by Lance Roberts, RIA

I have been slammed with emails over the last couple of days asking the following questions:

“What just happened to my bonds?”

“What happened to my gold position, shouldn’t it be going up?”

“Why are all my stocks being flushed at the same time?”

As noted by Zerohedge:

“Stocks down, Bonds down, credit down, gold down, oil down, copper down, crypto down, global systemically important banks down, and liquidity down…

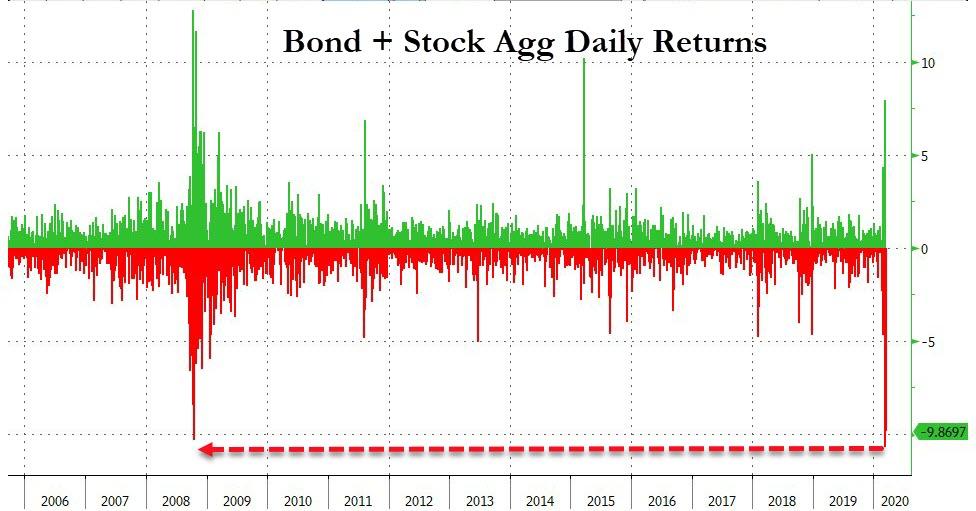

Today was the worst day for a combined equity/bond portfolio… ever…”

This Is What A “Margin Call,” Looks Like.

In December 2018, we warned of the risk. At that time, the market was dropping sharply, and Mark Hulbert wrote an article dismissing the risk of margin debt. To wit:

“Plunging margin debt may not doom the bull market after all, reports to the contrary notwithstanding.

According to research conducted in the 1970s by Norman Fosback, then the president of the Institute for Econometric Research, there is an 85% probability that a bull market is in progress when margin debt is above its 12-month moving average, in contrast to just a 41% probability when it’s below.

Why, then, do I suggest not becoming overly pessimistic? For several reasons:

1) The margin debt indicator issues many false signals

2) There is insufficient data

3) Margin debt is a strong coincident indicator.”

I disagreed with Mark on several points at the time. But fortunately the Federal Reserve’s reversal on monetary policy kept the stock market from sinking to levels that would trigger “margin calls.”

As I noted then, margin debt is not a technical indicator that can be used to trade markets. Margin debt is the “gasoline,” which drives markets higher as the leverage provides for the additional purchasing power of assets. However, that “leverage” also works in reverse as it provides the accelerant for larger declines as lenders “force” the sale of assets to cover credit lines without regard to the borrower’s position.

That last sentence is the most important and is what is currently happening in the market.

The issue with margin debt, in terms of the biggest risk, is the unwinding of leverage is NOT at the investor’s discretion.

It is at the discretion of the broker-dealers that extended that leverage in the first place. (In other words, if you don’t sell to cover, the broker-dealer will do it for you.)

When lenders fear they may not be able to recoup their credit-lines, they force the borrower to either put in more cash or sell assets to cover the debt. The problem is that “margin calls” generally happen all at once as falling asset prices impact all lenders simultaneously.

Margin debt is NOT an issue – until it is.

When an “event” occurs that causes lenders to “panic” and call in margin loans, things progress very quickly as the “math” becomes a problem. Here is a simple example.

“If you buy $100,000 of stock on margin, you only need to pay $50,000. Seems like a great deal, especially if the stock price goes up. But what if your stock drops to $60,000? Suddenly, you’ve lost $40,000, leaving you with only $10,000 in your margin account. The rules state that you need to have at least 25 percent of the $60,000 stock value in your account, which is $15,000. So not only do you lose $40,000, but you have to deposit an additional $5,000 in your margin account to stay in business.“

However, when margin calls occur, and equity is sold to meet the call, the equity in the portfolio is reduced further. Any subsequent price decline requires additional coverage leading to a “death spiral” until the margin line is covered.

Example:

- $100,000 portfolio declines to $60,000. Requiring a margin call of $5000.

- You have to deposit $5000, or sell to cover.

- However, if you don’t have the cash, then a problem arises. The sell of equity reduces the collateral requirement requiring a larger transaction: $5000/.25% requirement = $20,000

- With the margin requirement met, a balance of $40,000 remains in the account with a $10,000 margin requirement.

- The next morning, the market declines again, triggering another margin call.

- Wash, rinse, repeat until broke.

This is why you should NEVER invest on margin unless you always have the cash to cover.

Just 20%

As I discussed previously, the level we suspected would trigger a margin event was roughly a 20% decline from the peak.

“If such a decline triggers a 20% fall from the peak, which is around 2340 currently, broker-dealers are likely going to start tightening up margin requirements and requiring coverage of outstanding margin lines.

This is just a guess…it could be at any point at which “credit-risk” becomes a concern. The important point is that ‘when’ it occurs, it will start a ‘liquidation cycle’ as ‘margin calls’ trigger more selling which leads to more margin calls. This cycle will continue until the liquidation process is complete.

The Dow Jones provided the clearest picture of the acceleration in selling as “margin calls” kicked in.

The last time we saw such an event was in 2008.

How Much More Is There To Go?

Unfortunately, FINRA only updates margin debt with about a 2-month lag.

Mark’s second point was a lack of data. This isn’t actually the case as margin debt has been tracked back to 1959. However, for clarity, let’s just start with data back to 1980. The chart below tracks two things:

- The actual level of margin debt, and;

- The level of “free cash” balances which is the difference between cash and borrowed funds (net cash).

As I stated above, since the data has not been updated since January, the current level of margin, and negative cash balances, has obviously been reduced, and likely sharply so.

However, previous “market bottoms,” have occurred when those negative cash balances are reverted. Given the extreme magnitude of the leverage that was outstanding, I highly suspect the “reversion” is yet complete.

The relationship between cash balances and the market is better illustrated in the next chart. I have inverted free cash balances, to show the relationship between reversals in margin debt and the market. Given the market has only declined by roughly 30% to date, there is likely more to go. This doesn’t mean a fairly sharp reflexive bounce can’t occur before a further liquidation ensues.

If we invert margin debt to the S&P 500, you can see the magnitude of both previous market declines and margin liquidation cycles. As stated, this data is as of January, and margin balances will be substantially lower following the recent rout. I am just not sure we have “squeezed” the last bit of blood out of investors just yet.

You Were Warned

I warned previously, the idea that margin debt levels are simply a function of market activity, and have no bearing on the outcome of the market, was heavily flawed.

“By itself, margin debt is inert.

Investors can leverage their existing portfolios and increase buying power to participate in rising markets. While ‘this time could certainly be different,’ the reality is that leverage of this magnitude is ‘gasoline waiting on a match.’

When an event eventually occurs, it creates a rush to liquidate holdings. The subsequent decline in prices eventually reaches a point that triggers an initial round of margin calls. Since margin debt is a function of the value of the underlying ‘collateral,’ the forced sale of assets will reduce the value of the collateral, triggering further margin calls. Those margin calls will trigger more selling, forcing more margin calls, so forth and so on.

That event was the double-whammy of collapsing oil prices and the economic shutdown in response to the coronavirus.

While it is certainly hoped by many that we are closer to the end of the liquidation cycle, than the beginning, the dollar funding crisis, a blowout in debt yields, and forced selling of assets, suggests there is likely more pain to come before we are done.

It’s not too late to take actions to preserve capital now, so you have capital to invest later.

As I wrote in Tuesday’s missive “When Too Little Is Too Much:”

“With our risk limits hit, and in order to protect our clients from both financial and emotional duress, we made the decision that even the reduced risk we were carrying was still too much.

The good news is that a great ‘buying’ opportunity is coming. Just don’t be in a ‘rush’ to try and buy the bottom.

I can assure you, when we ultimately see a clear ‘risk/reward’ set up to start taking on equity risk again, we will do so ‘with both hands.’

And we are sitting on a lot of cash just for that reason.”

You can’t “buy low,” if you don’t have anything to “buy with.”

Copyright © RIA