by Manmeet Bhatia, CFA, CFP, Franklin Templeton Investments

Franklin Templeton Canada’s 2020 Retirement Income Strategies and Expectations (RISE) survey revealed the importance of having a plan to help reduce financial-related stress—particularly relevant amid today’s uncertainties. Our Manmeet Bhatia discusses some findings of the survey, and how respondents feel about their financial future.

The uncertainty and financial hardship related to COVID-19 has caused many individuals to reconsider their short- and long-term financial priorities. Individuals without adequate savings may not only need to curb everyday spending, but also delay their retirement or other long-term goals. The virus has put the spotlight on financial preparedness, and the importance of having a strategy to cope with unforeseen events or things generally beyond our control.

The Importance of Emergency Savings

Franklin Templeton Canada’s 2020 Retirement Income Strategies and Expectations (RISE) survey was conducted before the coronavirus triggered lockdowns across the country, but the survey’s findings are perhaps even more relevant today. Across all age groups surveyed, one’s ability to handle unforeseen expenses ranked as the top financial driver of moderate or significant stress.1

When the survey was conducted in early February, just over a month before our shutdowns started, 77% of Canadians said their ability to cover an unexpected expense/life event was already causing them stress. With millions of jobs lost and/or pay hours cut since, the loss of income has likely led to even more stress today for many individuals. But what’s the alternative if you don’t have an emergency fund? Go into debt? Statistics Canada recently reported that household credit market debt as a proportion of household disposable income rose from 175.6% to 176.9% in the first quarter, approaching a record high.2 In other words, there was C$1.77 in credit market debt for every dollar of household disposable income. So many Canadians are pretty deep in debt.

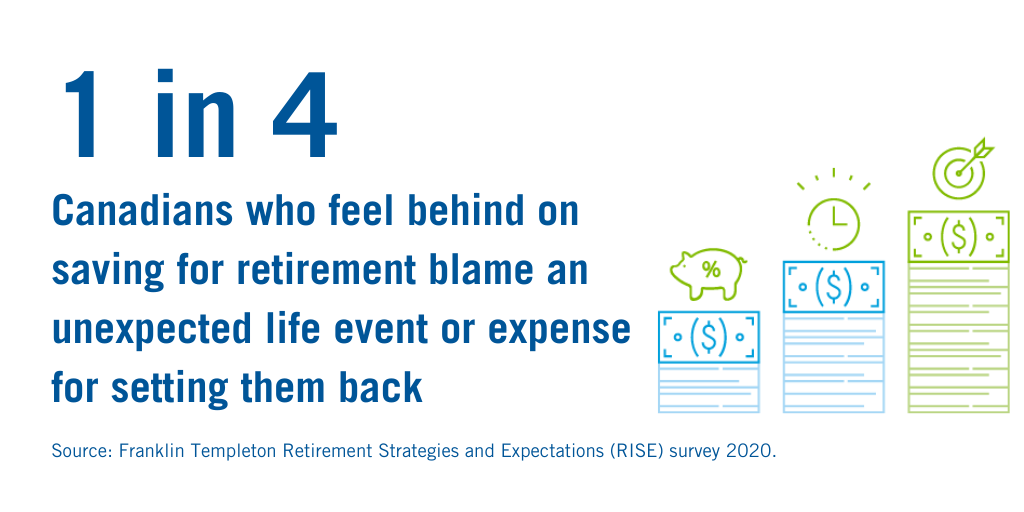

When asked to choose from a list of different current financial goals or priorities, respondents in our RISE survey cited “having sufficient emergency savings to cover unexpected expenses” more frequently than saving for a home or for retirement. While withdrawing from retirement savings might seem like a good solution to cover short-term needs, according to our RISE survey, one in four Canadians who feel they haven’t saved enough for retirement blame their shortfall on an unexpected expense or event.

It’s clear many individuals need help balancing urgent needs, while still preparing for long-term goals such as retirement. Of course, if an individual is struggling to make ends meet, it’s hard to think about saving enough for an emergency fund—one that can cover several months of expenses—let alone retirement.

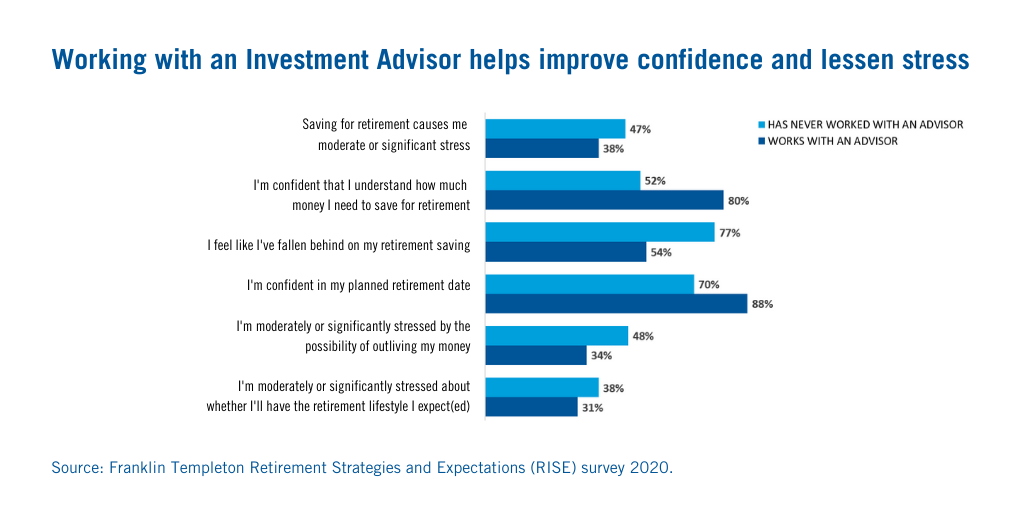

So, how can people better prepare for both short- and long-term income needs? This is where we think engaging with a financial professional can help you balance your financial priorities. Even setting up a budget can help. Compared with non-budgeters who are time-crunched or feel overwhelmed, a survey from the Financial Consumer Agency of Canada conducted in 2019 revealed Canadians who budget are less likely to be falling behind on their financial commitments (8% vs. 16%), and also demonstrate more effective management of their monthly cash flow.3

Many workers may also have additional employer benefits that can help them improve their financial wellbeing. While emergency or hardship funds may not be a common workplace benefit today, one that is perhaps more widespread is a defined contribution plan—where a percentage of one’s paycheque is set aside in a retirement account, often matched by an additional employer cash contribution. Many workers overlook this benefit, but it can represent “free money” from your employer, in addition to any potential tax-exempt growth over time of one’s own contributions. Over a long period of time, even setting aside a small amount can add up to a more secure future.

Planning Inspires Confidence

Thinking about finances can certainly be stressful for many, but Franklin Templeton’s RISE survey found that having a strategy to accomplish one’s savings goals can lead to increased confidence. Of individuals with a retirement plan, 77% said they were “confident that I will have enough money to last the rest of my life” versus 52% of those without one. Among retirees, 54% with a plan said they “saved enough for retirement,” versus 33% of those without a plan. A financial professional can teach you how to build an appropriate nest egg for short-term needs, devise strategies to tackle debt, and transition toward longer-term goals.

And, given that individuals tend to take action when they are emotionally motivated to make a change, financial professionals who meet people where they are emotionally (i.e., stressed about ability to handle unforeseen expenses) will have more success at getting them to take positive action. These actions could help establish habits that could transcend the current situation and extend to a lifetime of other goal successes—and ultimately a feeling of financial security.

In order to help achieve overall financial wellbeing, we believe it’s important to help people feel more empowered. Setting good financial habits early like saving regularly for a goal is important—but it’s never too late to develop a financial plan. Competing priorities call for a holistic and highly personalized approach, and even small changes can help reduce stress and anxiety, should an unexpected shock occur.

Additional survey information and retirement planning resources can be found on Franklin Templeton’s website at franklintempleton.ca/rise.

Important Legal Information

Survey Methodology

The Franklin Templeton Retirement Income Strategies and Expectations (RISE) survey was conducted online among a sample of 2,004 adults 18 years of age or older. The survey was administered between 31 January and 11 February 2020, by ENGINE’s online CARAVAN®, which is not affiliated with Franklin Templeton. Data is weighted to gender, age, and geographic region. The custom-designed weighting program assigns a weighting factor to the data based on current population statistics from Statistics Canada.

All financial decisions and investments involve risks, including possible loss of principal.

This communication is general in nature and provided for educational and informational purposes only. It should not be considered or relied upon as legal, tax or investment advice or an investment recommendation, or as a substitute for legal or tax counsel. Any investment products or services named herein are for illustrative purposes only, and should not be considered an offer to buy or sell, or an investment recommendation for, any specific security, strategy or investment product or service. Always consult a qualified professional or your own independent financial advisor for personalized advice or investment recommendations tailored to your specific goals, individual situation, and risk tolerance.

Franklin Templeton does not provide legal or tax advice. Federal and provincial laws and regulations are complex and subject to change, which can materially impact your results. Franklin Templeton Investments Corp. (FTIC) cannot guarantee that such information is accurate, complete or timely; and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information.

Data from third party sources may have been used in the preparation of this material and FTIC has not independently verified, validated or audited such data. FTIC accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

___________________________

1. Source: The 2020 Franklin Templeton Retirement Income Strategies and Expectations (RISE) survey

2. Source: Statistics Canada, national balance sheet and financial flow accounts, first quarter 2020, released 12 June 2020.

3. Source: Financial Consumer Agency of Canada, “Canadians and their Money: Key Findings from the 2019 Canadian Financial Capability Survey.”

This post was first published at the official blog of Franklin Templeton Investments.