by Sound Choices, AGF Management Ltd.

Insights and Market Perspectives

Author: Sound Choices

March 31, 2020

While we can’t control the markets, we can control how we react to them.

It can be scary when there’s volatility in the stock markets. It’s out of our control and we may be worried about what’s going to happen with our investments.

What is volatility?

Volatility refers to the price fluctuations of a particular item, such as an individual stock or a whole market or portfolio.

Stock markets aren’t the only market with fluctuating prices. Fresh produce, for example, may not be the same price from week to week, depending on the season or supply. Same with gas prices – when supply is plentiful, prices can drop, sometimes dramatically.

How much the price changes determines how high the volatility is for that item. If the price is fairly stable, butter for example, that item is said to have low volatility.

Higher volatility – and specifically market corrections – can be unnerving. Shorter-term declines can happen fairly frequently and may trigger the fear of a bigger market decline.

So what can you do during stock market volatility?

It’s important to remember that no one can predict exactly when the markets will rise or fall – or precisely how significant that change will be.

But what we can control is how we react to those market events. Here are our top three tips for staying calm when market volatility occurs:

1.Ignore today’s price if you don’t need the money today.

In other words, if you don’t need that money today, today’s price doesn’t matter. Consider the housing market. If housing prices go down, but you’re not selling your house right now, you may not be concerned about the value of your house today, thinking that when it does come time for you to sell, housing prices will have rebounded.

2.Don’t try to time the market.

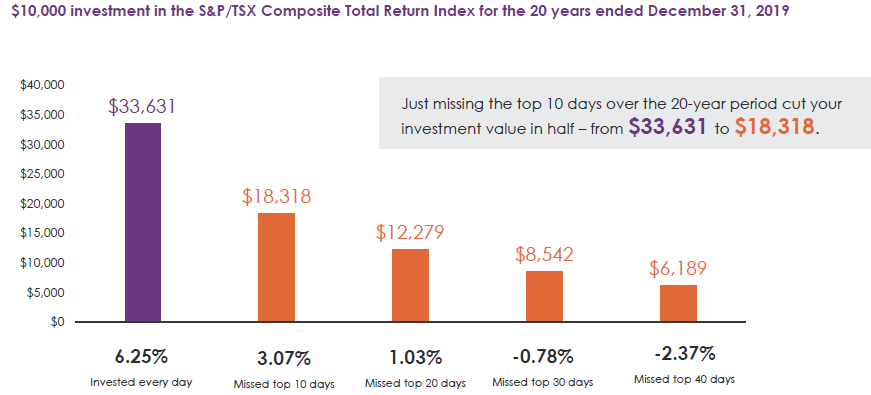

The chart below shows that missing just the 10 best days over the past 20 years would have cut your return in half. And missing the top 30 days means you would have lost money on your investment.

Source: AGF Investment Operations as at December 31, 2019. For illustrative purposes only. You cannot invest directly in an index. Past returns are not indicative of future results.

3.Invest regularly regardless of what’s going on in the market.

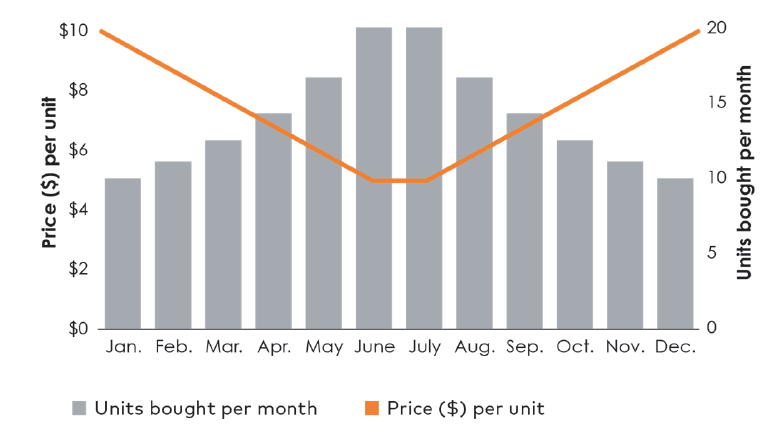

By investing regularly, you can potentially buy more units of the fund when prices are low and buy fewer units when prices are high, which can average out to a reduced purchased price over time. Known as “dollar-cost averaging”, this can help minimize the effects of market swings on a portfolio.

Source: AGF Investment Operations. January 1, 2000 to December 31, 2019. The information provided is for illustrative purposes only and is not meant to provide investment advice. You cannot invest directly in an index.

BONUS TIP: Work with a financial advisor.

Your financial advisor can help ensure your portfolio is diversified appropriately for your risk level, investment goals and time horizon.

If you have questions about what’s going on in the markets, contact your financial advisor or visit AGF.com/volatility. There you’ll find articles and videos that discuss the current markets as well as providing context and tips for managing volatility on an ongoing basis.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

© 2020 AGF Management Limited. All rights reserved.

This post was first published at the AGF Perspectives Blog.