by Don Vialoux, EquityClock.com

Morning Technical Notes for July 9th

Walgreen Boots (WBA), a Dow Jones Industrial stock moved below $39.83 setting an intermediate downtrend. The company announced plans to reduce its workforce by 7,000.

CVS Health (CVS), an S&P 100 stock moved below $61.82 setting an intermediate downtrend.

More precious metal stock breakouts on U.S. equity markets! Wheaton Precious Metals moved above US$47.05 to an all-time high, Kinross Gold moved above $US7.67. Hecla Mining moved above US$3.65.

Higher gold prices are helping the price of South African equities and ETFs. South Aftica iShares (EZA moved above $38.27 extending an intermediate uptrend.

Costco (COST), an S&P 100 stock moved above $324.52 to an all-time high extending an intermediate uptrend. The company announced an 11% increase in June sales.

Maxim Integrated Products (MXIM), a NASDAQ 100 stock moved above $62.72 extending an intermediate uptrend.

Pre-opening Comments for Thursday July 9th

U.S. equity index futures were higher this morning. S&P 500 futures were up 4 points in pre-opening trade.

Index futures were virtually unchanged following release of Weekly Jobless Claims at 8:30 AM EDT. Consensus was 1.375 million versus 1.427 million last week. Actual was 1.314 million

The Canadian Dollar was virtually unchanged at US74.05 cents following release of June Canadian Housing Starts. Consensus was 198,000 versus 193,500 in May. Actual was 211,700.

Walgreen Boots dropped $1.34 to $40.95 after the company announced plans to reduce its workforce by 7,000.

Bed Bath and Beyond slipped $0.81 to 9.60 after the company announced plans to close 200 stores during the next two years.

Microsoft gained $2.88 to $215.71 after Wedbush raised its target price from $240 to $260.

Costco gained $4.58 to $320.90 after announcing an 11% rise in June sales to $16 billion.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2020/07/08/stock-market-outlook-for-july-9-2020/

Technical Notes

Silver moved above $18.95 per ounce to close at $19.16 extending an intermediate uptrend.

Silver stocks continue to attract buying on strength in silver prices. Pan American Silver (PAAS) moved above $30.59 to an all-time high extending an intermediate uptrend.

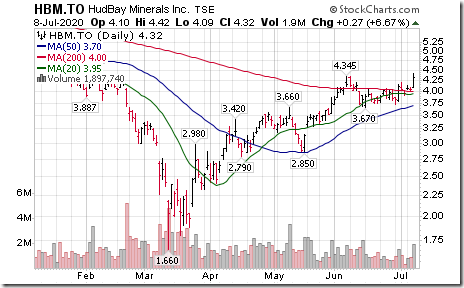

Another base metals equity breakout! HudBay Minerals (HBM) moved above $4.34 extending an intermediate uptrend.

Occidental Petroleum (OXY), an S&P 100 stock moved below $17.10 setting an intermediate downtrend.

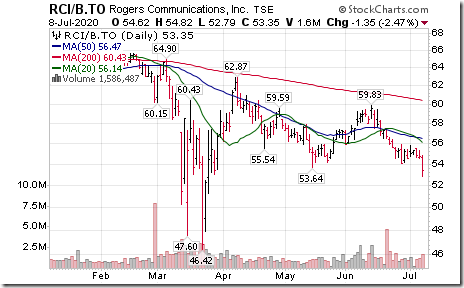

Rogers Communications (RCI.B), a TSX 60 stock moved below $53.64 extending an intermediate downtrend.

Twitter led the technology sector higher yesterday on news that the company plans to launch a subscription service.

Greg Schnell’s “Market Buzz” yesterday

Title reads,”Pillars of Strength or Shifting Sands”? Following is a link:

https://www.youtube.com/watch?v=Pfmi0hnFuLc&feature=youtu.be

Trader’s Corner

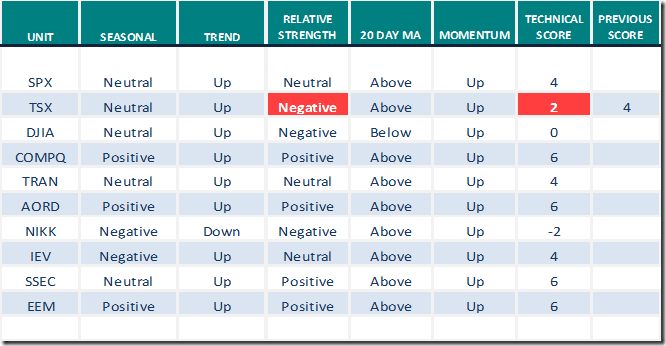

Equity Indices and related ETFs

Daily Seasonal/Technical Equity Trends for July 8th 2020

Green: Increase from previous day

Red: Decrease from previous day

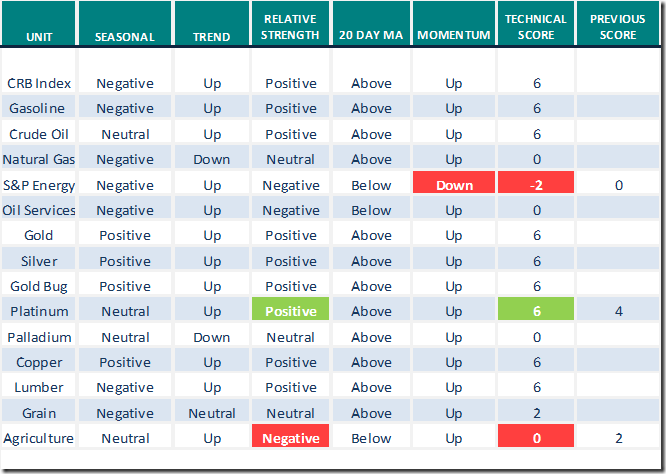

Commodities

Seasonal/Technical Commodities Trends for July 8th 2020

Green: Increase from previous day

Red: Decrease from previous day

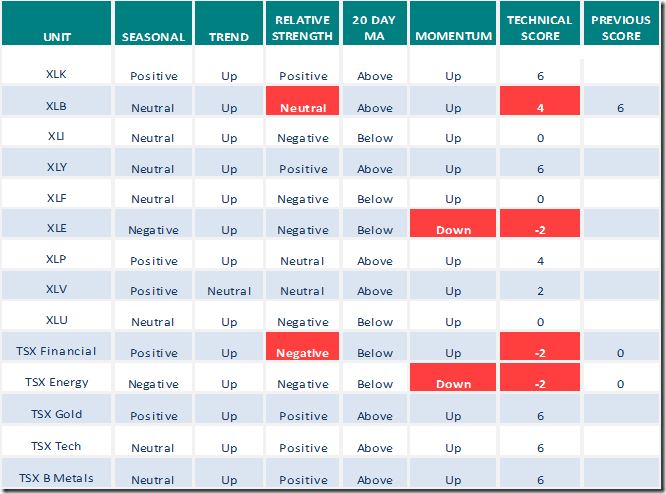

Sectors

Daily Seasonal/Technical Sector Trends for July 8th 2020

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometer

The Barometer slipped another 1.60 to 63.73 yesterday. It remains intermediate overbought and showing signs of rolling over.

TSX Momentum Barometer

The Barometer slipped another 1.43 to 69.52 yesterday. It remains intermediate overbought and showing signs of rolling over.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image001[3] clip_image001[3]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0013_thumb-1.png)

![clip_image002[3] clip_image002[3]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0023_thumb-1.png)

![clip_image003[3] clip_image003[3]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0033_thumb-1.png)

![clip_image004[3] clip_image004[3]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0043_thumb-1.png)

![clip_image005[1] clip_image005[1]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0051_thumb.png)

![clip_image006[1] clip_image006[1]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0061_thumb.png)

![clip_image008[1] clip_image008[1]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0081_thumb.png)

![clip_image001[1] clip_image001[1]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0011_thumb-5.png)

![clip_image002[1] clip_image002[1]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0021_thumb-5.png)

![clip_image003[1] clip_image003[1]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0031_thumb-3.png)

![clip_image004[1] clip_image004[1]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0041_thumb-1.png)