by Andy Kochar, Portfolio Manager, Head of Credit, AGF Investments Inc.

There’s no denying the strong ties that bind financial markets and the economy together. After all, the outcome of the former is often conditional on the strength of the latter. But the past few months have been an important reminder to investors that the two don’t always move in lockstep.

This is perhaps best highlighted by the fact that stock markets sold off well in advance of the recession caused by the pandemic-induced economic shutdown around the world and have since rallied off their March bottoms even though economic growth is still deeply depressed. However, it also holds true of the relationship between bonds and the economy. And, much like equities, credit markets have rebounded from their recent lows and now look poised for additional gains despite the expectation of more corporate downgrades, defaults and bankruptcies in the coming months.

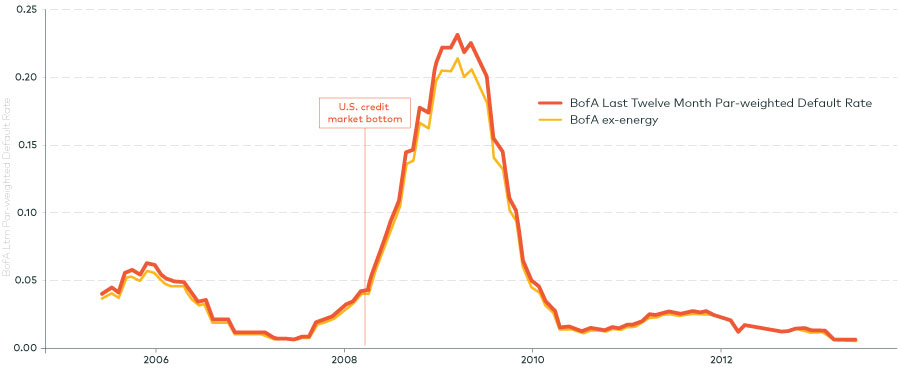

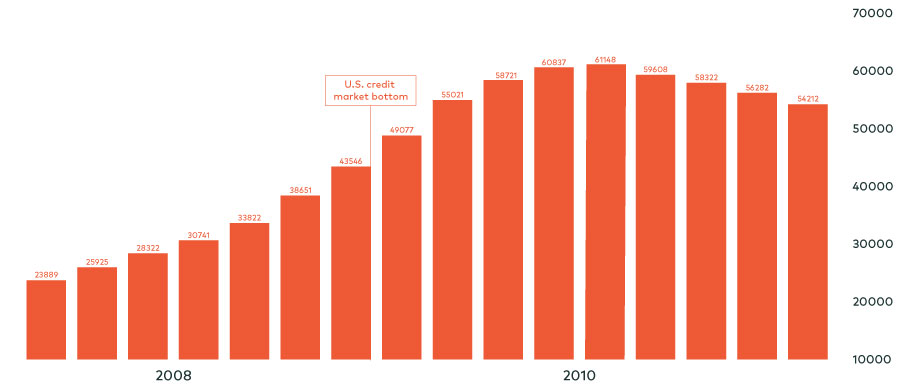

To that end, it’s been typically at these junctures in an economic cycle for corporate bonds to provide some of their best months of performance. Take the Great Financial Crisis in 2008-2009, for example. U.S. credit markets troughed 10 months before U.S. default rates peaked and it was almost 18 months before U.S. bankruptcies topped out. More importantly, investment grade & high yield returns over this stretch were 17.1% & 49% (Default rate peaked Q3 2009) and 21.4% & 65.5% (bankruptcies peaked Q1 2010 peak) respectively.

U.S. Default Rates and the Great Financial Crisis

Source: Bank of America Merrill Lynch, High Yield Strategy Credit Chartbook, July 01, 2020

U.S. Bankruptcies and the Great Financial Crisis

Source: Trading Economics. This graph is represented in quarters.

The severity of the potential corporate fallout from a recession has also been favourable for credit returns in the past. When implied default rates were 14% or greater—as they were in recent weeks—the subsequent one-year total return for the Bloomberg Barclays U.S. High Yield Index was 46% on average, according to research from KKR & Co. Inc., a private equity firm. But when implied default rates were between 8% and 10%, the average returns were just less than 18%.

U.S. High-Yield Implied Default Rates: Subsequent One-Year Total Return

Source: KKR Research, Bloomberg as of March 27, 2020.

While these performance outcomes might seem counter intuitive, recessions that are more severe tend to result in greater deleveraging of corporate balance sheets, which helps cleanse credit markets of companies who had become excessively levered during the expansionary cycle of the past decade. In other words, it creates new opportunities for credit investors to potential exploit. For example, fallen angels or companies who have their credit ratings downgraded to high yield from investment grade status often rally once the downgrade takes place. In part, that’s because the downgrade attracts a whole new set of investors, but also because the risk of actual default is still relatively low. Meanwhile, many companies who default and/or file for bankruptcy end up being much more attractive for it if their ability to generate sales can be maintained throughout the process.

Of course, none of this is to say that the current environment isn’t without risk. Many names listed on broader credit indices will never recover as repercussions of the recession continue to unfold. But more likely than not, the worst of the crisis is over and credit investors who take an active approach to separating the winners from the losers stand to gain the most in the months ahead.

Andy Kochar is a Portfolio Manager and Head of Global Credit at AGF Investments Inc. He is a regular contributor to AGF Perspectives.

To learn more about our fundamental capabilities, please click here.

The commentaries contained herein are provided as a general source of information based on information available as of July 13, 2020 and should not be considered as investment advice or an offer or solicitations to buy and/or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Investors are expected to obtain professional investment advice.

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds or investment strategies.

AGF Investments is a group of wholly owned subsidiaries of AGF and includes AGF Investments Inc., AGF Investments America Inc., AGF Investments LLC, AGF Asset Management (Asia) Limited and AGF International Advisors Company Limited. The term AGF Investments m ay refer to one or more of the direct or indirect subsidiaries of AGF or to all of them jointly. This term is used for convenience and does not precisely describe any of the separate companies, each of which manages its own affairs.

™ The ‘AGF’ logo is a trademark of AGF Management Limited and used under licence.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

© 2020 AGF Management Limited. All rights reserved.

This post was first published at the AGF Perspectives Blog.