by Maarten Bloemen, Franklin Templeton Investments

Global equity markets plunged in the first quarter of 2020 as investors struggled to weigh the impact of an unprecedented global economic shutdown stemming from the escalating coronavirus pandemic. The pandemic emphasised the importance of environmental, social and governance (ESG) factors, as we have seen evidence that the companies better prepared to manage these risks are likewise weathering the crisis better. For example, strong disaster preparedness, including supply chain management and business continuity planning, has been a hallmark of the crisis.

ESG investing has been growing in popularity over the past few years. We think the coronavirus crisis could draw even more attention to this space and bring more flows into ESG-focused funds.

At Franklin Templeton, ESG analysis is an inherent component of research and investment decision making. We believe the intersection of traditional financial measures alongside sustainability measures provides a valuable tool to differentiate between companies and sectors that are vulnerable to disruption and those that should be better equipped to adapt to shocks.

While there are different approaches to ESG analysis, we believe monitoring these issues can provide valuable insights that balance sheets or other financial metrics don’t reveal and help identify potential risks or vulnerabilities. The current crisis has highlighted some of these factors.

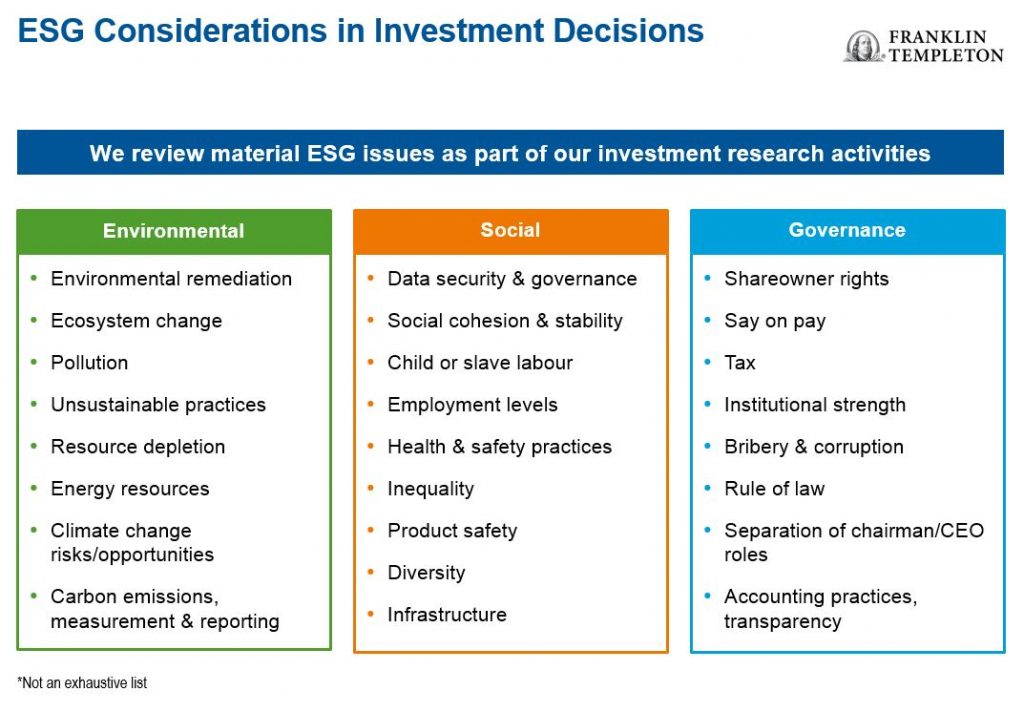

The graphic below outlines some considerations within each element of ESG for investors.

Health and Safety Issues

The coronavirus has brought a spotlight on several issues in the “S” category of ESG, including social stability, employment, infrastructure, data security, and keeping employees and customers safe—whether they are physically interacting or not. Investors may find the strength of ESG practices in this area something to consider not only as we navigate the current crisis, but also as we think about the next potential crisis.

Naturally, many are looking for potential investment opportunities in the health care sector as a result of the crisis, including the race to develop vaccines, and ESG issues play a part here too. My colleagues Stephen Dover, Head of Equities at Franklin Templeton, and Evan McCulloch, Portfolio Manager at Franklin Equity Group, have shared thoughts recently on this subject and the opportunities they see. For more insight, read “Biotech Progress in Addressing Coronavirus, but it Takes Time,” and “COVID-19: What Can Science Tell Us, and What Are the Implications?”

Climate Change Initiatives Delayed, but Not Derailed

Climate change represents another large global shock that companies need to prepare for. There has been much talk about potential delays or derailment of climate change initiatives due to the coronavirus crisis and the heavy government spending to combat the economic impacts of the global lockdown. While some of these initiatives will inevitably be delayed, we think governments will largely renew and increase commitments once the current crisis ebbs. And they may even allocate some coronavirus-stimulus funds to ensure a more sustainable economy longer term. Efforts to battle climate change may bolster the manufacturing and construction industries, creating new jobs.

As active investors, we have seen some potential value opportunities in companies exposed to attractive long-term growth tied to climate change initiatives.

Global Push for Green

Given the importance of the auto industry to major economies throughout the world, governments are likely to support growth of electric vehicles and clean energy, including the expansion of electric vehicle (EV) battery charging infrastructure. We also anticipate continued investment in smart grid infrastructure to integrate growing clean energy generation, and commercial and residential building energy efficiency renovations.

There’s also evidence of this push toward clean energy around the world. In early April, China’s State Council extended subsidies for EVs up to US$3,525 each and an exemption from the 10% purchase tax.

The European Green Deal, the European Union’s ambitious bid to transform the 27-country bloc into a low-carbon economy, also prioritises rapid decarbonisation of energy systems, large-scale renovation of existing buildings, cleaner public and private transport and sustainable food systems. The recent UK budget in March targeted EV charging, extended EV subsidies and tax incentives, and supported low carbon heat including heat pumps and more efficient boilers.

These environmentally focused efforts also create jobs. The World Resources Institute’s research estimates that every US$1 million invested in building retrofits creates eight full- time jobs.1 Every US$1 invested in modernising transmission infrastructure creates US$2.40 in economic benefits by improving reliability, reducing costs and delivering environmental benefits.2 It estimates every US$1 spent in public transportation creates US$4 of economic activity.3

Secular Growth Opportunities

When looking at long-term investment opportunities within the realm of ESG, our team is particularly excited about companies in the renewable energy sector, and those that manufacture parts for those industries. Solar power developers, particularly those in India and China, have made good progress with their product pipelines and could provide significant earnings growth for several years.

The recent market selloff has presented higher-growth opportunities in the solar energy equipment space. In 2019, the US solar market grew by 23% from the year prior,4 a trend we expect to continue. As prices have fallen for equipment, we’ve seen a significant increase in solar installations, also tied to regulatory and economic factors.

Sustainable transportation is a theme that also appears attractive to us. While this sector has had limited value opportunities over the past few years, an increase in demand for low-emission public transportation has led to the need for cathode suppliers and semiconductors for EV batteries. We recognise governments around the world are now working towards more sustainable mass transport networks that include eco-friendly fuel and greener vehicles. It’s encouraging to see industrial gas companies look into solutions that involve hydrogen and biomethane used as fuel for an increasing number of vehicles, including buses and heavy-duty vehicles.

In our view, similar to the coronavirus crisis, disruptions due to climate change may uncover an even greater need for companies—and investors—to focus on ESG themes.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of 30 April 2020, and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own professional adviser or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com—Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton Investments’ U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

What Are the Risks?

All investments involve risks, including possible loss or principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size and lesser liquidity.

____________________

1. US Congress Joint Economic Committee, June 2017. [https://www.jec.senate.gov/public/_cache/files/e56eed31-f51d-449d-90e2-65ae35d938de/energy-efficiency-powers-economic-opportunities-final.pdf]

2. World Resources Institute, Accelerating Building Efficiency, May 2016. [https://publications.wri.org/buildingefficiency/]

3. World Resources Institute, Resilience After Recession: 4 Ways to Reboot the U.S. Economy, March 2020. [https://www.wri.org/blog/2020/03/coronavirus-rebooting-US-economy]

4. Solar Energy Industries Association, Year-in-Review, 2019.

This post was first published at the official blog of Franklin Templeton Investments.