by Craig Basinger, Chris Kerlow, Alexander Tjiang, Derek Benedet, Richardson GMP

Behavioural finance has gained a considerable amount of popularity over the past few years as it pertains to investing. Among other things, it highlights how humans appear to be hardwired to make certain systematic mistakes despite our best efforts. Emotions get the better of us and this unleashes behavioural biases that negatively impact our decision making. The discipline of behavioural finance, which resides between economics and psychology, has researched and uncovered hundreds of these behavioural biases, highlighting how often humans make poor decisions.

However the discipline has fallen short on solutions – more often just highlighting our mistakes. Well that isn’t very helpful. In this Ethos, we will share a number of behavioral biases that have become more prevalent due to the bear of February/March and the huge rebound in April/May. And we will share strategies that we have developed to help our team manage money (and hopefully avoid as many pitfalls as possible).

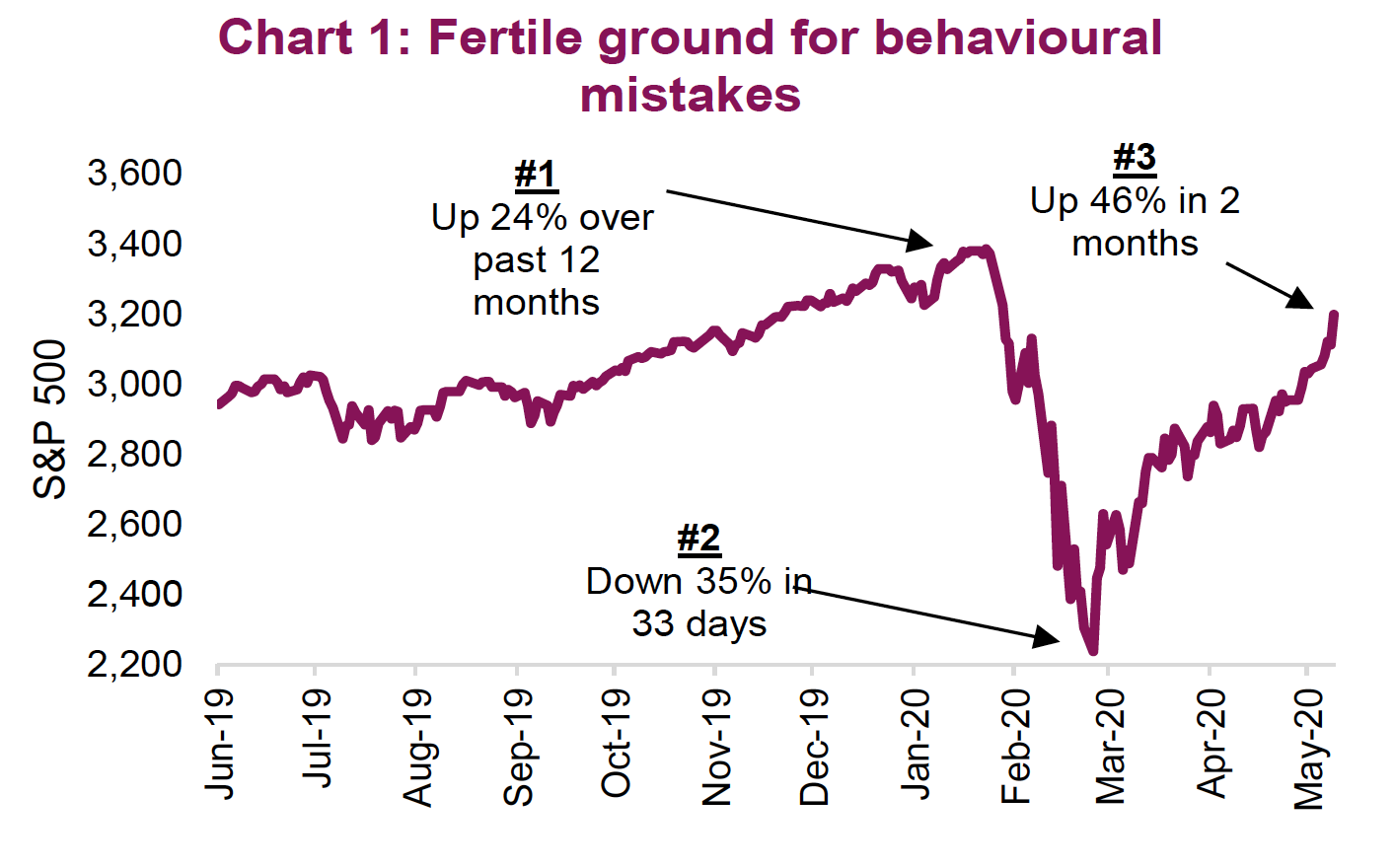

2020 – fertile ground for behavioural biases

We have yet to reach the half-way point for this calendar year, and so far, 2020 has created various environments or situations ideal for behavioural biases to get the best of investors. It actually started in late 2019 and greatly accelerated in 2020. Adding to our behavioural bias susceptibility is the emotional stress from the pandemic. We are concerned about our health, friends and families, while social support structures are lacking.

Phase #1 Up 24% in the past year – Before the pandemic gripped global markets, the S&P 500 staged a solid run in late 2019 and early 2020. Improving news on trade tensions had animal spirits gripping many investors. This had the S&P 500 up over 20% on a trailing annual basis, leaving no doubt that investors chase performance. In early 2020, intense speculation was elevated with companies like Virgin Galactic (space tourism) rising +250%, Tesla +120% and anything with an environmental tilt jumping higher. The ostrich effect – the attempt made by investors to avoid negative financial information (see details below) – was widespread.

Phase #2 Down 35% in 33 days – The bull ended quickly and violently as the pandemic spread. Economies shut down, equity markets tumbled and bonds markets froze. Market sentiment has rarely moved from greed to fear so quickly. Availability along with recency bias was very evident.

Phase #3 Up 46% in 2 months – The fastest bear market in history has been followed by one of the biggest bounces, which will be the fastest recovery in history if markets rise a little more. Greed has not returned, but the fear of missing out (FOMO) is widespread at the moment. Availability, anchoring and FOMO have been impacting many investors.

Based on conversations with investors and advisors over the past few months, the following appear to be the most pervasive behavioural biases impacting investor decisions. We have also included strategies to help mitigate this flawed thinking, some of which are applicable today while others may be useful for the next cycle.

Prevalent behavioural biases of late

Ostrich effect (Phase #1)

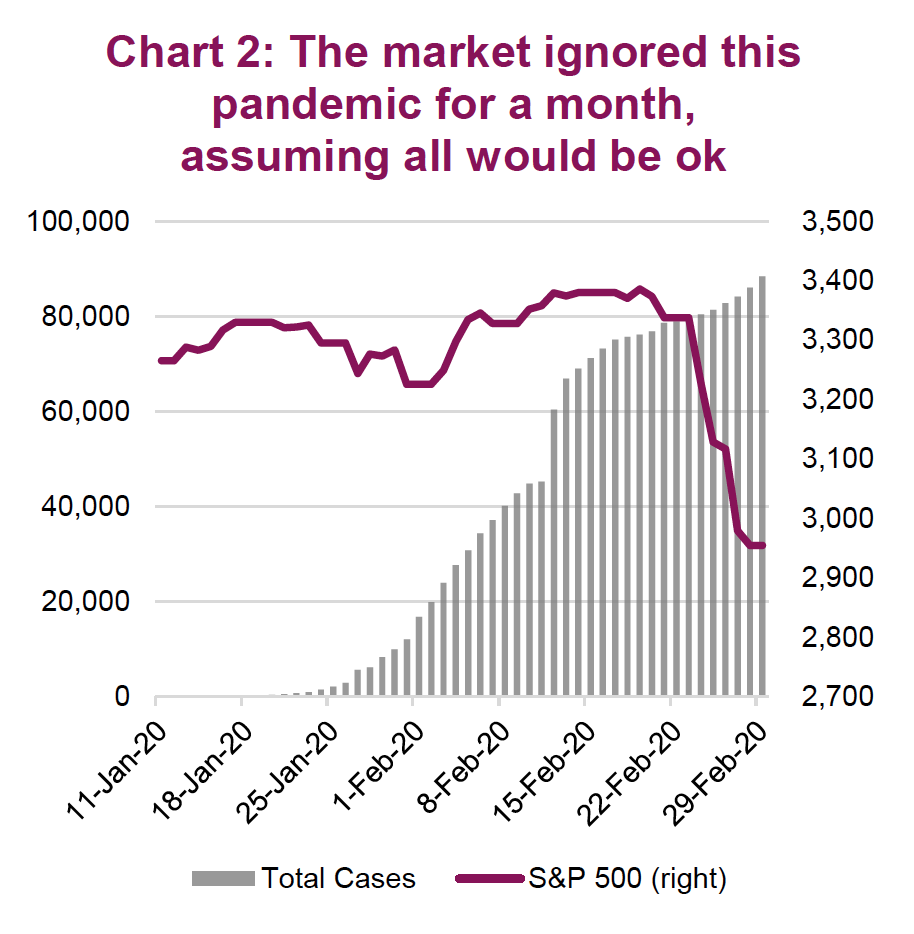

Everyone likes good news, being optimistic and making money. The ostrich effect occurs when we focus or place more emphasis on good news and ignore or downplay bad news (glass half full). In early 2020 this was the case as investors were more focused on the prospects of space tourism than a health crisis in China. Most of those who were aware of the pandemic touted comparisons with SARs, MERs or Ebola as a short-term buying opportunity (Chart 2).

This effect drives our attention away from bad news, almost as a defense mechanism. Investors most at risk of this bias are those who have become attached to a view, opinion or position for an extended period of time.

Strategies to counter the ostrich effect

1) Actively search out negative or contrary opinions. This can help open your mind to alternative scenarios. 2) Get a second opinion. Other subject experts may not be as attached to your view or opinion, enabling a more balanced approach to weighing pros and cons. 3) Pre-mortems on an existing position can really help uncover what could go wrong. And if more contrary evidence surfaces, you will be in a better position to assess and incorporate it into your overall view. (Pre-mortem Ethos)

Availability bias (#2 & #3)

This bias appears at work today with most eyes glued to protests, wondering if this will cause an acceleration in COVID-19 cases. Meanwhile cases are rising very fast in developing nations. Less known information includes the fact that Italy and Spain have opened up and are seeing the fewest new cases since the start – fewer than Canada in fact.

Strategies to counter the availability bias

1) Stop watching the news (kidding). Media is often focused on sharing more vivid images or information in efforts to maintain viewers’ attention. Less exciting information is often not reported on.

2) Track the sources of your investment information and attempt to diversify across many different sources. Using an investment journal is a must.

Anchoring bias (#3)

We very often become anchored based on what we paid for an investment or by the fact that an investment traded at a certain level. This anchor price can have an outsized impact on subsequent decision making. This is the case even if that anchor price is no longer appropriate given the market environment or if the anchor itself was inappropriate.

At the moment, many investors are anchored to the lows of March, saying “how can I buy today given it was so much cheaper two months ago?” The TSX was below 11,500 in March and is now almost at 16,000. However, the March lows may not even be appropriate because they were exacerbated by the pandemic in full swing, a frozen corporate bond market and the most unknown outlook for the economic impact of social distancing. What we know today is very different – risk is less and prices should be higher (not sure they should be this high, but that is likely one of my biases talking).

Strategies to counter the anchoring bias:

1) Remove all original costs when reviewing a portfolio. The decision to buy/hold/sell a position or fund should be based on future prospects relative to its current price. It is ok to consider cost for tax reasons, but this should be secondary.

2) When researching, avoid numerical forecasts especially early in the process as this may impact how additional information is incorporated.

3) Associate the market environment or company news with a certain price level. If the news changes materially or the market environment changes, the anchored price should no longer be applicable, so throw it out.

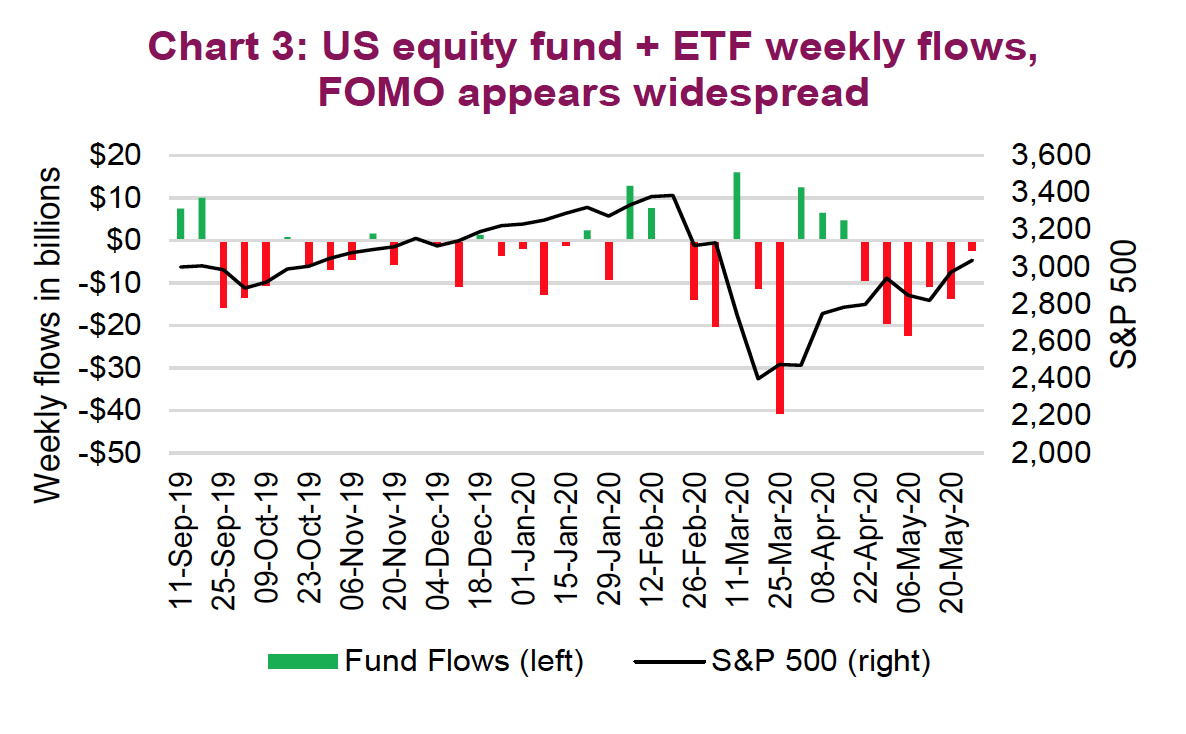

Fear of missing out (#3)

A 46% bounce off the bottom has certainly elicited the FOMO feeling in many investors due to inaction or selling when fear was peaking. So many investors were waiting for a second bottom to put more money to work in the market. FOMO is driven in part by loss aversion in the sense that missing out on something good is considered a loss.

FOMO actually isn’t a behaviour bias, but the result of a few biases: loss aversion, herd behaviour and status quo bias. Not surprisingly, it impacts investors when markets or specific industries have a great amount of volatility (weed, bitcoin).

Weekly flows into equity funds and ETFs certainly makes it clear that FOMO is widespread. Notice the spike in redemptions near the bottom; there were some initial buyers early in the recovery but recently it’s been all selling (Chart 3).

Strategies to counter FOMO

1) Being more systematic. FOMO is often caused by inaction due to fear or regret. Having a more systematic approach that reduces emotions can certainly help.

2) Move in smaller steps. We would all love to simply buy at bottoms and sell at tops. Since that is unrealistic, moving in smaller incremental steps can have you doing more selling when prices are elevated and more buying when cheaper. This also helps diversify timing risk when markets are volatile.

3) Have a long-term plan. It really helps you think in longer time horizons and fret less about near- term market volatility.

*****

Source: All charts are sourced to Bloomberg L.P. and Richardson GMP unless otherwise stated.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances. Insurance services are offered through Richardson GMP Insurance Services Limited in BC, AB, SK, MB, NWT, ON, QC, NB, NS, NL and PEI. Additional administrative support and policy management are provided by PPI Partners. Insurance products are not covered by the Canadian Investor Protection Fund.

Richardson GMP Limited, Member Canadian Investor Protection Fund. Richardson and GMP are registered trademarks of their respective owners used under license by Richardson GMP Limited.