by Susan Hutman, Director, Investment Grade Corporate, and Robert Hopper, Director, High Yield, AllianceBernstein

The coronavirus pandemic continues to wreak havoc across economies and markets. A wave of rating downgrades, fallen angels and corporate bond defaults has begun—and it could grow into a tsunami before the pandemic recedes.

But that doesn’t mean investors should stay out of the water. In many cases, today’s yields more than adequately compensate bondholders for potential losses. Here’s what we expect.

Corporate Bond Defaults Will Spike

In March and early April, as economies around the world ground to a halt and liquidity challenges skyrocketed, investors sold corporate bonds in record numbers for fear of a surge in downgrades and defaults. Forced sales exacerbated the liquidity spiral. Corporate bond spreads soared as prices dropped.

The default rate—including imminent defaults—in the US high-yield market has already picked up, to 3.2% year to date, according to J.P. Morgan. But we aren’t yet out of the woods.

We think the US and other developed-market economies will remain shuttered until early summer. Economic activity will likely resume slowly in the second half of the year. In this base-case scenario, we expect the US high-yield default rate to climb to between 10% and 13% over the next 12 months. Global default rates will likely be somewhat lower.

Should the pandemic require a longer shutdown, or if the recession is worse than we currently expect, US high-yield defaults could be as high as 15%–20%. That’s our downside scenario.

With the opening of various credit market facilities, corporate yield spreads have retreated somewhat from their highs. But a significant share of the market continues to trade at spreads above 1,500 basis points. That suggests to us that the market is pricing in defaults in line with our base-case scenario. In other words, spreads on many corporate bonds amply compensate investors for the coming default wave.

A Blizzard of Fallen Angels

Defaults aren’t the only worrisome potential outcome of a sudden and deep recession. Even in good times, it’s not unusual for companies clinging to the bottom rung of the investment-grade ladder to become fallen angels. On average, $72 billion worth of investment-grade bonds were downgraded to high yield each year between 2009 and 2018.

Yet concerns surrounding fallen angels are especially pronounced today, and not just because of the coronavirus pandemic and concurrent oil crash. During the past decade, the volume of debt rated BBB ballooned as a share of the investment-grade universe as issuers ramped up their leverage.

Bond investors find all this hard to ignore—with good reason. A wave of downgrades across the cliff between investment grade and high yield could lock in big losses for restricted investment-grade strategies and spark a disruptive repricing in the high-yield market as it attempts to digest an elephant.

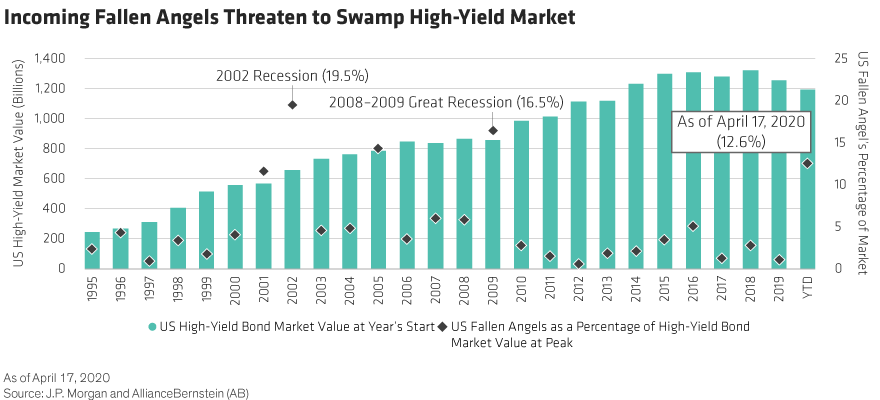

Already this year, given the sudden onset of liquidity challenges and lack of access to capital, the volume of fallen angels has surpassed $150 billion, exceeding 2009’s record (Display 1). The energy and retail sectors have led the pack. Three of the seven largest fallen angels on record occurred in the last two months.

At the onset of the crisis, and before these outsized fallen angels shook the markets, our bottom-up credit forecasts led us to upwardly revise our aggregate expectations for fallen angels. We estimate that 8.5% of the US investment-grade corporate market will be downgraded below investment grade. This is close to the experiences in past crises, such as the 2002 recession (10%) and the Great Recession (8%).

However, because today’s investment-grade corporate market is four times as large as in 2008, our fallen angel forecast affects bonds worth around $450 billion. That makes it potentially much more disruptive to the comparatively small US high-yield market (Display 2).

In the past, the high-yield market has reliably absorbed large volumes of fallen angels. Nonetheless, the potential for a blizzard of fallen angels to overwhelm the high-yield market in terms of both comparative volume and difference in average market duration (interest-rate sensitivity) has exerted enormous pressure on both bonds rated BBB– and the highest-rated high-yield bonds.

Thankfully, with the US Federal Reserve now prepared to buy some fallen angel debt and provide liquidity to eligible fallen angels, that pressure will be reduced. We estimate that US$34.5 billion of fallen angel debt will be eligible for purchase under the Fed’s Secondary Market Corporate Credit Facility (SMCCF).

While this should help soften the impact, it doesn’t reduce our forecast for fallen angels in the coming months.

Some Industries Will Be Spared

Industries most at risk for fallen angels are those directly impacted by the coronavirus pandemic, those along the global supply chain and those hurt by lower energy prices.

The lion’s share of fallen angels will be issuers from industries directly affected by the coronavirus crisis. These include consumer cyclicals, such as autos, gaming, leisure, airlines, homebuilders and retailers. These industries are suffering from prolonged stay-home orders that have dried up discretionary spending and large purchases.

Also at risk are issuers that came into the crisis highly leveraged in their ramp-up to mergers and acquisitions. These are primarily food and beverage companies. Reeling from empty restaurants and disruptions in the food supply chain, this sector faces a tough road ahead.

And energy issuers are under extra pressure, thanks to the oil shock. Although we expect oil prices to recover over time, today’s ultralow prices create huge challenges for many energy companies.

In contrast to the industries above, financials and utilities may be less vulnerable to fallen angel risk. Combined, these represent just one percentage point of our 8.5% projection for US fallen angels.

While earnings leave some room for improvement, large banks’ balance sheets were in relatively solid financial shape coming into the crisis, unlike in 2008. And utility providers’ revenue flows should hold steady, but with a noticeable shift from commercial to residential consumption for the near term.

That said, fundamentals in the financial and utility sectors may also deteriorate as the crisis continues and uncertainty remains elevated. It’s therefore important to be selective and watchful, in addition to paying attention to position in the capital structure.

It’s Time to Lean—Cautiously—into Risk

Investors who are able to ride out near-term volatility might consider increasing their credit exposure now. With spreads still exceptionally wide by historical measures, we see opportunities in both investment-grade and high-yield markets. It’s critical, though, to be discriminating.

Our research not only identifies those investment-grade bonds that are likely to become fallen angels, but also assigns internal ratings to issuers. These can then be compared to a security’s market price. Securities that are priced as less risky than our research indicates may warrant caution, whereas credits that the market is pricing as riskier than our research suggests may be attractive opportunities.

This kind of scrutiny is important for all types of investors.

For managers who are prohibited from owning high-yield bonds, avoiding the riskiest BBBs in today’s market should be a top priority. Since these investors must sell any high-yield credits, they’ll be better off unloading the vulnerable securities before the rating agencies act.

For investors who can hold high-yield debt, owning some angels after they’ve fallen may make sense. This is because fallen angels tend to enter the high-yield universe undervalued relative to their credit fundamentals and often end up outperforming original-issue high-yield bonds. In addition, the Fed’s SMCCF provides more than the usual support for fallen angels. High-yield investors should also consider BB and B issuers with strong liquidity profiles, which help manage pricing pressure in sharp sell-offs.

Above all, it’s important not to overreact to swings in investor sentiment. Avoiding the credit market entirely for fear of downgrades and defaults is just as risky as indiscriminately increasing exposure to corporates now that spreads are wider. In our view, careful analysis is essential for uncovering value and raising overall return potential, no matter the state of the market.

Susan Hutman is Director of Investment-Grade Corporate and Municipal Credit Research and Robert Hopper is Director of High Yield and Emerging-Market Corporate Credit Research at AB.

The views expressed herein do not constitute research, investment advice or trade recommendations, do not necessarily represent the views of all AB portfolio-management teams, and are subject to revision over time.

This post was first published at the official blog of AllianceBernstein..