by Don Vialoux, EquityClock.com

Technical Notes for July 20th

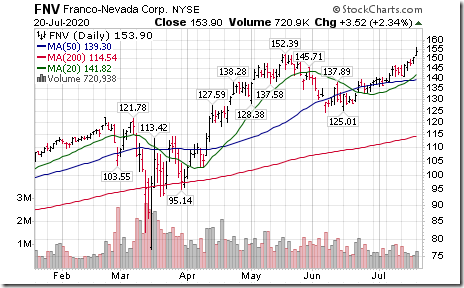

More strength in gold stocks! Franco-Nevada (FNV), a TSX 60 stock moved above US$152.39 to an all-time high extending an intermediate uptrend.

Another Canadian gold stock breakout! Yamana Gold (YRI), a TSX 60 stock moved above Cdn$7.78 to a six year high extending an intermediate uptrend. Yamana is seeking a listing on the London Exchange.

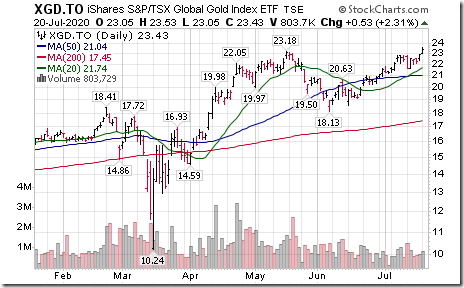

TSX Gold iShares (XGD) moved above $23.18 to an eight year high extending an intermediate uptrend.

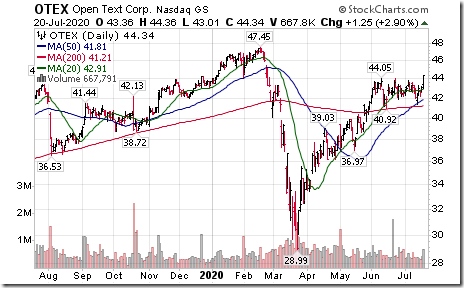

Open Text (OTEX), a TSX 60 stock moved above US$44.05 and Cdn$59.51 extending an intermediate uptrend.

Metro (MRU), a TSX 60 stock moved above $59.16 resuming an intermediate uptrend.

Texas Instruments (TSN), a NASDAQ 100 stock moved above $135.68 to an all-time high extending an intermediate uptrend.

Trader’s Corner

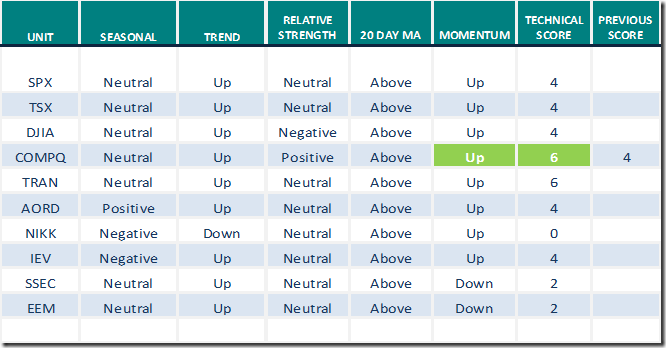

Equity Indices and related ETFs

Daily Seasonal/Technical Equity Trends for July 20th 2020

Green: Increase from previous day

Red: Decrease from previous day

Commodities

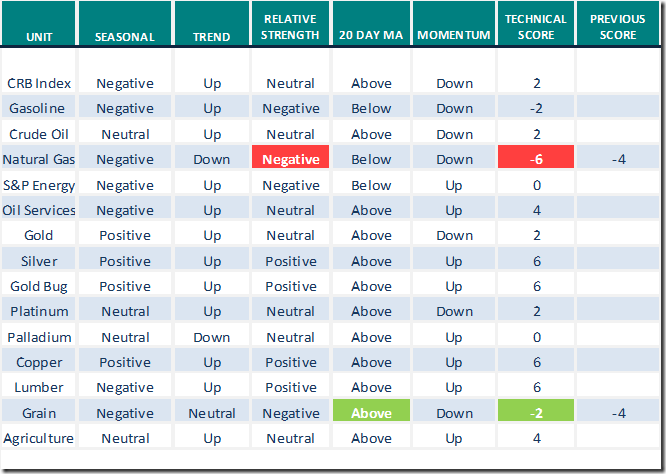

Seasonal/Technical Commodities Trends for July 20th 2020

Green: Increase from previous day

Red: Decrease from previous day

Sectors

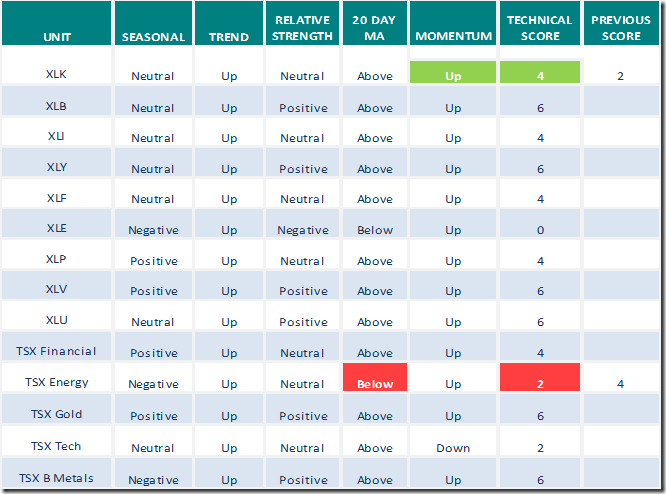

Daily Seasonal/Technical Sector Trends for July 20th 2020

Green: Increase from previous day

Red: Decrease from previous day

Technical Scoop

Thank you to David Chapman and www.EnrichedInvesting.com for a link to the following weekly report. Headline reads, “FAANGS fall, saviours fly, divergences abound, money expands, gold rises, Dollar falls, uncertainty rises”. Following is the link:

S&P Momentum Barometer

The Barometer dropped 5.17 to 73.35 yesterday. It remains intermediate overbought

TSX Momentum Barometer

The Barometer slipped 3.45 to 78.85 yesterday. It changed from extremely intermediate overbought to intermediate overbought on a move below 80.00.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.