate risk. We favor shorter maturity inflation-protected securities to reduce this interest rate risk.

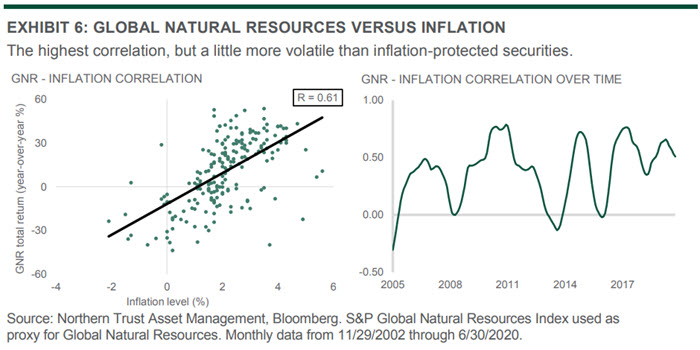

The highest correlation with inflation comes from global natural resources, specifically the public equities of commodities producers. Historically, many investors utilized a futures-based strategy for commodities exposure, but we have shown that an equities-based approach generates a superior outcome. Natural resources have provided the best protection against inflation as the underlying companies within the index frequently benefit from rising prices and profitability during periods of broad inflation. They also hold an advantage to gold through broader diversification across many different commodity types which have different economic exposures.

GOLD AS A CURRENCY DEBASEMENT HEDGE

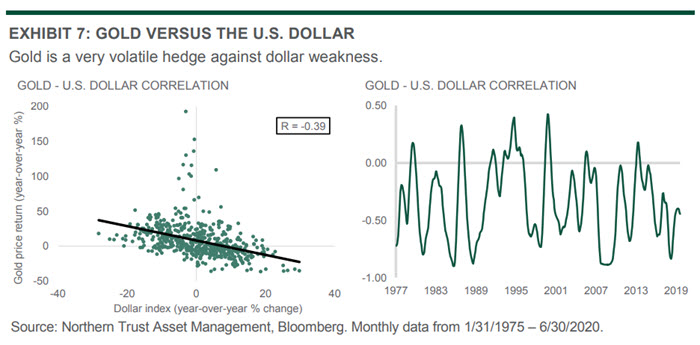

Another frequent thesis for gold investors is protection against the debasement of their home currency (in this example the U.S. dollar). Gold has historically been negatively correlated with the dollar, rising in value when the dollar depreciates. But, as shown on the right, this is the most volatile of all the correlation tests we ran. We have never been big believers in currency debasement hedging for U.S. investors, as we aren’t bearish long-term on the world’s reserve currency. We also find that some investors do not give enough thought to the reality that currency values are a zero-sum game. For the dollar to be significantly impaired long-term against world currencies, you need to bet that the growth and inflation outlook for the U.S. is going to materially deteriorate against the other major currency issuers — including Europe, Japan, the U.K. and China. Our longer-term growth outlook for the U.S. stacks up well, as does our relative outlook for inflation against these other economies.

GOLD AS AN ARMAGEDDON HEDGE

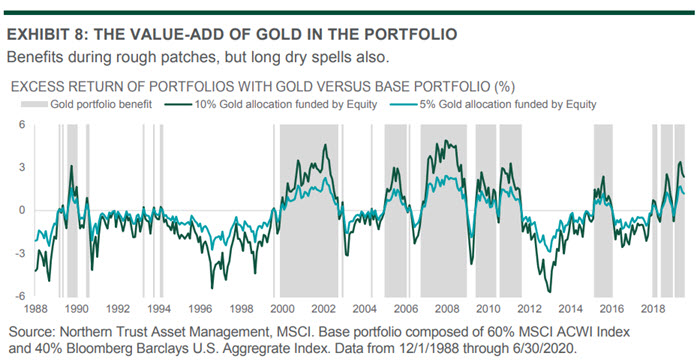

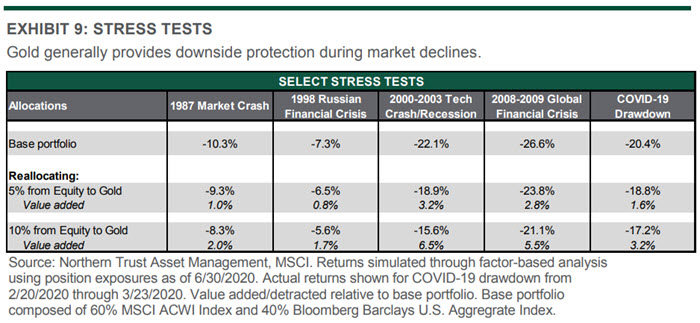

To assess the portfolio implications of an allocation to gold, we utilize Northern Trust’s Portfolio Construction Desk (PCD). Using risk modeling software that includes both historical and projected return, risk and correlation data, PCD assessed the portfolio impact of varying levels of exposure to gold and also conducted scenario analyses showing how portfolios behaved during various historical stress events. Those events included the 1987 stock market crash and the market decline in the wake of the Lehman Brothers bankruptcy, as examples. Exhibit 8 shows the marginal positive or negative contribution to a base balanced portfolio from a gold allocation of either 5% or 10%, funded by equities. During the stock bull market of the 1990s, the gold allocation detracted from performance — but earned its stripes during the most recent bear markets.

Of the 50 market events PCD evaluated, 34 were negative stress events – an allocation to gold (drawn from equities) hurt the performance of the portfolios in only seven of these 34 instances. In other words, the batting average of gold being either neutral or positive to portfolio performance during periods of market stress is 79% – but the contribution in some market downturns was fairly nominal. Exhibit 9 shows the portfolio impact of 5% and 10% portfolio allocations to gold in certain high profile market declines, with the allocation sourced through a reduction in equities.

CONCLUSION: THE BENEFITS OF GOLD CAN BE FLEETING

In this report, we have assessed the potential role of gold in portfolios, showing when it works and when there are better alternatives. We believe its most clear benefits are derived during periods of low real short-term interest rates and/or market stress events. With nominal short rates unable to fall much more, a significant further fall in real rates will require a sustained jump in inflation — which we don’t expect. Even if that were to occur, we have demonstrated that inflation-protected securities and natural resource equities are superior hedges compared to gold. We also aren’t bearish enough on the overall risk taking environment to suggest a tactical gold hedge. The price of gold is inherently unpredictable, as it lacks the traditional economic fundamentals for forecasting fair value. So, its course over the next year is anyone’s guess. But as we focus on being compensated for the risks we are taking during portfolio construction, we find other asset classes that more clearly fulfill a well-defined purpose in helping overall portfolio return and risk characteristics.

Special thanks to Tom O’Shea, Investment Strategist, and Colin Cheesman, Investment Analyst, for data research.

IMPORTANT INFORMATION. The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. Northern Trust and its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, and its accuracy and completeness are not guaranteed. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor.

This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions. Investing involves risk- no investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment.

Forward-looking statements and assumptions are Northern Trust’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

Past performance is no guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by Northern Trust. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South Capital Advisors, LLC, and personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

© 2020 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. northerntrust.com

Copyright © Northern Trust