by Don Vialoux, EquityClock.com

Pre-opening Comments for Friday July 10th

U.S. equity index futures were lower this morning. S&P 500 futures were down 15 points in pre-opening trade.

Index futures recovered slightly following release of the June Producer Price Index at 8:30 AM EDT. Consensus was an increase of 0.4% versus a gain of 0.4% in May. Actual was a decrease of 0.2%. Excluding food and energy, consensus was an increase of 0.1% versus a decline of 0.1% in May. Actual was a decline of 0.3%.

The Canadian Dollar was virtually unchanged at US73.51 cents following release of Canada’s June Employment Report at 8:30 AM EDT. Consensus was an increase of 700,000 versus an increase of 289,600 in May. Actual was an increase of 952,900

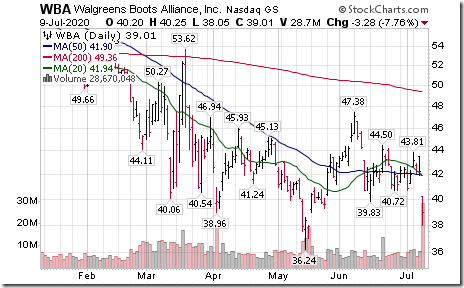

Walgreen slipped $0.38 to $38.63 after the company announced employee layoffs of over 4,000 jobs. Deutsche Bank and JP Morgan lowered their target price on the stock.

Whirlpool (WHR $133.17) is expected to open higher after JP Morgan raised its target price from $124 to $158.

Stanley Black & Decker (SWK $137.00) is expected to open higher after JP Morgan raised its target price from $130 to $175

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2020/07/10/stock-market-outlook-for-july-10-2020/

Note seasonality charts on Wholesale Sales and Wholesale Inventories.

Technical Notes for July 9th

Walgreen Boots (WBA), a Dow Jones Industrial stock moved below $39.83 setting an intermediate downtrend. The company announced plans to reduce its workforce by 7,000.

CVS Health (CVS), an S&P 100 stock moved below $61.82 setting an intermediate downtrend.

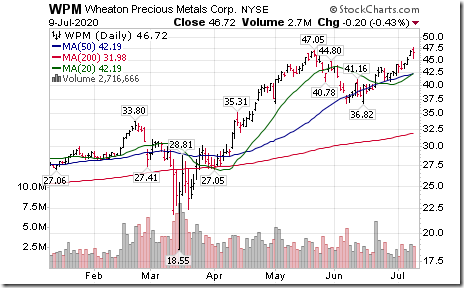

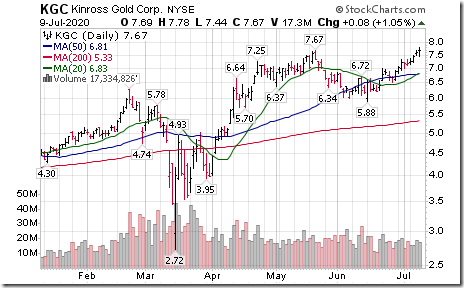

More precious metal stock breakouts on U.S. equity markets! Wheaton Precious Metals moved above US$47.05 to an all-time high, Kinross Gold moved above $US7.67. Hecla Mining moved above US$3.65.

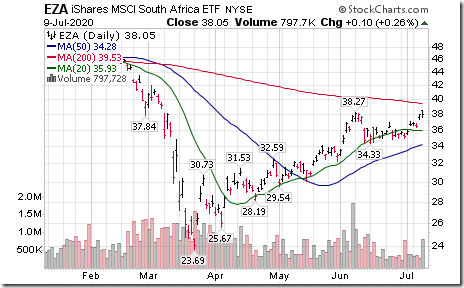

Higher gold prices are helping the price of South African equities and ETFs. South Aftica iShares (EZA moved above $38.27 extending an intermediate uptrend.

Costco (COST), an S&P 100 stock moved above $324.52 to an all-time high extending an intermediate uptrend. The company announced an 11% increase in June sales.

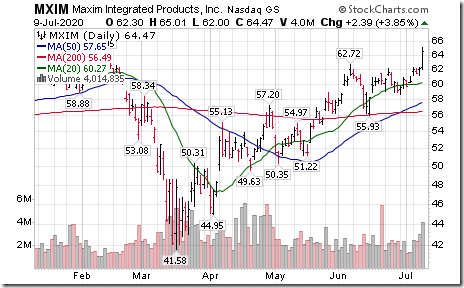

Maxim Integrated Products (MXIM), a NASDAQ 100 stock moved above $62.72 extending an intermediate uptrend.

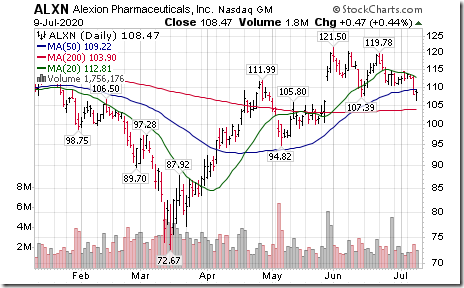

Alexion Pharma (ALXN), a NASDAQ 100 stock moved below $107.39 setting an intermediate downtrend.

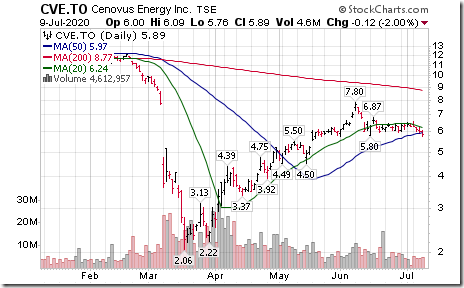

Energy stocks on both sides of the border came under technical pressure yesterday. Chevron, a Dow Jones Industrial stock moved below $85.78 completing a Head & Shoulders pattern. Cenovus (CVE), a TSX 60 stock moved below Cdn$5.80 setting an intermediate downtrend.

Pembina Pipelines (PPL), a TSX 60 stock moved below $31.73 setting an intermediate downtrend.

Couche Tard (ATD.B) a TSX 60 stock moved above $44.59 extending an intermediate uptrend. Testing its all-time high at $45.93.

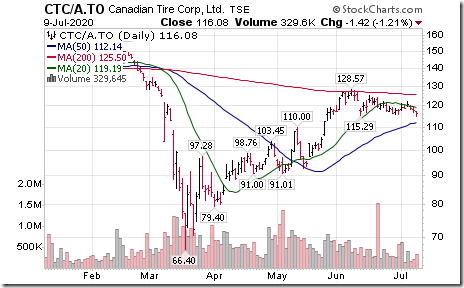

Canadian Tire (CTC.A), a TSX 60 stock moved below $115.29 setting an intermediate downtrend.

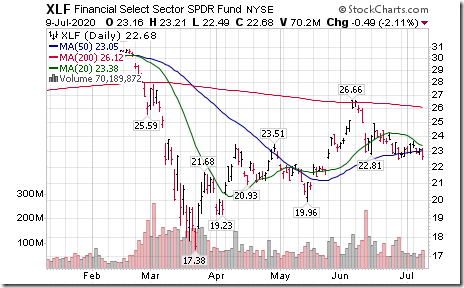

U.S. Financials and related ETFs are under technical pressure prior to release of second quarter earnings reports by major money center banks starting next Tuesday.

Brookfield Infrastructure (BIP/UN), a TSX 60 stock moved below $53.00 setting an intermediate downtrend.

Trader’s Corner

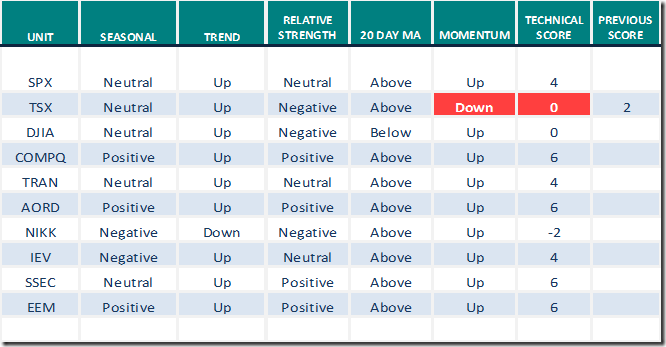

Equity Indices and related ETFs

Daily Seasonal/Technical Equity Trends for July 9th 2020

Green: Increase from previous day

Red: Decrease from previous day

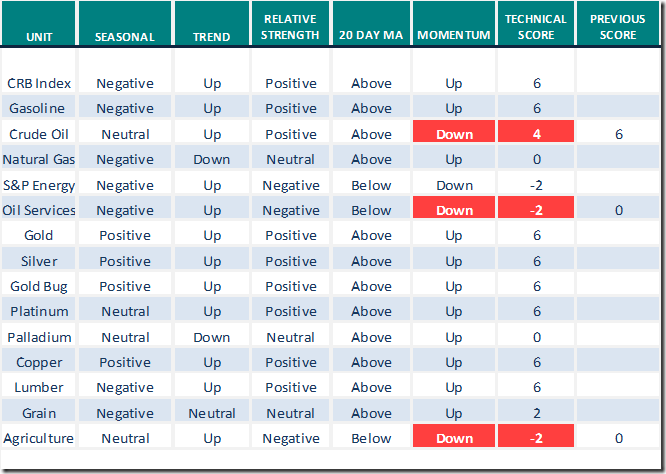

Commodities

Seasonal/Technical Commodities Trends for July 9th 2020

Green: Increase from previous day

Red: Decrease from previous day

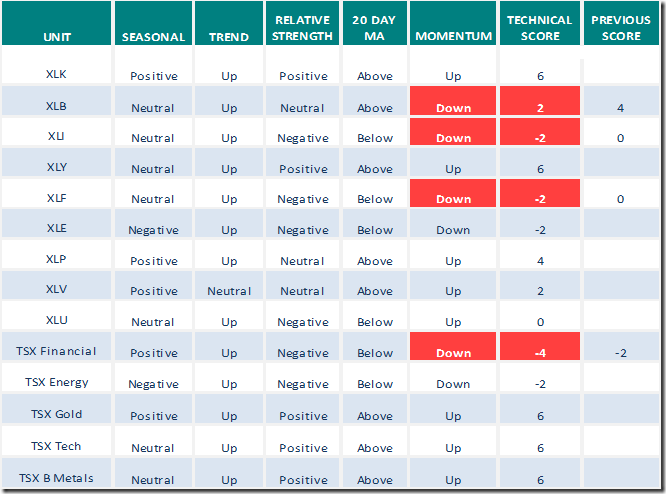

Sectors

Daily Seasonal/Technical Sector Trends for July 9th 2020

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometer

The Barometer plunged 12.42 to 51.30 yesterday. It changed from intermediate overbought to intermediate neutral on a drop below 60.00. Trend remains down.

TSX Momentum Barometer

The Barometer plunged 11.43 to 58.10 yesterday. It changed from intermediate overbought to intermediate neutral on a move below 60.00. Trend remains down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image001[3] clip_image001[3]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0013_thumb-2.png)

![clip_image002[3] clip_image002[3]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0023_thumb-2.png)

![clip_image003[1] clip_image003[1]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0031_thumb-4.png)

![clip_image001[1] clip_image001[1]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0011_thumb-6.png)

![clip_image002[1] clip_image002[1]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0021_thumb-6.png)