by Don Vialoux, EquityClock.com

Technical Notes

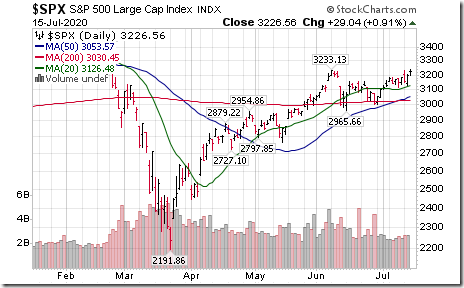

S&P 500 Index and its related ETF trading on the TSX managed to close at a four month high yesterday.

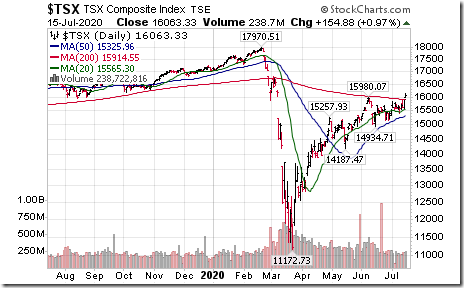

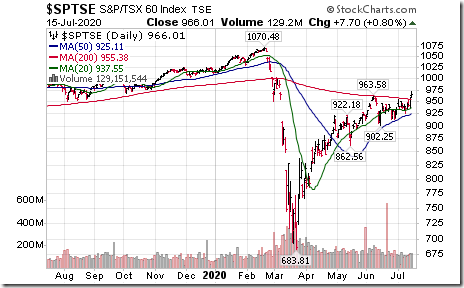

TSX Composite Index moved above $15,980.07 and the TSX 60 Index moved above 963.58 to a four month high extending an intermediate uptrend.

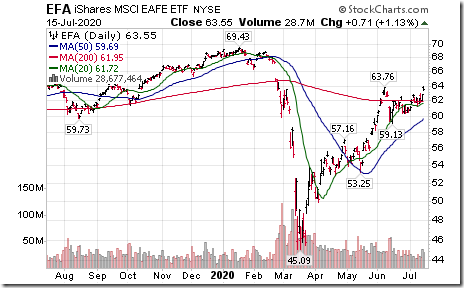

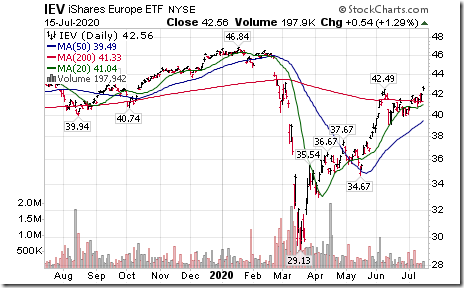

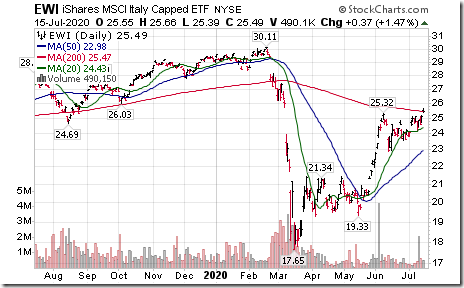

Equity indices and related ETFs tracking equity markets outside of North America are breaking to four month highs extending intermediate uptrends. EAFE (EFA) moved above $73.76.

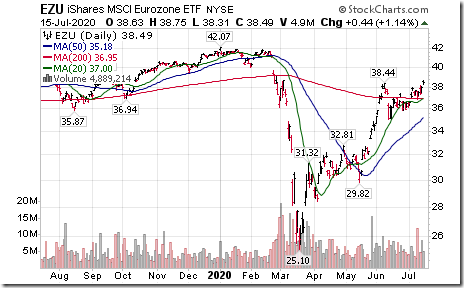

European iShares were notable for their breakouts to four month highs:

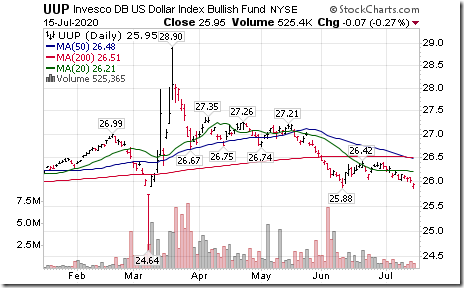

A major reason for the gain by equity markets and related ETFs outside of the U.S. can be attributed to weakness in the U.S. Dollar and corresponding strength in other currencies (notably the Canadian Dollar). The U.S. Dollar ETN (UUP) briefly moved below $25.88 extending an intermediate downtrend.

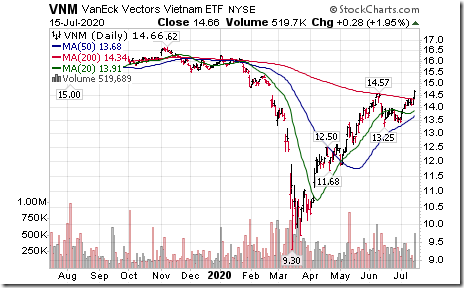

Other breakouts by equity indices and their related ETFs included Israel and Vietnam

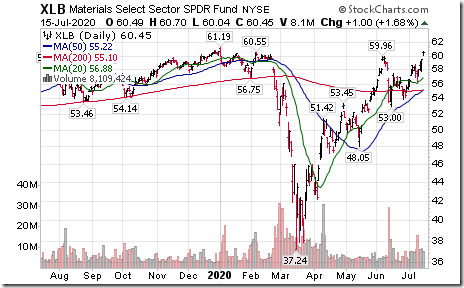

Materials SPDRs moved above $59.96 extending an intermediate uptrend.

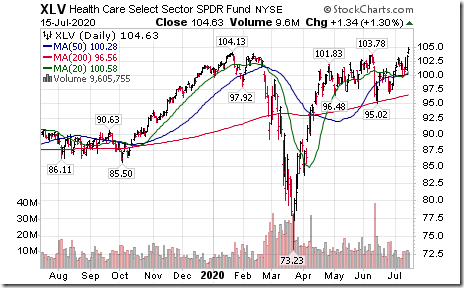

Pharmaceutical ETF (PPH) moved above $64.20 extending an intermediate uptrend.

Healthcare SPDRs moved above $103.78 to an all-time high extending an intermediate uptrend.

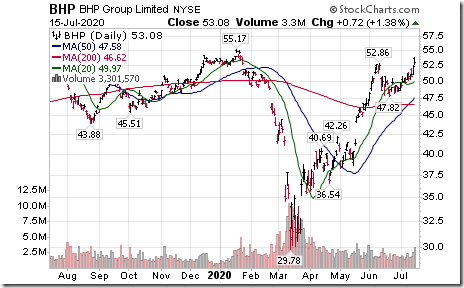

Base metal stocks and their related ETFs continue moving higher. Base Metals iShares moved above $26.19 extending an intermediate uptrend.

Strength in base metals sector was led by BHP on a breakout above $52.86.

Uranium stocks and related ETFs also moving higher. Uranium producer ETF URA moved above $11.30 extending an intermediate uptrend.

Most of the strength in the uranium ETF can be attributed to a breakout by Cameco (CCJ CCO.TO) above US$11.26.

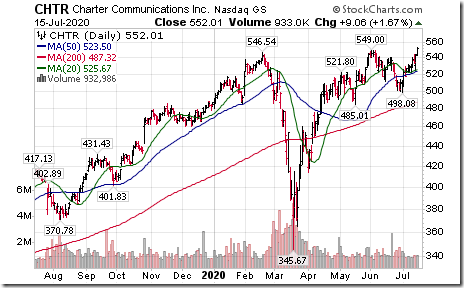

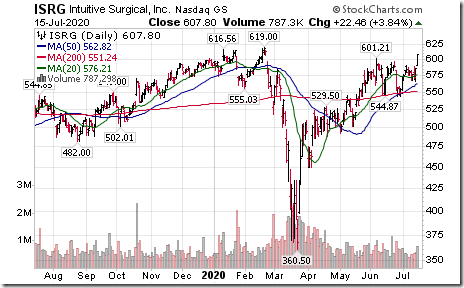

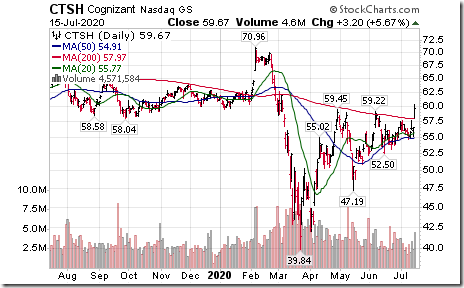

NASDAQ 100 stocks were leading the advance by U.S. equity markets in early trade yesterday. Nice breakouts by CHTR, ISRG and CTSH.

Morgan Stanley (MS), an S&P 100 stock moved above $51.85 extending an intermediate uptrend.

Blackrock (BLK), an S&P 100 stock moved above $567.58 and $568.67 to an all-time high extending an intermediate uptrend.

The U.S. Dollar ETN (UUP) briefly moved below $25.88 extending an intermediate downtrend.

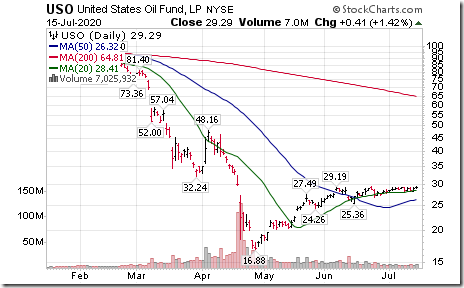

U.S. Crude Oil ETN (USO) moved above $29.19 extending an intermediate uptrend.

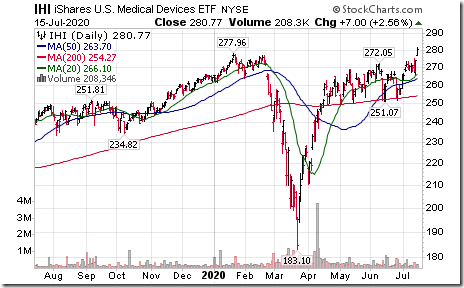

U.S. Medical Devices iShares (IHI moved above $277.96 to an all-time high extending an intermediate uptrend.

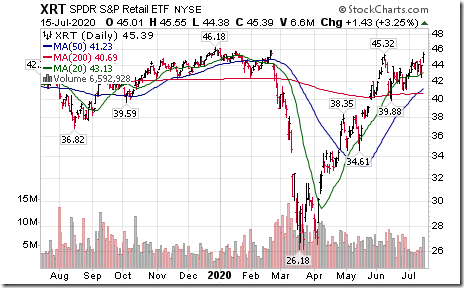

Retail SPDRs (XRT) moved above $45.32 extending an intermediate uptrend.

Trader’s Corner

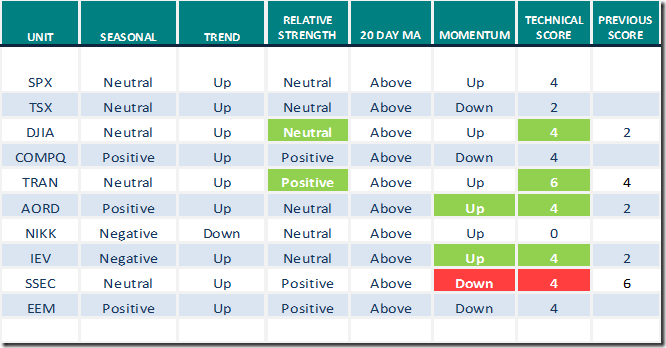

Equity Indices and related ETFs

Daily Seasonal/Technical Equity Trends for July 15th 2020

Green: Increase from previous day

Red: Decrease from previous day

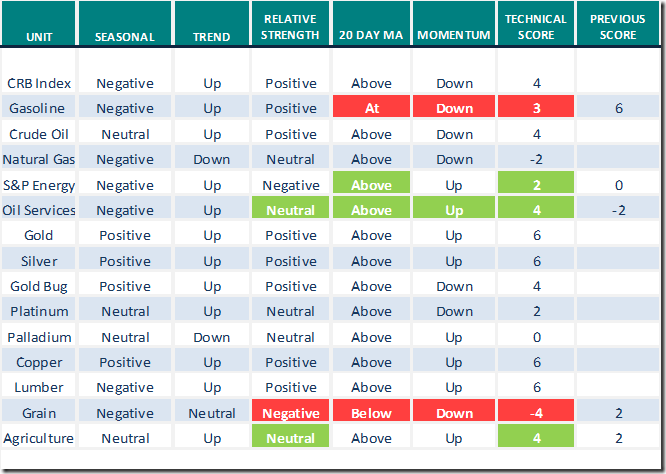

Commodities

Seasonal/Technical Commodities Trends for July 15th 2020

Green: Increase from previous day

Red: Decrease from previous day

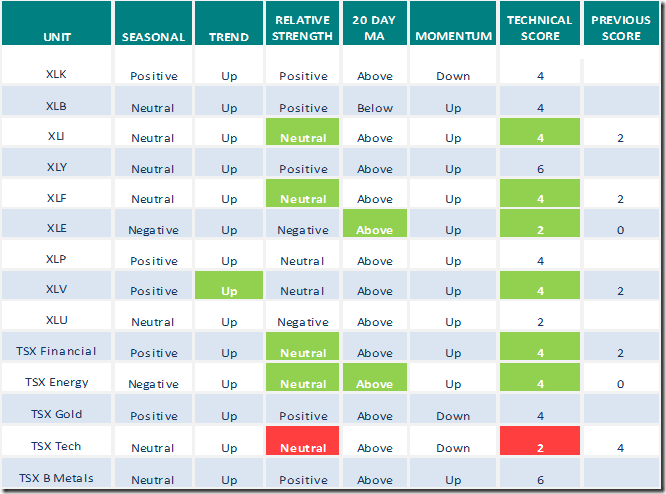

Sectors

Daily Seasonal/Technical Sector Trends for July 15th 2020

Green: Increase from previous day

Red: Decrease from previous day

Greg Schnell’s “Market Buzz”

Headline reads, “The Rise of Power”. Following is a link:

https://www.youtube.com/watch?v=0z0BxcRP2nM&feature=youtu.be

Focus is on the industrial commodity sector with an emphasis on copper and copper stocks.

S&P 500 Momentum Barometer

The Barometer gained 13.23 to 82.77 yesterday. It has reached the extremely intermediate overbought level on a move above 80.00.

TSX Momentum Barometer

The Barometer gained 11.48 to 87.08 yesterday. It has reached the extremely intermediate overbought level on a move above 80.00.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image010[1] clip_image010[1]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0101_thumb-1.png)