by William Housey, CFA, Managing Director of Fixed Income, Senior Portfolio Manager, First Trust Portfolios

SENIOR LOAN PERFORMANCE AS PRICES DROP BELOW $80 (USD$100 is par) LEVELS

MARCH 23, 2020

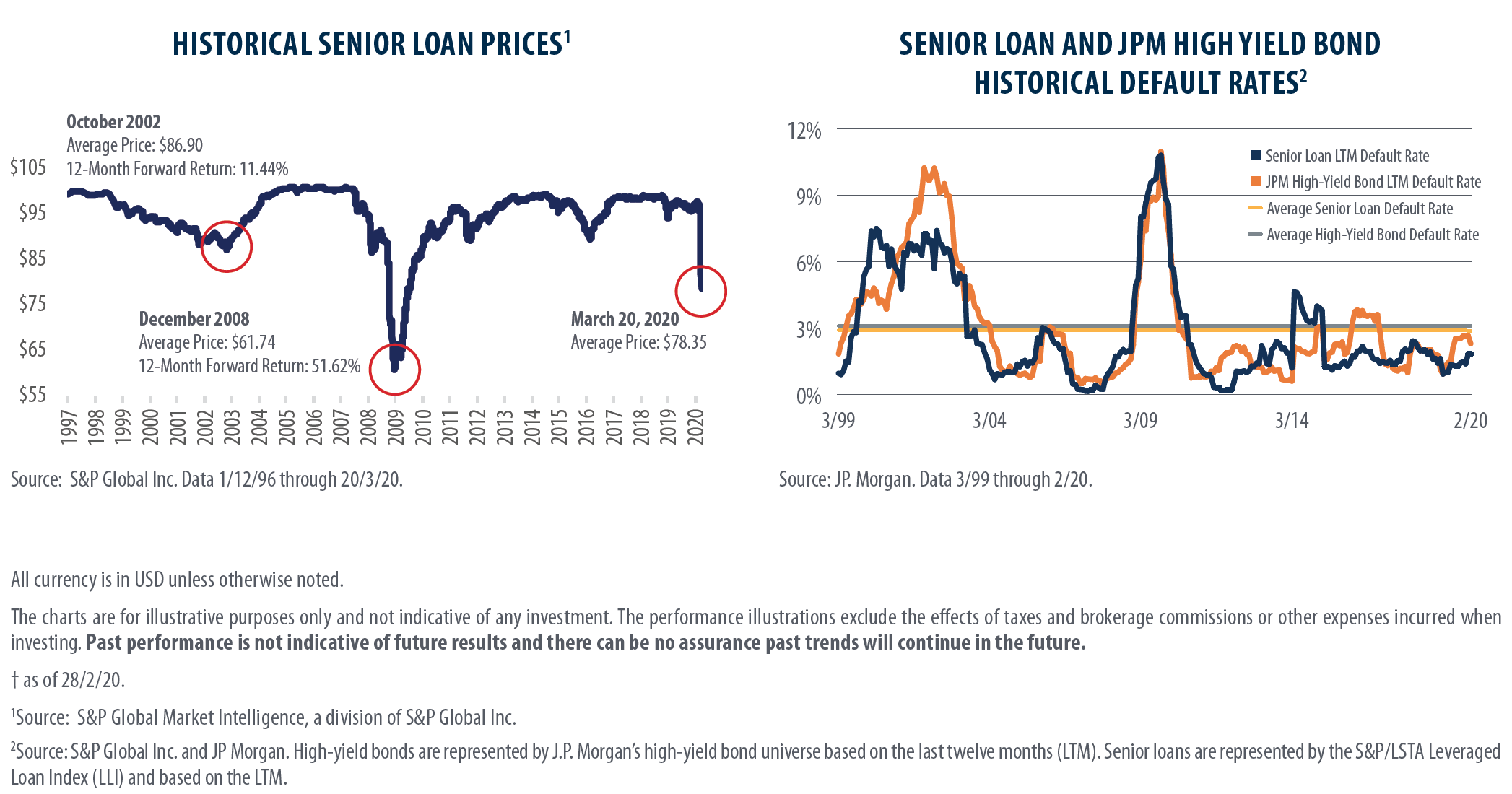

The uncertainty and economic shutdown resulting from COVID-19 combined with the steep decline in oil prices has had a significant impact on the outlook for both U.S. and global economies. Leveraged Loans, much like other risk-assets, have come under immense pressure given their correlation with equity markets. In fact, four of the five largest daily declines in senior loan prices in history occurred during this market correction. Weighted average prices have dropped approximately 970 bps in the last seven days. The velocity of the sell-off now exceeds the financial crisis of 2008 when the seven-day drop was 672 bps, for the period ending October 10, 2008.

While some of this pressure has been warranted, notably the decline in trading prices related to the commodity industry (oil, gas, iron ore, coal), and leisure companies impacted by social distancing (airlines, hotels, casinos, theaters), the remaining approximately 83% of the S&P/ LSTA Leveraged Loan Index (LLI) has also followed a similar decline. Unlike the high-yield bond market which has 16.8% exposure to Oil & Gas and Nonferrous metals/minerals, we believe these weak commodity prices are likely to have a nominal impact on the loan market given the loan market’s relatively modest exposure at 4.4% to the industry.† In addition, while some sectors will be harder hit than others from COVID-19, it is our opinion that sectors such as Healthcare, Pharmaceuticals, Software, Insurance, Cable Television, Food and Grocery, etc. should be relatively insulated from both the economic slowdown and social distancing.

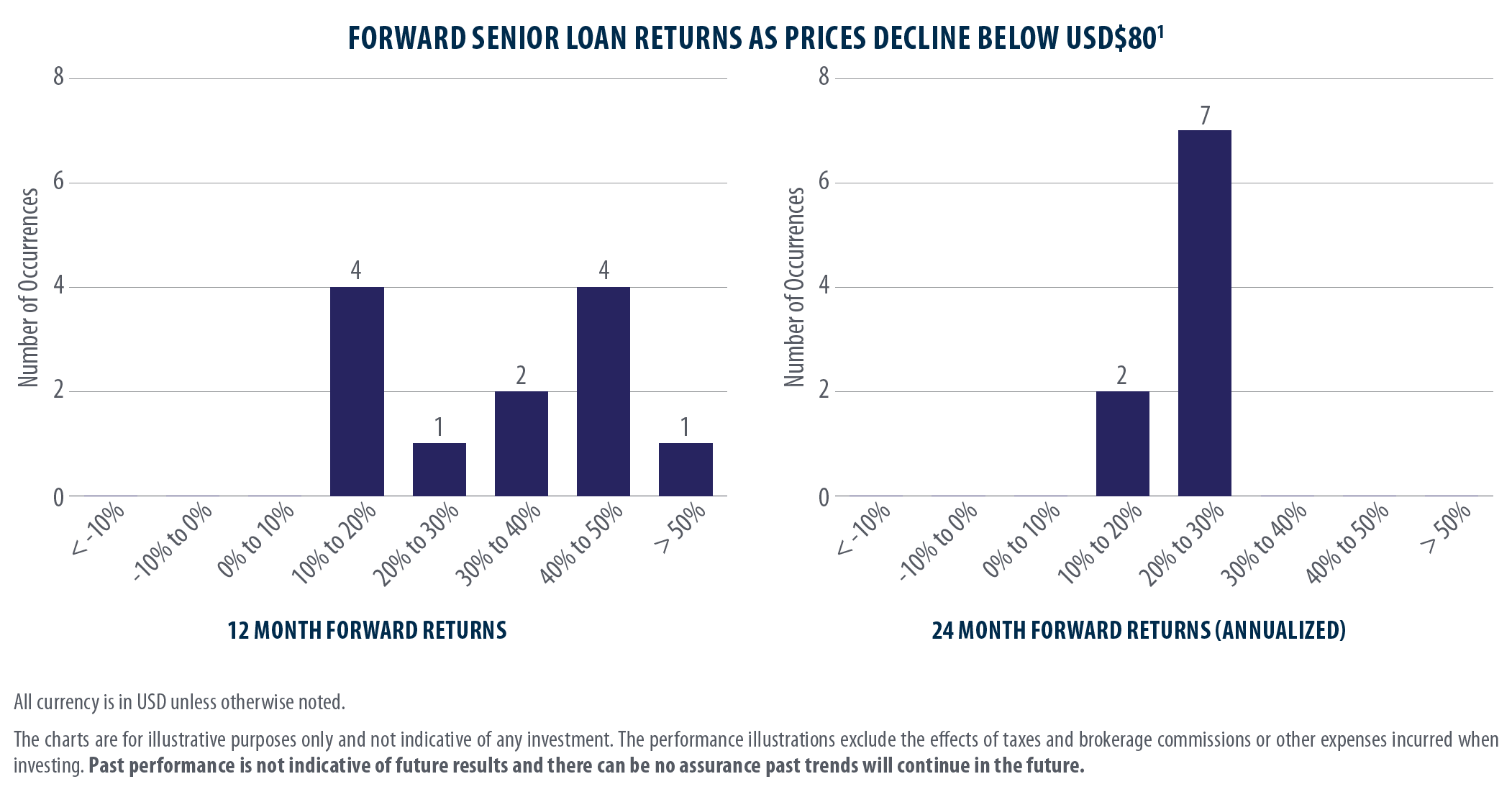

When reviewing the Senior Loan asset class, we believe it is important to take a disciplined approach rooted in arithmetic, incorporating both fundamentals and valuations. That approach is even more important in times of high volatility, in our view. Looking at valuations today, the average bid price for the S&P/LSTA Leveraged Loan Index is approximately $78.35 ($100 is par), as of March 20, 2020. For reference, the average bid price for the Senior Loan Index (LLI) was $96.67, as of February 21, 2020. Over the past 23 years, 31/1/97 – 28/2/20, there have been nine instances when Leveraged Loan prices have ended the month with a price below USD$80. In our review of subsequent returns, the average annualized return over the next 12 and 24 months following a price below $80 are 37.18% and 22.61%, respectively. In no instance would an investor have experienced a loss over the subsequent 12 and 24 month periods. Of course, past performance is not a guarantee of future results.

While there is no way to know when the markets will normalize, we can use math to derive implied default rates from current trading levels to determine the probability of success based on the current trading price in the market. Empirically, the average recovery for a senior secured loan in default is approximately 80% according to Moody’s. However, we know there is considerable debate about what future recoveries will be given weaker senior loan documentation/structures. As such, we frame a few scenarios:

While there is no way to know when the markets will normalize, we can use math to derive implied default rates from current trading levels to determine the probability of success based on the current trading price in the market. Empirically, the average recovery for a senior secured loan in default is approximately 80% according to Moody’s. However, we know there is considerable debate about what future recoveries will be given weaker senior loan documentation/structures. As such, we frame a few scenarios:

• 80% Recovery: If loans have an 80% recovery in default, on average, the implied default rate for the senior loan market at an average trading price of $0.78 is 110%! I.e. over 100% of the market would have to default to justify current loan prices, which is simply not possible.

• 70% Recovery: If loans were to experience a 70% recovery in default, on average, the implied default rate for the senior loan market at an average trading price of $0.78 is 73%! Nearly . of the loan market would have to default to justify current loan prices.

• 60% Recovery: If loans were to experience a 60% recovery in default, on average, the implied default rate for the senior loan market at an average trading price of $0.78 is 55%! Over half of the loan market would have to default to support these trading levels.

For reference, the highest ever loan default rate was 10.81%, which occurred in 2009. At First Trust, we believe math wins. While it can be extremely difficult to call bottoms in markets, we focus on the fundamentals and allow the math to lead our decisions. We believe the math supports senior loans today.

*****

Index Definition: Leveraged Loans and Senior Loans are represented by the S&P/LSTA Leveraged Loan Index (LLI) which is a market-weighted index that tracks the performance of institutional leveraged loans. Indexes are unmanaged and an investor cannot invest directly in an index. All opinions constitute judgements as of the date of release and are subject to change without notice. There can be no assurance that any forecasts will be achieved. Data is taken from sources we believe to be accurate and reliable but we do not guarantee its accuracy or completeness.

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. Financial advisors are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

Commissions, trailing commissions, management fees and expenses all may be associated with ETF investments. Read the prospectus before investing. ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

Copyright © First Trust Portfolios