by Kurt Feuerman, Chief Investment Officer, Select US Equity Portfolios, AllianceBernstein

The Fed’s recent stress tests triggered sharp declines in US bank stocks amid concern over new capital buffer requirements. But bank fundamentals haven’t changed much, and earnings may be more resilient than expected in the face of a terrible economy.

Results as Expected—with a Twist

US banks are under the microscope as the COVID-19 recession challenges the financial sector. Investors watched closely when the Federal Reserve released the results of its annual bank stress test for the country’s largest banks after market close on June 25. Results were largely in line with expectations. But the next day, the already beleaguered KBW Bank Index fell 6.4% versus the market’s 2.4% loss—a stunning outcome for results that we do not believe will reduce bank earnings.

Stress test outcomes on three historic criteria did not trigger dramatic changes for the sector. Banks were told dividends may be maintained as long as there is earnings support but should not be raised; no stock buybacks for at least another quarter; and banks will have to resubmit capital plans later in the year.

Are Pandemic Solvency Concerns Overblown?

The new fourth test, a stress capital buffer because of the pandemic-induced recession, created a bit more angst. This ratio more closely aligns each bank’s capital requirements with its risk profile, and more importantly, it will become a day-to-day ongoing requirement from October 2020.

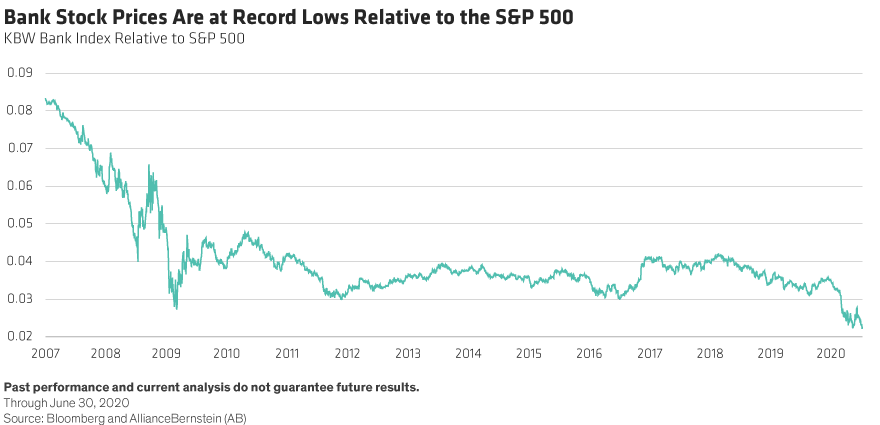

Some banks had already announced measures to reduce exposures in the stress capital buffer, such as balance sheet illiquidity. But the test results were still weak for some companies. The market reacted by pushing already low bank valuations to discounts that haven’t been seen since the global financial crisis (Display).

But we think the solvency issue is a red herring. Since the global financial crisis of 2008 and resulting banking rule changes, the two biggest headwinds for the US banking industry now are credit costs and low interest rates, in our view. Since each of the 34 institutions required to undergo the Fed’s stress tests have unique characteristics, we believe a single standardized measure of risk is an inadequate measure of the underlying business.

Investors Should Measure What Matters

Second-quarter earnings announcements should be the great equalizer. That’s because earnings reports take into consideration not only the historic solvency issues measured by the Fed but also the charming quirks that each bank brings to the table in the midst of a global crisis. For example, companies with larger illiquid positions which are marked to market quarterly should benefit from plunging interest rates in the second quarter. Banks with greater exposure to rate compression and credit costs, today’s real bank hobgoblins, may have had a harder time even if their Fed stress tests were strong.

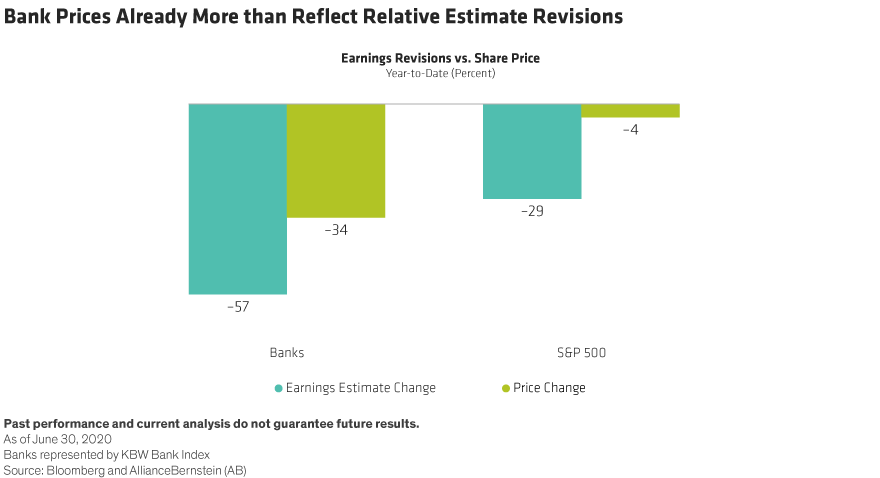

Meanwhile, banks with large investment banking businesses may have advantages in today’s environment. Equity and debt capital markets are booming; May was a record month for global equity issuance, and June appeared to be even stronger. And during the downturn in March and April, clients needed liquidity. So, institutions capable of providing that liquidity through world-class trading businesses should have fared well. Given that bank stocks have already fallen quite sharply amid steep downward revisions of earnings estimates (Display), lenders that deliver positive earnings surprises may be ripe for a share price rebound, in our view.

Next Issue Up: Politics

By far the biggest future risk to banks, in our view, is political. Under the Trump administration, banks have benefitted not only from lower corporate taxes, but also from a Fed that wants them to succeed. The possibility of a change in Washington after the elections in November adds political risk to bank stocks. While we believe the bank solvency issue is irrelevant, investors will be concerned about regulatory uncertainty and potentially higher corporate tax rates. Market participants have long memories, and they remember when every new day brought fresh headlines about legal risks or punitive costs after the global financial crisis.

In the current crisis, we believe banks have been excellent corporate citizens, providing financial relief to struggling consumers and businesses. They’ve also been functioning well through the worst economic collapse of our lifetimes. While bank earnings will take a hit during the recession, we think lenders look relatively resilient compared to other sectors that suffered a direct hit from the pandemic.

Equity investors shouldn’t rely on the Fed stress tests to evaluate a bank’s outlook. By identifying select stocks that have been unfairly punished over solvency concerns, investors can find solid bank businesses that should withstand political risk and provide strong long-term return potential for a post-pandemic recovery.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

Kurt Feuerman—Chief Investment Officer, Select US Equity Portfolios at AllianceBernstein (AB)

This post was first published at the official blog of AllianceBernstein..