by Lance Roberts, RIA

Since the March lows, the markets have rallied on optimism of a “V-shaped” economic recovery and constant stimulus from the Fed. So far, that has been the right call. However, in recent weeks, the threats to the bullish thesis have grown.

We recently discussed the Fed’s inflation of an asset bubble. The crux of the analysis was the unprecedented amount of monetary stimulus to counter the “pandemic.”

“The Fed was able to inflate another asset bubble to restore consumer confidence and stabilize the credit markets. The problem is that since the Fed never unwound their previous policies, current policies will have a more muted long-term effect.

However, this time there are 50+ million unemployed, wage growth is declining, and bankruptcies are on the rise. The Fed’s attempt to inflate another bubble to offset the damage from the deflation of the last bubble, will likely not work.”

In the short-term, the Fed’s actions had the intended outcome by providing “stability” to the financial markets.

The Paradox

What is most imperative for the Fed is those market participants, and consumers “believe” in their actions. With the financial ecosystem more heavily levered than ever, the “instability of stability” remains the most significant risk.

“The ‘stability/instability paradox’ assumes that all players are rational. That assumption implies participants will avoid complete destruction. In other words, all players will act rationally, and no one will push ‘the big red button.’”

The problem the Fed, and Global Central banks, currently face is an inability to extract themselves from ongoing monetary policy measures. After the “Financial Crisis,” the Fed had hoped they would be able to reduce their accommodation as economic growth and inflation returned.

Neither ever happened.

A Diminishing Rate Of Return

Instead, as each year passed, more monetary policy was required just to sustain economic growth. Whenever the Fed tightened policy, economic growth weakened, and financial markets declined. The table shows it takes increasingly larger amounts of QE to create an equivalent increase in asset prices.

As with everything, there is a “diminishing rate of return” on QE over time. Since QE requires more debt to be issued, the consequence is slower economic growth over time.

“The relevance of debt growth versus economic growth is all too evident. Debt issuance initially exploded during the Obama administration. It further accelerated under President Trump, and has taken ever-increasing amounts of debt to generate $1 of economic growth.”

In other words, without debt, there has been no organic economic growth.

Importantly, after a decade of unprecedented monetary policy programs in U.S., the risks in the system have been expanded. It is now imperative that everyone continues to “act rationally.”

By not letting the system correct, letting weak companies fail, and allowing valuations to mean revert, the Fed has trapped itself. Such was a point we discussed previously:

“One way to view this problem is by looking at the Nasdaq 100 versus the S&P 500 index. That ratio is now at the highest level ever.”

These levels of extremes rarely exist for extended periods. It currently seems as if “nothing can stop the bullish market.” However, it is always an unexpected, exogenous event, which pops the bubble.

The Bear Case

My colleague Doug Kass recently penned an interesting post on this issue:

“In aggregate terms, COVID -19 will likely have a sustained impact on the domestic economy. Such will be seen in reduced production and profitability for several years and forever in some industries.

At the core of my concerns:

- Important Industries Gutted: Several key labor-intensive industries, such as education, lodging, entertainment, restaurant, travel, retail, and non-residential real estate, all face an existential threat. For these industries, they simply cannot survive the conditions they face. For these gutted industries, we face, at best, an 80% to 85% recovery in the years to come. In the case of some of these sectors like retail, Covid-19 only sped up what was already a secular decline.

- A Negative Knock-On Effect: Tangential industries, like food and other services surrounding less utilized offices, malls, and other spaces, will also get hit. They, too, face at best, an 80% recovery.

- Widening Income and Wealth Inequality: The combined unemployment impact will run deep and cause adverse economic ramifications and intensified social imbalances.

- A Battered Public Sector: With a lower revenue base, the Federal government and municipalities will cut services (and employment).

- Rising Tax Rates and Redistribution: To fund the revenue shortfall tax rates will steadily increase. Such will exacerbate the disruption described above, and create a less than virtuous cycle.

Negative Impact To Stocks

As Doug also notes, there are substantial impacts to companies individually, which will eventually manifest in lower asset prices.

- Weak Capital Spending: With a large output gap and higher debt loads ($2.5 trillion of Federal Debt and $16 trillion of non-financial debt), the outlook for capital spending is weak over the next several years.

- Higher Costs And Lower Profit Margins: The surviving companies in a post-virus world will face higher costs of doing business.

- The Competitive Influence of Zombie Companies Exacerbate Lower Profitability: Corporations will face further pressure on profit margins from “zombie companies.” These companies compete aggressively on cost, and take longer to die due to low interest rates and weak loan covenants.

- Small Businesses Gutted: The greatest brunt from the pandemic is faced by small businesses that historically account for the largest job creators.

- The Specter of a Secular Erosion in Unemployment: Permanent job losses will be surprisingly large, ultimately killing consumption.

- More Cautious Business Confidence and Spending: The surviving companies were ill-prepared operationally and financially, in early 2020 for the disruptive impact of COVID- 19. Such will force companies to maintain a “buffer” of additional capital (and cash) in the event of another unforeseen event or tragedy. In all likelihood, this will make for less ambitious capital spending and expansion plans relative to the past.

- Financial Repression Holds Multiple Risks: A sustained period of low-interest rates, necessary (by some) to offset reduced economic growth, could backfire. Repressing interest rates runs the risk of a pension fund crisis, and intransigence on the part of businesses to expand and may impair the U.S. banking system.

- A Political Stasis: Political divisiveness and partisanship could intensify – dimming the probability of effective, pro-growth fiscal policy necessary in a low growth economy.

Overly Bullish

When reading through Doug’s list, the immediate response from readers who have a “bullish bias,” is “yeah…but what about the Fed?”

In the short-term, the Fed’s monetary interventions can certainly lift asset prices. As noted in the table above, the biggest “bang for the buck” is when asset markets are profoundly depressed, and negative sentiment is exceptionally high.

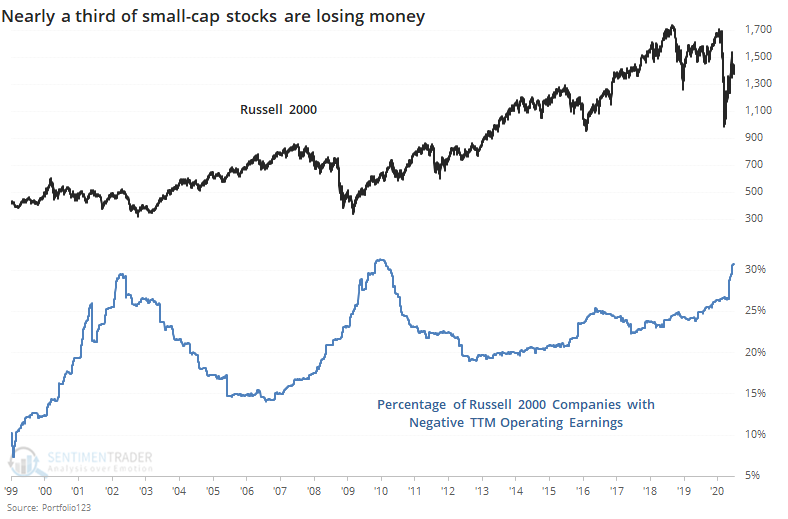

Such is not the case currently with retail investors chasing momentum in the markets with reckless disregard of the underlying investment risk. The sharp rise in the Russell 2000 index, as noted by Sentiment Trader, supports this view:

“Below is the percentage of Russell 2000 firms that have negative operating earnings over the trailing-12 months. It just moved above 30%, the most in over a decade. Only twice before in 20 years have such a high proportion of these small companies lost money. Those two periods were in April 2002 and December 2009 through February 2010.”

Furthermore, you have a near-record number of small traders speculating on asset prices through the use of options.

As noted previously, investors are also using 24-month forward estimates to justify overpaying for assets.

But, by nearly any metric, stocks are extremely expensive. There is only so much “future growth” that can be pulled forward. Eventually, “the piper must be paid.”

The Risks Of Being Bullish

At the moment, none of these risks seem to matter.

What is vital to understand none of these issues will “cause” the “bear market.”

They are just the “fuel” that will exacerbate an eventual decline when the right catalyst is applied. Much like a can of gasoline stored in your garage, gas is inert until introducing the proper catalyst (a match.)

Concerning the financial markets, it will most likely not be a resurgence of the virus, weak economic data, or even a dismal earnings season. Such has already been “priced in” by the market. However, as stated, it will require an unexpected, exogenous event to ignite the fuel. At the point, it will become hard to contain the flames.

From an investment standpoint, it is critical to understand the “risk” under which you deploy capital into overvalued and extended assets.

While it may seem like a “no-lose” scenario due to the Fed’s liquidity programs, mean reversions can, and have previously, occurred.

As Doug concluded:

“While the Federal Reserve can provide the necessary ammunition (and liquidity) to stabilize activity briefly – it is unlikely a longer-term solution.

As we pass another Independence Day, the downcast prospects will impact the markets in the coming weeks and months

These are not an ingredient for a “Bull Market” or rising valuations. Instead, the above factors may be an ingredient to:

- Increased market volatility.

- Increasing economic uncertainty and cautiousness in the C-suite.

- An irregular period of growth.

- Lower price-earnings ratios.

- More social unrest.

The U.S. economy and our financial markets now face a crossroad – they are once again decoupling. The test of economic aspiration and market optimism will come in the years ahead.”

Navigating The Risk

Whenever I write an article that discusses a “bearish view” on the financial markets, readers construe it to mean I am sitting in cash, or short the “bull market.”

Nothing could be further from the truth. As stated over the last few weeks, we are currently “uncomfortably long” the market on our portfolios’ equity side. While we continue to hedge our risks to some degree through our bond, gold, and cash holdings, we are still well exposed to potential downside risks.

Having a thorough understanding of the “risk” is to have better control over long-term outcomes. While it is essential to make money while markets are rising, it is even more critical to control the losses. Spending a bulk of your time getting “back to even” is not a long-term investment strategy.

In January and February of this year, we discussed taking profits in stocks like AAPL, MSFT, AMZN, and others. The reason was not some prediction about the impact of the virus, but rather the gross deviation and extension of these positions from long-term means.

That risk reduction benefited us much when the crash came in March.

On Wednesday, we took profits in AAPL, MSFT, NFLX, and AMZN. (Taking profits does not mean we sold the entire position.)

I don’t know what might cause the next correction, or if there will even be one. But what I do know is that when stocks are this extended, overbought, and deviated above long-term means, bad things tend to happen.