by William Smead, Smead Capital Management

“Was it over when the Germans bombed Pearl Harbor?”

– John Blutarsky in Animal House

The year after I graduated from college, the movie Animal House debuted in 1981. With everything falling apart for the Delta fraternity, including grades and double-triple probation, all looked lost. At the point when others would give up, senior fraternity member, John Blutarsky, gave a spirited call to arms by reminding everyone that the U.S. didn’t give up when our Naval operations at Pearl Harbor were bombed on December 7, 1941. He said, “When the going gets tough…?” and then he ran out the door expecting everyone to follow him. The fact that he got the wrong attacking country didn’t end up holding anyone back.

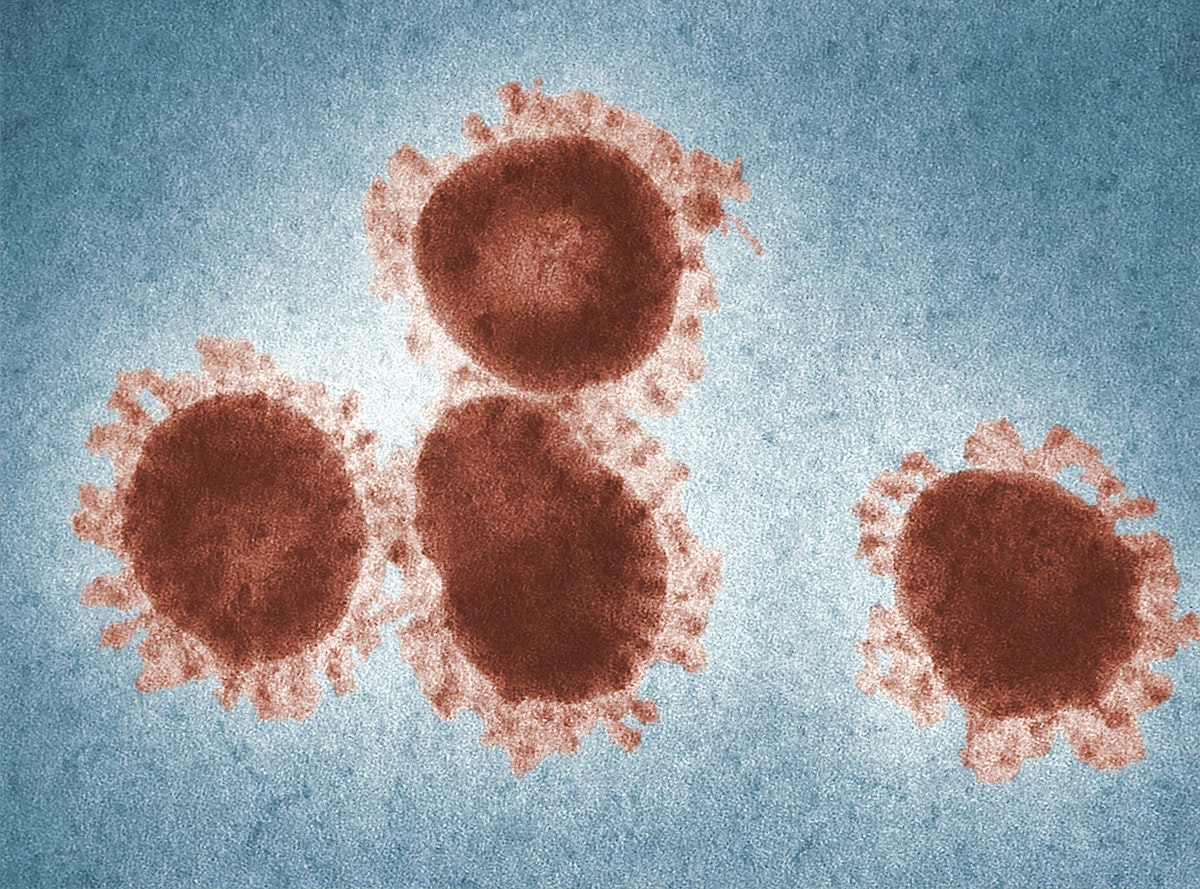

The coronavirus has done a surprise attack on the U.S. stock market and economy over the last six weeks. Gruesome statistics on new cases of the virus and lost lives are being dropped on us by the biggest barrage of information human experience has ever known. Traditional media and digital media have bombarded people into a panic in the stock market and into a much needed and massive economic time out. Brains, emotions and reasoning got fried by this information overload. Why was this the most violent decline and fastest bear market of my 40 years in the investment business?

- We have argued for two years that the stock market’s narrow infatuation with large growth stocks, low vol strategies and crowding into agnostic index investing would end badly. Nothing is more painful than the bear markets which follow the crowd getting stuck in the same investments at the same time. From a historical standpoint, we believe success over the next 10 years will include poor performance by the S&P 500 Index. It is entirely possible that the S&P 500 Index won’t exceed its 2020 high for a number of years.

- The coronavirus shut down the economy completely and crushed economically sensitive stocks, like banks, home builders, energy, etc. Simultaneously, the market had bid up the shares of companies who temporarily benefitted from the public misery (Netflix, Amazon, Walmart, etc.). They are effectively the Omega fraternity. These were many of the same companies which had benefitted the most from the prior five years of agnostic ownership heaven.

- The Japanese bombed Pearl Harbor on December 7, 1941 and the U.S. stock market bottomed in April of 1942. Did we know that we were going to win a World War being fought on two continents? Did the Delta’s know that they could successfully fight back against Dean Wormer, who had banned them from Faber College? The answer was no!

- Stocks are anticipatory vehicles. When priced appropriately, they represent the net present value of their future income stream discounted back into today’s dollars by a conservatively used discount interest rate. Stocks bottom when you run out of sellers, via panic and margin calls. You never get to know when the bottom hits until after the fact and that is exactly why a diversified portfolio of well selected common stocks has produced above average returns compared to all other liquid asset categories. You have to operate in long-term time frames because at any time you can get bombed by the Germans!

- This episode is made much more difficult by information overload. Is it harder to believe that the economy will come storming back when the all-ahead signal is given soon, than it was in 2008 when we recapitalized our nation’s banks? You’d think so if you listen to the fearmongering from the media and online. In Animal House, the Delta’s were given the wrong answers by members of their rival frat, the Omega’s, when they tried to cheat on a test. Investors have to put up with a series of fearmongers being trotted out in the media every day, and for the most part it’s the same fearmongers that spooked us in prior selloffs.

- A massive valuation gap has opened between common stocks tied to the main street economy and the 60% of the S&P 500 Index which came into this decline with price-to-earnings (P/E) ratios in the range of 20 to 60. Many meritorious companies trade for 10x P/E or less which are exactly the ones who would benefit from people going back to work and living a normal life again. Normal life is going to seem like a wonderful vacation for an extended period of time. Our guess is contentment will rise over the next few years.

- Who might be the big winners the next ten years coming out of this violent panic? The group gaining the most from this are the millennials. They don’t own much in common stocks. Many millennials are bearing children and want to buy a new house (virus free). Mortgage rates are historically low and gasoline prices are headed off the cliff. The U.S. is massively understocked with new homes, because single millennials crowded into tech-based, super-expensive cities. Thanks to the coronavirus, they found out that expensive coastal cities have a downside and everyone who can work from home has been doing it. Mass intra-country migration could be spreading people all over the country into less crowded and significantly less expensive cities when this dawns on everyone.

We are re-emphasizing home builders like Lennar (LEN), banks like Wells Fargo (WFC), credit cards from American Express (AXP) and kids apparel from Target (TGT). Coming out of this violent panic created by a virus which seemed to come out of nowhere, will take time. But like in Animal House, at some point us optimists, like Blutarsky, could rain on the Faber-like pessimistic parade!

Warm regards,

William Smead

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2020 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com.