by Hubert Marleau, Market Economist, Palos Management

What Happened Last Week:

In the week ended April 9, the S&P 500 increased 12.1% to 2790, recovering about half of its losses since the February peak of 3386. According to EPFR Global data, portfolios that invest in equities have pulled in billions of dollars in the last two weeks.

The flattening of the infection curve, the Fed’s $2.3 trillion financial support for small businesses and the White House plan to unveil a task force to reopen the economy buoyed investor sentiment.

The Act Now and IHME models showed that the number of new cases and new deaths were falling. These new numbers suggest that a point of inflection might be in reach and a new trend could soon emerge. Many health officials are starting to expect that the curve could suddenly bend.

People have finally understood the dynamics of what is a pandemic and are practicing social distancing on a large scale. Consequently, peak estimates are being revised to even half of where they were just a week ago.

In this connection, many are imagining that the pandemic will run its course during the spring, terrible results will be avoided by social distancing and other cautious measures, near normal lives will prudently return in the summer and science will eventually rescue us with effective treatments, antibody drugs and vaccines.

For the period under consideration:.

- The foreign exchange value of the U.S. dollar dropped. There is growing evidence that the greenback’s upside is increasingly limited and long in the tooth. The monetary and fiscal measures combined with the lagging response of the U.S. to the pandemic and the Fed’s intensive use of the forex swap lines will likely take a toll on the currency. Moreover, the IMF may be willing to put itself on the hook. It’s pondering a new vehicle to add more liquidity in the international markets by nourishing countries that do not have treasury collateral with dollars.

- The shape of the bond curve improved--the yield differential between 10 and 2 year bonds widened from 39 bps to 49, reliably signaling that an economic recovery can be expected.

- Copper prices made some impressive gains rising 3.6% from $2.19 to $2.27, suggesting that the level of economic activity is rising in Asia.

- Credit conditions have stabilized. Yield differentials between corporate bonds and U.S. Treasuries should favourably narrow, given the Fed’s decision to come to the aid of the junk bond market. The St. Louis Fed Financial Stress Index fell 226 bps to 2.72 in the week ended April 3, the second straight weekly decline. Another decrease is anticipated for April 10.

Preliminary data prints, reports and anecdotes are indicating that the major central banks are injecting at both the domestic and global levels, an enormous volume of liquidity and the banking system is furnishing ample amounts of money to individuals, corporations and local governments to keep them in business.

For example, the U.S. monetary base is rising at an extraordinary rate and the money supply is increasing at an incredible speed, preemptively preventing the virus from doing lasting damage.

While the economy has been put on ice, the Fed and the government have been preparing the terrain for an eventual recovery. The government will be spending 10% of the N-GDP and could go much higher to help out on the fiscal side. The Fed’s monetary base accounts for 20% of the N-GDP and could go much higher to help on the monetary side.

The authorities have taken a lot of risk off the table and, in turn, changed the cost-benefit ratio of the economy and the risk-return structure of the stock market. Luckily, consumer price inflation is not a problem. I see further downside risk to inflation. Gasoline prices, utility bills and shelter costs are falling.

The fiscal and monetary programs that were announced two weeks ago are being implemented with vigor. The Bloomberg Consumer Comfort Index may have registered the biggest weekly decline on record, but given what has transpired of late, the absolute level is still elevated at 49.9. In 2010, the index averaged around 24.

The bottom line is that the stock market is viewing this whole episode as a bad dream and that it will wake up sooner than later with a new perspective, when there will be definite proof that the economy will be on the road of recovery. The thinking is that the anticipated economic rebound from this deep recession may come back at tremendous speed because the economic contraction rapidly arrived at a brutalized pace.

The Exit Strategies:

The population is fully aware that the looming economic pains resulting from the engineered lockdown will soon be reflected in upcoming prints. It will not be surprising. That is why people are fixated on the prospect that the economy will reopen in the hope that it will survive the virus. Italy, Austria and Denmark are giving hope. They are the first countries to plot the gradual unwinding of their lockdowns with a detailed road map. Their experiences will show the path ahead for North America.

Albeit an exercise in quesswork, economists are roughly split on whether the expected recovery will be in the form of a U-shape with a prolonged recovery or a V-shape with a quick recovery. I think that it will be neither. In my judgement, the probability is good that we shall get a high I-shape massive vertical uptick in both employment and productivity, followed by a shallow upward tangent.

The pending recovery will happen but not like many think it will. Businesses will be on their guard, avoiding unnecessary risk; and individuals will face a rude awakening that there will be checks, delays and resistance. While the restart will be fast and furious, the aftermath could be slow and uneven because many may prefer not to show up for work or plainly work remotely from home.

Don't kid yourself, the next phase will be about managing a lower level of contagion. Governments will make it mandatory to use face masks, insist on large-scale testing, application of cell phone apps to contain transmission of the virus and dedicate hospitals to treat the infected.

In the final analysis, the economy will only fully normalize when there will be assurances that an effective vaccine has been created or that treatment options which are safe and available before the monetary and government stimuli start to fade.

A full return to regular activities will happen when people have sufficient confidence that everything is hunky dory and re-entering the workforce is a calculated risk.

Nevertheless, the drastic experience of this awful episode will have a social, political and economic impact on how people choose to live with long-term effects on our collective behaviour. The psychology of being uncertain about the future could foster prudence and frugality. Conservatism and even thriftiness and parsimony may become more important.

People and businesses may have figured out from the health scare that sacrificing immediate consumption for financial safety may not be a bad idea. I wouldn't be surprised if households and businesses were to save a bigger chunk of their income for precautionary reasons in the future.

There is a weird truism about the economy---that is, the larger the government deficit, the larger the corporate profits, the personal savings and the inflow of foreign capital. Given that it is the intent to keep the dollar as low as possible, private sector savings will have to increase to meet the rising federal budgetary deficits. The U.S. government will be running an extra $3.0 to $4.0 trillion deficit in 2020 and 2021. I know that the Fed will finance a large chunk or all of the deficit.

Nevertheless, it still remains that government spending will end up in the pockets of individuals and corporations. The big question is what will they do with the money. I think that a bigger portion will end-up in their wallet, saving bank accounts and the investment markets, than it did in the past.

Consequently, investors should bear in mind that the economy will not be operating anywhere near its full potential for at least one year after the initial expected surge in the second half of 2020. My guess is that the economy will be running at 85% of capacity in 2021 and 2022. It means that:

1) the unemployment rate will remain high around 8.0%--so guaranteed basic income is coming,

2) the inflation rate will hover around zero--so only industries which can boost productivity will enjoy rising profit,

3) the health-care system will tap a lot of financial, industrial and human resources,

4) the government’s finance will be tapped out--so levies on wealth, taxes on high income earners and foreign withholding taxes will rise,

5) interest rates are likely to remain low--so companies with safe rising cash flows will be preferred and 6) corporate tax rate will be lowered and/or depreciation allowances rate will rise.

Stock Prices Are Not Based On What the Economy Looks Like Now But On How It Will Look Later

At this time, market participants are satisfied with what comes next on the economic front. It will be clearly better than now. It is a viable option if you wish to share my belief that we have already had a total capitulation, are ready to stomach future dips and willing to accept that low valuations usually precede new bull runs.

For investors with weak nerves or who do not want to be heroes, I would suggest monitoring the weekly usage of electric power, railroad traffic and steel output, and the daily performance of the Balic Index for confirmation. It’s a less risky way to play the stock market, but the potential for big rewards is much less.

Technically, we are in a new bull market and it started on March 23. Since then, the S&P 500 is up 24.7%. It's hard to believe, because it is an historical anomaly to be so fast. Normally, it takes years for this sort of thing to happen. It took place in the span of a few weeks. History shows that stock prices tend to decrease before a recession starts and rise before it ends.

A real growth recovery should resume in the September quarter. Hereon, spending time on choosing which stocks to own will become more important than trying to determine where the stock indices are heading. While the S&P 500 will likely continue to rise very slowly, it is unlikely to make fresh all-time highs until late 2021. The year 2020 is lost.

The rally was not the start of being back to normal. Yardeni Research is projecting that S&P 500 earnings will take a hard hit in the first and second quarter of 2020 followed by a big surge in the following months. For the full 2020 year, Factset expects a 10% profit decline, but expects a big increase of 16% in 2021.

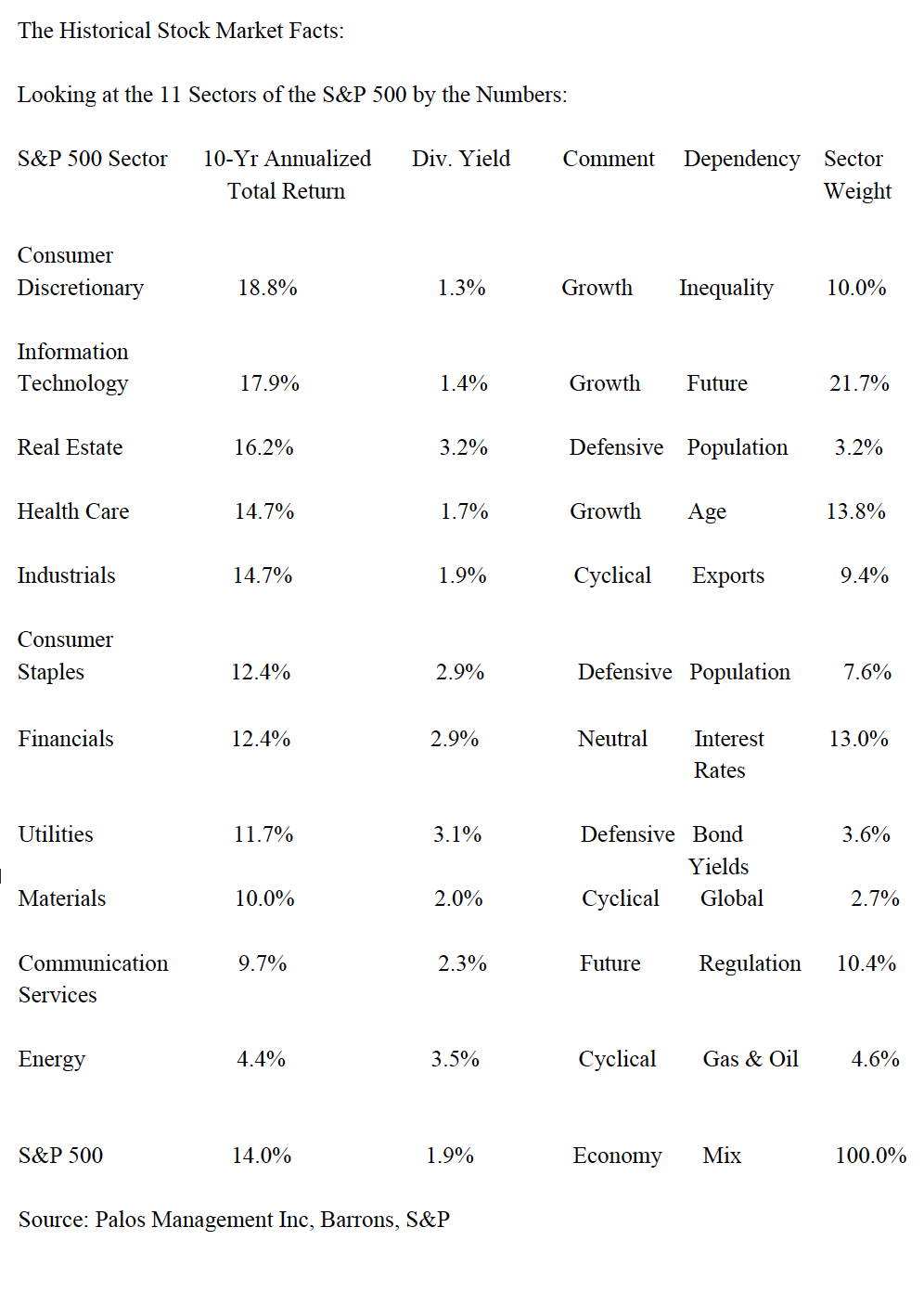

It may be a better idea to focus on fundamentals like valuation metrics, growth factors and yield spreads to rebalance one’s portfolio. Given that central banks and governments have taken on the task of smoothing economic cycles and fighting external shocks, it seems to me that markets may become more micro efficient and less macro efficient.

In this respect, trying to pick a few winners may become a chosen strategy. It may make good sense to look for bargains rather than being brave. Companies that have reliable access to capital, strong balance sheets, and in the promising industries will likely to weather the storm better ending up with a greater market share of revenues and profits.

By the same token, investors should take into account that a debasement of money down the road, perhaps in two years, is probable.

The Fed will likely monetize the entire fiscal stimulus, liberate capital that is stuck in unsaleable risky assets, and keep the policy rate below the cost of money and the latter below that of capital. Keep in mind that common stocks represent ownership of real assets--- a reliable long-run inflation hedge.

Copyright © Palos Management